“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability –problem areas where America will have neglected, denied, or delayed needed action.” – The Fourth Turning – Strauss & Howe – 1997

This past week saw an event revealing the cluelessness and ignorance of the linear thinking establishment. They are oblivious to the cyclicality of history and unaware of their precarious situation, as the mood of the country and the world portends their demise. Eric Cantor, the ultimate establishment neo-con Republican House Majority Leader, was crushed in a primary by a completely unknown economics professor, outspent by Cantor $4.9 million to $123,000. Cantor spent more at steakhouses than David Brat spent on his entire campaign. Cantor, a lackey for Blackstone, Goldman Sachs, Israel, and dozens of other mega-corporations, was the first House Majority leader defeated in a primary since the position was created in the 1890s. He won his last primary by 60%.

This was as big a shock to the Republican establishment as it was to the Democratic establishment, the mainstream corporate media establishment, and the Tea Party establishment that didn’t provide David Brat one red cent of their vast horde of contributions. They are now scrambling to generate a storyline explaining this unexplainable development as if it was entirely predictable. These wealthy, myopic, propaganda peddling, purveyors of the status quo just felt the foundation of their world shudder beneath them. Like a volcano, with pressure building within, the world as we know it is about to blow. Who gets devastated by the massive explosion and flow of molten lava is yet to be determined, but there is nothing the establishment can do to stop the eruption. This entire Deep State hierarchy has been developed over decades, as they have flawlessly implemented Edward Bernays teachings from the Propaganda playbook.

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. …In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons…who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind.” – Edward Bernays – Propaganda – 1928

The linear thinkers, who constitute the invisible government and unelected true ruling power, are flabbergasted their game plan, which has worked for the last seven decades, is failing to have the usual sway over the normally compliant masses. Lies, misinformation, deception, propaganda, easy debt, cheap oil, endless commercial expansion, relentless marketing, never ending war, politicians selected by bankers and mega-corporations, tax code created to benefit the .01%, and laws written by the lobbyists for the oligarchs designed to control the plebs and enrich the modern aristocracy, made the world go round until 2008. Linear thinkers in government, business, banking and media have been perpetuating the falsehood of a return to normalcy, recovery, and linear progress. They are willfully ignorant of history because acknowledging its cyclicality would be admitting how precarious their positions of power, wealth, and control truly are.

History does not proceed in a straight line of forward advancement. It has a seasonal nature geared to the 80 year life cycle of human beings. The most basic lesson of history is we never seem to learn the lessons of history. A period of Crisis arrives like Winter, approximately 60 years after the resolution of the prior Crisis, with a climax occurring approximately 80 years after the prior Crisis climax. The generational dynamics based upon human life cycles have lined up once again into Crisis mode. Anyone who hasn’t sensed the mood change in the country since 2008, hasn’t been paying attention. The linear thinking establishment refuses to accept the inevitability of their existing paradigm collapsing in a chaotic whirlwind of violence, death on a grand scale and decisive war. The existing social order is always swept away during a Fourth Turning.

| Saeculum |

(climax year) Crisis (Full Era) |

Time from one Crisis climax to next Crisis climax |

| Revolutionary |

(1781) American Revolution(1773–1794) |

| Civil War |

(1863) Civil War(1860–1865) |

82 years |

| Great Power |

(1944) Great Depressionand World War II(1929-1946) |

81 years |

| Millennial |

(2025?) Global Financial Crisis(2008–2029?) |

81 years? |

|

The Global Financial Crisis, which began in September 2008, marked the beginning of a likely two decade long episode of fierce winter-like blizzard conditions that will get progressively worse as this Fourth Turning churns toward its bloody climax. The evil wealthy men and their paid off pawns in politics and the media who constitute the invisible government, governing behind the scenes, molding minds, forming tastes and suggesting ideas to the gullible masses, will not relinquish their wealth and power without a fight. They have been utilizing all emergency monetary and fiscal levers, while conducting a data disinformation campaign and utilizing their control of the dying legacy media to keep the masses distracted, entertained and confused.

