While Joe Biden insists that Americans are doing great – suggesting in his State of the Union Address last week that “our economy is the envy of the world,” Americans are being absolutely crushed by inflation (which the Biden admin blames on ‘shrinkflation’ and ‘corporate greed’), and of course – crippling debt.

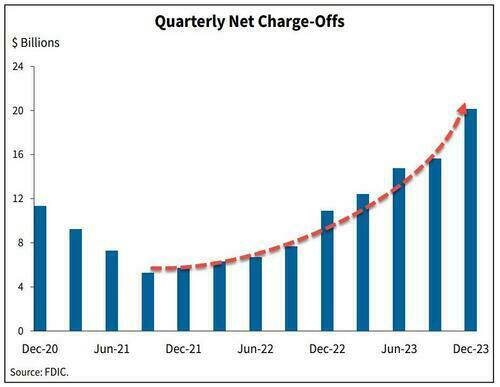

The signs are obvious. Last week we noted that banks’ charge-offs are accelerating, and are now above pre-pandemic levels.

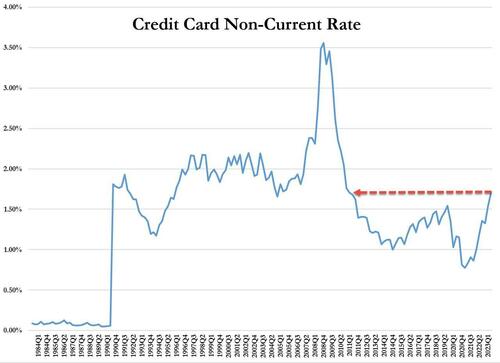

…and leading this increase are credit card loans – with delinquencies that haven’t been this high since Q3 2011.

On top of that, while credit cards and nonfarm, nonresidential commercial real estate loans drove the quarterly increase in the noncurrent rate, residential mortgages drove the quarterly increase in the share of loans 30-89 days past due.

And while Biden and crew can spin all they want, an average of polls from RealClear Politics shows that just 40% of people approve of Biden’s handling of the economy.

Crushed

On Friday, Bloomberg dug deeper into the effects of Biden’s “envious” economy on Americans – specifically, how massive debt loads (credit cards and auto loans especially) are absolutely crushing people.

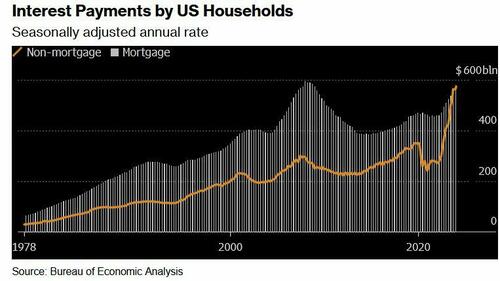

Two years after the Federal Reserve began hiking interest rates to tame prices, delinquency rates on credit cards and auto loans are the highest in more than a decade. For the first time on record, interest payments on those and other non-mortgage debts are as big a financial burden for US households as mortgage interest payments.

According to the report, this presents a difficult reality for millions of consumers who drive the US economy – “The era of high borrowing costs — however necessary to slow price increases — has a sting of its own that many families may feel for years to come, especially the ones that haven’t locked in cheap home loans.”

The Fed, meanwhile, doesn’t appear poised to cut rates until later this year.

According to a February paper from IMF and Harvard, the recent high cost of borrowing – something which isn’t reflected in inflation figures, is at the heart of lackluster consumer sentiment despite inflation having moderated and a job market which has recovered (thanks to job gains almost entirely enjoyed by immigrants).

In short, the debt burden has made life under President Biden a constant struggle throughout America.

“I’m making the most money I’ve ever made, and I’m still living paycheck to paycheck,” 40-year-old Denver resident Nikki Cimino told Bloomberg. Cimino is carrying a monthly mortgage of $1,650, and has $4,000 in credit card debt following a 2020 divorce.

“There’s this wild disconnect between what people are experiencing and what economists are experiencing.”

