Crypto bulls – at least those who didn’t betray their “laser eyes” PFP and sell previously – have had their day in the sun for the past 3 months as bitcoin and most other digital fiat alternatives soared, making it clear why, despite the difficult, it can be so very profitable to HODL, especially with the US is approaching the Minsky Moment of issuing $1 trillion in debt every 100 days, and interest on US debt, now at $1.1 trillion, is set to surpass Social Security spending and become the single largest government outlay before the end of the year.

Now that rate cuts are off the table, interest on US debt – currently the second biggest government outlay at $1.1 trillion – will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion. pic.twitter.com/OQYjHhOks9

— zerohedge (@zerohedge) April 11, 2024

And now, it’s time for GODL!

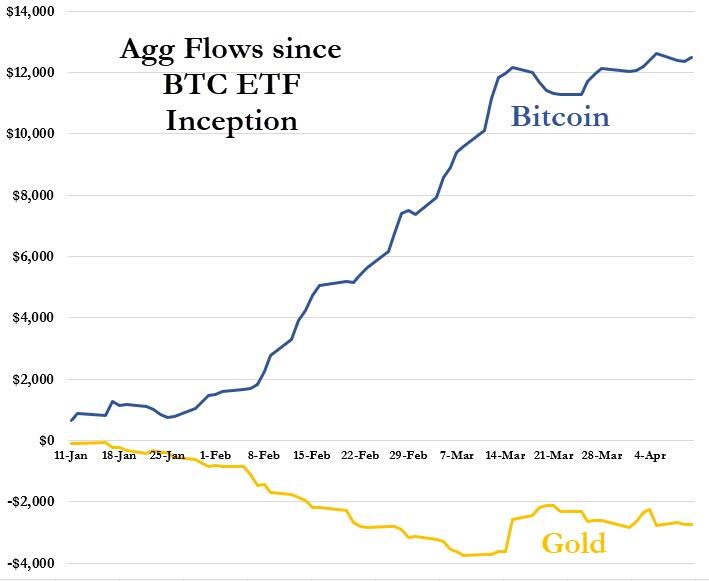

Stupid jokes aside, while bitcoin was rampaging higher, goldbugs stared in disgust, wondering why their non-fiat god had forsaken them… after all, when the collapse of the dollar, and fiat in general, finally arrives gold will be one of the very few currency alternatives still standing. Alas, ETF flows have not provided any respite, because while bitcoin ETFs soaked up most money in the past 3 months, aggregate gold flows continued to shrink.

