U.S. — As struggling American citizens finished filing their taxes this week, many expressed hope that their small contributions will be instrumental in getting the national debt down to a much more manageable $34 trillion.

U.S. — As struggling American citizens finished filing their taxes this week, many expressed hope that their small contributions will be instrumental in getting the national debt down to a much more manageable $34 trillion.

From Peter Reagan for Birch Gold Group

The last few years have featured heavy doses of economic turmoil for most older Americans trying to save for their retirement. That turmoil includes persistent (possibly long term?) inflation, pandemic panic, and even the potential for a near-term recession.

So let’s take a moment to cover a bit of good news.

Today, we present five meaningful tax breaks for older Americans. After all, you have better things to do with your money than let the government spend it!

Here’s the first…

The world’s first parking meter, known as Park-O-Meter No. 1, is installed on the southeast corner of what was then First Street and Robinson Avenue in Oklahoma City, Oklahoma on July 16, 1935. Continue reading “THIS DAY IN HISTORY – World’s first parking meter installed – 1935”

Written in December 2019. Reposted in honor of the 50th anniversary of the album

And if the cloud bursts thunder in your ear

You shout and no one seems to hear

And if the band you’re in starts playing different tunes

I’ll see you on the dark side of the moon

Brain Damage, Pink Floyd

And if the dam breaks open many years too soon

And if there is no room upon the hill

And if your head explodes with dark forebodings too

I’ll see you on the dark side of the moon

Brain Damage, Pink Floyd

Pink Floyd’s 1973 Dark Side of the Moon album is considered one of the greatest albums of all-time. It stayed on the Billboard 200 charts for 937 weeks. Roger Waters concept was for an album that dealt with things that “make people mad”. The Dark Side of the Moon’s themes include war, conflict, greed, the passage of time, death, and insanity, the latter inspired in part by former band member Syd Barrett’s worsening mental state.

The five tracks on each side reflect various stages of human life, beginning and ending with a heartbeat, exploring the nature of the human experience, and empathy. The themes of this album are timeless and are as germane today as they were forty-six years ago, if not more relevant. The country and world are awash in conflict, driven by the greed of evil men. Decent, law abiding, hard-working, critical thinking Americans see the world going insane as the passage of time leads towards the death of an American empire.

Guest Post by Simon Black

“There is nothing sinister,” wrote Judge Billings ‘Learned’ Hand, “in so arranging one’s affairs as to keep taxes as low as possible.”

The year was 1947, and Hand was a high level federal judge for the US Second Circuit Court; he was writing an opinion in a complicated case in which the Internal Revenue Service was suing a taxpayer over a complex structure to reduce their tax.

Judge Hand sided with the taxpayers, writing “Everyone does so [tries to keep their taxes low], rich or poor. . . for nobody owes any public duty to pay more than the law demands.”

But this standard of paying what the law demands was thrown out a long time ago. Now it’s all about paying what the social revolutionaries demand.

And they want their pound of flesh.

Continue reading “So I guess it wasn’t “two cents” after all. . .”

Guest Post by Simon Black

In early 387 AD in the eastern Roman city of Antioch, a local bureaucrat stood outside of the city council chambers to read a new decree that had just arrived from Emperor Theodosius I.

As the anxious crowd gathered, the bureaucrat began reading aloud–

Just as the crowd had feared, the new decree was a series of debilitating new taxes, ranging from heavy taxation on commercial activities, to mandatory donations to the Emperor himself.

The crowd became furious.

Guest Post by The Zman

Way back in the early days of the conservative movement, it was assumed that Federal spending was both unsustainable and damaging to the country. Cutting the size and scope of government was their thing. The tool they eventually settled on to reduce Federal spending was taxes. If they made high taxes so unpopular with the public, the Left could not keep raising taxes. If they could not raise taxes to cover their spending, they would eventually have to yield to the mathematics.

International Man: President Biden’s Treasury Secretary—and Obama Fed Chair—Janet Yellen recently floated the idea of taxing unrealized capital gains through a “mark-to-market” mechanism.

What is going on here?

Doug Casey: When you tax unrealized capital gains—as they do with foreign stocks in a number of countries, like New Zealand, where it made my life expensive and miserable while I was living there—any stock market assets that you have are marked to market annually. This is a big disincentive to own them because whether you sell the asset or not, you’re going to pay taxes as if you’d sold it.

This is why very few Kiwis own foreign stocks. They’re liable to be taxed on gains, whether or not they sell and actually pocket the gains. I presume that’s what Yellen is talking about. It would make it pointless to buy a stock like Berkshire Hathaway and just hold it for decades to escape capital gains taxes. But the bright side is that if this law was in force, Warren Buffett would no longer be able to whine about the injustice of paying fewer taxes than his secretary.

Continue reading “Doug Casey on Rapidly Rising Taxes and 3 Other Imminent Dangers to Your Wealth”

Guest Post by Simon Black

Once upon a time, long long ago in a dreamworld far far away, banks actually used to be capitalists.

They were wealth creators. They wanted to do business with their customers. They facilitated important trade and commerce. They acted responsibly and conservatively with other people’s money.

Now it’s a totally different story.

Banks seem to routinely steal from their customers. They gamble our savings away on ridiculous investment fads, treat us like criminal suspects, bury us in an absurd bureaucracy, and then charge us fees for the privilege of working with them.

And to add insult to injury, many banks seem to have become full-blown Marxists.