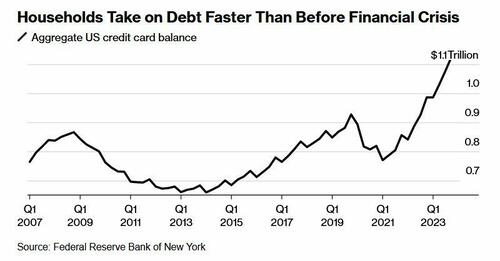

What’s more, according to Wells Fargo, families have taken on debt at a comparatively fast rate – no doubt to sustain the same lifestyle as low rates and pandemic-era stimmies provided. In fact, it only took four years for households to set a record new debt level after paying down borrowings in 2021 when interest rates were near zero.

Meanwhile, that increased debt load is exacerbated by credit card interest rates that have climbed to a record 22%, according to the Fed.

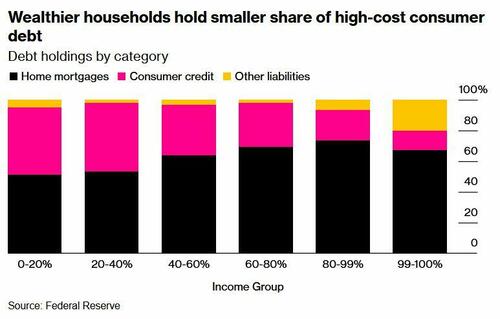

[P]art of the reason some Americans were able to take on a substantial load of non-mortgage debt is because they’d locked in home loans at ultra-low rates, leaving room on their balance sheets for other types of borrowing. The effective rate of interest on US mortgage debt was just 3.8% at the end of last year.

Yet the loans and interest payments can be a significant strain that shapes families’ spending choices. -Bloomberg

And of course, the highest-interest debt (credit cards) is hurting lower-income households the most, as tends to be the case.

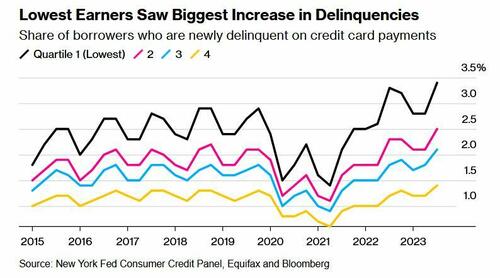

The lowest earners also understandably had the biggest increase in credit card delinquencies.

“Many consumers are levered to the hilt — maxed out on debt and barely keeping their heads above water,” Allan Schweitzer, a portfolio manager at credit-focused investment firm Beach Point Capital Management told Bloomberg. “They can dog paddle, if you will, but any uptick in unemployment or worsening of the economy could drive a pretty significant spike in defaults.”

“We had more money when Trump was president,” said Denise Nierzwicki, 69. She and her 72-year-old husband Paul have around $20,000 in debt spread across multiple cards – all of which have interest rates above 20%.

Photographer: Jon Cherry/Bloomberg

During the pandemic, Denise lost her job and a business deal for a bar they owned in their hometown of Lexington, Kentucky. While they applied for Social Security to ease the pain, Denise is now working 50 hours a week at a restaurant. Despite this, they’re barely scraping enough money together to service their debt.

The couple blames Biden for what they see as a gloomy economy and plans to vote for the Republican candidate in November. Denise routinely voted for Democrats up until about 2010, when she grew dissatisfied with Barack Obama’s economic stances, she said. Now, she supports Donald Trump because he lowered taxes and because of his policies on immigration. -Bloomberg

Meanwhile there’s student loans – which are not able to be discharged in bankruptcy.

“I can’t even save, I don’t have a savings account,” said 29-year-old in Columbus, Ohio resident Brittany Walling – who has around $80,000 in federal student loans, $20,000 in private debt from her undergraduate and graduate degrees, and $6,000 in credit card debt she accumulated over a six-month stretch in 2022 while she was unemployed.

“I just know that a lot of people are struggling, and things need to change,” she told the outlet.

The only silver lining of note, according to Bloomberg, is that broad wage gains resulting in large paychecks has made it easier for people to throw money at credit card bills.

Yet, according to Wells Fargo economist Shannon Grein, “As rates rose in 2023, we avoided a slowdown due to spending that was very much tied to easy access to credit … Now, credit has become harder to come by and more expensive.”

According to Grein, the change has posed “a significant headwind to consumption.”

