I wrote this article in May 2009. I couldn’t get anyone to publish it because it makes a clear distinction between evil and good. I call out those that I think are evil. Many people don’t think things are that black and white. I stand by every word. Check out the chart near the end on the article where Obama and the CBO projected deficits in FY11 and FY12 of $900 billion and $500 billion. They only missed by $1.2 trillion. Close enough for government work.

There ain’t no rest for the wicked, money don’t grow on trees, I got bills to pay, I got mouths to feed, there ain’t nothing in this world for free. I know I can’t slow down, I can’t hold back though you know I wish I could, oh no there ain’t no rest for the wicked, until we close our eyes for good. – Ain’t No Rest for the Wicked – Cage the Elephant

Money doesn’t grow on trees for most of America. We sit down at our kitchen tables and write out checks to the phone-company, electric company, credit card-company, mortgage-company, and auto finance company every month. We clip coupons and go to the grocery store every week to put food in the mouths of our children. This is what our parents did before us. We work 40 to 60 hours a week to pay these bills and feed those mouths. It’s not easy. We do it because that is what hard working American families do. We work hard, try to save some money for a rainy day and do the best we can. We had been taught that nothing in this world was free. We have been misled. If you were wicked, taking risks beyond the comprehension of average Americans and endangering the entire worldwide financial system, money does grow on trees and there is plenty for free. Money can be printed out of thin air by the wicked and doled out to the wicked. The definition of wicked is:

Evil in principle or practice; deviating from morality; contrary to the moral or divine law; addicted to vice or sin; sinful; immoral; profligate

To put it in the most basic terms, what has happened in this country in the last decade is that evil wicked people have attained positions of power in government, banking, and industry and have committed sins against humanity for their own glory and enrichment. Those who should have stood up to these evil doers are just as guilty as the engineer driving the train to Auschwitz. Albert Einstein understood this danger:

“The world is a dangerous place to live; not because of the people who are evil, but because of the people who don’t do anything about it.”

There have always been evil people. Adolf Hitler, Joseph Stalin, Bernie Madoff, Dennis Kozlowski, Charles Manson, Charles Keating Jr., Joe McCarthy, Jeff Skilling, Bernie Ebbers, Jim Jones, Michael Milken, and Ivan Boesky come to mind. Some committed horrendous atrocities, others stole billions, others destroyed reputations, and others lived lives of decadence and immorality. The reason they are all household names is because they were able to commit their crimes because other people didn’t do anything to stop them. All of these men could have been stopped if citizens, coworkers, auditors, Prime Ministers, government regulators, Boards of Directors, Congressmen, or family members had been brave enough and moral enough to make a stand against their evil deeds. The one and only poem that ever made an impression on me in high school was The Hangman by Maurice Ogden. Below are the last stanzas. Evil can only flourish in society if we allow it to flourish. A society united against wickedness, dishonesty, corruption and wantonness could stand the test of time. I’m afraid our Great American Republic has allowed evil to flourish, and the hangman’s scaffold has grown to enormous proportions.

“You tricked me Hangman.” I shouted then,

“That your scaffold was built for other men,

and I’m no henchman of yours.” I cried.

“You lied to me Hangman, foully lied.”

Then a twinkle grew in his buckshot eye,

“Lied to you…tricked you?” He said “Not I…

for I answered straight and told you true.

The scaffold was raised for none but you.”

“For who has served more faithfully?

With your coward’s hope.” said He,

“And where are the others that might have stood

side by your side, in the common good?”

“Dead!” I answered, and amiably

“Murdered,” the Hangman corrected me.

“First the alien … then the Jew.

I did no more than you let me do.”

Beneath the beam that blocked the sky

none before stood so alone as I.

The Hangman then strapped me…with no voice there

to cry “Stay!” … for me in the empty square.

THE BOTTOM LINE: “…I did no more than you let me do.”

Hell is Empty and all the Devils are Here

Bill Shakespeare sure had a way with words. He understood the battle between good and evil on earth. He also understood that evil can span generations. “The evil that men do lives after them; the good is oft interred with their bones.” The main stream liberal media scoff at the use of the terms evil, the devil, sin and wickedness. These are antiquated terms used by our grandparents. Everyone knows that we have progressed beyond such childish terms. The distinctions between evil and good have been purposely blurred by those in power. The ruling elitists prefer to operate in shades of gray, where right and wrong can be spun and parsed into legal mumbo jumbo. This is not as complicated as those in power want you to think. Our parents taught us right from wrong. Lying, cheating, stealing, swearing, and killing are wrong. It’s that simple. No gray, just black and white. As the mainstream liberal media is filled with vacuous, cheerleader ideologues, I prefer the wisdom of the greatest minds in history. Evil does exist in the words and deeds of men in government, banking, the media and corporate America today.