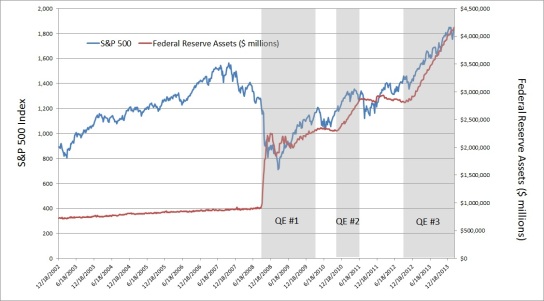

The establishment has convinced a vast swath of the public to actually believe 0% interest rates for the last 5 years, adding $1 trillion per year to the already Himalayan national debt, allowing the Federal Reserve buy $3 trillion of toxic debt from their Wall Street banking cabal owners, while creating a high rate of inflation in energy, food, healthcare and tuition costs, and negative growth in real wages, is somehow beneficial to them and reflects a return to normalcy. The current state of our economic, financial, political and judicial systems, along with the fraying social fabric of society reflects EXTREME dysfunction and in no way exhibits anything resembling a normal state of affairs. The government apparatchiks, corporate media talking heads, Wall Street captured economists, and lackeys for billionaire oligarchs are highly paid liars using every Bernaysian trick to manipulate the beliefs, desires, and prejudices of the willfully ignorant masses. They capitalize on the cognitive dissonance and normalcy bias being practiced by the majority of people in the country. Like a dog chasing its tail, they have the public up in arms about meaningless social issues and ignoring the looting of the country by sociopathic bankers.

Those in power need to sell their storyline of advancement, despite the overwhelming evidence of a societal implosion and economic regression for the 99.99%. They need to distract the masses with inconsequential emotional issues like gay marriage, mass murderers, climate change, party politics, racism, and phantom terror threats, so the masses don’t focus on how badly they are being screwed by the One Party invisible government. For those who have been too dumbed down by our government public education system to even comprehend anything beyond a third grade level, we have The Kardashians, Bridezilla, Duck Dynasty, I Didn’t Know I Was Pregnant, iGadgets, Twitter, Facebook, professional sports, Hollywood blockbusters, and toxic fast food paid for with your EBT card. Our world is besieged by triviality, plagued by idiocy, inundated with propaganda, and consumed with consumption.

In a country of 318 million people, the few believe they must mold the minds of the masses in order for society to function smoothly. Of course this is a huge lie. They need to mold those minds in order to retain their power, wealth, control. They are focused on the daily dose of lies, mistruths, disinformation, and distractions required to keep the masses anesthetized. They have ignored the lessons of history and the big picture driving the Crisis events which will change the world over the next fifteen years. Fourth Turnings don’t calm down, fizzle out, or revert to what happened in the prior twenty years, just as the unyielding harsh Winter cannot revert to the glorious days of Fall or the sweltering days of Summer. There is no escaping the dire, deadly and dangerous times directly ahead of us.

“Reflect on what happens when a terrible winter blizzard strikes. You hear the weather warning but probably fail to act on it. The sky darkens. Then the storm hits with full fury, and the air is a howling whiteness. One by one, your links to the machine age break down. Electricity flickers out, cutting off the TV. Batteries fade, cutting off the radio. Phones go dead. Roads become impossible, and cars get stuck. Food supplies dwindle. Day to day vestiges of modern civilization – bank machines, mutual funds, mass retailers, computers, satellites, airplanes, governments – all recede into irrelevance. Picture yourself and your loved ones in the midst of a howling blizzard that lasts several years. Think about what you would need, who could help you, and why your fate might matter to anybody other than yourself. That is how to plan for a saecular winter. Don’t think you can escape the Fourth Turning. History warns that a Crisis will reshape the basic social and economic environment that you now take for granted.” – Strauss & Howe – The Fourth Turning

Strauss and Howe wrote their epic historical treatise in 1997 and their predictions, based upon centuries of generational analysis, have been uncannily accurate. The predictions are not event based, but based upon generational mood and core elements of Crisis, which were predictable over a decade before the 2008 start to this Crisis. The core elements of Debt, Civic Decay, and Global Disorder were evident to anyone with a functioning critical thinking brain, not in the employ of the establishment. These core elements are front and center today, as the Fourth Turning gains momentum like a gathering winter storm. The captured mainstream media does their utmost to obscure, downplay, and ignore these issues, but alternative truth telling websites like Zero Hedge, Mike Krieger’s Liberty Blitzkrieg, Mike Shedlock, John Rubino’s Dollar Collapse, Jim Kunstler, John Hussman, Jesse’s Cafe Americain, Charles Hugh Smith, Karl Denninger, and number of other freedom minded websites keep the spark of truth alive for those seeking it. A perusal of headlines from these sites over the last week or so provides the true nature of this worsening Fourth Turning Crisis:

Debt

Mindblowing Fact Of The Day: China Has Over 52 Million Vacant Homes

The Subprime Auto-Lending Credit Bubble Is Bursting

China HSBC PMI Misses; Economy Contracts For 5th Month In A Row

Will Spain Default?

