What Does Really Matter?

Guest Post by Dennis Miller at Miller On The Money

Guest Post by Dennis Miller at Miller On The Money

Recently our friends at WHVP published an eye-opening article, The Swiss View: “It doesn’t really matter that much” discussing Fitch downgrading the US credit rating:

“Fitch announced that they downgraded the credit rating from the U.S. from AAA to AA+. ….(citing) the suspended debt ceiling and the high debt-to-GDP ratio.

…. While the announcement itself is already worrying, it is not comparable to the reactions that followed…packed with unreasonableness and arrogance.

The Fed Illusion

The Fed Illusion

This isn’t just the US. Urs Vrijhof-Droese recently provided his international perspective:

This isn’t just the US. Urs Vrijhof-Droese recently provided his international perspective:

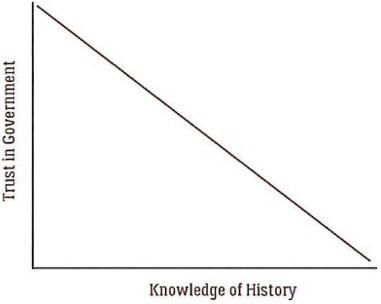

Anyone shopping goods, services, airline tickets, an automobile, clothing, and particularly medical care is seeing significant price increases. While the government wants to reassure us things are under control, we know better when we pay the bills.

Anyone shopping goods, services, airline tickets, an automobile, clothing, and particularly medical care is seeing significant price increases. While the government wants to reassure us things are under control, we know better when we pay the bills.