Then there’s the election

“Maybe the Fed is done hiking, but as long as rates stay on hold, you still have a passive tightening effect flowing down to the consumer and being exerted on the economy,” she continued. “Those household dynamics are going to be a factor in the election this year.”

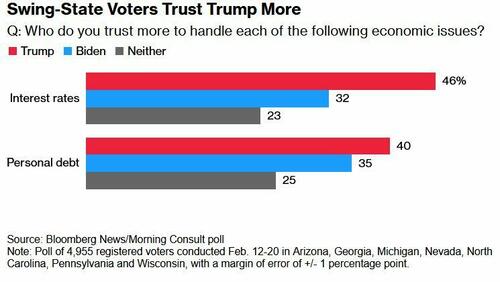

Meanwhile, swing-state voters in a February Bloomberg/Morning Consult poll said they trust Trump more than Biden on interest rates and personal debt.

Reverberations

These ‘headwinds’ have M3 Partners’ Moshin Meghji concerned.

“Any tightening there immediately hits the top line of companies,” he said, noting that for heavily indebted companies that took on debt during years of easy borrowing, “there’s no easy fix.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Yet the liberal morons are not buying inflation is $11 trillion in printed money, but they believe Joe’s fake assertion it is all “corporate greed”. We really need to start teaching economics in Jr High.

Whose economics?

Keynes?

MMT?

Careful what you wish for.

Just simple stuff, nothing advanced, like how printing money causes inflation, and how producers are as affected by inflation as consumers.

Stuff all theories would agree on. Even in Keynes money printing “inflates”.

The Austrian School of Economics

Mises you mean. Rothbard perhaps. Really walk it back and consider Adam Smith.

Children graduating from 12th grade in most instances can barely exhibit verbal or math skills past 3d grade level … and just how many of them could even spell ‘economics’?

Kids can’t even find countries on a map, know nothing of history. Kids were taught how to save money and basic budgeting, some in grade school into Jr high. The push for women in the work force in the ’60’s was so gov. could collect more taxes from workers. In high school girls were taking shorthand, typing classes and book keeping basics, got basic office jobs right out of high school.

FOMO YOLO spending is what got these people into debt.

They spend money on expensive cars expensive houses expensive vacations expensive restaurants. And they say it’s not my fault

Losers

embrace poverty! It’s your destiny….and…

have another scoop of bs:

Biden New Regs Will Cost up to $25,000 per home to Comply

Regulations and executive orders are NOT laws.

Why are they being enforced with no law(s) backing them?

EO’s need to go. Makes the O’Biden into our own little dictator.

What they accuse Trump of.

Shame on you Jill. Ah, love (of money power and control.)

My air conditioner bit the dust….

Jesus wept.

Yes, I know it was sarc. But hey go on line and see what you might learn! Lots of good info on youtube, you just gotta get off of social media and view some educational media. Use the brain and wisdom God blesses us with.

My bug-out place has a screen door for the summer heat.

Don’t ever opt for the wall splits, because, unknown to me at the time and not informed by the salesman, the splits do not work at heating the house if the temperature drops below 30 degrees for more than 6 hours, AND the fins on the rollers inside the split are impossible to clean by yourself without disassembling the entire thing, and once clogged with caked-on dust/humidity, they freeze up like the insides of an old style refrigerator freezer, the kind you had to manually defrost, and then the ice gradually melts and drips off and down your walls, and to have them “professionally” cleaned is $300 per split.

Obama gave tax credits for new high efficiency heatpumps, new windows, and certain types roofing. Companies installing had specials on rebates.

a

I don’t disagree that this economy is a disaster (it has been for some time). But anyone who bought a house for the extremely inflated values that they were selling for is a fool. To add to that, anyone who goes out racking up credit card debt is an even bigger fool. People continue to want to live beyond their means. I am willing to bet some of these people in the above article who are struggling with debt issues have expensive gas guzzling SUVs or trucks.

What if many of the wealthy up their purchases from 2 homes to 3,4,5 homes? Especially, in vacation areas. People will scramble for tangible assets in monetary change. Those so called fools wouldn’t look so dumb then.

Not referring to the wealthy. I am referring to the average home owner that paid $200,000 at a 7% rate for a house worth $125,000.

You cannot save when you spend everything you have on things you could and should be doing for yourself.