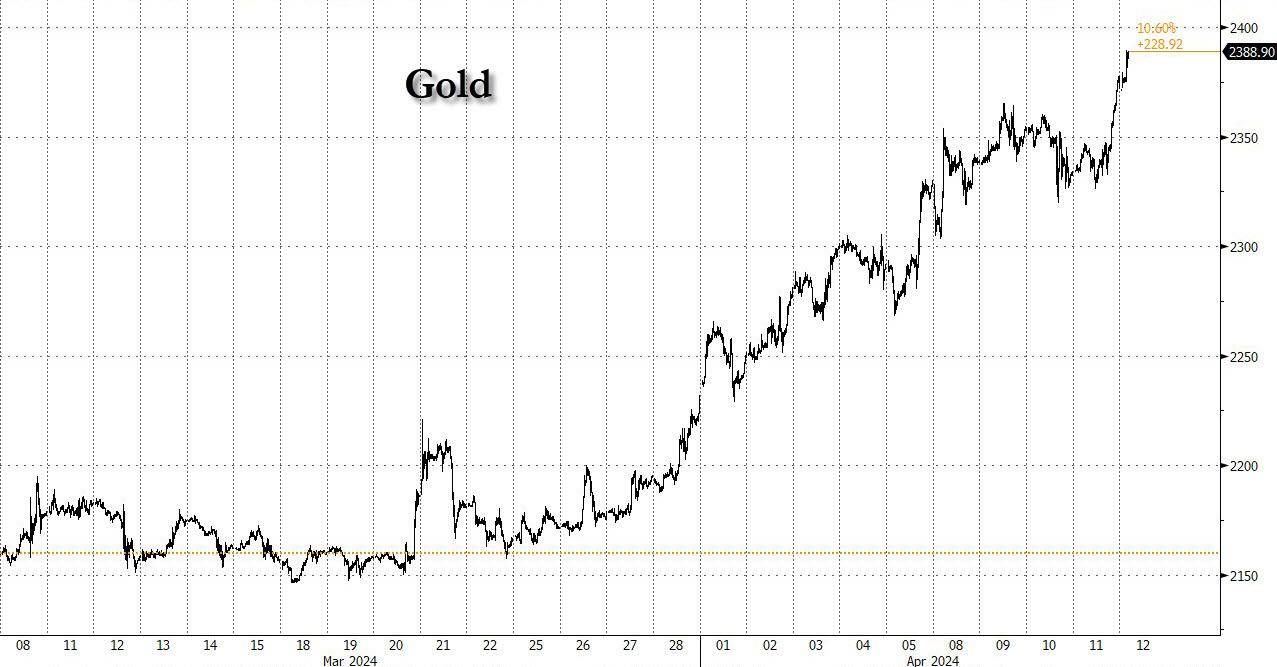

And yet, starting in the beginning of March, gold finally broke out from the black hole gravitational attraction of the Bank of International Settlements trading desk, and has soared some $300 dollars in just 6 weeks, its fastest ascent in decades.

Fast forward to tonight when, with most other assets quiet, gold suddenly surged higher, and after closing at an all time high, the precious metals spiked by another $15 in a matter of seconds, a move which for the otherwise hyperlethargic assets, is the equivalent of turbo boost.

