“The major function of secrecy in Washington is to keep the U.S. people and U.S. Congress from knowing what the nation’s leaders are doing. Secrecy is power. Secrecy is license. Secrecy covers up mistakes. Secrecy covers up corruption.

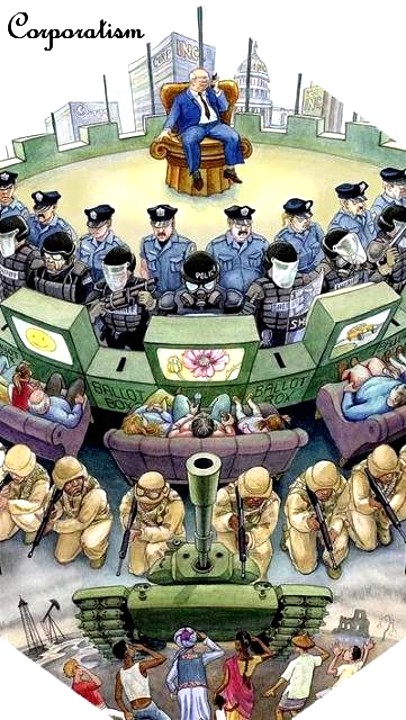

The United States [is] cast in the role of Praetorian Guard, protecting the interests of the global financial order against fractious elements in the Third World. As the Praetorian Guard, fighting wars for multinational interests while also paying for such adventures, our relative economic stability, domestic social and material infrastructure, and the freedom and liberties of the American people may all be forfeited.

James Stockwell, Praetorian Guard: US Role In the New World Order

“There are only two reasons why you should ever be asked to give your youngsters. One is defense of our homes. The other is the defense of our Bill of Rights and particularly the right to worship God as we see fit. Every other reason advanced for the murder of young men is a racket, pure and simple.

I spent thirty-three years and four months in active military service as a member of this country’s most agile military force, the Marine Corps. I served in all commissioned ranks from Second Lieutenant to Major-General. And during that period, I spent most of my time being a high class muscle-man for Big Business, for Wall Street and for the Bankers. In short, I was a racketeer, a gangster for capitalism.”

Smedley D. Butler, War is a Racket