If you are paying others for the goods and services that have historically been provided by the family for their own use, you will spend the money you could have saved.

At some point people are going to have to either accept their own responsibility for their choices or learn to live as an indentured servant to the system they do not want to give up.

Yes, but fiat currency also eats that money, plus .gov taxes it and spends it to kill and indoctrinate.

Yes, govn’t taxes, especially increasing property taxes are driving people out of their homes. Add to that increasing insurance rates and it’s very tough out there. Of course I believe most of this was caused by Biden flooding the economy with trillions in free money.

You end the fed by paying off your debts.

After that you don’t give a fuck anymore.

I noticed an interesting anomaly as I waited outside the local elementary school: door dash, etc., delivering lunch to the folks working at the school — the one delivery guy in a Mercedes Benz 300 C …

Something seems off when the teachers, etc., in our community are complaining all the time, yet they spend all of that extra money on fast food delivery to their workplace … and the guy delivering it is doing so in a $48K automobile.

I see that all the time as well. Who the hell wants McDonald’s delivered after 30 minutes? It’s bad enough straight from the drive thru window. I take sandwiches to work for lunch . No chips or soda. A couple bologna and cheese classics. Cheap and simple.

Bologna … what my old 1st Sergeant used to call ‘penis d’stallion’ …

I have had Amazon delivery drivers show up in Teslas….

My homeowners and auto insurance just went up 2200 dollars (no change in coverage, no claims, no accidents or tickets), I have two new large taxes to pay that I did not pay in the past, one is a corporate tax and the other is a brutal occupational tax. I have done everything possible to stay out of debt but tax and insurance is biting me in the ass.

Try being poor like myself, no corporate tax to pay. Just the hidden inflation tax, the most regressive tax ever.

Yes: the one tax that the poor actually pay, and pay mightily. Now Schwab wants them to eat cereal instead of food.

All by design.

And enabled by insouciance. The many submit to the few.

Never had it happen, but the day I have to use a credit card to make daily-expense purchases might well be the day that I finally mask up, but not with virus avoidance in mind. Save that before that day arrived, the die will already have been cast. It’s all about planning ahead with a realistic timeline.

Maybe folks are just being grossly irresponsible with their spending … what with $75K SUVs and such … plus $850K houses … and all of the accoutrements that seem to go with that sort of ‘lifestyle’.

Also … imagine just how much lower housing prices would be without 65,000,000 illegal aliens in our Nation … or how much lower health care might be without them … or education … or how many fewer prisons we’d need … or …

Take all large sums of worthless fiat out of banks and buy gold and silver. Leave in the bare minimum to pay your bills.

I guess youse/emite^ Sam’s kids, of all ages, haven’t heard the “news”:

Bullshit is an important part of regenerative-sustainable food-growing. Including even the growing of more bulls.

(Cows. Horses. Oxen. Donkeys. Mules. Etc. Beasts of burden, milk, meat.)

^(I’d tell the usual semite-negate suspects to forget it, but slot s/cars don’t ride on memory.)

Spirals. Not linear bisoncide & plowing furrowed rows of soil destruction.* Jazz, not the Blues corners & Rap serrated edges it elicits in people who don’t/can’t appreciate Jazz.

What are you, vegetarian? Vegan?

Those aren’t diets that can Texas Ranger the riot.

And those dudes don’t abide.Those dudes are screwed.

Unless … unless … too much bullshit is piled up into too small a space.

Urban-suburban slots are too small, for example.

Craniums, too.

In•SID•ious the sudden infant death is. The literal is tragic. The far more prevalent metaphorical is tragicomic.

Get used to a lifestyle, a level of living. Disregard the fact of that level’s anomalousness. Cuz “How’s the water, boys?” (DF Wallace’s Kenyon College commencement speech.) “Water? What the hell is that?”

Further denial-disregard that the life level pedestal your “free will” garnered & “earned” you as you “willingly” were moved from board square to board square was an emergent property & simultaneously a tactical ploy of pushers of the ultimate addictive drug cocktail: Affluenza & Conceit, Hopium & Denial … shaken, not stirred, & poured into a chilled crib-mold … homemade, with just a little psyop** help, popsicles.

