The two articles below paint a bleak picture for the owners of SUVs, pickup trucks, Hummers and sports cars.

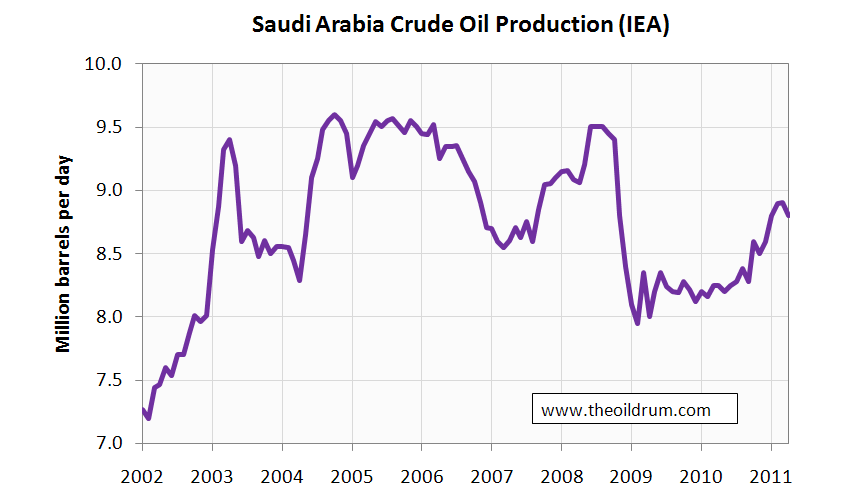

The Arabs are liars. They know that Americans are dupes and will believe any story that makes them feel comfortable. OPEC hates America. They have been lying about their oil reserves for years. They are lying now. Saudi Arabia declared a couple months ago that they would make up for the 1.5 million barrels per day that left the market when Libya erupted in war. It didn’t happen. They have now declared they will produce 10 million barrels per day. One small problem. They can’t. They have never ever produced more than 9.6 million barrels per month and that was when prices reached $140 per barrel. Their oil fields are 40 years old. They are depleting. That is what happens to oil wells. They run out.

You have the biggest producer in the world that can barely increase production (of sour oil) and you have China and India increasing their demand by double digits. Then you have Saudi Arabia spending $150 billion per year on their military as they prepare for a major war in the Middle East. You already have civil war in all the countries surrounding Saudi Arabia. The rumblings about Israel attacking Iran grow louder. Do you think Iran has any missiles pointed at Saudi oil fields and refineries?

Anyone who thinks this Fourth Turning is going to ratchet down in intensity, just ain’t paying attention. When the Middle East explodes, the US economy will blow sky high. When the price of oil hits $200 per barrel, the American way of life implodes. Nothing will work at $200 per barrel. Riots, looting, and general all around chaos will be unleashed. It should be fun.

Saudi oil spare capacity shrinking fast

Reuters Jun 14, 2011 – 8:05 AM ET | Last Updated: Jun 14, 2011 10:20 AM ET

By Barbara Lewis and Braden Reddall

LONDON/HOUSTON — Saudi Arabia’s cushion of spare oil capacity is thinning far faster than widely believed, threatening to trigger price spikes in the months ahead, energy industry experts warned at the Reuters Global Energy and Climate Summit on Monday.

Concerns are growing over the kingdom’s ability to pump more oil beyond an anticipated summer boost, leaving the world exposed to any further unexpected disruptions. The world’s top exporter promised to produce as much oil as the market needs after the Organization of the Petroleum Exporting Countries last week failed to reach a deal.

Saudi newspaper al-Hayat reported Saudi Arabia would boost output to 10 million barrels per day (bpd) in July, which Goldman Sachs’ global head of commodities research Jeff Currie said would leave only 500,000 bpd spare. Currie and his team have warned for months about overstated Saudi output capacity.

“If you get up to (10 mln bpd), you start to really create a very tight market relative to spare capacity,” he told the Reuters Global Energy and Climate Summit in London.

“But the question that’s more appropriate is when do you get to 9.5, when do you get to 10? Because when you start to look out over the horizon, their ability to create more flexibility in spare capacity increases tremendously.”

Peter Oosterveer, group president for energy and chemicals with global engineering giant Fluor Corp, recently met with executives in the Middle East, and returned with a feeling that Saudi Arabia’s capacity was not as large as some estimates.

He did not provide any specific numbers on the kingdom’s overall production, but said workable spare capacity was in the range of 1.5 to 2 million bpd.

“That doesn’t mean to say that it isn’t ultimately available,” Oosterveer said at the Summit. He added that there did not seem to be a great deal of concern in Saudi Arabia about the current level of capacity.

“There’s always a lot of activity in Saudi, and there’s still a lot of activity in Saudi as we speak,” he added, with more focus there on exploration and production projects compared with two or three years ago.

