Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

TIME FOR A BREAK – BOOM is taking a short, well-earned break over the next two weeks. Holidays are important to recharge the batteries. During this period, BOOM will publish some previous editorials which readers should hopefully find of interest which you can read at the links above. [AP, au contraire, will be posting some interesting articles about Bible chronology and The Younger Dryas, in the coming two weeks]. First, a few things of great economic interest occurred last week,

GREEK POPULATION COLLAPSE HAS ECONOMIC CONSEQUENCES

Prime Minister Kyriakos Mitsotakis called the prospect of population collapse a “ticking time bomb” and a “national threat”. The Greece birth rate fell by 30% in the ten years 2011-21, to under 84,000pa, and slipping below the death rate, according to the country’s National Hellenic Statistical Service, also known as ELSTAT.

“This is one of the most serious problems we face not only in Greece but in the EU as a whole,” Finance Minister Kostis Hatzidakis said last week, referring to the rapidly declining population in his country.

THE DISASTER OF ZIMBABWE’S NEW “DIGITAL CURRENCY” – THE ‘ZiG’ ZIMBABWE “GOLD”

This will be yet another monetary disaster for the people of Zimbabwe. BOOM can guarantee that. “Backing” any currency with a limited supply of any commodity will always fail. The ZiG is the name of Zimbabwe’s new currency which was introduced out of the blue on April 5, 2024. The name stands for ‘Zimbabwe Gold’. No one was given any notice about the ZiG as banks, shops, businesses, utility providers, and communication networks all went into an instant spiral.

Everyone was in the dark. Chaos was inevitable. The stock market immediately crashed 99%. A statement from the Reserve Bank of Zimbabwe (the central bank) said that the existing currency known as ZWL, RTGS, or Bond Dollars would cease to be legal in 21 days. They instructed everyone to hand in all banknotes and small change.

It has been reported that transactions via bank cards, internet banking, phone banking, or mobile money platforms all crashed. Bank-issued debit and credit cards suddenly didn’t work. Internet banking didn’t work. Phone banking didn’t work. The result was that people could not pay their bills, buy food, or get medical help.

Some people received this message from their bank, “Dear Customer. Our ZWL platforms are down to allow for currency changeover. We will advise once service has been restored.” Four days later the platforms were still down and customers had no access to their money. The banks then sent this notice: “Dear Customer our conversion to ZiG is still ongoing. Thank you for your patience.” This underlines what BOOM has repeated many times: “A nation must NEVER allow circulation and general acceptance of any foreign currency.”

Citizens must NEVER surrender their right to physical cash. They must use physical cash every day and keep using it to preserve their right to interest-free, sovereign money. Citizens must NEVER accept a central bank-issued “digital currency” which is a rival to physical cash.

A nation’s currency is ‘The Peoples’ currency. Currency is determined and issued by the State, not by the central bank (except in a Communist nation) [AP additional note via ZH: “One hopes, for the sake of the long-suffering citizens of Zimbabwe, that this time around the result of yet another monetary reconstitution is successful, fostering a stable general price level, a reliable monetary unit for saving and spending, and enhanced possibilities for economic calculation. Without fundamental changes guaranteeing private property protection, pro-market reforms, and safeguards against corruption, though, the ZiG is likely to retrace the unfortunate steps of its predecessors.” Sources

- BOOM is right, even the Chinese recognise the importance of CASH! https://www.theguardian.com/world/2024/apr/29/china-slows-cashless-society-transition-cash-digital-currency-mobile-payment-system?utm_term=662f43738d64b6d42583f007fd8dfca2&utm_campaign=BusinessToday&utm_source=esp&utm_medium=Email&CMP=bustoday_email

- Zimbabwe’s historical relationship with money has been inundated with mistakes, recklessness, and hardship https://www.zerohedge.com/markets/sixth-time-charm-meet-zig-zimbabwes-new-gold-backed-currency

- Zimbabwe Gold (ZiG) currency set to collapse, say economists https://www.theafricareport.com/343424/zimbabwe-gold-zig-currency-set-to-collapse-say-economists/

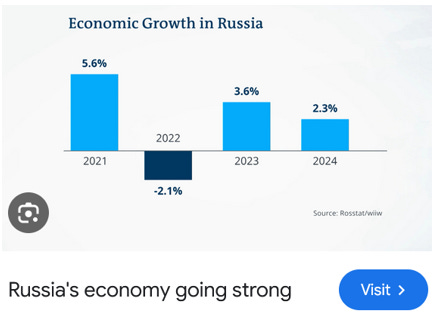

THE RUSSIAN ECONOMY IS STRONG – SANCTIONS HAVE BACKFIRED

Kammer has been the Director of the European Department of the International Monetary Fund since August 2020. The IMF has upgraded its growth estimate for the Russian economy, expecting the country’s GDP to expand by 3.2% this year, up from its January projection of 2.6%. Its latest projections put Russia ahead of several major Western economies in terms of growth this year, including the US (2.7%), UK (0.5%), France (0.7%), and Germany (0.2%). Russia’s Economy Ministry expects GDP growth this year to come in at 3.6%, the same as last year.