**(just a word. As magical as arrangements of letter symbols are to so many, & contra the A9racer missed punch I saw, psyops predates the cyclops – that fingers/buttons symbiosis goes all the way back.)

Industrial revolutionaries & financial engineers used the cribbed cog-people – – who went along & said it was all always their idea to do so – – to build the overarching wealth superstructure.

As the build-out topped out the useful-used chain-gang became evermore “useless eaters” & the slotted-cars architects added, via PID control commands, proportional takeaway closes to the deadly cocktail. That ingredient is as amphetamine speeding up ever more the ACHD.

Work ‘em to death in concentration gulags. Hitler & Stalin & their progeny are good & strong & leaders of merit say good followers of demerit.

I’ve used the takeaway close. The startling results contributed to my lowering opinion of people. I had to quit it. Shameful to be party to shameless, or mostly so, reflexes. Because that’s what it is: response to takeaway close that cements so many deals & pitches is just as cemented in as patellar reflex is.

That is a poorly made, unintelligently designed, herd animal. Unless & except from the perspective of prey animals that rely upon it.

Another miss I saw, forget the opiner who posted it, described mice going gently into that constricted night. “Not like that. Not like you say.” (As Carla Jean said to Anton Chigurh.)***

I kept snakes & raised mice. Lots of both. What the mouse does depends on where it finds itself in the snake’s grip. That too is a metaphor atop downer & dirtier reality. If the mouse has any high ground at all ~reality/metaphor~ it will sink its teeth into the snake. I saw it, over & over.

***(McCarthy got the Pulitzer for The Road. I suppose that can combine with “under appreciated” – not to mention the various screen treatments, but I don’t think so. And I certainly appreciate that one’s work.)

I could go on. Indefinitely. “Tediously” per the editorial stuffed shirts that can’t help themselves but be what they are.

Some good bits from On The Natural History Of Destruction, W.G. Sebald, that I finished in the wee hours this morning, while the snakes hunted & the mice hummed that BeeGees tune, hoping for Staying Alive.

So much fooking falsetto out there.

Instead, I gotta get a go on otherwise.

I’ll close with the jazz club scene from Collateral. Because that is the takeaway close endpoint that herds shepherd themselves to. And herds will never stop doing that.

*I used to know this old scarecrow

He was my song

My joy and sorrow

Cast alone between the furrows

Of a field

No longer sown by anyone

~ Elton John, Curtains (the old Edward G Robinson gangster meaning, & the old Wizard of Oz meaning & how urbanites like to leave them wide open meaning

)

well, that’s another one. Mr. Brooks, institutional man, was here ~ Shawshank Redemption:

IF

WTF word salad. Go take your meds.

Iceberg, oil&vinegar, was fine (well, canola oil was “healthy” then), when I was a kid.

& iceberg writing was imposed, too, in all the Prussian dressing schools – straight thru college.

“Use *these* symbols in *this* diagrammatic way” – if you want the all-important Fonzie “Aaaaaaay.”

Well, The Fonz jumped the shark & I put away those childish things. Smashed the iceberg to chips & it melted away, for good, decades ago.

Tonight’s salad bowl has arugula, radicchio, & belgian endive lettuces. Plus a big chunk of the rest of the garden.

Put it this other way, What It’s All About, Alfie (Oh, I got plenty alfalfa sprouts, too) is The Myth of Progressyphus.

If it walks like a platypus, it ain’t no duck – but you should (or should have).

Yet continuing to roll that boulder up, follow it back down, again & again continues to be all the peer pressurized rage.

“Me talk pretty!” Pretty funny.

“Everybody has a plan until they get punched in the mouth” means a lot of people, apparently, have no nerve endings in, can’t feel, their faces. Or maybe its that asian face-save thing.

Whatever it is a whole lotta battered faces it is.

And I saw somebody write in here that they’d use up a trip back in time on killing some existentialists.

Camus would say “how absurd!”

And I’d agree.

A single man can almost always pay his bills and save a little. Females make life expensive. My grown daughter has eaten away 150K of my retirement savings due to stupid shyte life choices.

To Hell with the bankers. Stiff them.

For example, seniors with huge credit card debt, walk away.

Young people with huge student loans, sorry, you’re screwed under the current rules.

Exactly.