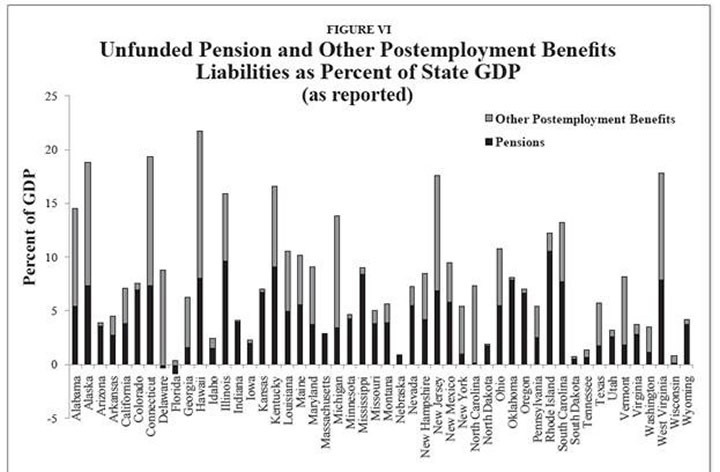

Unfunded state pension liabilities have climbed to $8.28 trillion, or nearly $25,000 for every person in the United States, according to a new report from the American Legislative Exchange Council.

The American Legislative Exchange Council released the latest edition of its report on pensions in all 50 states Thursday. The report, “Unaccountable and Unaffordable 2021,” shows just a handful of states with outsize pension liabilities account for a large share of overall pension debt in the U.S.

The report looked at 290 state-administered government pension plans and their assets and liabilities from fiscal year 2012 to fiscal year 2020. An example of state-administered government pension plans in Illinois would cover state employees, teachers, university workers, judges and lawmakers.

The states with the most unfunded liabilities were California ($1.53 trillion), Illinois ($533.72 billion), Texas ($529.70 billion), New York ($508.70 billion) and Ohio ($429.53 billion). These five states alone account for more than $3.5 trillion in unfunded liabilities, or about 43% of all unfunded liabilities in the U.S.