NOW A LOOK BACK AT THE PAST — A SELECTION OF PREVIOUS BOOM EDITORIALS – From October 7, 2023.

THE DISASTROUS FAILURE OF NIGERIA’S CENTRAL BANK DIGITAL CURRENCY – THE eNAIRA.

Disastrously, the Government deliberately decided to restrict and withdraw physical cash as a key part of the experiment. That was a very grave mistake, similar to what had happened in India previously in 2016 when the Indian Government instantly removed 86% of physical cash from circulation. This plunged the poor of India into a huge crisis and a desperate search for survival. But Nigeria’s central bank and government ignored all of that. But that is not all they ignored.

Cash is ‘The Peoples’ money, non-interest bearing and anonymous which must be made available by a government upon demand from The People. That is what all of monetary history tells us. To ignore such is to court social, financial, and economic disaster. In Nigeria, the rationale for the eNAIRA was threefold:

- To increase financial inclusion. 38 million people in Nigeria do not have a bank account.

- To reduce the cost of foreign remittances. Money transfers from Nigerians working in foreign countries amounted to $24bn in 2019. They pay commissions of up to 8% to do that. The eNAIRA was supposed to make that far cheaper and more convenient.

- To reduce the black market economy where Cash is used as a settlement

The eNAIRA was supposedly a solution to these “problems” as envisaged by the Central Bank of Nigeria. However, the “problems” did not exist in the minds of the people. The three goals overlooked three important facts about many Nigerians:

- They can and do live quite happily without bank accountsThey don’t want Big Brother watching their remittances

- They don’t want to lose their Black Market economy, based on Cash.

Of course, the protagonists of the eNAIRA made the proposition right at the outset that there is such a thing as a “Cashless Trend”, an inevitable move toward cash-free economies. This is a common theme in monetary circles promulgated principally by bankers (who make zero profit from cash; in fact, it is a cost centre for them) and totalitarian governments (who want to peer into every citizen’s financial affairs). The unelected IMF and the unelected WEF (World Economic Forum) also promote such falsehoods. However, BOOM cannot find a demand from the people to eliminate cash. Anywhere.

The big question to be answered is this: how popular has it been? The answer, according to an IMF Paper released in early May, is that “the take-up of the eNaira by households and merchants in Nigeria has been slow”.

That is a gross exaggeration. The total population of Nigeria is 224 million people. After an initial surge of wallet downloads, the uptake was very slow indeed. After 12 months, there were 860,000 retail wallets downloaded (retail, meaning in the hands of individuals) and the vast majority of those were downloaded at the very outset with relatively few being loaded each month as the year progressed.

That represents 0.35% of the population. That is 0.8% of Nigeria’s active bank accounts. And only 10% of merchants with suitable equipment had downloaded a merchant wallet.

But it’s worse than that. Disastrous. 98.5% of the retail wallets that were downloaded were not used even once. The average total value of eNaira transactions was 923 million Naira per week or 0.0018% of the average amount of M3 money during those 12 months.

These are disastrous figures. It represents an almost complete failure of acceptance. In the (real) world of money, General Acceptance is the sine qua non. Without general acceptance then whatever is being used is not money by definition, no matter how theoretically sound it may appear.

CENTRAL BANK DIGITAL CURRENCIES (CBDCs) CANNOT SUCCEED – THEY ARE INTELLECTUALLY BANKRUPT

At the end of May 2023, the President of Nigeria, Bola Tinubu, restored the validity of the old currency and issued fresh new physical banknotes. He ordered an investigation into the Central Bank of Nigeria (CBN) and, quite rightly, this resulted in the arrest of the former CBN governor, Godwin Emefiele, on June 10, 2023.

In late July the court released him from custody but the security service rearrested him and is holding him in custody. The investigation is ongoing as far as BOOM is aware. BOOM suggests that the Government of Nigeria abandon the experiment completely and immediately. It is dangerous in the extreme to the Nigerian nation and to the national economy, especially if allowed to fester and undermine the social fabric of the nation.