Fed Prepares to Maintain Record Balance Sheet for Years

Steve Forbes Warns Of Economic “Catastrophe” Due To Fed’s Dollar Debasement

Obama Unveils Student Loan Debt Bubble Bailout

America’s Insatiable Demand For More Expensive Cars, Larger Homes And Bigger Debts

China Scrambling After “Discovering” Thousands Of Tons Of Rehypothecated Copper, Aluminum Missing

Western Banks Scramble As China’s “Rehypothecation Evaporation” Goes Global

Consumer Credit Has Fifth Biggest Monthly Jump In History; Revolving Credit Soars By Most Since November 2007

Abenomics’ Legacy: Japan’s Greatest “Misery” In 33 Years

NIRP Has Arrived: Europe Officially Enters The “Monetary Twilight Zone”

EU Warns Greece Is “A Cause Of Serious Concern” As Top Tax-Collector Resigns

Why Central Bank Stimulus Cannot Bring Economic Recovery

Summer Gas Prices Highest Since 2011 As Oil Hits 9-Month Highs

It Was A Reeeeeally Bad Winter: JPM Cuts Q1 GDP From -1.1% To -1.6%

How The Fed Feeds The Sharks, While Shafting Wage Earners And Savers

Fed’s Bubble Finance Is Primary Cause of Massive Wealth Gains At The Top

Former ECB Chief Economist Says Central Bank Run Monetary System Is “Pure Fiction”

More On The China Property Bubble: April New Housing Starts Down 25%; Beijing/Shanghai Sales Down 50%

What Happens After The Bubble Bursts: 85% Of Pension Funds Could Fail Due To An Era Of Niggardly Returns

Civic Decay

Across America, Police Departments Are Quietly Preparing For War

Meet The “Minerva Research Initiative” – The Pentagon’s Preparation For “Mass Civil Breakdown”

The Obama Administration Is Forcing Local Cops To Stay Silent On Surveillance

In 33 U.S. Cities, Feeding The Homeless Has Been Criminalized

Obama Popularity Plunges To New Low: “No Longer Likeable Enough”

Historic Loss: House Majority Leader Cantor Loses Virginia Primary To Tea Party’s Brat

Suspect Yells “Tell The Police, The Revolution Has Started” Before Shooting Spree In Las Vegas WalMart

Two Thirds Of Gen X Households Have Less Wealth Than Their Parents Did At The Same Age

7 In 10 Americans Believe The Crisis Is Not Over Or Worst Is Yet To Come: 52% Can’t Afford Their Homes

1 In 4 Obamacare Signups Are Faulty – But, We Are Sure Obama Never Knew Anything About It Until Now

Fed Warns The Plunge In “Routine” Jobs Won’t Slow Down Anytime Soon

US Finally Recovers All Jobs Lost Since 2007 While People Not In Labor Force Increase By 12.8 Million

Two-Thirds Of Americans Do Not Back Obama’s Decision On Bergdahl

Hiring In The US Remains Far Below Pre-Recession Levels

Half The Country Makes Less Than $27,520 A Year And 15 Other Signs The Middle Class Is Dying

The Rich Get Richest: Household Net Worth Rises To All Time High Courtesy Of $67 Trillion In Financial Assets

Challenger Job Cuts Soar 45%; Most Layoffs Since Feb 2013

It’s Not Just Europe; As Many As 16 California Counties May Seek Secession From The State

America’s Insanely Complex And Endemically Corrupt Tax Code: Mother Lode Of Crony Capitalist Plunder

Global Disorder

Al-Qaeda Jihadis Loot Over $400 Million From Mosul Central Bank, Seize Saddam’s Hometown

Al Qaeda Militants Capture US Black Hawk Helicopters In Iraq

Iraq Update: Kurds Take Kirkuk, Al Qaeda Surges Toward Baghdad

“Well-Armed” Taliban Tried To Hijack Airplane Leading To Pakistan Airport Shootout

Gruesome Footage Of ISIS Atrocities Reveals Al Qaeda Jihadists “Will Stop At Nothing”

Ukraine Military Transport Plane Shot Down, 49 Killed

Marc Faber Blasts “American Military Presence In Asia Is Completely Unacceptable”

B-1 Stealth Bomber “Friendly Fire” Strike Kills 5 US Soldiers In Afghanistan

World Needs Record Saudi Oil Supply as OPEC Convenes

Déjà vu: echoes of pre-crisis world mount

Chinese military spending exceeds $145 billion, drones advanced: U.S.