“When good people in any country cease their vigilance and struggle, then evil men prevail.” – Pearl S. Buck

There are many good people in our country. I would even venture to state that the overwhelming vast majority of our 306 million citizens are good people. The problem is that the good people have let their guard down and allowed evil men to prevail. By delegating their civic responsibility for their own well being to corrupt, power hungry, evil men, we have traded liberty and freedom for a false sense of security. The military industrial complex, healthcare industrial complex, media industrial complex and now the banking industrial complex and auto industrial complex are now in command of our lives. By following the false prophets of government solving all the ills of society, we have allowed the hangman’s gallows to grow and loom ever larger over our every day existence. The examples of evil infiltrating the halls of government, banking and industry are many.

Evil Words & Actions

“False words are not only evil in themselves, but they infect the soul with evil.” – Socrates

- CEO’s of banks and financial institutions going on TV and lying that their firms were strong and viable. (Angelo Mozilo, Jimmy Cayne, Ken Lewis, Robert Steele, Charles Prince, John Thain)

- The President and Vice President of the United States lying to the American people that there were WMD in Iraq and proclaiming that Iraq was involved in the 9/11 attack.

- The Secretary of the Treasury lying to the American people and Congress regarding the banking system in order to ram the TARP bill through Congress.

- The Secretary of the Treasury and Federal Reserve Chairman threatening the CEO of Bank of America and forcing him to lie about the true losses of Merrill Lynch.

- Mortgage brokers lying to their clients regarding the terms of the toxic mortgage products they were peddling.

- Homebuyers who lied about their income and/or assets in order to qualify for a mortgage.

- Alan Greenspan urging Americans to take out an adjustable rate mortgage when rates were at all time lows, while simultaneously saying that home prices on a national basis would never fall.

- Treasury Secretaries and other high officials lying on their tax returns.

- Financial advisors telling their clients to invest in a financial product because it makes the advisor more money, versus being in the best interest of the client.

- Being politically correct in your speech rather than truthful because a constituent might be offended.

- Politicians making promises to voters while trying to be elected which they never intend to keep.

- When the President of the United States commits adultery in the Oval office and then lies to the American public.

Creative Evil

“Ignorance, the root and stem of all evil.Knowledge becomes evil if the aim be not virtuous.” – Plato

- When the highly educated use their knowledge to keep the ignorant from understanding the truth about the financial condition of the country.

- When the Federal Reserve Chairman withholds the names of the banks that have received billions in taxpayer funds with no accountability.

- The MBA genius or geniuses who created the stated income, no documentation mortgage loan in order to enrich themselves and their leaders.

- The millions of Americans who accepted loans for homes, cars, and home furnishings that they knew they could never repay.

- The bankers who made loans to people who they knew could never repay them, because they would earn all of their money upfront and would sell the loans to someone else.

- The executives of AIG who silently allowed twenty employees in their Financial Products Group, led by Joseph Cassano, to gamble and lose $500 billion while paying Mr. Cassano $280 million in compensation.

- Alan Greenspan for allowing moral hazard to grow to immense proportions due to the unspoken Greenspan Put. Every financial institution knew he would come to their rescue if their risky bets blew up. Therefore, they had no reason not to leverage 40 to 1.

- The bank executives who allowed their trading desks to use derivatives to make huge bets on currencies, interest rates, default rates, and mortgages in order to generate obscene salaries, bonuses and stock option awards. The original purpose of derivatives was to hedge risks.

- The rating agencies Moody’s and S&P who took blood money from banks and other financial institutions to rate packages of subprime mortgages, credit card debt, and car loans as AAA without ever examining the assets or real potential for default.

- The Accounting Firms that will sell audit opinions based on the amount of fees they receive. This leads to the logical conclusion that no financial statements can be relied upon.

- The bank executives who knowingly sold toxic worthless assets to pension funds, insurance companies, municipalities and senior citizens because of their desire for short-term profits and obscene bonuses.

Government Evil

“Society in every state is a blessing, but government, even in its best stage, is but a necessary evil; in its worst state an intolerable one.” – Thomas Paine

- When elected government officials secretly collude with bankers to create a non-governmental Federal Reserve Bank that controls the currency of the country and systematically generates inflation to allow government to spend at an ever increasing rate.

- Taxing citizens to create bureaucratic government agencies and programs that fail to accomplish their mission while continuing to grow in size as politicians use them to reward the contributors to their re-election campaigns.

- Congressmen allowing 40,000 highly paid corporate lobbyists in Washington DC to write laws and buy votes because it will keep them in power.

- Putting thousands of earmarks into every Congressional spending bill to benefit your supporters to the detriment of the country.

- When government employees leave government service and accept high paying jobs with the companies they previously regulated.

- The SEC hierarchy ignoring the conclusive evidence provided by Harry Markopoulos about the Bernie Madoff Ponzi scheme because Madoff was respected, connected and had friends in high places at the SEC.

- Low paid SEC investigators are purposely less stringent in their investigations because they want high paying jobs on Wall Street with the firms they are regulating.

- The Federal Reserve has purposely taken worthless assets onto their balance sheet from insolvent banks in order to fraudulently portray the U.S. banking system as healthy. They have committed billions of taxpayer funds with no oversight or audit of their activities.