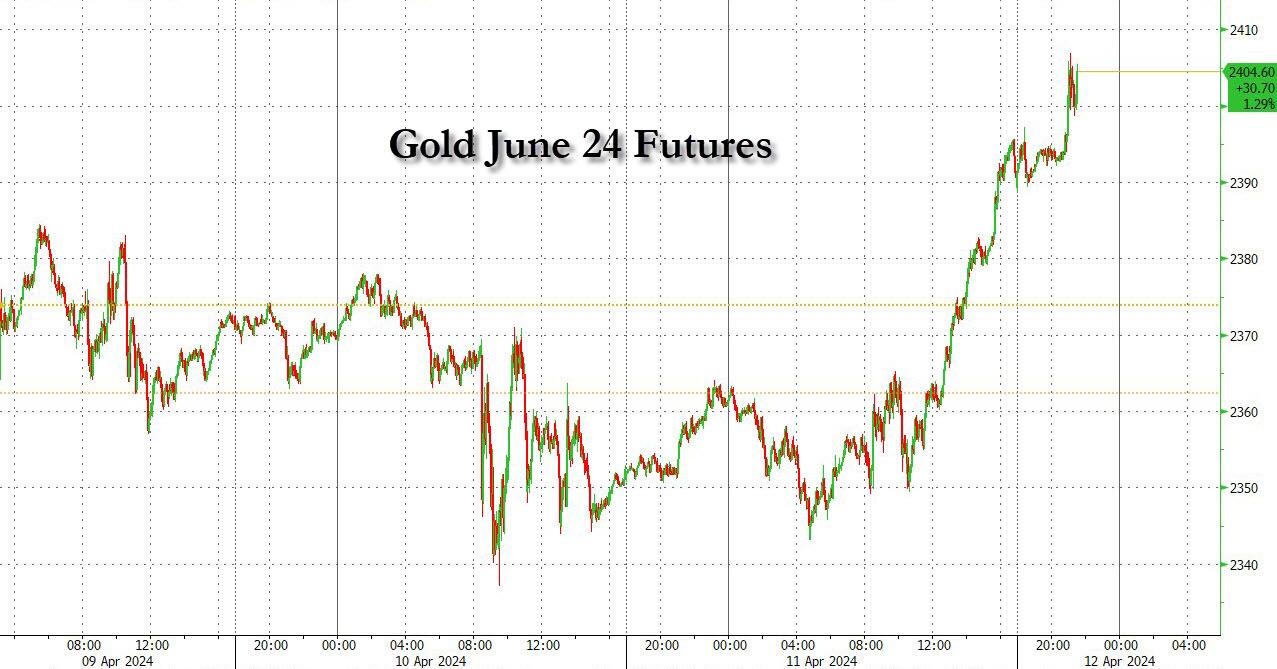

And while it’s now just a matter of hours if not minutes, before spot rises above $2,400, gold futures are already there: the active, June contract just hit a new all time high of $2,406.9 moments ago around the time Chinese buy orders started rolling in…

… and contrary to speculation that this is just a fat finger, or a another one-off buy orders, gold future volumes are solid, especially given volumes would have already been very high in the last few days. GCM4 volumes are now 23.5k lots vs. 5-day average of 17.85k lots.

While it wasn’t clear what sparked the buying frenzy, UBS’ trading desk notes that “gold futures gapped up $10 as they traded through Thursday’s high on what felt like stop losses being triggered; 0.5moz of futures volume were behind the move.”

What happens next is also unclear, although as we showed moments before the breakout, the current divergence between gold prices and 10Y real rates, suggests that something awful is about to happen…

this is not normal pic.twitter.com/mv0uLsDs7R

— zerohedge (@zerohedge) April 12, 2024

… a dismal outlook proposed last week by none other than BofA CIO Michael Hartnett, who in his latest Flow Show report noted that investors are looking beyond the “here and now”, realizing that there is no way markets or the economy can sustain 5% nominal and 2% real rates, and are hedging two things: i) the risk that the Fed cuts as CPI accelerates, and ii) and more ominously, the “endgame of Fed Interest Cost Control (“ICC”), Yield Curve Control (YCC) and QE to backstop US government spending.”

In short, something big is about to break, and if the surge in gold leads to a spike in yields, start the countdown to one of two things: i) QE and/or ii) YCC, because if the bond market sniffs out the endgame that gold is currently smelling, it will be up to Powell to once again prevent a catastrophic financial collapse.