Saudi Arabia is the only country in the world with a significant base of idle capacity, and therefore can act as a supplier of last resort in times of crisis. It has already ramped up output following the halt in Libya’s over 1 million bpd of oil exports, and is expected to pump more shortly.

Following a wave of investment as oil surged to a record high US$147 a barrel in 2008, Saudi Arabia says its capacity stands at 12.5 million bpd, giving it a comfortable cushion based on recent output estimates.

But analysts are still beginning to debate the risk of a repeat of the last decade, when years of underinvestment and a surge in Chinese demand forced OPEC to pump nearly flat out, drawing down their reserve to less than 1 million bpd.

That fundamental tightness underpinned the five-year rally that lifted prices six-fold until 2008. While few expect that to recur as spectacularly, some are warning of spikes.

“Once spare capacity falls below 2 million bpd, which will be sometime next year, then we will see substantial spikes in the oil price from time to time,” Robeco fund manager Peter Csoregh told the Summit.

“There’s an inherent bias, especially in the Middle East and Saudi Arabia, to overstate their spare capacity.”

Saudi Arabia Prepares for a Crude Oil War

Monday, 13 June 2011

In a truly alarming development, Saudi Arabia is gearing up for all-out crude oil war in the Middle East.

In a truly alarming development, Saudi Arabia is gearing up for all-out crude oil war in the Middle East.

Right now, the world is in a deflationary state.

While countless other outlets have gone on endlessly about inflation, we have warned repeatedly in these pages that the “D” word is not dead. U.S. Treasury bond yields, a harbinger of deflation, have been falling, not rising. Now the broad markets are falling too.

There is hope that emerging markets (particularly China) will be able to bail out the world, once again, if the West slows down and falls back into a funk. But it is a weak, false hope.

China ginned up the economic juice of recent years through a massive 2009 half-trillion-dollar stimulus program — far, far bigger than America’s stimulus program, relative to the size of the Chinese economy. China can’t do that again without unleashing melt-your-eyeballs inflation.

The Federal Reserve is similarly “out of bullets”… and Quantitative Easing 2 did not help the real economy anyway. So now things are slowing down again, with crisis in the wings. Deflation pressures are back, as monetary velocity threatens to stall out.

All of the above is very bearish for the price of crude oil. It explains why crude oil could fall all the way back to $60 a barrel under the right combination of events, with long-side commodity bulls getting crushed to powder.

But there is one very big reason to be bullish on the crude oil price — or at least not bearish: The Middle East could soon be in flames.

(Don’t forget, you can sign up for Taipan Daily to receive all of my and fellow editor Joseph McBrennan’s investment commentary.)

Did you watch the Lord of the Rings movies? Do you remember the scene where the wizard Saruman is building his subhuman army, preparing weapons in deep fire pits on a mass scale?

Your editor was reminded of that imagery on reading about Saudi Arabia’s latest. The following, via CNN, is from Nawaf Obaid, a Senior Fellow at the King Faisal Center in Riyadh:

As the birthplace of Islam and the leader of the Muslim and Arab worlds, Saudi Arabia has a unique responsibility to aid states in the region, assisting them in their gradual evolution toward more sustainable political systems and preventing them from collapsing and spreading further disorder.

That the Kingdom has the ability to implement this foreign policy goal should not be in doubt – it is backed by significant military and economic strength.

The foundation for this more robust strategic posture is Saudi Arabia’s investment of around $150 billion in its military. This includes a potential expansion of the National Guard and Armed Forces by at least 120,000 troops, and a further 60,000 troops for the security services at the Interior Ministry, notably in the special and various police forces. A portion of these will join units that could be deployed beyond the Kingdom’s borders.

In addition, approximately 1,000 new state-of-the-art combat tanks may be added to the Army, and the Air Force will see its capabilities significantly improve with the doubling of its high quality combat airplanes to about 500 advanced aircraft.

A massive new missile defense system is in the works. Finally, the two main fleets of the Navy will undergo extensive expansion and a complete refurbishment of existing assets.

As part of this new defense doctrine, the leadership has decided to meet the country’s growing needs for new equipment by diversifying among American, European and Asian military suppliers.

Few countries are able to support such considerable military investment, but Saudi Arabia occupies a unique position in that it has sufficient reserves and revenues to carry out the above plans…

Read it again. Consider the implications. Saudi Arabia is preparing for WAR.

Mr. Obaid, taking the Saudi point of view, sees it as a good thing that The Kingdom has the resources to implement “peace through superior firepower” in the Middle East.

But the whole point is that the Saudis see the need to gear up for war in the first place…

The Middle East is a long-simmering cauldron of ancient hatreds and deadly conflicts. The two major players are the Saudis — who are Sunni Muslim — and the Iranians, who are Shia.

