Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

On 21st January, BOOM wrote “BOOM’s China trade indicator has turned upwards in the last two months and is gaining strength. This is a reliable sign of increased Chinese trade which usually precedes a resurgence of the domestic economy.” And …. “… if the upswing in external trade continues, then we should soon see a rebound in the Chinese economy and a subsequent rebound in stock prices.”

Then, on Sunday 4th February, BOOM wrote “the Chinese stock market indices have not yet shown a base formation. However, with huge investment inflows and a recovering trade picture, there is potential here for a significant turnaround soon in stock market valuations.”

Check the charts below to see what happened the next day, 5th February. Then, on the 18th February, BOOM wrote “China’s government is communist. However, they must now encourage all of their citizens to become buyers of shares in Chinese companies. If they don’t, the Chinese stock markets will be at risk of progressive slow melt down with no end. And if that were to happen, the ownership of corporate China will become locked into fewer and fewer hands, creating an elite class of citizens who own the productive assets of China.

This elite class would become the robber barons of China by default, capable of exerting great influence. China’s communist ideals could then become corrupted by the financial power of an organised group of oligarchs. None of that is compatible with communist ideology. Therefore, the best way forward is for the central government of China to encourage its citizens to start buying shares as soon as possible.

“BOOM is expecting such a direction from the Chinese government soon. It is actually inevitable because the consequences of not doing this are too great to ignore.”

So, what happened? The Shanghai Stock Index hit a sharp bottom on Monday 5th February around 2,640 (the day after BOOM made the 4th February forecast) and has been climbing ever since to reach 3050. It has gained 15.5% in that time frame – just over one month.

BOOM knows that senior Chinese readers are reading and watching BOOM. Many major fund managers, central banks, and finance professionals are also reading and watching.

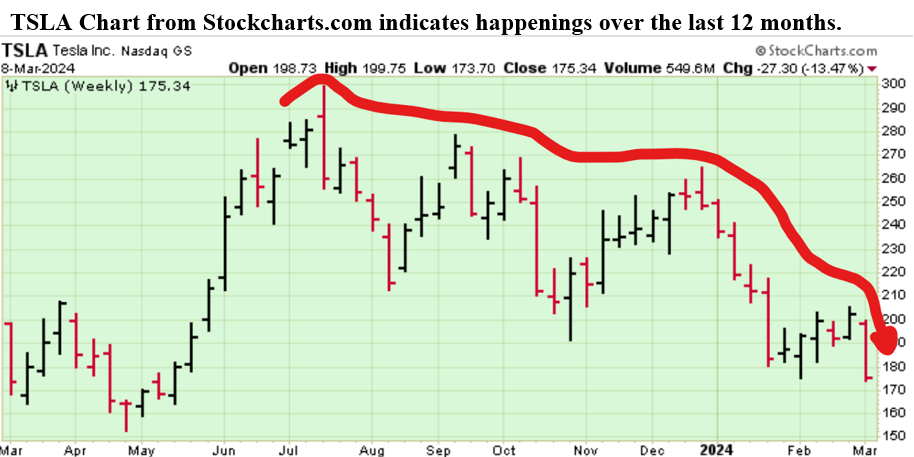

TESLA SHARES FALL OUT OF BED! One month ago, on 11th February, BOOM wrote this about Tesla: “Tesla shares (TSLA) finished the week up by 3% which sounds promising. However, they did so on progressively falling daily volumes. This is an unconvincing bounce. BOOM is waiting and watching closely for further weakness here as this is the “moment of truth” for Tesla.”

