Previously, we learned that the early 20th Century was a whole new ball game. A new and improved banking reform demanded by the people, with help, led to the Federal Reserve System. The “war to end war” commenced and ended, more or less …

Although peace broke out on November 11,1918 an Allied naval blockage hemmed in Germany for eight more months. Some 250,000 civilians, estimated, died in this period of disease and starvation. The necessity of importing food and the refusal of a loan from the United States meant Germany’s gold reserves diminished.

The signing of the Treaty of Versailles on June 28, 1919 ended the blockade. Germany had neither representation nor an invitation to the treaty completion. German reparations were specified at 132 billion marks (US$31.5 billion) and loss of territory, as well as limitations of their military. (The final reparation payment occurred in October, 2010.)

A few movers and shakers sat on the carpet playing their own version of ‘Risk’ and redrawing the world map to their liking. Meanwhile …

The Return of the Gold Standard

Great Britain was one of the victors of World War One – at a cost. They, and others, had monetized the debts for the war effort, double, triple or quadruple their money supply. Germany had extended to eight times pre-war! Only the United States had remained on the classic gold-coin standard, a dollar equal to one-twentieth of an ounce.

By February, 1920, the fiat pound sterling was worth one-third less than the pre-war value. Other countries were worse; the German mark had depreciated by 96 percent.

The British had a plan, floating exchange rates had to go: only a return to the pre-war value of the pound sterling would save the day.

Only one thing was wrong with this idea: an overvalued pound meant their mercantilist export market would suffer. A further complication to the alternate of a realistic value was the trade unionist movement – a deflationary policy was unthinkable. Britain would continue a monetary expansion – inflation – from the new standard and easy credit would solve all problems.

A policy was formulated, provisional on the U.S. maintaining an inflational policy to prevent adverse flow of British gold out of the country.

Britain hedged with the Gold and Silver Embargo Act of 1920, vowing to return to a gold standard by 1925. Both countries had seen an immediate post-war boom – and a ‘correction’ in 1920-21.

That Unknown ‘Correction’

Not many people apparently know of the U.S. Recession of 1920-21.

The Federal Reserve had been compliant in easing policy to support World War One. According to New York Federal Reserve Governor Benjamin Strong, the Fed was Treasury’s agent and servant. Independence … Anyway, by 1919, U.S. Inflation had risen over 27%. The Wilson administration slashed federal spending severely and by November, the federal budget was balanced. In concert, the Fed Reserve raised interest rates, sequentially to a final 7%.

This one-two punch to the economy resulted in employment and productivity declining and finally falling remarkably in June, 1920. Farmers, misled by high food prices in wartime had expanded land holdings based on cheap credit. The 7% final Fed’s rate was a killer. Wholesale prices overall declined by half. Bankruptcies on the land and general contagion bottomed the economy. Briefly – the economy immediately bounced upward (not a dead cat bounce) and the short-lived hardship was forgotten in the bling of the Roaring 20s.

Most everyone knew Great Britain intended to restore the gold standard. Speculators took advantage and a return to the prewar value of the pound stering was effectively priced in – objectively, it was overvalued.

Warren G. Harding had assumed the presidency in 1921 and further assisted the recovery by cutting government spending even more.

Incidentally, there was another Harding during this era: William P.G. Harding, second president of the Federal Reserve, 1916-1922. then president of the Federal Reserve Bank of Boston, 1923 to 1930, when he died. Connecting more dots … Carter Glass was Secretary of the Treasury from late 1918 to early 1920.

Great Britain’s post war recovery was not quite reflected in the unemployment rate, which varied between 9 and 15 percent even into 1924. The government countered this with a new unemployment program. Most of the problem involved the export industries. J.M. Keynes offered some opinions and criticism during the period. (By the way, he insisted his name was pronounced “Canes” or “Cains.” Or maybe it was “Cain’s descendant … )

“When stability of the internal price level and stability of the external exchanges are incompatible, the former is generally preferable.

“There is no escape from a ‘managed’ currency, whether we wish it or not. In truth, the gold standard is already a barbaric relic.”

A Tract on Monetary Reform – 1924

Keynes advocated semi-monopolistic structures operating under government approval and with government supervision. He also favored eugenics. And he appeared to believe that individual or private business self-interest should be replaced by the “intelligent judgement” of government. For the common good.