- Taxing citizens to use the money to create offensive weapons of war and using them to preemptively invade a sovereign country with no Constitutionally required declaration of war.

- Launching hundreds of cruise missiles from a thousand miles away into a city of six million people, knowing thousands of innocent people would be murdered.

- Torturing human beings at Abu Ghraib and Guantanomo, thereby winning the fight, but losing the war. The U.S. will have no moral authority when American soldiers are captured and tortured.

- Invading a country under false pretenses in order to enforce our world view on a sovereign nation to secure billions of barrels of oil.

- Selling weapons of mass destruction to other nations.

- Convincing the majority of the population through manipulative means to give up freedoms and liberties in the name of safety and security.

- Monitoring the phone conversations, emails, and movements of American citizens without their knowledge.

- Paying farmers to not grow food, while millions in the world starve to death every year.

- Encouraging the poorest Americans to gamble what little they have at State sponsored casinos and in State run lotteries to pay for ever increasing State spending.

- Politicians spend money today in order to bribe their constituents for votes, while passing the bill onto future unborn generations.

- Politicians pass laws that reallocate wealth from producers to the takers in society and create a class of societal dependents who will continue to vote for more goodies and benefits.

- The FASB allows financial firms to value “assets” at whatever price they choose in order to mislead investors.

Media Evil

“Young people are threatened… by the evil use of advertising techniques that stimulate the natural inclination to avoid hard work by promising the immediate satisfaction of every desire.” – Pope John Paul II

- Advertising by the National Association of Realtors in 2005 and 2006 after home prices had doubled in five years telling all Americans it was the best time to buy and that buying a house is always a great investment.

- Both liberal and conservative ideologue pundits skewing every issue in order to prove their pre-ordained position.

- Corporate titans like GE own TV networks and slanting the reporting of the news in a way that aligns with their corporate interests.

- Paid political consultants train politicians to not answer the questions they are asked. They are trained to repeat their talking points, not answer questions truthfully.

- The mainstream media use their power and influence to mislead the public regarding the true state of the economy and the truth about the future finances of the country.

- Companies like GMAC/Ditech used misleading TV commercials to lure the ignorant and poor into loans which they could never repay.

- The negative ads run during political campaigns are made up of smears, innuendo, half truths, and bold faced lies intended to destroy the character of opponents.

- Using polls in order to slant your message in a way that appeals to the most voters.

- Using advertising techniques to convince people to buy products they can’t afford by appealing to their emotions and biases.

- TV shows that glorify killers, immoral lifestyles, crime, drug use, etc. in order to push their agenda on children.

- The media exaggerating risks of pandemics, terrorism, crime, and weather events in order to increase ratings.

After slogging through this depressing list I’m sure there will be many in the status quo crowd who will argue that most of the examples I’ve listed are not illegal, therefore they are not evil. This is where the elite in control of the country and the average American part ways. The elite will make the case that we live in a modern world with modern standards, based on modern thought. They use the media to manipulate the masses into believing that evil is actually good. As the citizens of the country allow this to happen, the hangman’s scaffold grows ever larger. Our parents taught us right from wrong. It is black and white. Only those in power want the world to be bathed in shades of grey. This allows them to commit fraud, manipulate public opinion, utilize leverage to make risky bets with taxpayer funds, and use wealth and power to secure more wealth and power. The unelected bureaucrats in the back pocket of the banking cartel designed a bailout plan that attempts to keep the evil bankers in control of our economy. Nobel economist Joseph Stiglitz, whose sound advice has been ignored by government central planners, described the bailout recently:

“The designers of the bailout are either in the pocket of the banks or they’re incompetent. It’s a real redistribution and a tax on all American savers. This is a strategy trying to recreate the bubble. That’s not likely to provide a long-run solution. It’s a solution that says let’s kick the can down the road a little bit. They haven’t thought enough about the determinants of the flow of credit and lending.”

The business pundits think it is wonderful that criminally negligent banks can borrow at 0% from the Fed and lend to the public at 6%. Meanwhile, senior citizens get .50% on their money market funds and 2% for 5 year CDs. Until we bring the country back from its acceptance of immorality and evil as common place, we are destined for the tragic fate of the Roman Empire.

Money is the Root of Evil

Now a couple hours past, and I was sitting in my house, the day was winding down and coming to an end, so I turned on the TV, and flipped it over to the news, and what I saw I almost couldn’t comprehend, I saw a preacher man in cuffs taking money from the church, he stuffed his bank account with righteous dollar bills but even still I can’t say much cause I know were all the same, oh yes we all seek out to satisfy those thrills. – Ain’t No Rest for the Wicked – Cage the Elephant

Money is not inherently evil. It is useful to buy food, pay for utilities, education, and transportation. It can be used to support charities, take vacations, or be saved for a rainy day. It can be invested in capital equipment, research, or technology, which has the potential to generate more money for the investor. It can also be squandered on depreciating assets such as unnecessarily luxurious houses, luxury cars, TVs, stereo systems, Blackberries, iPods, and other baubles and trinkets. Spending money on these things is not evil or wrong. Buying these things with borrowed money that you are not capable of paying back is wrong. Lending money to people and companies that cannot pay you back in order to generate short term profits to enrich management is wrong. Creating financial leverage products whose sole purpose is to mislead investors, regulators, accountants and the public in order to enrich management is wrong. Debt which is not used for productive purposes only leads to sorrow and heartbreak.