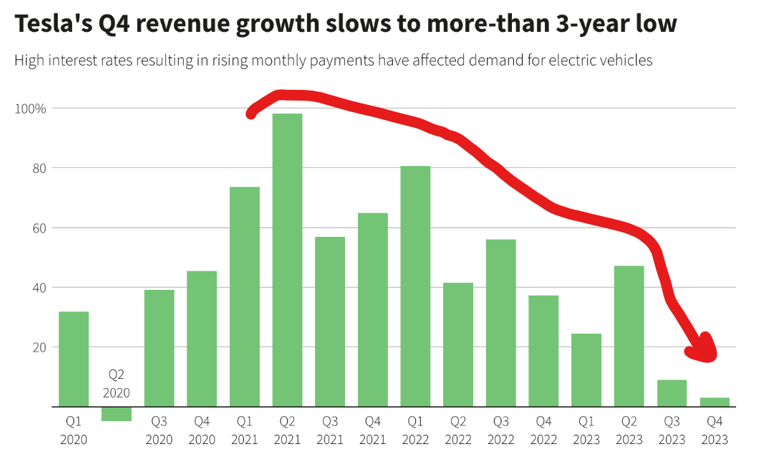

Since then, Tesla shares have slowly traded to slightly higher prices. However, progress has continued to be unconvincing for tentative buyers. Last week, it all came to an end with Tesla shares falling out of bed during Monday’s trading session. On that day, the share price fell by more than 7%. By the end of the week, they had fallen by almost 13.5% and were desperately trying to hold above $170.

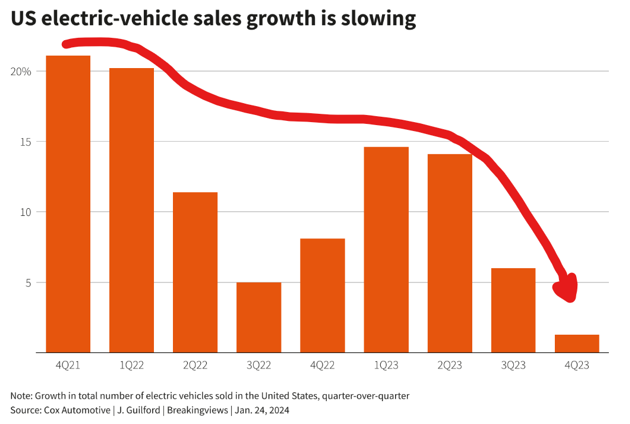

- China’s Sales Volumes and Revenues are falling

- US Sales Growth and Revenue Growth are slowing

- A major Tesla investor seems to have lost enthusiasm for the stock

- The Tesla factory in Germany was shut due to apparent sabotage of its power supply

- Major regulatory and legal problems are affecting Elon Musk and Twitter (“X”).

- Tesla is facing stiff competition in the largest market for electric cars in the world, in China. Sales numbers are falling there and so are revenues. BYD is the major competitor but there are many other Chinese companies to contend with such as XPeng. BYD is about to slash the price of its updated Yuan Plus SUV by 11.8%. That is a huge discount that Tesla will have difficulty matching.

- Data from the China Passenger Car Association last week showed deliveries from Tesla’s Shanghai (so-called) “Gigafactory” are at their lowest point in more than a year. Tesla is trying to maintain sales through price reductions but, of course, this causes revenues to fall and inspires the competition to drop their prices as well.

- Tesla delivered 60,365 vehicles from its China factory in February. That marked the lowest level since December 2022 and was 19% lower year-on-year; a horror result. Tesla’s China factory produces over half the company’s global production.

- The 12-month chart for BYD shares, as traded on the OTC Market in the US, is almost identical to Tesla in overall appearance. Both companies began to downtrend in August. Investors have been selling since then. BYD’s sales in February were 37% below the numbers achieved in the same month last year.

LOSS OF INVESTOR ENTHUSIASM. Last week, a major enthusiastic investor for Tesla, Ross Gerber, was reported as being less confident about the company’s future. Gerber’s wealth management company controls US$2.3bn for clients, according to its website. He suggested that Musk has too many projects and problems on his plate.

Perception matters in the world of investment, especially for any company without a long history of net profits and regular dividends. Unfinished artificial intelligence and self-driving technology projects are a distraction which means the company is now being valued as just another car supplier. AI and self-driving are the reasons stated by many long term investors for Tesla’s valuation premium.

GERMAN FACTORY PROBLEMS – TESLA STOPPEN. Last week, the Tesla factory in Germany, near Berlin, was the target of a sabotage attack by environmental activists. The factory had to shut down production for a few days. Yes, some environmentalists in Germany are opposed to electric cars. BOOM expects this trend to grow in many nations very soon indeed.

Reuters reported that local media had published a letter from a far-left activist organisation called the ‘Volcano Group’ that claimed responsibility for the incident, in a 2,500 word attack on Tesla and its billionaire CEO Musk. The letter apparently said “Tesla consumes earth, resources, people, workers, and in return spits out 6,000 SUVs, killer cars and monster trucks each week.”

