Hussman knows the culprit for this stock market bubble. It is none other than your friends at the Federal Reserve. Shockingly, they are owned by the very bankers who have benefited from the bubble.

One would think the Federal Reserve would have learned from that catastrophe. Instead, the Fed has spent the past several years intentionally trying to revive the precise dynamic that produced it. As a consequence, speculative yield-seeking has now driven the most historically reliable measures of equity valuation to more than double their pre-bubble norms. Meanwhile, as investors reach for yield in lower-quality but higher-yielding debt securities, leveraged loan volume (loans to already highly indebted borrowers) has reached record highs, with the majority of that debt as “covenant lite” issuance that lacks traditional protections in the event of default. Junk bond issuance is also at a record high. Moreover, all of this issuance is interconnected, as one of the primary uses of new debt issuance is to finance the purchase of equities.

This market is walking on air, lies, and delusion. When it breaks, there will be nowhere to run. This bubble is bigger and wider than the tech bubble of 2000. Large cap value stocks were unbelievably cheap in 2000. Today, nothing is cheap. Everything is overvalued and everything will fall hard.

Make no mistake – this is an equity bubble, and a highly advanced one. On the most historically reliable measures, it is easily beyond 1972 and 1987, beyond 1929 and 2007, and is now within about 15% of the 2000 extreme. The main difference between the current episode and that of 2000 is that the 2000 bubble was strikingly obvious in technology, whereas the present one is diffused across all sectors in a way that makes valuations for most stocks actually worse than in 2000. The median price/revenue ratio of S&P 500 components is already far above the 2000 level, and the average across S&P 500 components is nearly the same as in 2000. The extent of this bubble is also partially obscured by record high profit margins that make P/E ratios on single-year measures seem less extreme (though the forward operating P/E of the S&P 500 is already beyond its 2007 peak even without accounting for margins).

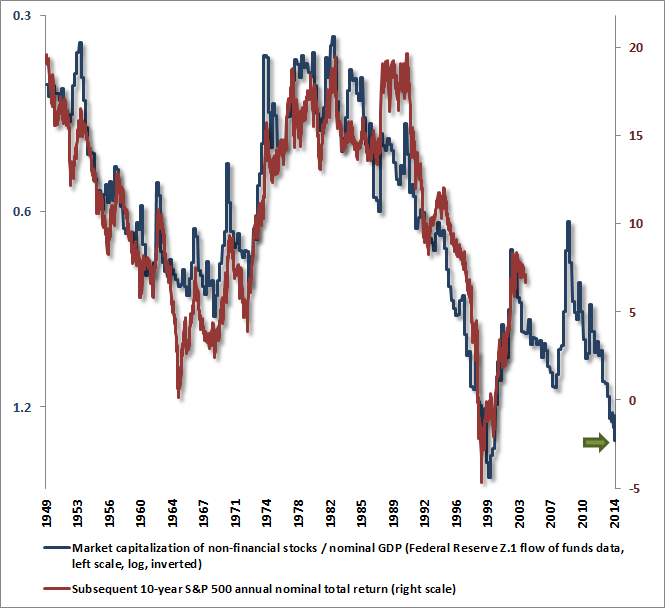

Recall also that the ratio of nonfinancial market capitalization to GDP is presently about 1.35, versus a pre-bubble historical norm of about 0.55 and an extreme at the 2000 peak of 1.54. This measure is better correlated with actual subsequent market returns than nearly any alternative, as Warren Buffett also observed in a 2001 Fortune interview. So if one wishes to use the 2000 bubble peak as an objective, we suggest that it would take another 15% market advance to match that highest valuation extreme in history – a point that was predictably followed by a decade of negative returns for the S&P 500, averaging a nominal total return, including dividends, of just 3.7% annually in the more than 14 years since that peak, and even then only because valuations have again approached those previous bubble extremes. The blue line on the chart below shows market cap / GDP on an inverted left (log) scale, the red line shows the actual subsequent 10-year annual nominal total return of the S&P 500.

Hussman is talking to a brick wall when he tells the Federal Reserve what they should do. They are captured by the oligarchs and will do their bidding until the end.

If the Federal Reserve is historically informed, it should concentrate now on supervisory oversight of those areas where systemically interconnected institutions have major loans out to entities with thin capital structures and highly leveraged exposure to equities. Hedge funds and private equity firms are often the canaries in that coalmine, because their highly leveraged, lopsided bets typically fail first. Our nation lost its best opportunity to strengthen the financial system when policy makers dropped the ball on changes that might have required banks and other financial institutions to carry a significant portion of their funding in the form of mandatory convertible debt (which would change automatically to loss-bearing equity if the company approached insolvency). The best that can be done is for the Fed to scramble early enough to identify and contain the expansion of loans that directly or indirectly finance leveraged equity positions.

There is not much benefit to be gained from surprising the market by ending QE prior to October, but the Fed should also begin talking now about suspending reinvestment of interest and principal payments starting in October. The marginal benefits of QE have already turned sharply negative by encouraging speculation and low-quality debt expansion, Failure to begin drawing down the balance sheet will only make future policy normalization more challenging.

As investors, the problem is that we don’t know the point where a shift in risk tolerance will occur. We’re certainly seeing some increase in junk bond yields, and increasingly choppy market internals (where small capitalization stocks have been the clearest divergence), but given that the market has – so far – fought extreme overvalued, overbought, overbullish conditions that have historically been a severe warning for investors, we really have no strong opinion about the timeline. I doubt that the timing will matter even a few quarters from now, but our best response at this point is simply to maintain a defensive stance without fighting the market or taking investment positions that rely on immediacy of negative outcomes.

This one should be a real humdinger when it pops. The one that ushers in the 4th turning crisis.

Fuck’em ALL…the Messiah Jeebus Greenspan said the Federal Reserve can’t stop bubbles . His disciple, Yellen The Righteous agrees .