![[D.+Debt+to+GDP+from+1920s]](http://www.financialsensearchive.com/editorials/quinn/2009/images/0526_clip_image001.jpg)

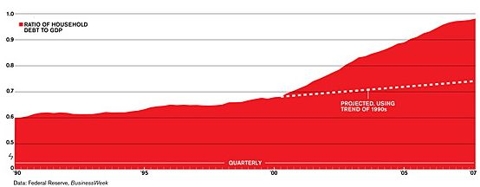

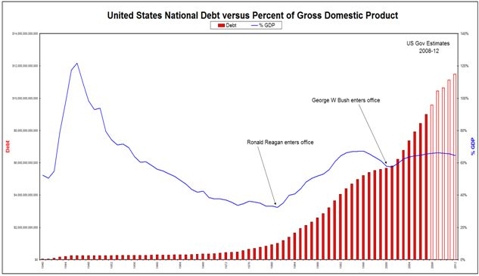

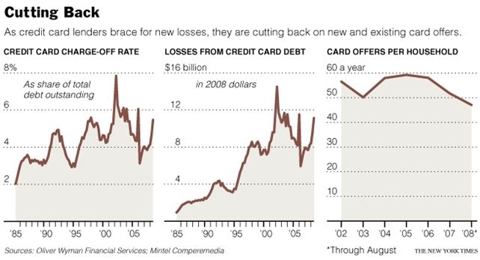

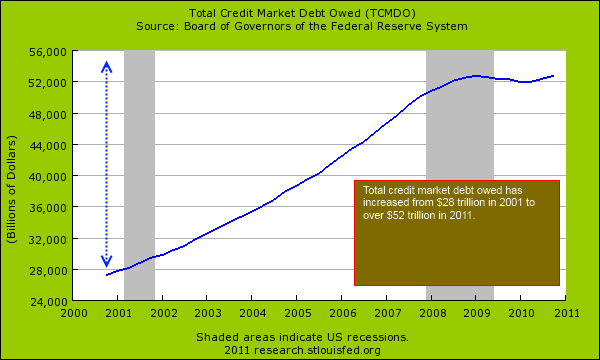

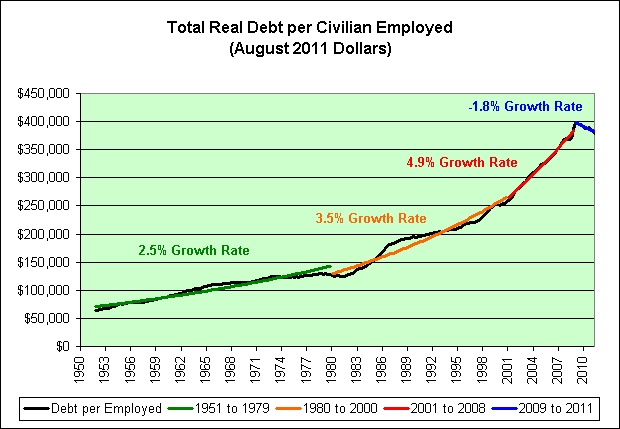

Total credit market debt as a percentage of GDP has risen from 130% of GDP in 1952 to 350% of GDP today. The various bailout and stimulus schemes enacted in the last year will drive this percentage above 400% in the near future. When a country allows this much debt to accumulate versus its GDP, they have done something seriously wrong. The country’s politicians, business leaders, and citizens have all contributed to this disaster. If the debt had been used for constructive fruitful purposes such as building refineries, laying pipelines, replacing decaying water pipes, building nuclear power plants, repairing the 156,000 structurally deficient bridges, or researching and developing cutting edge energy, biotech, or nanotech technologies the increase may have had some merit.

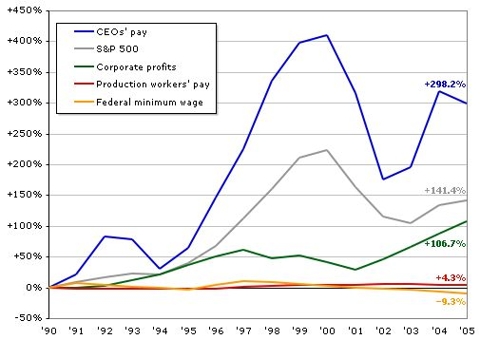

Instead, banks created new forms of debt to benefit themselves through excessive CEO pay, stock options to reliable lieutenants and stock buybacks to make EPS appear better. Government used debt to pay for useless wars of choice, tax cuts for the rich, expansion of the unfunded Medicare program, ethanol subsidies, and other payoffs to the 40,000 lobbyists scurrying around Washington DC like cockroaches. Of course, I didn’t intend to insult cockroaches. Americans used the debt buy and sell houses to each other, leasing cars they couldn’t afford, taking vacations they couldn’t afford, and buying doo-dads they didn’t need. Corporations used debt to buy and sell divisions to each other, bought back their own stock, rewarded management with $50 million compensation packages, while shipping millions of jobs to China. Reckless companies used leverage to do $3 trillion of mergers and acquisitions in 2006, at the top of the market.