The factory manager made the following comment. “We are shocked by what happened today. It’s the second direct attack on power supply to the factory and there was a third attack on the railway nearby. We are very concerned.”

Local residents have also previously blocked expansion at the plant. They were unhappy with plans to cut down trees in the area. A group of climate activists, calling themselves, “Tesla Stoppen” which involves 80-100 people are also attempting to stop the plant from expanding.

POTENTIAL FINANCIAL PROBLEMS FOR MUSK. And then there are the lawsuits and regulatory issues to consider plus financial aspects regarding Musk’s newest project of scale, ‘X’ aka Twitter. These all have an indirect impact on Tesla.

Musk acquired Twitter for US$44bn in October 2022. He sold shares in Tesla to help him fund the deal, possibly up to $27bn. According to a report by Al Jazeera at the time, on 28th October 2022, the total sum of the deal also included $5.2bn from investment groups including Larry Ellison, Qatar’s Sovereign Wealth Fund, and Prince Alwaleed bin Talal of Saudi Arabia. The rest of the money, about $13bn, was provided by bank loans, including from Morgan Stanley, Bank of America, Japanese banks Mitsubishi UFJ Financial Group and Mizuho, Barclays, plus the French banks, Societe Generale and BNP Paribas.

These loans are guaranteed by Twitter, not by Musk himself. It is the company that assumes the financial responsibility to pay them back. If Twitter falters in revenues and gross profit, then the loans could theoretically become a default risk. In such a situation, Musk could sell some of his personal assets to fund Twitter with personal loans. Such loans could then be used to pay the outstanding interest on the bank loans. Alternatively, Musk may have other options:

- Sell some of his personal Tesla shares and buy out the banks or…

- Twitter borrows more money from the original banking consortium to cover the loan repayments (unlikely), thus capitalising the interest or…

- Borrow from yet another banking consortium hastily assembled to pay out the original consortium if and when they become disgruntled lenders.

Selling Tesla shares to fund Twitter’s interest payments buys precious time and causes minimum disruption. All the other options are more public and alert Tesla investors that the whole pack of cards may collapse.

The possibility of Musk becoming a significant seller of Tesla shares would have a major dampening effect on the price. He reportedly owns 715 million shares which at $175 (Fridays closing price) are valued at US$125bn. On paper, Musk could easily raise the $13bn, the capital sum owed to the Twitter banking consortium, by selling just over 10% of his Tesla shares.

However, this could damage the share price very significantly. In such a scenario, the share price of Tesla could plunge back to US$100 or below. In such an event, Musk would still retain approximately 640 million shares. Even if the share price fell to $50, that shareholding would still be valued at $32bn, a sizeable sum. But the reputations of both Tesla and Twitter would be severely damaged.

Thus it appears Musk has taken a big gamble with his investment in Twitter, but the fact is, he can afford to. This is the advantage of his extreme wealth as measured in Tesla shares. Big wave riders are always wondering if the next big wave is going to be the one they don’t survive. That is why they do it by the way. Musk can take this gamble and still wind up as a billionaire even if the whole pack of cards does collapse. Investors in Tesla may suffer a different outcome, depending upon their average entry price. Reference: https://www.aljazeera.com/economy/2022/10/28/how-elon-musk-financed-his-twitter-takeover

POTENTIAL LEGAL PROBLEMS FOR MUSK. The deal to buy Twitter upset a lot of people. BOOM saw one media report that stated, “under Musk’s ownership, the company has stopped paying rent on some of its offices, which has led to lawsuits and evictions. It has also been reported that Musk laid off about 80% of Twitter staff after he took over the company.”

Nobody really knows the extent of the carnage. Several class action lawsuits have been launched with dismissed workers seeking more than US$500m in severance pay. In the suits, this statement was reportedly made, “This is the Musk playbook: to keep the money he owes other people, and force them to sue him“.

And last week, another lawsuit was filed on behalf of four former high-ranking Twitter executives. They’re asking for a total of more than US$128m in unpaid severance.