Keynes surely appreciated the U.S. Federal Reserve System. Before 1914, government issued gold certificates were 100% redeemable. FRNs afterward were only 40% backed by gold. Aha, thus the money supply increased during the war years a great deal.

Benjamin Strong had gone to England in 1916 to set up monetary coordination between the two countries. He met Montague Norman, then deputy governor of the Bank of England and a personal and professional friendship began that ended only in 1928 when Strong died.

A dozen years working together can accomplish a lot. The goal was to return to a gold standard with the pound sterling at $4.86, its pre-war value. To accomplish this, the U.S. would maintain inflationary policy to keep gold from leaving England. Strong and his New York Fed purchased U.S. government securities from November 1921 to June 1922 and the money supply grew. To enhance this policy, Norman also advocated lowering Fed interest rates.

Strong was ill through much of 1923 and the Federal Reserve Board sold off much of the government securities. On his return, Strong intervened again and again the money supply increased.

Secretary of the Treasury Andrew Mellon received the rationale that keeping American prices higher than British would establish the pound around par and facilitate the return to the gold standard. By early 1925, a line of credit to Britain of $200 million in gold was necessary to keep the scheme alive. The House of Morgan assisted with a $100 million line of credit. No one in authority disagreed with these maneuvers, neither Mellon nor the Federal Reserve Board. Higher prices in America supported the pound sterling.

Even so, Norman came to America for a serious talk with Strong and “Jack” Morgan, seeking reassurance about returning to gold.

Harding had died in office in August, 1923 and Vice President “Silent Cal” Coolidge had become the new president. Business as usual. Except …

… there was this: Weimar Germany and war reparations. The German war machine was powered by the printing press – the national debt went from 5 billion marks to 156 billion. Their wartime government had imposed price controls but the flood of money printing overwhelmed such efforts.

The first reparations payment, at 2 billions of gold marks at the 1913 value came due in June, 1921. A combination of gold, currency, coal, iron and wood sufficed to keep the wolves from the door.

But prices had caught up well and truly with the supply of money and in 1922, it appeared a default on the next installment was inevitable.

“Jack” Morgan organized an international reparations conference; to no one’s surprise, no easy answer was available. The German cost of living index that June was 41 but had risen to 685 by December.

France had its fifty-year grudge for the defeat of 1871 and with Belgium, invaded the productive Ruhr industrial area in January, 1923.. The Weimar government ordered a general strike. To pay the idled workers and support families who’d lost their homes during the 18-month occupation, there was only one quick answer: print more money!

Imagine at a given moment that a person orders one cup of coffee at a cost of 5,000 marks – and minutes later, a second cup had risen to 9,000.

Overall the mark had gone from 4.20 to the U.S. Dollar in 1914 and by November, 1923, one dollar fetched 4.2 trillion with a T marks.

Klaus Mann, a writer of the day: “What breathtaking fun it is to watch the world coming off the rails … the complete depreciation of the only truly credible value in this godforsaken era: that of money.”

His brother, Golo Mann, a historian: “What was there to trust, who could you rely on if such were even possible?”

A critic of the government at the time was interviewed and asserted that the high cost of living was the biggest problem Germany faced. “We intend to make life cheaper,” he declared. His name was Adolf Hitler.

The Gold-Exchange Standard!

At last! Years in the making, the British Cabinet announced the return to gold on March 25, 1925, with conditions: a $300 million credit line from the U.S., no Bank of England change of the bank rate, and the new pretend standard would be based on gold bullion and not gold coin redemption. Also, the Chancellor of the Exchequer would discourage the domestic use of gold coin. If this didn’t work, there was always the legislative hammer.

By comparison, the classical gold standard empowering redemption in gold coin restrained issue of the currency and government excess. The bullion standard thus disempowered ordinary people but kept exchange for international trade.

The Gold Standard Act of 1925 specified a minimum bullion bar of 400 gold troy ounces. Montague Norman explained it this way:

“ … confidence in the value of money does not depend upon the existence of gold coin … in times of abundance hoarding [of gold coin] is bad because it weakens the command of the Central Bank over the monetary circulation and hence over the purchasing power of the monetary unit … the use of monetary gold can be limited, in case of need, to the settlement of international balances.”