The debt was wasted on non-productive assets, useless financial gimmicks and complex fraudulent products sold to investors. No one knows at what level the debt will swamp the ship of state. A rogue wave has just crashed across our bow and washed many overboard. A captain of state that cared about the remaining passengers would reverse course and take responsible evasive action. Our captain and his crew of gamblers have decided to speed up and take the ship of state headlong into a perfect storm. We all know how this will end it is only a matter of when.

We also know how it all began:

“Permit me to issue and control the money of a nation, and I care not who makes its laws.” – Mayer Amschel Rothschild

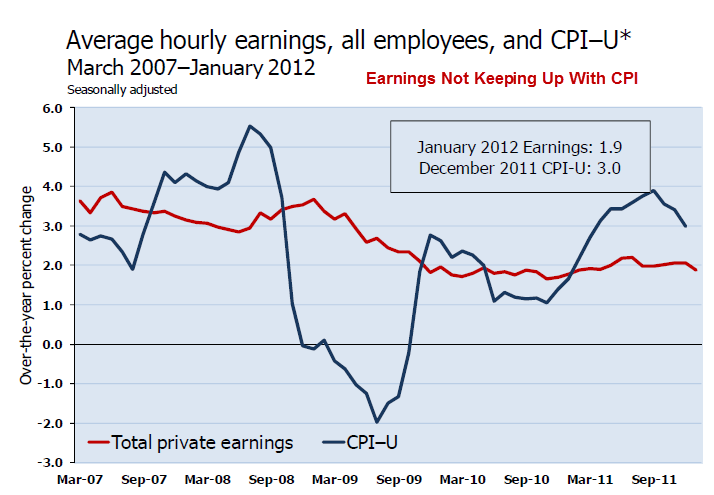

When the banking cartel succeeded in creating the Federal Reserve Bank in 1913, control of money in the United States was put into the hands of bankers whose sole purpose is to enrich themselves at the expense of the citizens of the country. Their relentless printing of money has resulted in the dollar losing 96% of its value since 1913. The printing of dollars has allowed politicians to spend money today and make unfunded commitments decades into the future. The systematic inflation created by the Federal Reserve is immoral as it impoverishes the middle class and senior citizens for the benefit of bankers, the elite rich and entrenched politicians. Much of the moral decay in our nation can be traced to the manipulation of money in the last 8 decades. During the 1950’s, 1960’s and into the 1970’s, a family of five could be supported with a father working and a mother staying at home with the children. Today, due to relentless inflation, the average family of four needs to have both parents working to maintain a similar lifestyle. Inflation adjusted median household income has been stagnant since 1970. The social pressures caused by the Federal Reserve induced inflation such as increased divorce, children raising themselves, and focus on material possessions has resulted in a society whose fabric is tearing.

The Federal Reserve’s mandate to keep short term interest rates steady and conducive to long-term growth has been a farce. The interest rate policies of the Federal Reserve have caused every financial crisis since 1913. The Great Depression from 1929 to 1940 is debated endlessly regarding FDR’s social programs and whether they helped or hurt. What is rarely discussed is the fact that the Federal Reserve’s loose monetary policies in the 1920’s created the disastrous stock market crash and the depression that followed. Milton Friedman explained the decadent relationship between banks and the Federal Reserve:

“Banking is a major sector of the economy in which no enterprise ever fails, no one ever goes broke. The banking industry has been a highly protected, sheltered industry. That’s because the banks have been the constituency of the Federal Reserve.”

Alan Greenspan’s interest rate decisions and belief that financial institutions did not need to be regulated during his reign as Federal Reserve Chairman from 1987 to 2006 were by far the most significant cause for the worldwide financial system collapse. Greenie trained Wall Street to expect the Federal Reserve to bail them out whenever their horrific financial bets went south. He created the moral hazard that eventually led to the recent collapse. He did it in 1987 after the stock market crash, in 1990 when Citicorp was rescued for the 1st time, during the Reagan initiated S&L crisis, the Mexican peso rescue, the Asian currency bailout, when Myron Scholes and his models brought down Long Term Capital Management, prior to the Y2K fake crisis, after 9/11, and lastly during the 2003 false deflation scare. These bailouts encouraged the extreme risk taking and 40 to 1 leveraging that occurred between 2003 and 2008. Allowing financial institutions to not have to accept the consequences of their irresponsible actions was and is wrong. Ben Bernanke has continued this immoral policy of bailing out corrupt bankers at the expense of prudent bankers and prudent citizens.