Ukraine Closes 8 Border Crossings On Reports Of Russian Troop Movement

Firefight Underway As Russian “Rebels” Cross Border Into Ukraine

US Begins Delivering F-16s To Iraq This Week, A Decade After It Wiped Out Iraq’s Air Force

Two Ukraine Helicopters Shot Down: Watch As Gunship Engages Eastern Militia In Intense Fighting

Saudi Arabia Reveals Surge In MERS Deaths: One Third Of Infected Patients Die

Japan Base Wages Decline 23 Months In A Row

Obama Calls for $1 Billion Europe Security Fund; Will Increase U.S. Military Presence in Eastern Europe

China Sends 4 More Fighter Jets To Oil Rig Area As Vietnam Threatens Legal Action

“Political Earthquake” – Nigel Farage “Big Winner” In Local Elections

Do these headlines indicate a lessening or deepening of the ongoing Crisis? You won’t see these truthful headlines in the mainstream captured media. You will see feel good headlines touting non-existent economic recoveries, decreasing unemployment rates with record levels of non-working Americans, and storylines of government, corporate and consumer austerity as debt levels reach all-time highs. You will see stories scorning Edward Snowden as a traitor for exposing the highest levels of the United States government as criminals for shredding the Fourth Amendment to the U.S. Constitution. You will see articles hyping one hundred years of shale oil and gas as energy prices approach record highs and the point of peak cheap oil has been passed. You will see publications owned by billionaires peddling hogwash about fantastic Wall Street profits entirely dependent upon mark to fantasy accounting and accounting journal entries relieving loan loss reserves as loan losses rise. You will see hyperbolic fear mongering dreck about foiled terrorist plots concocted by the FBI and DHS. You will see stories about the evil Russians and evil Chinese as our CIA promotes the overthrow of democratically elected officials in countries around the globe. You will see stories about the dangers of foreign countries conducting cyber-warfare against the U.S. as our government intercepts every electronic communication of our allies and citizens. It’s as if we are lost in a blizzard of lies.

Debt, Civic Decay, Global Disorder

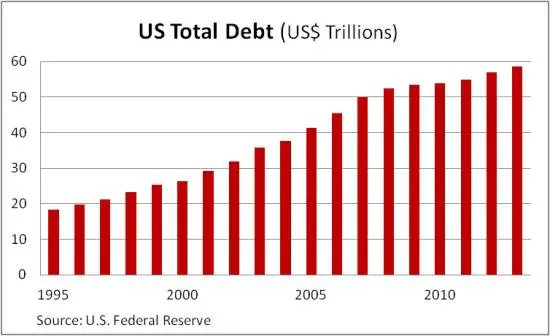

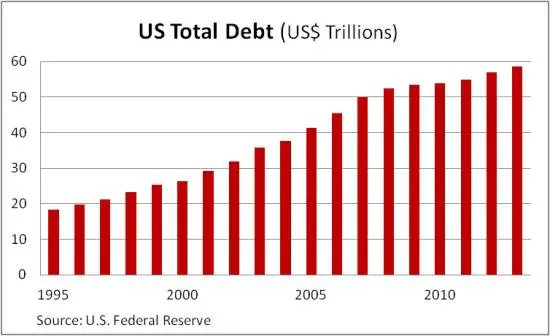

Propaganda and the molding of minds cannot change the course of history. Those in power can ignore the facts, but they can’t change the facts. During the “austere” period from 2009 through until today, total credit market debt in the U.S. has expanded from $53.4 trillion to $59.4 trillion. It now stands at 350% of GDP, even after the government added $500 billion out of thin air to GDP to further their deception of recovery. The U.S. national debt is at a record $17.5 trillion and goes up by $2.0 billion per day. This doesn’t include the $200 trillion of unfunded liabilities politicians have committed taxpayers to pay over the next few decades. Corporate debt is at record highs as CEO’s borrow to buy back their stock at record highs in order to boost EPS and drive their compensation higher.