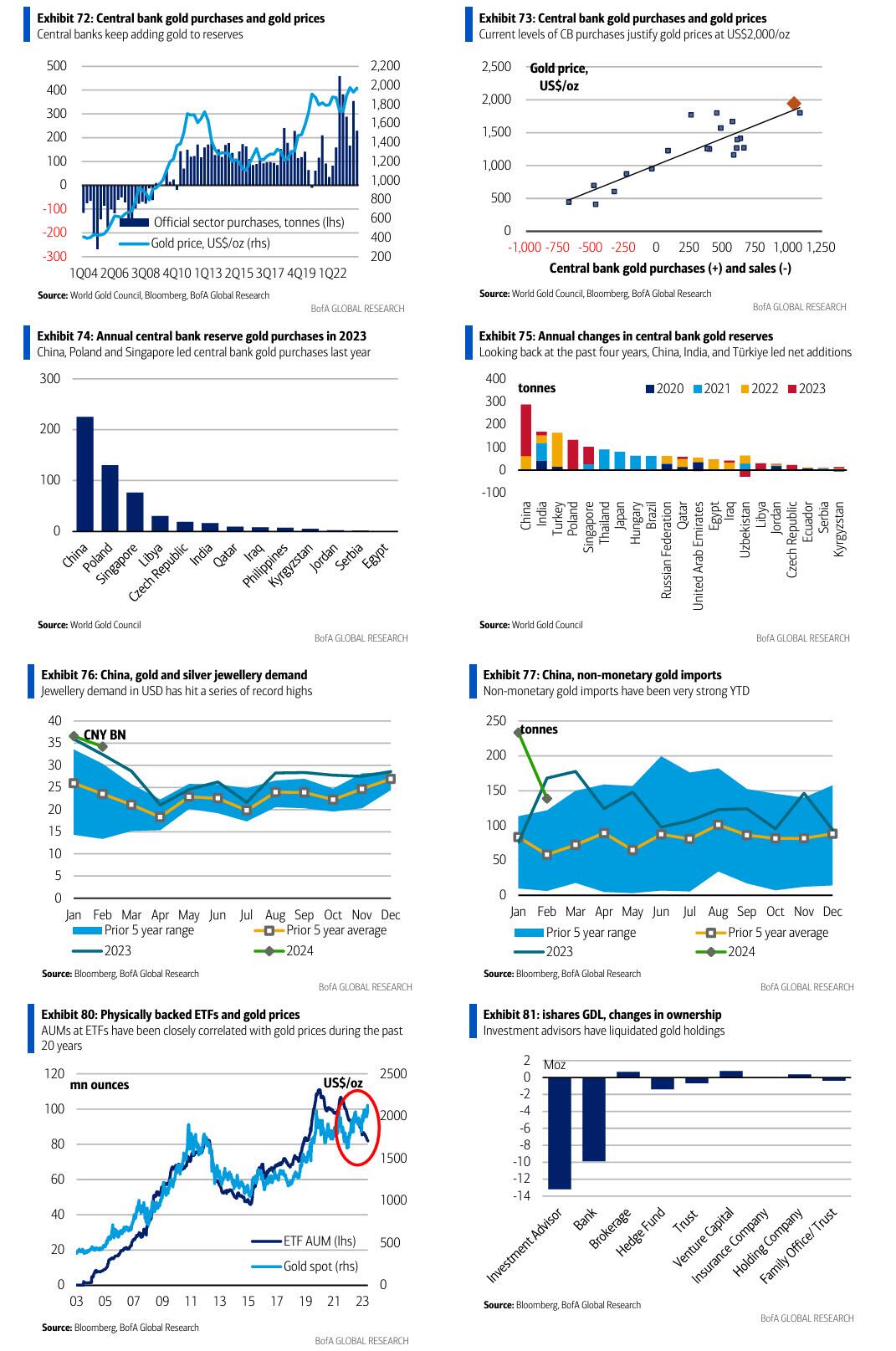

For those wondering how far gold can rise, we excerpt from the latest note from BofA commodities strategist Michael Widmer (available to professional subscribers), who writes that…

Gold and silver are among our most preferred commodities, with the yellow metal pushed up by central banks, China investors and, increasingly, Western buyers on a confluence of macro factors, including an end to hiking cycles. Accordingly, we see the yellow metal rally to US$3,000/oz by 2025. Silver benefits from that too, with prices also boosted by stronger industrial demand. This could take prices above US$30/oz within the next 12 months.

And some charts.

And here is UBS, predicting that the price of the precious metal could double from here (note also available to pro subs):