The reduction of interest rates to 1% in 2003 by Greenspan encouraged consumers, investors, banks, hedge funds, and investment banks to go on the greatest debt financed buying binge the world has ever seen. By “saving” the idiots who lost their shirts in the internet bubble, Greenspan created a debt bubble of epic proportions. Lessons about margin debt and excessive leverage that should have been learned during the 2000 – 2002 stock market crash were forgotten by 2004, with margin debt reaching $381 billion in 2007, 40% higher than the NASDAQ peak in 2000. Investment banks increased their leverage from 10 to 1 to as high as 40 to 1. Consumers used home equity and credit cards to live way above their means. All of these choices were bad decisions. Very simply, these decisions made freely by millions of people were wrong.

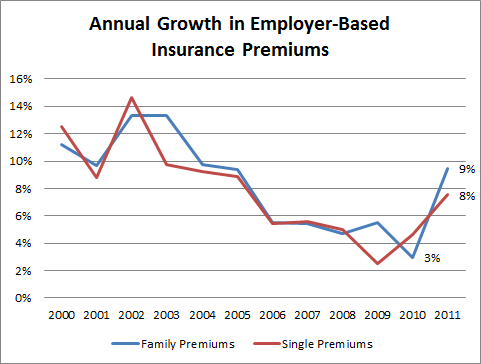

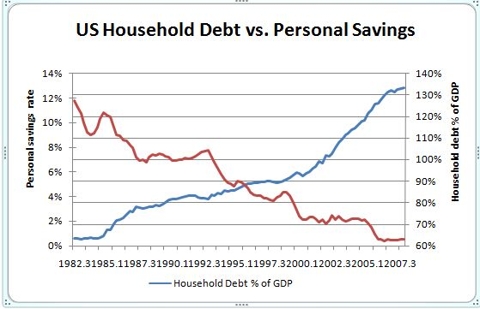

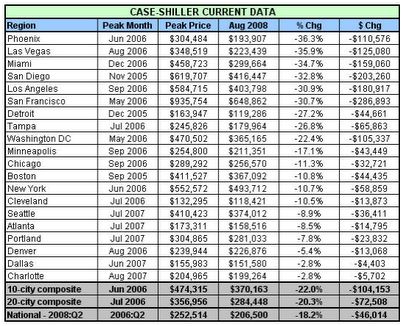

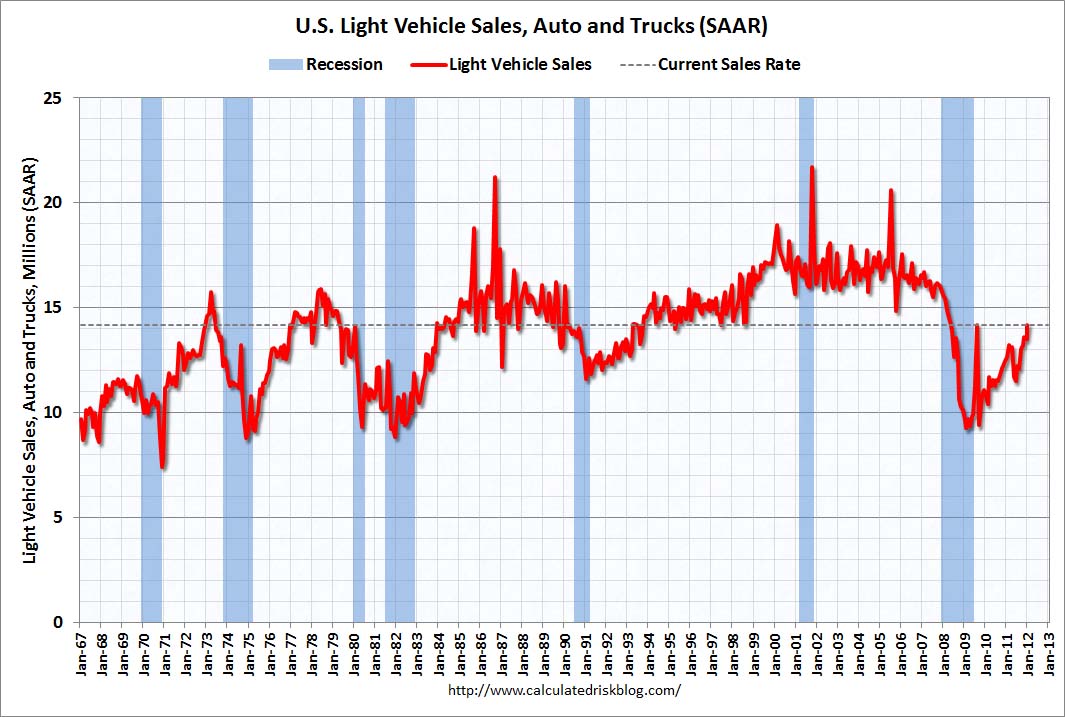

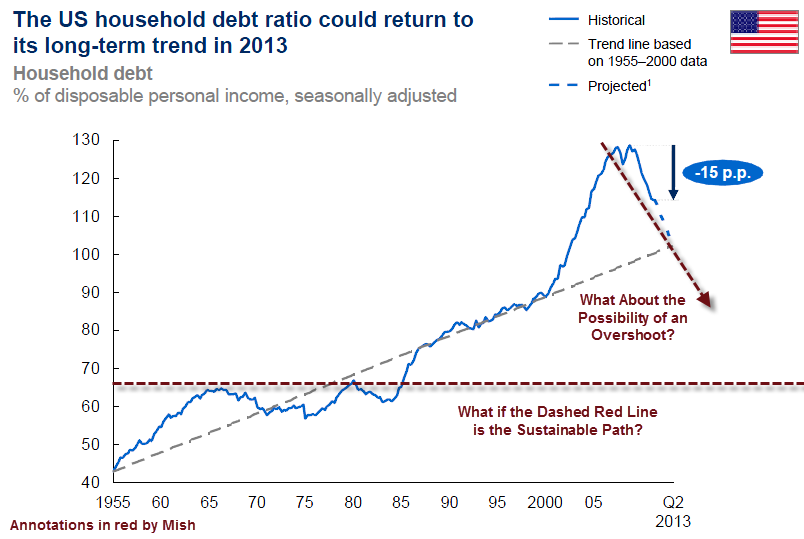

The chart below is the clearest visual representation of why those proclaiming green shoots sprouting are either, liars, knaves, or fools. The green shoots are actually poison ivy. Real disposable income has only risen fourfold since 1960. Real household debt rose at virtually the same rate as disposable income from 1960 to 1980. By 2009, real household debt had increased by twelvefold. The miraculous Reagan Revolution was nothing but a debt induced fraud. All of the apparent wealth in America has been a gigantic sham. The McMansions, fancy cars, HDTVs, jewelry, and other “essential” gadgets were not bought with earned income. The Federal Reserve and their banking brotherhood leant billions to delusional Americans, convincing them to live for today and not worry about tomorrow. But now tomorrow has arrived. Housing “wealth” continues to plummet, stock “wealth” is down 40% in 18 months, and our old friend household debt remains stubbornly in place. This debt must be paid down before any green shoots can take permanent root. Any policy that encourages the expansion of consumer debt would be immoral, wrong and foolish. This is the policy that the Obama administration has chosen.

Something Wicked This Way Comes

“No one in this world has ever lost money by underestimating the intelligence of the great masses of the plain people. Nor has anyone ever lost public office thereby.” – H.L. Mencken

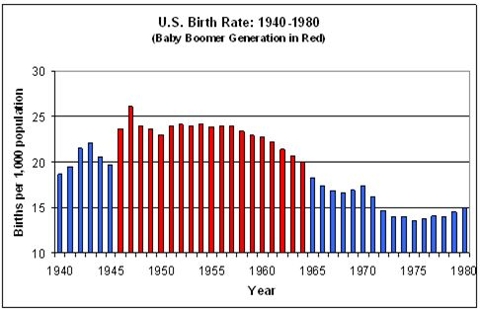

