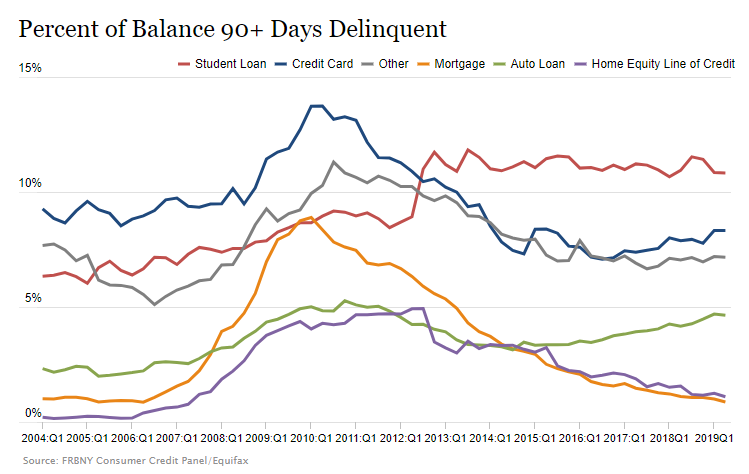

I think this may be the first canary in the coal mine. The entire auto sales recovery has been driven by easy money, subprime debt, and leases based on pie in the sky assumptions. Loaning money to people incapable of paying you back for $40,000 Cadillacs makes your numbers look good in the short term. Now the debt is going bad at rates last seen in 2008. Remember 2008?

The tidal wave of repo vehicles and vehicles being returned after their 3 year leases are up are driving the prices of used cars down. This is creating a snowball effect as more vehicles come off lease. The residual value calculations are wrong.

Banks, financing companies, and the automakers are all going to get hit with loans losses, leasing losses, and automakers are being forced to discount new vehicles dramatically. Profits are going to get hammered, production lines will be shut down, and workers will be laid off.

The canary is dead. I wonder what happens to all those subprime derivatives being sold to pension plans.

For those of you holding out hope that the North American auto market is anything but a massive debt-fueled bubble on the verge of imminent collapse, you may want to avert your eyes now. For the rest of us who prefer to live in reality, as painful as it can be, today’s FY2017 earnings warning from Ally Financial offers a stinging wakeup call to auto investors.

And while Ally’s CEO, Chris Hanley, tried to downplay the company’s 2017 earnings guidance cut to “5% – 15%” on today’s call by saying that it was “generally in line with a 15% EPS growth path that we previously described to analysts and investors,” the market didn’t buy it.

Continue reading “Ally Financial Slashes Guidance As Used Car Prices Suffer “Worst Decline In 20 Years””