In point of fact, however, Britain would be on gold and European countries effective went on a pound sterling basis. Effectively, European countries would redeem their masses of international trade currency for pounds as reserves.

The beauty of this was that Britain could issue more pounds for settlement which was a stealth opportunity for European economies to inflate their own money supply due to greater pound reserves. Such a deal!

America was the exception in this scheme but the Strong-Norman connection ensured U.S. Dollar inflation and no gold would flee jolly old England.

Some European countries fared better than others, initially. France, for example, had experienced significant inflation to the rate of 240 francs to the pound. Under the British plan, France returned to gold at 124 francs/pound. Germany, Austria, and other countries that experienced hyperinflation returned to the pretend gold standard at a more pragmatic rate.

Immediate post-war prices were high due to the armies of fiat dollars sloshing around the world. Those early masters of the universe feared ‘deflation’ so much that the falling prices of 1920-21 convinced them without much effort that an inflationary policy was the best response.

Some 39 countries were embroiled in the gold-exchange standard by 1926, and 43 by 1928.

Governor of the Bank of France, Emile Moreau had this to say at the time:

“England … putting Europe under a veritable financial domination … remedies prescribed always involve the installation in the central bank of a foreign supervisor who is British or designated by the Bank of England … guarantee against possible failure they are careful to secure the cooperation of the Federal Reserve Bank of New York. Moreover, they pass on to America the task of making some of the foreign loans if they seem too heavy, always retaining the political advantages of these operations.”

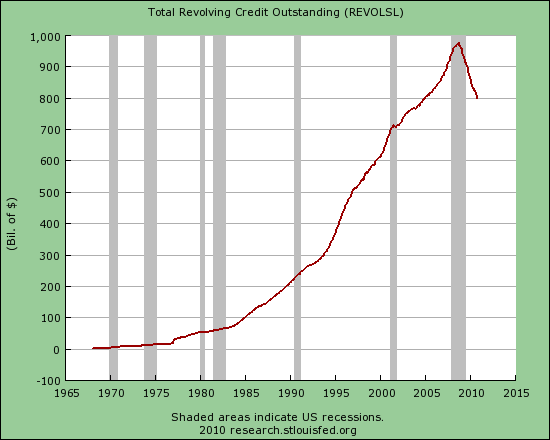

In the U.S., the money supply from 1921 to 1929 increased 61 percent. This certainly helped Great Britain but not enough. The self-serving policy of a strong pound sterling in reality shot themselves in the foot and fettered their export market. Also, militant trade unions maintaining a high wage rate also exacerbated high unemployment. During the whole of the Roaring Twenties, Britain’s unemployment rate remained around recession grade and was eleven percent by 1929.

Meanwhile, American prices had started to decline in the middle of the decade, and this threatened the balance again Britain. Not to be undone, the dynamic duo, Strong and Norman called a secret conference in 1927. Britain had already suggested to France that perhaps the pound sterling might have to be devalued. The duo met with counterparts from the French and German central banks. Even the Federal Reserve Board in Washington know nothing of this.

Strong promised more inflation, a boost to the stock market, and a further purchase of $60 million sterling to backstop that British pound. He also made significant purchases of U.S. Securities.

An article in The Banker, a London journal, praised Strong as “a friend of England in her greatest need.

Strong died in October, 1928, from a lengthy illness, and never saw the fruits of his labors.

The stock market certainly benefitted by Strong’s attentions, doubling in 1929. Before President Coolidge vacated the White House in March, 1929 he praised the American economy as “absolutely sound” and said stocks were cheap.

Black Thursday and Beyond

Belatedly, the Federal Reserve tried weakly to stuff the easy money genie back in the bottle. But the trends were already in place – July, 1927 unemployment, 3.3% and Dow Jones Industrial Average, 168. Early October, 1929, unemployment around 5%, DJIA, 343.

Coolidge had said back in 1927, “I do not choose to run for president in 1928.” He already had five years in and believed that too often, the man became the office. Harding, before him, had offered Herbert Hoover a cabinet post. Hoover chose Commerce, which was a minor position – and he aimed to change that. Harding died in office and VP Coolidge rose to the White House and though he kept Hoover in place, he privately referred to him as ‘Wonder Boy’.