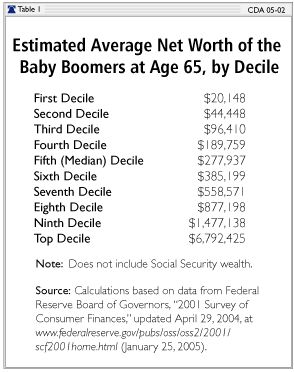

Americans are still infatuated with President Barrack Obama. He is a dynamic speaker and shrewd manipulator of public opinion. After eight years of George Bush’s narrow minded demagoguery, Obama’s appearance of intelligence and moderate rhetoric have been refreshing to many. His words may be comforting but his policies, if fully implemented, will lead to an irreversible decline of the American Empire. The chances of reversing our current misguided course get slimmer by the day. The Keynesians who have taken control of our government pick and choose the wisdom of this renowned economist. His assessment of how aging populations act describes a major roadblock to fixing our broken society.

“Most men love money and security more, and creation and construction less, as they get older.”

The government has promised to protect us from terrorists, protect us from swine flu, protect us from Wall Street, protect us from foreign corporations, protect our car industry, protect our union jobs, protect our retirements, and protect us from having to take responsibility for our actions. We have sacrificed liberties, rights, responsibilities, and entrepreneurial spirit for a false sense of security provided by a corrupt, inefficient, morally bankrupt government. Our rapidly aging population has chosen security over creative destruction and renewal of the American Dream.

The polarized extremists that dominate the dialogue in our country make rational necessary change virtually impossible. The public relations maggots have taken the “green” agenda into elementary schools and the mainstream media has done their usual job of misinforming the masses. As the “green” guru Al Gore continues to live in his 20 room mansion with 8 bathrooms while raking in millions as a partner in a joint venture firm, his misleading agenda is directing the country down the wrong path. The average Joe now believes that solar energy, ethanol, and higher mileage cars will save the earth and make the U.S., energy self sufficient. This is a big lie and will lead to suffering and economic calamity when oil prices soar past $200 a barrel in the foreseeable future. The U.S. no longer has the moral authority to tell other countries how to manage their finances. Our fiscal deficit as a % of GDP in 2009 will exceed 12%. Countries we have scoffed at and ridiculed like Italy, Mexico and Argentina will have deficits less than 4% of GDP. This is only the beginning.