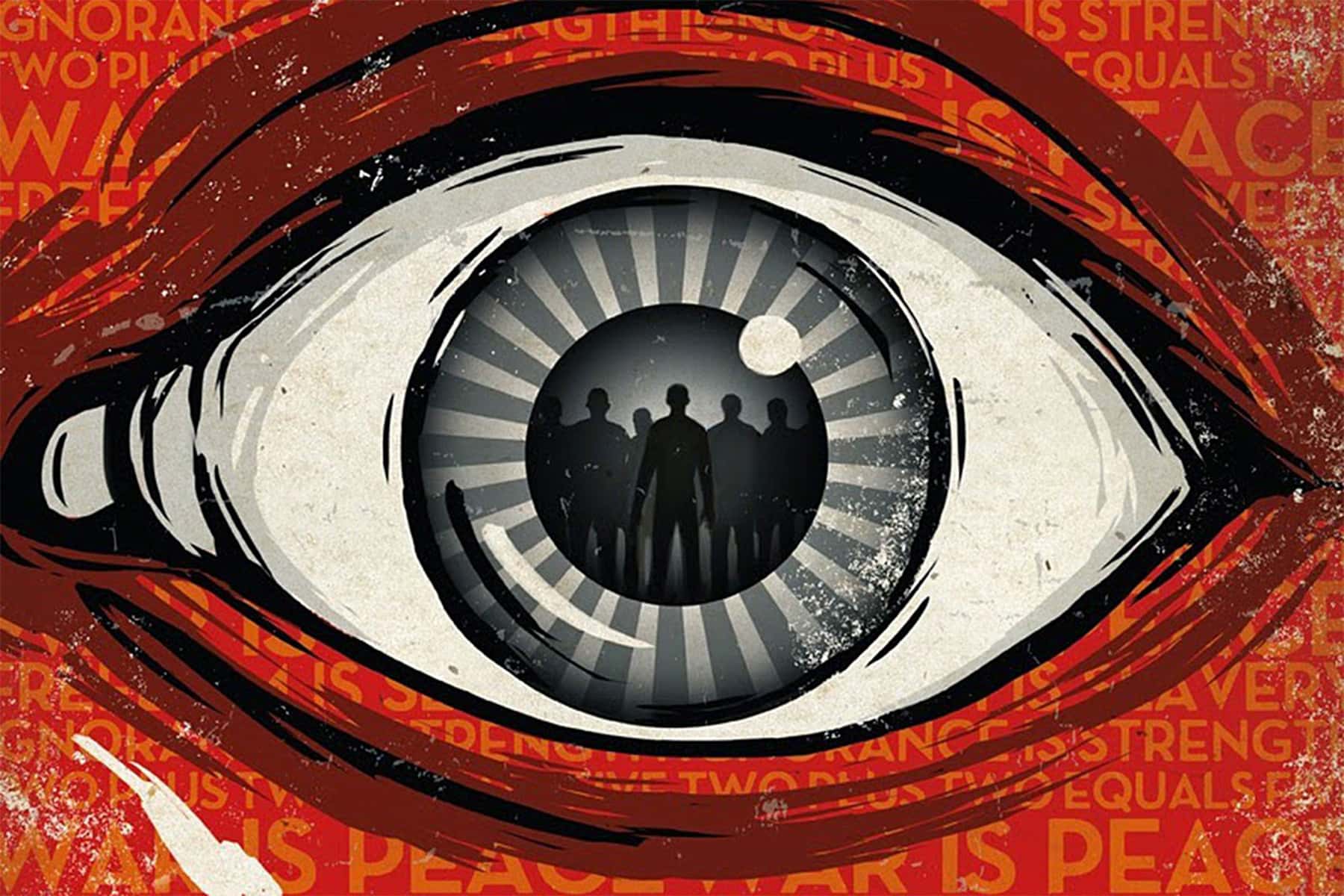

In Part One of this article I laid out the argument Huxley’s dystopian vision of the future had played out over many decades, but now I observe Orwell’s darker vision in motion since the start of this century.

All the “solutions” being imposed by those in power don’t solve anything, because they aren’t designed to solve anything. These are nothing but short-term emergency sustaining maneuvers to keep the dying patient alive, while the criminals ransack his house, extracting whatever wealth he has saved. Throwing $1,200 bones and $600 a week bribes to what they consider the Main Street riff raff, while funneling trillions into the pockets of Too Big To Trust Wall Street banks, billionaire oligarchs, connected mega-corporations, and pliable corrupt politicians, is just what the doctor ordered for the ruling class.

Their weak-kneed toadies at the Federal Reserve have dutifully fulfilled their mandate of no banker or hedge fund left behind. While Main Street is beset with potholes, boarded up small business storefronts (if they haven’t been looted and burned), homeless drug addicts, and the unemployed lining up at local food banks, Wall Street is being paved in gold, with its inhabitants eating caviar, drinking champagne, and celebrating their brilliance in owning a central bank, guaranteed to enrich them.

Continue reading “ARE YOU LOVING YOUR SERVITUDE? (PART TWO)”

Understanding taxes in 20 seconds.

By @DentesLeo pic.twitter.com/M36k2GJm1l— Steve Burns (@SJosephBurns) July 4, 2020

Guest Post by Eric Peters

Ever get tired of being mulcted? Yeah, me too. So I decided to stop being mulcted . . . at least a little bit. And decided to spend some of my money on something besides being mulcted… well, some of what’s left over of my money after being mulcted!

Repeatedly – serially – mulcted.

Uncle steals about 30 percent of every dollar the average person earns, in federal (including FICA “contributions”) and state income taxes.

U.S.—In a stunning new poll, Americans indicated they are OK with a 70% marginal tax rate, indicating that since the hefty taxes would only apply to other people and not themselves, they are alright with the extremely high taxes.

“See, a lot of people think the proposed 70% tax rate is way too high,” said one woman in California. “But what they don’t understand is that the 70% is only on really rich people—in other words, not me. Let’s crank it up to 90, 100, or 110% even. I don’t mind in the slightest.”

Continue reading “Poll Finds Most People OK With Raising Taxes On Other People”