A bear market in the used car market was confirmed in November and has since worsened through April. At the same time, negative equity values are hitting new record highs while auto insurance rates have soared the most since the mid-1970s. While gas prices at the pump are elevated, the environment to operate a vehicle is probably one of the worst ever. Just listen to Gen-Z and millennial users on X bitch and moan about $1,000 monthly car payments and other absurd costs associated with driving.

The Manheim Used Vehicle Value Index fell to 198.4 in April, a 14% drop from one year ago. This is the index’s lowest print since the first quarter of 2021. As for the bear market, the index is down 23% from the high and quickly falling – there could be air pockets given the rapid upward moves three years ago – and that demand has been suppressed given a high-interest rate environment.

All vehicle segments of the Manheim Used Vehicle Value Index experienced seasonally adjusted prices that were down double digits year over year in April. Luxury was the only segment that was not hit the hardest, down just 12.9%. The worst-performing segment was compact cars, down 17.6% compared with last year, followed by midsize cars, down 16.8%, and pickups, down 15.2%. EVs were down 17.5%.

This is a significant worry for millions of Americans who bought cars during the pandemic mania, which basically involved spending free money provided by the Federal Reserve, only now discovering that their loans are plunging into underwater territory.

According to a recent Edmunds note, 20% of new vehicle sales involving a trade-in had negative equity during the October-through-December period—the highest level since 2021.

Negative equity values soared to a new record high of $6,064 during the period, a massive 46% increase from late 2021.

We warned readers in 2023 about the worsening negative equity situation for heavily indebted drivers:

- Negative Equity Surges: More Consumers Find Themselves In Underwater Auto Loans

- Number Of Americans In Upside-Down Auto Loans Continues To Worsen

Adding to the financial stress for drivers, there’s also the concern that Joe Biden’s sticky inflation continues to send auto insurance rates to the highest levels since the inflation shitstorm in the mid-1970s.

We’ve pointed out that ridiculous repair bills for newer vehicles (cough, cough, EVs) are likely the main reason rates are higher.

- Rivian Owner Shocked By $41,000 Repair Bill For Minor Damage

- “Shocking Number”: Rivian Owner Sees $42,000 Repair Bill For Minor Accident

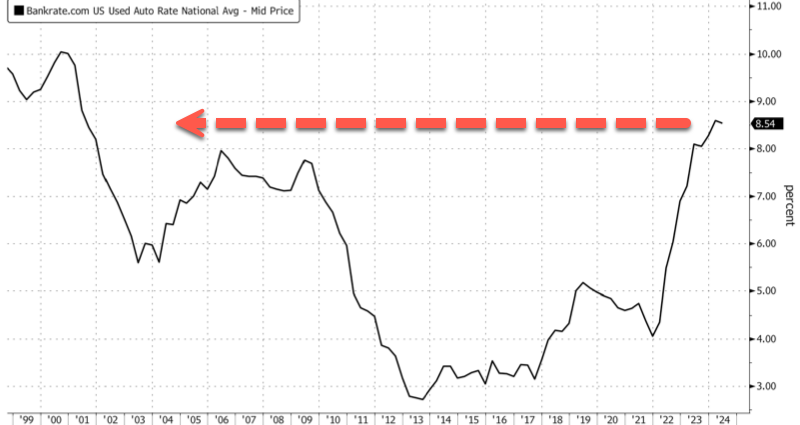

Right now, drivers are paralyzed as the average used car auto loans tracked by Bankrate surged again – now exceeding 8.5%.

