Consumers face increasing financial difficulties due to elevated inflation, a generational high in interest rates, maxed-out credit cards, lack of personal savings, and two years of negative real wage growth amid the mounting failures of ‘Bidenomics.’ The latest distress is that the number of Americans in upside-down auto loans has reached the highest level since 2020.

According to automotive research firm Edmunds.com, the number of Americans with auto loans “underwater” or “negative equity” in November reached an average of $6,054, the highest level since April 2020.

“It’s a precarious spot for many Americans, coming after a twin surge in car buying and interest rates has strained finances and fueled an uptick in automobile repossessions,” Bloomberg explained, adding the average rate for a new car loan is 7.4% and 11.6% for a used car.

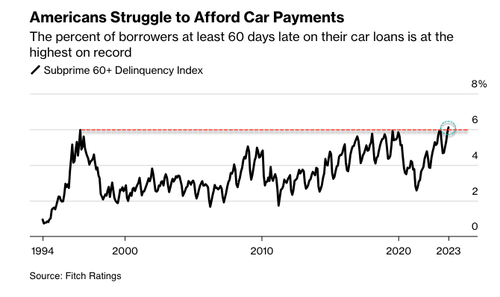

Earlier this year, when discussing the “perfect storm” hitting the US auto market, we showed that according to Fitch, “More Americans Can’t Afford Their Car Payments Than During The Peak Of Financial Crisis“… The average new car loan has reached a record high of $40,000.

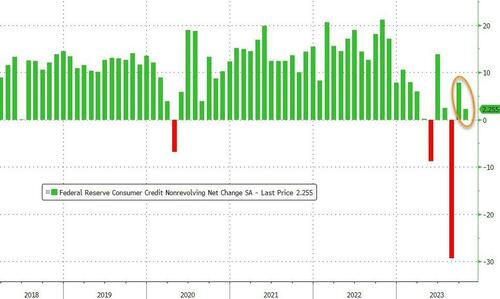

… which was to be expected: after all, the latest consumer credit report from the Fed revolving credit shows high-interest rates have bogged down student and auto loans; in other words, consumer is stretched.

“We’re in this situation where combined with the cost of the vehicles being so high and the interest rates being so historically high, you have a lot of people who are in bad car loans,” Joseph Yoon, consumer insights analyst for Edmunds, told Bloomberg.

To Yoon’s point, the percentage of subprime auto borrowers at least 60 days past due in September topped 6.11%, the highest ever.

The bear market in used car prices will only accelerate the number of auto loans underwater into 2024.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Underwater house loans, meet underwater car loans. Soon, it’ll be grocery, gasoline, and heat loans.

Better get some scuba gear ready

The price of money (interest) is the main culprit augmented by inflation.. The repo man is pretty much a recession proof job and will continue expansion. A collapse will cure the ailment of late payments and unfortunately everything else.

Fiat currency inflation, plus easy credit, encourages acquisition of unearned items. Reasonable, organic interest (aka, rent) on money which is lent by the industrious future-oriented and frugal who have accumulated it, to entrepreneurs for reasonable purchases, such as machine tools or carpentry tools, which are intended to create returns, is not a net societal negative.

Capital is as much a tool as is a hammer. One would not expect to lend out any other item free of charge. Reasonable interest on lent money – rent which is readily repayable by the labor of the rational borrower, without indenturing him for life – does not erode society, but helps maintain and build it.

The CQA guy say’s there’s not enough repo men out there and they can’t repo them fast enough. Wells Fargo is paying a premium to the repo men to get their services first.

The life of a repo man is intense.

UPside down is the normal in Clown World.

Anarchy is coming. Prepare or Perish.

I cacan’t believe some of my friends buying 80k trucks. My 20 year old truck is great and long paid off, more reliable and more rugged.

I have a 2011 Tacoma (bought it new) 4 wheel drive with a 5 speed anti-theft device. Runs like a well oiled machine (probably because I took great care of it). A year or so ago I talked with a guy that had just bought a brand new one. He told me I’d never get rid of that truck (meaning mine). I of course didn’t need him to tell me that.

In 1913 an ounce of gold would buy a nice suit. Today, an ounce of gold will buy a nice suit. The value of the PM hasn’t changed. The “value” of the fiat currency has. It’s fucking paper… hypothecated many times. Hell, the first house I bought was $30K, and now some are paying $80K for a pickup? (((Their))) usury has worked swimmingly for millenia. It’s why (((they))) have been booted from over 130 countries. The biblical story of the Exodus wasn’t about (((them))) being held in bondage by the pharoah… it was (((them))) getting (((their))) kike asses kicked out of Egypt. Humanity will never learn that you can’t co-exist with parasites. The shit occurring now is interesting though.

For the comprehension challenged:

You read it wrong.

Try Revelation, for a simple explanation?

Revelation 2:9 “I know thy works, and tribulation, and poverty, (but thou art rich) and [I know] the blasphemy of them which say they are Jews, and are not, but [are] the synagogue of Satan.”

Revelation 3:9 “Behold, I will make them of the synagogue of Satan, which say they are Jews, and are not, but do lie; behold, I will make them to come and worship before thy feet, and to know that I have loved thee.”

When are all the deals coming then?

I will gladly pay you in 10 years, for a new car today….. We are in a Wimpey economy….

Negative equity only matters if one is planning on using the object in question as a means of obtaining cash or equivalent value in a future transaction or if one is using current equity to finance expenditures in the present.

So, if you’re on the debt slave’s treadmill it matters, a lot. This is one of those games where the only winning option is not playing but we aren’t taught that of course, so we happily step on. Many of us see the glorious possibilities in future and turn that treadmill up as high as it’ll let us. As long as we can run faster than it does we’re winning, if we stumble it shits us off the back and we have to stop for a while, maybe a long while.

Some of us only see the present value and get on just to look as though we’re winning, that winning being purely relative to our peers or those we want to think of as our peers. My ‘97 Chevy looks pretty bad in a parking area full of ‘23 Teslas and the like, I must improve my appearance among my peers.

Buying productive tools using debt is often appropriate and sometimes the only way to get that tool. My Chevy does the same job your Tesla does but much less stylishly. My Chevy only retains salvage value at this point… oopsie, it’s looking like your Tesla’s about the same… repair costs and batteries, ya know. Of course, neither are Ferraris at any point in the game so what, exactly, was the point in borrowing for the Tesla? You know what it was. Use future income to finance current consumption. You look terrific! Your neighbors are envious! You’re a winner! See! See!

Consumer math. Consumer thinking. Consume. Consume at all cost, to achieve the markers of status among your peers. None of which are significant in the larger picture. After all, it isn’t a new Ferrari, now is it? Your yacht is 194 feet, mine is 210 and I have a helipad onboard as well! I win!?! Right? Right?

Following up on that, a banker friend, recently retired, said to me ‘I’ve never seen anyone who got rich without borrowing money.’

They were buying tools, not consumer goods.

Using debt to invest, and using debt to consume, are far different things. Using debt to consume, is committing cannibalism on your own finances….