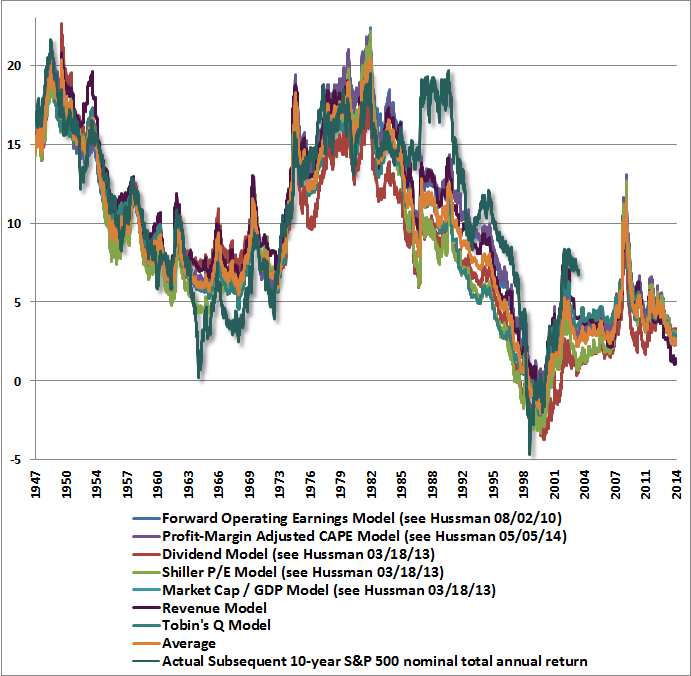

Consumer debt has surged to new highs reaching $3.2 trillion, as government pushed subprime student loan debt and government peddled subprime auto loan lure more math challenged dupes into the banker web of debt. Even credit card debt surged in May as people can no longer make monthly payments for energy, food, rent, and healthcare. Retailers continue to report horrific profits as disposable income has been disposed of by the Federal Reserve’s QE and ZIRP “solutions”. The immense levels of debt plague the entire world as total global debt now surpasses $230 trillion, 313% of world GDP. The 40% surge in global debt since the 2008 debt created collapse is unprecedented in its scope and lunacy. Trying to resolve a debt problem created by criminal Wall Street bankers by allowing Wall Street controlled central bankers, politicians, and government bureaucrats to issue more debt, reduce interest rates to zero, and enrich the oligarchs, will end in catastrophe. The house of cards is teetering as trust dissipates, rehypothecated assets evaporate, the suppression of price discovery fails and the rigged stock market crashes for the third time in fourteen years.