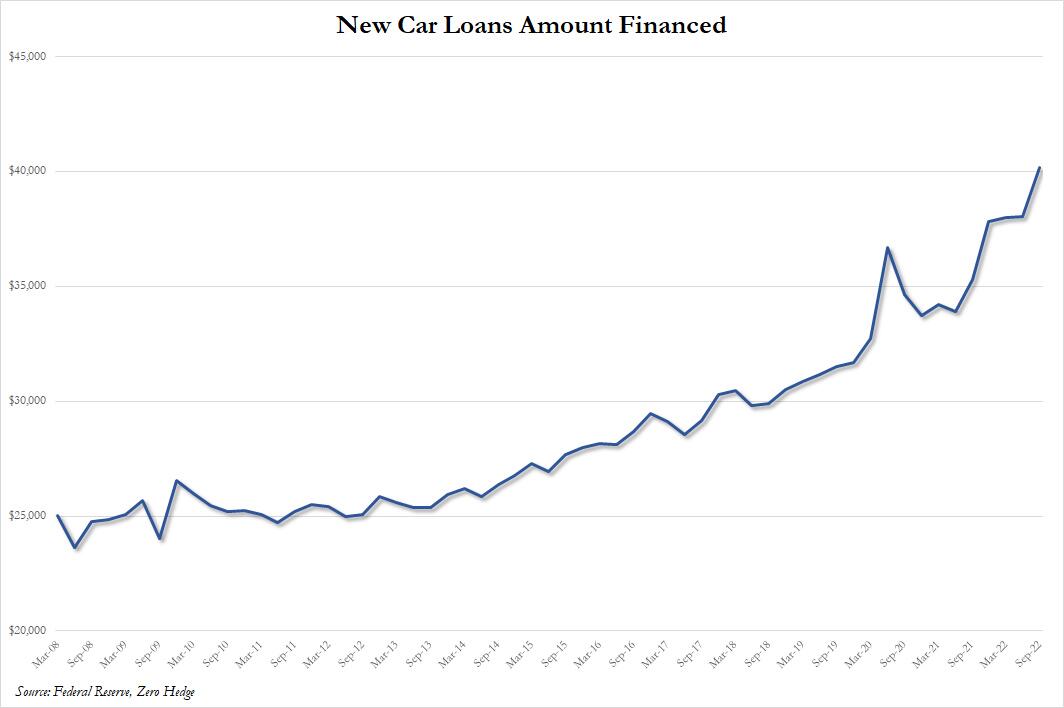

The average new car loan has reached a record high of $40,000.

In recent months, Joseph Yoon, consumer insights analyst for Edmunds, told Bloomberg:

“We’re in this situation where combined with the cost of the vehicles being so high and the interest rates being so historically high, you have a lot of people who are in bad car loans.”

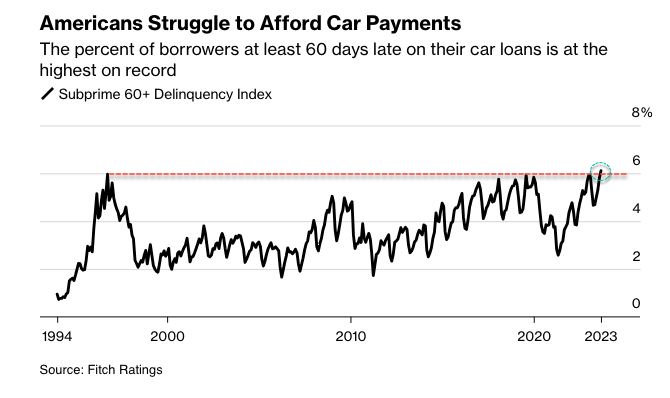

To Yoon’s point, the percentage of subprime auto borrowers at least 60 days past due in September topped 6.11%, the highest ever.

Out of all this gloom and doom for drivers. There’s good news on the inflation front: falling Manheim used car prices will only result in a lower future print for the US CPI Used Car index.

So the big question is when will the bear market in used car prices bottom?

Car owners should certaily not be looking for any bailouts from The Fed anytime soon (or Biden, who is too busy paying off student loans). Higher rates and longer is the theme, no matter the jawboning, with less than two cuts now priced in for the whole of 2024 (down from over seven at the start of the year).

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Withdrawing from the Rat Race Is Going Global

https://www.oftwominds.com/blogmay24/changing-economy5-24.html

He is interesting to read, but he has a pretty large commie streak running through him at times.

Try and buy a used car in Canada. I have a five year old vehicle that is selling for more than I paid for it.

I left the rat race, (the USSA). in 2012 and have not owned a car since, The money I have saved doing both is incredible.

I am amazed at how dense people still are.

We had an absolutely asinine “bubble” build up in used cars (not to mention food and other things), and now when car prices are starting to crater back to where they should have been, the stupid media calls it a “bear market”.

They NEVER should have been that high to begin with…

It’s not a “bear market”, it is the bursting of an artificial bubble that never should have materialized in the first place.

For those smart enough to be sitting on a pile of cash, your day is coming soon.

Real wealth is not made in good times, it is made when the blood is in the streets.

I know , I even tried to overpay for some property I have wanted for quite some time . Now it wont be too long before I can offer a lot less for it and theyll sell to me ,AND I EVEN I told them this !!! That how much of a stupid honest guy I am . Oh well , I’ll be happy to pay less for it when they are desperate only because it will be a more down to earth valuation than at the top of the bubble .

This index is dependent on where one lives. I’m begged via email to trade in my 2022 1794 Edition Tundra for $52K, and it has 40K miles.

So, buying a 2024 Tacoma. And netting $8K cash back.

By the same token, new car sales are crashing.