Twitter’s sacked executives reportedly stated in the lawsuit documents, “Because Musk decided he didn’t want to pay Plaintiffs’ severance benefits, he simply fired them without reason, then made up fake cause and appointed employees of his various companies to uphold his decision.” And “He claimed in his termination letters that each Plaintiff committed ‘gross negligence’ and ‘wilful misconduct’ without citing a single fact in support of this claim.”

THEN THERE ARE THE (EXTRAORDINARY) LAWYER FEES TO CONSIDER. As reported in the mainstream media, the lawyers who blocked Musk’s $56bn Tesla compensation package as being excessive are now seeking a record US$6bn legal fee for achieving success in that matter. The fee is payable by the company because the action saved the company $56bn.

Tesla is being asked to pay the legal fee because it benefited from Musk’s pay package being blocked. If the company pays the fee via the issuance of Tesla shares, it would not cost them any cash and apparently the lawyers are happy to accept shares in settlement. The fee is roughly equivalent to 30 million shares in value (at $200 per share).

However, the number of shares required to cover a fee of $6bn is rising as Tesla shares fall in price. The lawyers’ request comes over a month after a Delaware judge effectively stopped Musk’s $56bn pay package because his close ties with the directors, who approved the deal, weren’t fully disclosed to shareholders and the package’s performance targets were easier for Musk to meet than the company acknowledged. The $56bn package was the largest ever provided to the CEO of a publicly traded US company, although Musk wasn’t guaranteed any salary.

All of this prompts the (now moot) question: “Was Musk attempting to have Tesla pay him this sum in order to (somehow) help bail him out of his difficulties with Twitter and (possibly) some of his other loss-making ventures?” We will never know.

“X” MAY BE DESIGNATED A GATEKEEPER IN THE EUROPEAN UNION. Then there is “X” (Twitter’s) operations in the European Union to consider. Musk’s “X” (formerly Twitter) could be forced to follow a set of strict guidelines in the European Union after the European Commission (EC) announced that it may be classified as a ‘gatekeeper’ under the Digital Markets Act (DMA) and digital antitrust rules.

The European Commission (EC) has explained that companies may be subject to additional regulations if they operate what is described as a “core platform service”. This includes search engines, app stores, and messenger services that have over 45 million monthly active end users, more than 10,000 yearly business users, or over €75bn ($81bn) in market capitalisation.

According to an announcement published on the EC’s website on March 1, Twitter/X, Booking.com and TikTok have submitted notifications that their services potentially meet the DMA thresholds. The commission now has 45 days to decide whether to designate the three companies as gatekeepers.

“Gatekeepers” are required to let third parties inter-operate with their services, allow business users to access the data they generate on the platform and to let them conclude contracts with their customers outside the gatekeeper’s ecosystem. They must also seek explicit consent from users to track their activity outside the gatekeeper’s core platform service for the purpose of targeted advertising.

If companies fail to abide by the EU’s rules, they may face fines of up to 10% of their total worldwide annual turnover, or up to 20% in the event of repeated infringements. Businesses may also be slapped with periodic penalty payments of up to 5% of their average daily turnover.

If Twitter becomes designated as a Gatekeeper, then its advertising revenues could suffer. Of course, Musk has already seen this as a threat and is slowly changing Twitter to a paid subscription service and recently announced that Twitter would launch an email service called Xmail (presumably for a fee). But these initiatives may badly affect his user base. Google has the bulk of the email market with 1.8 billion active users worldwide and it is free.

NEW CHEAP TESLA MODELS PLANNED. Tesla is planning new, cheaper electric cars which will (hopefully) appeal to a whole new market segment. But new products consume a lot of capital and take time to develop. Maybe Musk will just start buying other electric car companies and re-badging their already developed products? Last week, Rivian shares rose by 12.6% while Tesla’s shares fell by 13.47%. Last week’s closing price values Rivian at US$12.5bn.