A central bank-issued currency CBDC should NEVER be contemplated. It suggests and provides a false alternative to the sovereignty of the nation and a threat to social cohesion. It arguably amounts to a treasonous act, not dissimilar to the adoption of a currency union. (Long-term readers will know that BOOM is not a fan of currency unions such as the euro).

General Acceptance of a currency MUST originate and reach fulfilment in and from the People for it to be a successful reflection of social bonds. From first principles, it cannot be imposed upon The People by a non-representative body such as a central bank, the IMF, or the World Economic Forum WEF (or, by the way, by a mysterious Japanese figure claiming the name of Satoshi Nakamoto).

The stakes are high in this game. If a CBDC is launched and is seen by the people as not emanating from them and is perceived to be an alternative to their national currency, then it will potentially threaten the acceptance of that national currency.

Trust in government and the institution of the central bank will be simultaneously weakened. In such a circumstance, the people may decide to generally accept another currency of convenience, such as the US Dollar or any other currency readily available in a neighbouring State.

Or they may decide to overthrow the Government and charge the politicians and central bankers with crimes against the State. Social trust is hard won but can be quickly lost if the fundamental principles of what makes money be accepted as money are ignored. And especially so if a currency experiment is launched by unelected institutions above to solve problems that don’t exist in the minds of the People below.

BOOM awaits the day (which will never come) when The People of any nation demand the issuance of a currency by their unelected central bankers in opposition to the currency of The People, issued and overseen by their representative Government.

CBDCs may be popular among unelected central bankers, unelected WEF members, and unelected IMF apparatchiks but money is ultimately a tool created by and for ‘The People’. This fact must not be overlooked when monetary reform is being considered.

From BOOM on May 7, 2023 – HOW SOUND MONEY POLICY FAILED TO PROTECT THE PEOPLE — THE PANIC OF 1837

It is fashionable to rage against central bankers and even commercial bankers with some people vehemently accusing them of creating most, if not all of society’s ills. It is time to re-consider a world of so-called “sound’ money, backed by gold, and when there was no central bank. That world occurred in the 19th century in the United States. BOOM wrote much of this in June 2021.

If you hate banks and bankers or if you are a true believer in the wisdom of governments or the concept of “hard” (or “sound”) money, you should take a good look at The Panic of 1837 in the United States. An examination of the events leading up to the Panic and the events that occurred afterward are worthy of your time.

Human history reveals that many governments don’t understand money. And the idea that the concept of “soundness” can be used to somehow tame money creation is merely magical thinking. All forms of money are contracts of credit, based upon trust and enforced by social agreement.

Human beings will always find ways to innovate regarding contracts of credit. That is what the history of money tells us. Let’s look back to 1837. It all started when the US President, Andrew Jackson, in his wisdom, effectively killed off the central bank which was then called the BUS, the Second Bank of the United States. That process started in 1833 but was not completed until 1836. The end of the central bank triggered a huge real estate boom as state-based commercial banks issued credit money loans in large volumes to eager borrowers to purchase land. Does this sound familiar?

The government became concerned. So they issued the so-called “Specie Circular”, an executive order issued by President Andrew Jackson on July 11, 1836. He ordered that payments for the purchase of public lands be made exclusively in gold or silver. Jackson was a “hard” money man who was always suspicious of banks creating credit money loans without the “sound” backing of gold and silver. The idea of the “Specie Circular” was to squash “excessive” land speculation and the “excessive” growth of the credit money supply (bank loans).

Jackson directed the Treasury Department and banks to only accept specie (Gold or Silver) as payment for government-owned land after August 15, 1836. However, settlers and residents of the state in which they purchased land were permitted to use “paper” money (bank credit) until December 15 on lots up to 320 acres. After that date, the Specie Circular effectively strangled the use of paper money.

This caused a huge collapse in real estate prices. Buyers simply could not find sufficient gold or silver to settle purchases so they stopped buying. The banks had no option but to reduce credit creation dramatically and many banks then subsequently failed (as you would expect) due to loan defaults.

The Panic of 1837 started in April, one month after Martin Von Buren became President. It was an absolute economic disaster. By May 21, 1838, a joint resolution of Congress repealed the Specie Circular. The experiment with “sound” money was decisively over.

Interestingly, a central bank was not established after that debacle. During the period from 1836 to 1862, there were only state banks with no Federal Bank. This period is called the ‘Free Banking Era’. Bank notes had to be issued with gold or silver backing but loan books of credit money were allowed. More chaos ensued.

During the free banking era, state banks had an average life span of just five years. About half of the banks failed for the usual reason of loan defaults. But some failed because they had inadequate gold and silver holdings with which to honour note redemptions. As a result, some banks innovated and began to offer central banking services to other banks. Nonetheless, bank failures continued in huge numbers.