The 1928 three-way early race for Republican nominee led to Hoover being nominated on the first ballot. The election went resoundingly to him with Democrat Al Smith winning but six states.

Hoover courted the press in his first seven months but after Black Thursday, his availability was diminished. Having already made a name for himself as a reformer and regulator of early radio, he made more plans for reform. He disliked laissez faire ideas and advocated public-private cooperation, expanded the civil service and unleashed the Justice Department and Internal Revenue Service on tax evaders like Al Capone.

Far from the “do-nothing presidency” faux reputation believed by some, he was a very busy administrator with hands in every pot, domestic and foreign.

Meanwhile in the last week of October, the Federal Reserve was still assisting Montague Norman; doubling the hoard of government securities and adding $300 million bank reserves increased liquidity, fuel to the fire on Wall St. Speculators on margin included more people than you can imagine: elevator operators, shoe shine boys, housewives, farmers, college students; it seemed every American was acting on the latest hot stock tip.

Volatility had increased with large swings both ways. DJIA peaked at 381.17 on September 3, the culmination of a six-year run.

On Thursday, October 24, the market fell by 11% after the opening bell.

Panic! The House of Morgan, Chase Bank, and the National Bank of New York met to agree on emergency funding. Richard Whitney, vice president of the New York Stock Exchange was chosen as their facilitator. He placed massive orders for blue chip stocks, U.S.Steel and others. By the day’s close, the DJIA was only down 6.38 and everyone breathed a sigh of relief until …

“Black Monday”, October 28, the market opened to massive selling and lost 13%. “Black Tuesday” followed with another drop of 12%. Sixteen million shares were traded that day, setting a record that lasted nearly 40 years.

One of the triggers for the instability was the anticipation, or dread, of the passage of Hoover’s Smoot-Hawley tariff.

Despite more interventions, the market continued to slide until November 13, 1929, with the Dow closing at 198.60. Then a bear market rally (dead cat bounce) took the peak to 294.07 on April 17, 1930. From there, the market declined to July 1932 when the Dow closed at 41.22. Only in November, 1954 did the Dow see a figure reminiscent of the 1929 peak.

The so-called ‘do nothing’ president got his tariff, part of an overall plan of price and wage manipulation, the Glass-Steagall Act, the National Credit Corporation, forced migration of Mexicans back to Mexico, the largest peacetime tax increase in history, the Federal Home Loan Bank Act, the Emergency Relief and Construction Act, the Reconstruction Finance Corporation – and more. Truly, these were the seeds of the New Deal.

Hoover’s policies claimed he did too little, too late, nothing worked – and then there was the debacle of the Bonus Army.

He accepted a nomination for re-election in 1932, likely because no other of the party wanted the job. Franklin Delano Roosevelt called Hoover “jelly” and people not only threw rotten eggs and fruit at his appearance but several assassination attempts were thwarted. By the election, Hoover won only as many states as Al Smith had in the previous election. Roosevelt captured the presidency, the house and the senate, and increased Democratic representation in many states as well.

Our next episode will begin with the real default of 1933, more interventions, the recession within the Depression, and the real end of the Great Depression.

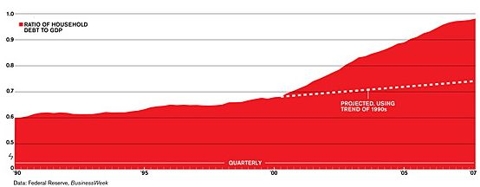

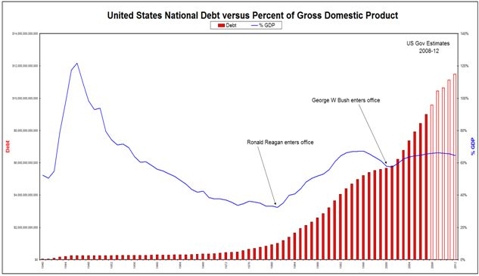

![[D.+Debt+to+GDP+from+1920s]](http://www.financialsensearchive.com/editorials/quinn/2009/images/0526_clip_image001.jpg)