Saudi Arabia and Iran hate each other. They are the Hatfields and McCoys of the region, on a far more serious scale.

And Saudi Arabia has good reason to loathe and fear Iran. Were the Saudi power structure to be toppled, that would leave the Sunni branch of Islam decapitated… allowing Shia Iran to dominate.

The “Arab Spring” of uprisings and turmoil is going to lead to war because significant interests in the region want war. They want conflict. The turmoil and uncertainty of toppling regimes has created a golden opportunity. Out of chaos and rubble, new structures can emerge. New power brokers can replace the old.

As the rich player with the most to lose, Saudi Arabia knows all this. And the Saudis are terrified. That is why they are ordering a thousand tanks. That is why they are building “a massive new missile defense system.”

The Kingdom is preparing for local Armageddon. Too bad all that preparation won’t help them, though, because warfare is no longer broad-based and symmetrical. It is more about terrorism and guerilla ambush than full-scale attack.

Except when it comes to one country attacking another in response to a clearly instigated terrorist event… like the destruction of a major Saudi oil facility…

And by the way, because we are talking Middle East here, local Armageddon means global Armageddon (as far as crude oil prices go).

With deflationary pressures building, Western economies slowing, and the China miracle threatening to stall, a spike in crude oil to $200 a barrel as the Middle East erupts in a giant fireball would be just about the worst scenario imaginable for the global economy.

Crude oil spiking to that price would act like a massive non-optional transaction tax. Millions of Americans would lose the ability to fill up their cars with gas. The transport cost of goods would go through the roof. Store shelves would be left unstocked, as the goods became too expensive to shift and a panicked populace had stopped buying them anyway.

It would be nice if this were all a bad dream, or just some fantastical movie plot. But it isn’t. It is very, very real.

What the Saudis are telling us is that, sooner rather than later, the Middle East could explode… and we understand the rationale as to why.

Will you be ready when the price of crude oil goes to $200 overnight? Ready or not, we may have no choice.

I now fill up once every 6-7 weeks.

Any one familiar with history will realize that massive military buildups are rarely a precursor to peace. Reaching back to an earlier thread about “false flags, ” wonder if the next false flag might not be on Saudi territory.

I’ve got to sell the monster truck…luckily, there’s a great demand for those things these days (sarcasm intended)

Admin,

I agree with the premise of driving more fuel efficient cars, but if oil goes to $200.00 a barrel and gas becomes $8.00 per gallon, how much difference will it make? Our food and consumables will be so expensive already most people won’t drive anyway. At least I can sleep in my SUV (pun intended).

matt

You’re right. Switching to fuel efficient cars won’t make a bit of difference as China and India increase usage by 10% per year and Saudi Arabia runs out. Our world will change dramatically at $8.00 per gallon.

this is actually not correct. the US has massive oil reserves as does iraq. secondly, the OPEC leaders dont want oil to go to $200 because the demand would drop like a rock and people would both cut back on oil use and look for alternatives.

fallout

You are full of shit. The US has 1.5% of the world’s oil reserves and uses 20% of the oil consumed. Iraq has the 3rd or 4th largest reserve. SO!!! We don’t control it. Iraq does. They are part of OPEC. Don’t be a dumbass peak oil denier.

I can hardly wait! Woohoo! I will be driving this:

[img [/img]

[/img]

While all the little people will be driving this:

[img [/img]

[/img]

Guess who wins in a fight for a parking spot?

Does that mean I gotta move to Iraqq and take my SUVs with me? Damn, that’s harsh.

whats this then? http://seekingalpha.com/article/274615-shell-oil-becoming-a-strong-player-in-shale-oil we are not opening up our reserves until we have taken every one elses. Yes Ill give you peak oil production, i agree with that. but please remind me again of how we dont control the iraq reserves? which one of these companies is Iraqi? BP? Halliburton?

fallout

The IRAQ government owns ALL the oil reserves in Iraq. The US companies do not control one drop of Iraqi oil.

Shale oil is viable at $150 per barrel prices. It requires massive amounts of water and natural gas to extract it. If the energy required to extract a barrel of shale oil exceeds one barrel of oil then it doesn’t matter.

You need to learn a few facts rather than listening to Republican idiots declaring drill drill drill.

I don’t have my facts at hand, but didn’t Bus’s Viceroy in Iraq extract a long term “sales” arrangement with the fledgeling hand-picked Iraqi government? I am old and my memory is fading, but I thought we locked up Iraqi oil as one of the first items of business in our quest for spreading democracy (house-by-house if necessary).

My point being that while the goverment of Iraq may nominally own the oil, the US controls it; a crucial distinction.

If I am wrong, please correct…

$8 oil is an inevitability, one that we should prepare for. And somewhere James Kunstler is describing a World Made By Hand.

To all of you jealous fucks thumbing me and my SUV down, I say this:

[img [/img]

[/img]