Guest Post by Eric Peters

Now is a good time to buy a used car – or soon will be, again. A house, too. Both for the same reason: Rising interest rates are making it more difficult to buy these things. Demand softens, prices lower. Sellers have the choice: Take less or get nothing.

The catch is, you’ve got to be able to afford to buy.

Increasingly, many can’t.

This is why the used car market is collapsing. Or rather, used car prices – and profits – are. Carvana – which was making lots of profit re-selling (re-financing) used cars – is a kind of canary in the coal mine and it just fell off its perch, onto the newspaper below. The value of shares in this once-hot-commodity is down 97 percent – and bankruptcy appears imminent.

“We are lowering our price target from $7 to $30 to reflect a higher likelihood of insolvency by 2024,” said market analyst Colin Sebastian earlier this week. Carvana shares fell to $6.70 on Tuesday – headed toward zero, probably. Chiefly, because Carvana did the opposite of what it’s necessary to do to make rather than lose money.

It bought high – and now must sell low.

Much of Carvana’s inventory of used vehicles was bought up during the time when the supply of new vehicles was low, which drove up demand – artificially – for used vehicles because they were often the only vehicles available. Interest rates on car loans were also low – and this induced a kind of artificial affluence that, for awhile, made it feasible for used car sellers like Carvana to sell used vehicles at new vehicle prices – and for people who really couldn’t afford to pay those prices to finance the purchase.

That’s all unwinding now.

Used car prices are falling – because new cars are generally available, again. Why pay new car prices for a used car? That’s a big problem for those – like Carvana – that banked upon being able to sell used cars for new car prices. It is also a problem for those selling new cars, too – for now a used car is a more affordable alternative to a new car. Assuming you can afford to buy (rather than finance) one.

An interesting storm is brewing.

As interest rates continue to rise, fewer people will be able to finance new cars, irrespective of their availability. This problem will wax as new car inventories stack up and new car prices continue to rise, as they must. This being a function of two facts:

One, the buying power of money is decreasing – which means it requires more to buy the same.

Two, it is not the same. It is more expensive as well as more pricey. The cost of regulatory compliance continues to increase – and those costs can’t just be swallowed. They must be folded into the price of the new car.

On average – just over the course of the past year – new car prices have gone up by $600. It may not seem much in the context of the average price paid for a new car, which is approximately $35,000 as of this year. But when you add increased interest – paid on the increased principle – the cost of the monthly payment inches (and may soon gallop) toward the unaffordable.

That will result in a further weakening sales of new cars, which is already happening, as a recent article in Forbes documents. People are running out of “stimulus” money – and what money they have left has had its buying power diminished by 8-15 percent, depending on whose numbers you use.

This weakening of new car sales will – well, would in ordinary times – result in used car prices going up, as demand for them (as an alternative to a more expensive used car) goes up.

But – aye, here’s where it is going to get interesting – very few people can afford to just buy a used car. Because very few people have the money to buy one. The cash – which is all most private sellers will accept. Used car dealers will, of course, try to finance the buy. But rising interest rates are making such financing – which is always higher to begin with on used cars because their value has already depreciated substantially relative to a new car – harder.

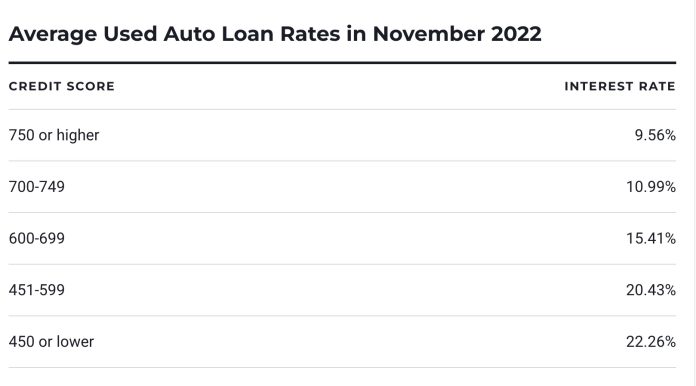

According to NerdWallet, the average cost of money – i.e., of interest – on a used car loan is about 8.33 percent, or almost twice as high as the 4.33 percent interest typically paid in interest on a new car loan.

That was in August, by the way.

Three months down the road and the cost of money for a used car loan approaches 10 percent – for those with high credit. Those with less-than-great credit are looking at paying 11 percent or more for money.

Most haven’t got it to spend.

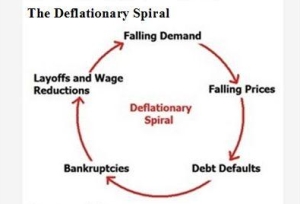

What will be the result? In all likelihood, a deflationary spiral. The prices of new and used cars will fall – to the level at which people can, once again, afford to buy (and finance). In the meanwhile – before that floor is reached – it will be exactly the right time to buy a used or new car, for those who can still afford to actually buy them.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I’ve always said the car you can pay cash for is the car you can afford.

I’ve wanted to buy a new truck for some time now because it’s now over twenty years old (22) but to pay $60k – $70K cash is like “OH Hell No”, I’ll just keep repairing this one.

If new truck prices come down to around $50k I might reconsider.

We are fucked this whole circle jerk is unwinding fast.Theres A whole class of nigs that just sticks a gun in people’s faces when they need to a car lol.

That’s real interest in action. 100%. 0 down immediate delivery. Dealer fees of a gun butt to the face as the victim didn’t overcome his hesitancy.

“ The catch is, you’ve got to be able to afford to buy.”

So, there is now a catch to buying something? Hat being you actually have to be able to afford to do it? For fuck sake, the world has really gone pear shaped. The world has become so accustomed to people being able to acquire shit they can’t afford, that now that it is reverting to people needing to be able to actually afford what they are acquiring, it is thought of as a “catch”.

You cannot make this shit up. The world has become so screwed up that needing to be able to afford something in order to have it is a “catch”. I need a drink.

llpoh, I can’t fucking stand you for the most part, but you’ve nailed it here.

Your comment reveals the potempkin village in which we live. Never in my life would I consider buying a used car for anything but cash. I pay off my credit cards every month.

But everybody is buying crap they cannot afford. The Gov’t is in debt up to its eyeballs. Corporations are borrowing money to meet payroll (!) on an ongoing, routine basis (!!). People buy fancy dinners with expensive wine, including tip, on their credit cards, carrying a balance at 29 percent interest (!) compounded (!!). That is an asset they will shit out tomorrow, along with the hangover. But they’ll still be paying it off for possibly the next decade or more!

If I could, I’d buy you that drink. And pay cash.

I think we are all gonna have to batten down the hatches, because this ship is going belly up.

The Titanic’s nose reached its highest highs before snapping and finding its true value at the bottom under an ocean of reality.

Whoever wants to buy a car just has to cut back in other areas…

The consequence of STEALING any car is zero.

Why buy when you can have any car you can steal?

QED.