In 1863, the National Banking Act was passed, creating a system of Federal banks. And the Office of Comptroller of the Currency was created to supervise those banks. A uniform national currency was also created. A huge bout of CPI inflation followed immediately with inflation hitting 24.6% in 1864. By 1870, there were 1,638 national banks and only 325 state banks.

Inevitably, with no Central Bank to provide overnight support, liquidity mismatches occurred and banks lost faith in each other. Mistrust ruled. Outright deflation hit and stayed for dinner (and beyond) from 1866 right through to 1897. Per capita GDP in the US rose very, very slowly from $4,700 to $7,200 over these thirty-long years. Much economic hardship was manifest.

As sure as night follows day, bank runs occurred when depositors panicked about the security of their deposits. There were banking panics in 1873, 1884, 1893, 1896, 1901, 1907. Many, many banks failed, people lost their savings, and deflationary real estate crashes occurred. This is what life is like without a central bank and with cash currency backed by gold. In other words, in such a situation, credit money, created via commercial bank loans, rules the roost with no effective controls.

But what about the early years of the 19th century? Surely it was a golden era of “sound” money? Gold rushes in the early part of the 19th century triggered mass migrations as people desperately tried to dig ‘money’ out of the ground. During the early years of the 19th century, there were banking crises in 1819, 1825, 1837, 1847, and 1857.

Almost the entire 19th century in the US was desperate times indeed. It was slowly becoming obvious that a central bank was needed to provide stability to a banking sector in which interbank trust was badly damaged.

The concept of “sound money” (backed by gold) failed to protect the people in the 19th century. The fact is that humans need supervision regarding money. Banks need to be supervised strictly and have access to overnight capital reserves. A central bank must maintain interbank trust and must stop excessive credit creation. Easy to say but not so easy to do.

The problem is that human beings are elected by governments and central banks. They also manage commercial banks. One nation attempted to rid itself of such beasts. It was called the USSR, the Union of Soviet Socialist Republics, where there were no elections, no commercial banks, and where a lone, all-powerful central bank controlled the supply of money.

That institution was appointed by a group of unelected tyrants in the Central Committee, unanswerable to the majority of the people. The experiment lasted 70 years. It ended when productivity eventually collapsed because nobody bothered to do any work, waiting for all their goods and services to be delivered by a benevolent central government. Utopia had been achieved. [AP, an old Soviet joke: “They pretend to pay us, and we pretend to work”]

Our governments, our central banks, and our commercial banks are all potentially flawed institutions because they contain human beings. Trust in our national money systems and our national currencies is critical to keep our social system from implosion. The alternative is economic and social chaos. Beware of anyone who attempts to destroy that trust. BOOM suggests reform as a better pathway, a better discussion. Source

- As the crisis intensified, the notion that each man assumed responsibility for his economic fate seemed increasingly flawed. Everyone, that is, was ready to claim credit for prosperity; none were willing to confess to personal failure https://commonplace.online/article/pictures-panic/

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

- Letter from Great Britain – CRIMES AGAINST HUMANITY – Saturday, May 4, 2024 – (Andrew Briden MP)

- SPECIAL Bible History Lesson – Tuesday, May 7, 2024 – (Replaces BOOM)

- The Financial Jigsaw Part 2 – GEOPOLITICS of WW3 – Saturday, May 11, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Brilliant. But our biggest problem is how the Stock Market is illegaly bought and controlled using taxpayer money via QE Fed bank purchases. Nobody knows or talks about it because their 401Ks are now finally in the Black. And everyone looks the other way. Until it all collapses and future gens pay for our temp fun and games as permanent indentured servants to Fascio Communists.

The freaks don’t want no Greeks.

Our Biggest problem (and entire problem) is that we turned our backs ,collectively, on Almighty God.

Let the shit storm begin.

Well said CS – a godless society is doomed beyond redemption. The USSR is just one of many examples.

Right per se because Honest Money is not as much the form of the money that matters as the character of the people. When the righteous are in authority, the people rejoice: but when the wicked beareth rule, the people mourn. Prov 29:2 We all know the character of TPTB today. 1 Timothy 6:10 : For the love of money is the root of all of evil. Not the money but the lust for money.

ChodeGPT sez wot?

In OUR LIFETIMES, when has Greece NOT been in “crisis” ? Or the United States for that matter. Seriously.

ChodeGPT sez wot?

you douchebags are so tedious at times

Don’t worry. Jim will get around to addressing this in another 5 years or so. I’m sure there is a lot to consider.