The deficit projections from the Obama administration and CBO are dead on arrival. When tax revenues don’t materialize and the predicted V shaped recovery turns into an L shaped depression, deficits will far exceed the already horrific projections. The government continues to spend our children’s and grandchildren’s money at an ever increasing rate on bailouts, non-investment stimulus, healthcare waste and subsidies for friends of Congress. P.J. O’Rourke humorously explained government drunk with power.

“Giving money and power to government is like giving whiskey and car keys to teenage boys.”

The dilemma facing our country is that the elite ruling class in control of the nation wants to maintain the status quo. The 50% of Americans who pay no Federal taxes will gladly support increases in taxes on the 50% of Americans who do pay taxes. Those without health insurance will vote for anyone who promises them government healthcare at no cost. There are 306 million Americans. I often refer to the average American in my articles. Part of our problem is that by definition, half of Americans are below average. After spending Memorial Day weekend at the Jersey shore, I know where a large number of below average Americans like to vacation. They give themselves away fairly easily. If your body is more than 50% covered in tattoos, you have more than 10 body piercings, your gold chain weighs more than 5 pounds, and your idea of cuisine is a fried Oreo, you’re a below average American. These zombie-like citizens have absolutely no interest in deficits, GDP, the National Debt or shared sacrifice. The majority prefer not to be bothered.

An entitlement society will eventually wither and die. Only societies that produce something of value to other societies will prosper. Using financial hocus pocus and enormous amounts of leverage creates nothing of value to anyone except the criminals who created the financial weapons of mass destruction. Bailing these criminals out will waste essential capital and lead to our ultimate demise as a world power. Dr. John Hussman clearly lays out our future:

“The bottom line is that the attempt to save bank bondholders from losses – to provide monetary compensation without economic production – is not sound economic policy but is instead a grand monetary experiment that has never been tried in the developed world except in Germany circa 1921. This policy can only have one of two effects: either it will crowd out over $1 trillion of gross domestic investment that would otherwise have occurred if the appropriate losses had been wiped off the ledger (instead of making bank bondholders whole), or it will result in a stunning and durable increase in the quantity of base money, which will ultimately be accompanied not by a year or two of 5-6% inflation, but most probably by a near-doubling of the U.S. price level over the next decade. As I’ve noted previously, the growth rate of government spending is better correlated with subsequent inflation than even growth in money supply itself, particularly at 4-year intervals. Regardless of near-term deflation pressures from a continued mortgage crisis, our present course is consistent with double digit inflation once any incipient recovery emerges.”

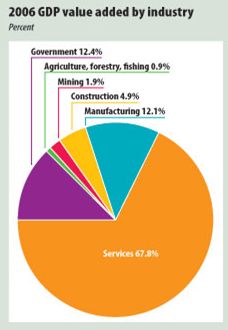

The following graphs tell the story of a country in decline and a country on the rise. We proudly proclaim that we are a consumer society that creates 70% of its GDP by buying stuff and saving nothing. Instead of encouraging and rewarding saving, which leads to productive investment, our government pours an additional $7.5 billion into GMAC and demands them to lend the money to millions of subprime borrowers, because they deserve to drive a BMW just like any big time Corporate Treasurer. While America was “inventing” Twitter so Americans could waste more time on useless bullshit, China built three nuclear power plants and two refineries.

China on the other hand is sailing an entirely different course. With gross national saving of 52% of GDP it is only a matter of time before China becomes the world economic leader. The 21st Century will be China’s century. There is much wrong with their society. Pollution, human rights abuses, and fraud are major issues, but the enormous amount of saving and investment in infrastructure, manufacturing plants, nuclear power plants and refineries will overcome those issues. As the Obama administration and the Federal Reserve double down on failed socialist policies that will bankrupt our country, the Chinese increase their productive capacity and use their depreciating dollars to buy up natural resources around the globe.

We have been confronted with stormy seas in the last two years. Our leaders’ inept management and inane solutions caused the crisis. They have committed hundreds of billions in the last six months. This has resulted in the seas receding from the shoreline. There is an unusual calmness. An alert and dutiful government would be warning Americans to run inland by paying off debt and preparing for rough times ahead. Our government is encouraging Americans to venture out to where the violent waves were recently breaking and pick themselves up a new car or an “affordable” house. When the tsunami warning is sounded, it will be too late.

We are in our current predicament because we have allowed evil men to gain control of our government and financial institutions. These men have enriched themselves at the expense of taxpaying citizens. Trillions have been stolen from the American people and no one goes to jail, no one is punished, and no responsibility is taken by the culprits. If we stand by silently while criminal bankers are bailed out and policies are put into place that increases our crushing debt, the Hangman’s scaffold will loom ever larger. On Memorial Day, when we honor those who died heroically to protect and defend our way of life, the lesson of shared sacrifice should bear out that it is morally wrong to spend money today and pass the bill to unborn future generations.

THE BOTTOM LINE: “…I did no more than you let me do.”