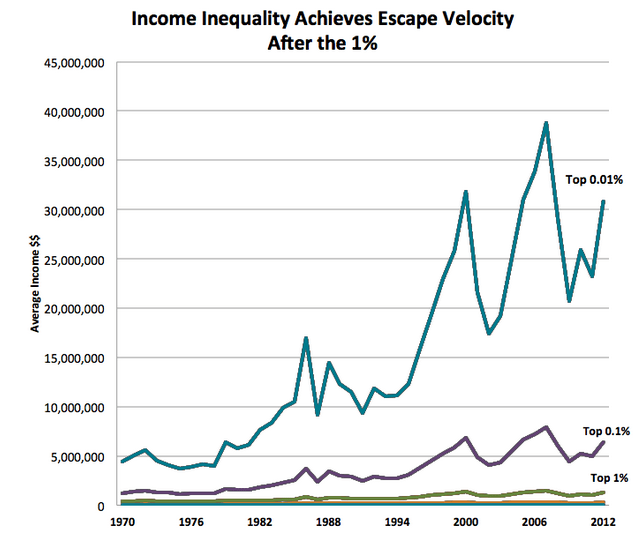

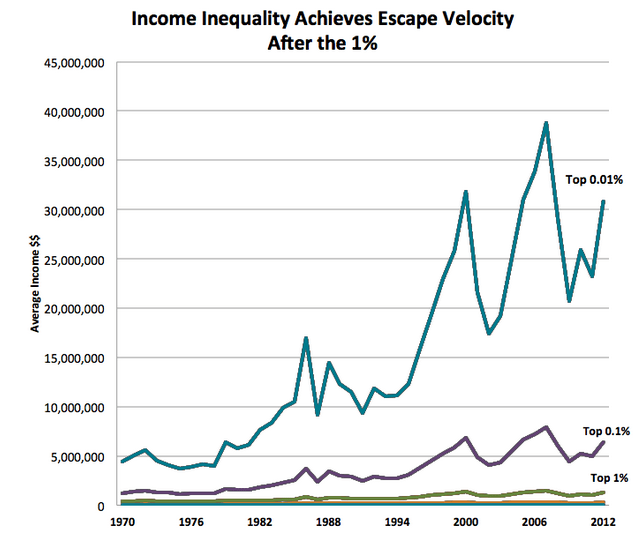

The 2008 global financial crash was the catalyst for this Fourth Turning and the next leg down will unleash the fury of the masses as their remaining wealth, along with their hopes and dreams are obliterated. The civic decay is unmistakably visible, like a fissure in the road after an earthquake, and has left the masses angry, confused, dependent, ignorant, distracted, and suspicious. The extreme and growing wealth inequality driven by Federal Reserve policies, corporate lobbyist written government regulations and tax laws, and bankers controlling the political, economic, financial, and media levers has reached levels previously associated with collapse and revolution. The greed, hubris and arrogance of the .01% will lead to their downfall.

A country with 102 million of its 247 million working age population not working is a powder-keg and the politicians are acting like slow witted monkeys lighting matches. With 20% of the 145 million jobs part-time, more than half low paying service industry jobs, real wages lower than they were in 1998, and a median salary of $25,000, it’s understandable why 20% of the population relies on food stamps to survive. The discontent is growing. We got a preview of how the establishment will deal with disgruntlement during the 2011 Occupy Wall Street protests. Liberal Democrat mayors aligned with Fox News neo-cons, Wall Street bankers, and police state thugs to eradicate, beat, tear gas, and pepper spray young people exercising their right to free speech protesting the wolves of Wall Street, who had pulled of the largest heist in human history with absolutely no consequences for their criminality. Both OWS and the Tea Party were co-opted by the establishment in short order and have been used by the One Party of oligarchs as a means to divide and conquer, by keeping the masses blaming liberal or conservative phantoms for the state of disunion.

The seemingly never ending revelations from the hero of this Fourth Turning – Edward Snowden – of government surveillance regarding every electronic communication of every American by the NSA is proof of a complete disregard for Constitutionally guaranteed protections by the powers that be. The current administration in conjunction with the hacks from the two headed party ignore, flaunt and show disdain for the Bill of Rights and legal precedent as they run roughshod over the citizens. The transformation of our republic into an authoritarian surveillance police state is almost complete.

The militarization of local police forces by the DHS, military training exercises in major cities, and plans being drawn up by the authorities to confront civil unrest all point towards the coming breakdown of civil society. The complete lockdown of Boston to apprehend two teenage cooking utensil terrorists was a dry run and probably gave the oligarchs confidence in their plan, as Bostonians cowered in their homes as heavily armed police thugs pissed on the Fourth Amendment by conducting door to door searches. If you listen closely, you can hear the fabric of our civilization being torn asunder.

The past few weeks have seen global disorder reach new heights, as Iraq has become Mission Un-Accomplished, the Ukraine explodes into civil war as Russia cuts off their natural gas, violent protests continue to rock Brazil, Egypt, Spain, Greece, France, Turkey and a myriad of other hotspots around the world. The very same forces Obama, McCain and the military industrial complex have been arming in Syria to fight a dictator who was our ally, are now ransacking Iraq, murdering the people we put into power when we deposed another dictator who had been our ally when he was fighting our sworn enemy – Iran. It seems Iran is now helping Iraq fight these jihadists, as they slowly but surely gain control over Iraq. The EU has papered over their national insolvency problems with more debt, while imposing austerity measures on the peasants. See French Revolution for the ultimate resolution of this banker-centric solution. The endemic fraud in China, along with an imploding real estate market, and corruption on an epic scale are creating a perfect storm which will derail the China miracle meme.

Meanwhile, the new dictator in Egypt who overthrew the democratically elected government, after our former dictator ally was deposed when Obama refused to support him, has clamped down on the citizens with his military force. The Ukraine is being torn apart after the CIA and their counterparts in the EU undermined the democratically elected government and started a civil war to undermine Russian influence in that country. To an impartial observer, you might think the American Empire is purposely sowing seeds of discontent, war, and disorder around the globe. Never ending war benefits the military industrial complex, as tremendous profits are generated from the sale of arms to all parties involved. Iraq and Syria are good for the bottom line of the U.S. Defense Industry. War and global disorder also benefit the worldwide banking cabal, as the only way to fund these misadventures is through debt. As we all know, debt is what makes this world go round – until it doesn’t.