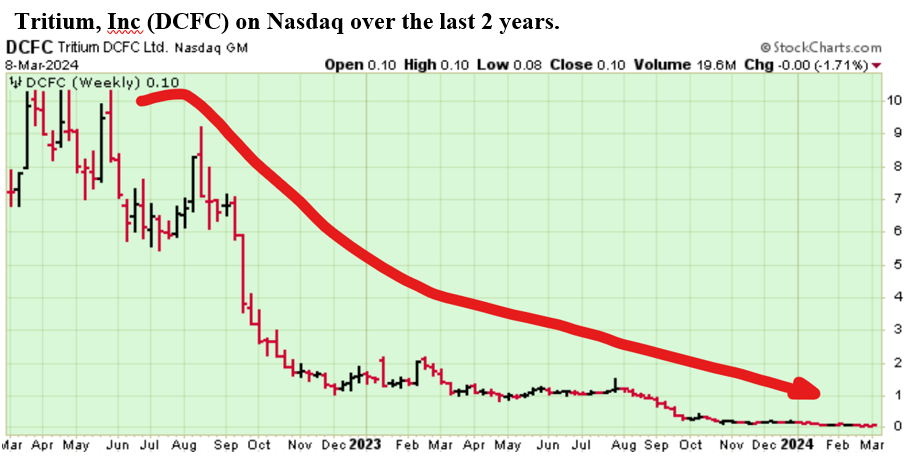

TRITIUM COLLAPSES FURTHER – IS THE EV DREAM A NIGHTMARE? Another company worth looking at in the electric car sector does not make any cars. It makes fast chargers, principally for the US market.

Tritium explains on its website, “On a Mission to Electrify Transportation, Founded in 2001, Tritium designs and manufactures proprietary hardware and software to create advanced and reliable DC fast chargers for electric vehicles. It sells its products in 47 nations and has sold 14,500 DC fast chargers worldwide.

However, its shares are in a state of utter collapse. They began life on the Nasdaq stock market in the US two years ago at $10 per share. Last week, they closed at 10 cents per share. This is another indicator that the electric car boom may well be over. Can Tesla survive in such a climate and if so, at what valuation? Time will tell.

Thanks for reading BOOM Finance and Economics. Subscribe to BOOM Finance and Economics on Substack linked below. BOOM has developed a loyal readership over five years (on other platforms) which includes many of the world’s most senior economists, central bankers, fund managers, and academics. Dr Gerry Brady 2024

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

- The Financial Jigsaw Part 2 – Chapter 4 – Personal Empowerment – Saturday, March 16, 2024

- BOOM Weekly Global Review – Tuesday, March 19, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Biden’s economy rolling along smoothly.

DAMN!

are they going to be ok ?

Those guys were dead before they hit the ground.

Nice – Cheers Red Six!

This is probably one of the dumbest articles I have ever read come out of BOOM.

Any idiot could have predicted China’s stock market would ‘turn around’. IT’S A COMMUNITS COUNTRY. THEY LIE ABOUT EVERYTHING, INCLUDING THIS.

Tesla: yeah, shocker. You mean people are sick of vehicles that don’t work all the time and want to drive vehicles that do? Well color me surprised.

Musk is just another asset controlled opp guy. He does what he’s told.

According to the WEF we peasants will own nothing so I suppose that means there will be no one to sell any personal travel device to. Hard to have any economy with no customers so the wealthy folks will only have what they can steal and nothing to spend it on.

But since the current goings on are just a sympton of God’s judgment everything is going to fly apart and be remade to God’s standards. The best I can tell from the Bible we shall become “wayfaring” men. That means we will walk everywhere!

ALL ELECTRIC VEHICLES WAR CREATED FOR ONE PURPOSE FOLKS…”ABSOLUTE-CONTROL” FOR THE FOLKS “DUMB-ENOUGH” TO BUY THEM!

WATCH THE MOVIE “LEAVE THE WORLD BEHIND” TO SEE HOW THEY WILL BE USED AGAINST YOU.

ARE SO FOOLISH TO BELIEVE THE “AUTO-PILOT” OPTION WAS FOR “YOUR CONVENIENCE”?!?!

THAT WAS THE SAME TECH USED AGAINST THE WORLD TRADE CENTERS…CALLED “FLY-BY-WIRE” IN JET PLANES!

AWAKEN FOLKS!!!

I’d like to see WDC publish a Citizens Constitutional Rights Recovery Index that tracks whenever a tyrannical unConstitutional regulation or law is repealed and We The People regain one of our God Given Rights back. It would be the inverse graph of the US Treasury budget, doomsday clock and civil war probability indexes.