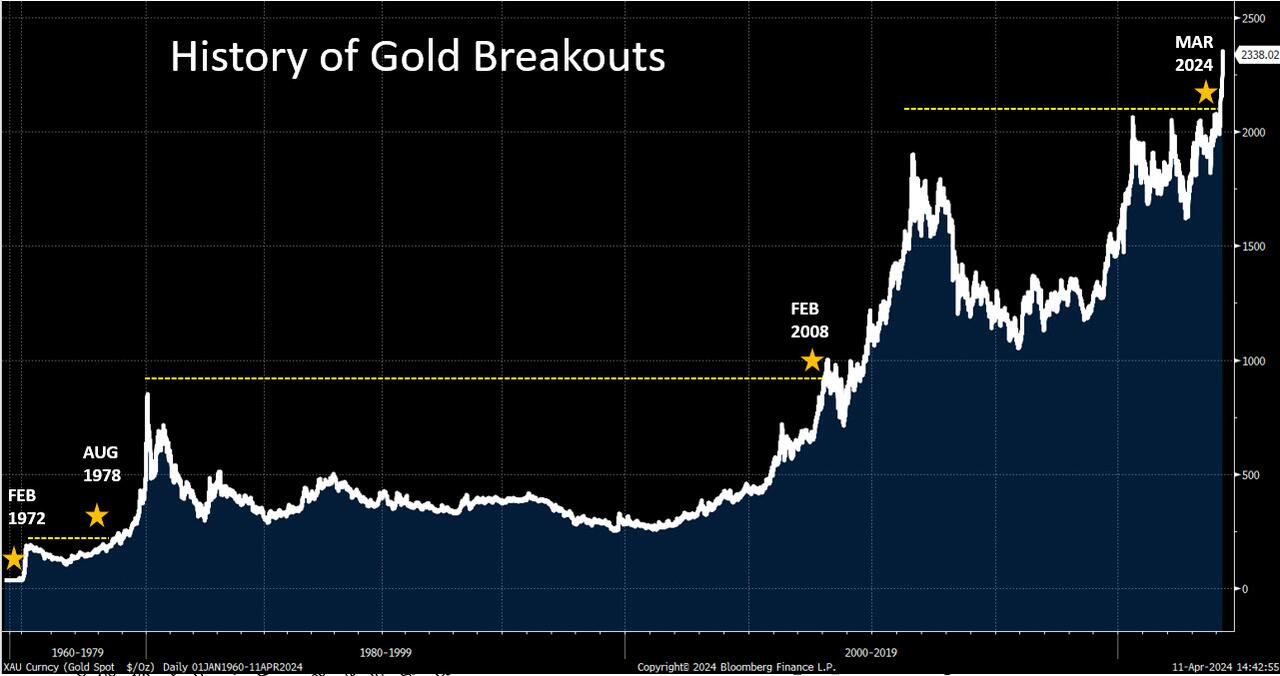

The recent move in gold reminds me of a famous quote: “There are decades where nothing happens, and there are weeks where decades happen.” Looking at history, gold price can stay in the doldrums for a long time but when it does breakout, the surge is usually fast and furious. In deciding whether to chase or fade the recent gold rally, it might be useful to draw some inspiration from past breakout episodes. Here I define a “breakout” to be when the gold prices move 10% above the previous historical peak.

Should history repeat itself, it is not too late to participate in the current gold rally. An investor with a two to three-year view could expect to see gold potentially double from here to more than $4,000. The take-profit signal is when real rates turn negative and when there is a full-blown recession. Today with real rate still high and a recession seemingly faraway, it is too early to call the end of the ongoing gold rally. Gold breakout can be seen as an ominous signal, and it is not difficult to imagine a range of geopolitical risk scenarios. As for markets, many things look mispriced today with a two to three-year lookout, ranging from incredibly low credit spreads, elevated equity valuation to subdued volatility. It’s fair to say that the gold market has fired its warning shot.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I wasn’t aware God was on the market. Definitely investing in that

I have a fair amount of metals,as always,be glad they just held their value and did not go up in value dramatically as means a lot of other issues boiling over.

I had preps covered as reasonable as possible short of concrete bunker before I put any money into metals.

So,keep prepping folks,and,Prepper Duck has got your back!

Still waiting for the first +$100 jump in day-to-day Gold price.

The collapse of the paper gold market is being shown to us in real time…

The window to buy gold for the average citizen has passed. There are far more important things to prioritize in these crazy times. When the big crash comes it won’t be long until everything will fail and come to a halt. That includes just in time deliveries of all goods and particularly all utilities. Time to prepare is growing shorter by the minute.

Sliver is still affordable. BUT…. additional preps are likely the better investment right now. If you haven’t started prep’n… you’d best het on that. It doesn’t have to be painful.

Next time in the grocery store instead of buying one item, buy two or three and shelve the extras. Soon you’ll have a pantry filled with provisions. For the uninitiated, your preps are not going to get you thru the coming calamity. They will buy you time to figure out what to do next is all. They will keep you out of the danger zones for a short while.

Get prep’d first, buy silver second.

I’m thinking when gold hits 2500, it’s all over for the US dollar and we will see a banking collapse like no other in human history. Could even happen today.

I have been buying PM’s for years, slowly and methodically as insurance, I have done the same with lead and food. I have tried to tell people to prepare, I have tried to tell people not to take the vax…but the sheep still think I’m crazy and they continue to graze oblivious to their impending doom. I’m done trying to convert anyone…time is too short.