There has been a virtual mainstream media blackout regarding the Ukraine as government forces bomb and murder civilians. The billionaires running America need to support the billionaire president of the Ukraine because he is one of them. Truth has no place in modern governmental affairs. The mainstream media ignores the fact the United States has armed Sunni terrorists in Syria who are now on the verge of overrunning Baghdad, as they slaughter Iraqi Shiites by the thousands. They ignore the fact that Iraq was a modern, stable, non-religious, oil producing nation under Hussein, with no Al Qaeda or sectarian violence. The United States invaded a sovereign country under false pretenses, wasted over $1 trillion of precious national wealth, killed over 100,000 Iraqis, sustained over 37,000 physical casualties, untold numbers of mental casualties, and now Iraq is dissolving into a quagmire of religious violence threatening oil supplies and driving prices higher. After 13 years and 21,000 casualties in Afghanistan, the Taliban are stronger than ever as we declare victory and slink away. Libya has been another feather in the cap of American foreign policy as we deposed another former ally dictator and have left the country in disarray and civil war. Just because the American corporate media doesn’t report these facts, doesn’t make them not so.

It should be clear to anyone willing to open their eyes and not be influenced by the establishment propaganda that this Fourth Turning is entering a new ominous phase, as the 2008 Global Financial Crisis catalyst has ignited a volcanic eruption which has put tremendous strain on the areas of extreme vulnerability – debt, civic decay, global disorder. The few aware Americans who frequent truth telling websites are frustrated and impatient, waiting for the tsunami of change to sweep over the world. History operates at its own cyclical pace. An accelerated Fourth Turning would likely not be a positive development. The Civil War Crisis was accelerated, resulting in 700,000 deaths in four years. With the worldwide proliferation of nuclear missiles, this Fourth Turning could be over with the push of a button. I don’t think anyone is rooting for that outcome.

You can easily be distracted by the day to day machinations of evil men, relentless propaganda, meaningless distractions, and various forms of bread and circuses. But history is unforgiving. The details and events will be different, but the path of this Crisis will follow past Crisis periods. The worldwide debt bubble will burst. The resulting loss of wealth, jobs, entitlements and trust will ignite mass civil disorder as years of civic decay lead to a swift societal collapse. With China also entering a Fourth Turning, a global debt implosion, resource wars breaking out, religious extremism, and nationalistic drums beating, the likelihood of global war is high.

For some perspective, six years into the last Fourth Turning in 1935, GDP had risen by 30% from its 1933 low and FDR’s New Deal was supposedly lifting the country from its depths. In reality, the population was experiencing a worsening depression and a few years later a world war killed 65 million people. After six years the Civil War Crisis was resolved with 5% of the nation’s male population killed, a president assassinated, and the South left in ruins. This Fourth Turning will proceed along its destined path at its own pace. The molten ingredients of debt, civic decay and global disorder are conjoining in an explosive concoction leading to a conflagration which will flow across the globe on a scale not seen since the Second World War. There is no escaping the trials and tribulations awaiting us. The outcome is uncertain. It could end in glory or destruction. Individual sacrifice, shared burdens, courageous stands and inspired leadership will be required to survive the perilous trials ahead.

I see the bad moon arising

I see trouble on the way

I see earthquakes and lightnin’

I see bad times today

Creedence Clearwater Revival

“Imagine some national (and probably global) volcanic eruption, initially flowing along channels of distress that were created during the Unraveling era and further widened by the catalyst. Trying to foresee where the eruption will go once it bursts free of the channels is like trying to predict the exact fault line of an earthquake. All you know in advance is something about the molten ingredients of the climax, which could include the following:

- Economic distress, with public debt in default, entitlement trust funds in bankruptcy, mounting poverty and unemployment, trade wars, collapsing financial markets, and hyperinflation (or deflation)

- Social distress, with violence fueled by class, race, nativism, or religion and abetted by armed gangs, underground militias, and mercenaries hired by walled communities

- Political distress, with institutional collapse, open tax revolts, one-party hegemony, major constitutional change, secessionism, authoritarianism, and altered national borders

- Military distress, with war against terrorists or foreign regimes equipped with weapons of mass destruction” – The Fourth Turning – Strauss & Howe – 1997