Guest Post by Jesse

When suppertime came, the old cook came on deck

Sayin’ Fellas, it’s too rough to feed ya

At seven PM a main hatchway caved in

He said, Fellas, it’s been good to know ya

The captain wired in he had water comin’ in

And the good ship and crew was in peril

And later that night when his lights went out of sight

Came the wreck of the Edmund Fitzgerald.Gordon Lightfoot, The Wreck of the Edmund Fitzgerald

I have included the two stock index cash market charts with technicals.

There is a potential ‘island top’ forming on the NDX, and the SP 500 looks like it might be testing the 200 DMA.

Bottom line is if stocks start rolling over with some real selling, and not this tissue thin HFT shell game that has taken the place of actual price discovery, then we could be in for a very rough ride.

Let’s see how much more the Fed is willing to spend to support their latest paper asset bubble. And let’s see if they can raise rates fast enough to have enough room to lower them again in response to another crisis which they have themselves would most likely have caused.

Today is the 40th anniversary of the wreck of the Edmund Fitzgerald during a fierce November storm on Lake Superior.

Guest Post by Jesse

I like Dean Baker quite well, and often link to his columns. On most things we are pretty much on the same page.

And to his credit he was one of the few ‘mainstream’ economists to actually see the housing bubble developing, and call it out. Some may claim to have done so, and can even cite a sentence or two where they may have mentioned it, like Paul Krugman for example. But very few spoke about doing something about it while it was in progress. The Fed was aware according to their own minutes, and ignored it.

The difficulty we have in the economics profession, I fear, is a great deal of herd instinct and concern about what others may say. And when the Fed runs their policy pennants up the flagpole, only someone truly secure in their thinking, or forsworn to some strong ideological interpretation of reality or bias if we are truly honest, dare not salute it.

Am I such a person? Do I actually see a fragile financial system that is still corrupt and highly levered, grossly mispricing risks? Or am I just seeing things the way in which I wish to see them?

That difficulty arises because economics is no science. It involves judgement and principles, and weighs the facts far too heavily based upon ‘reputation’ and ‘status.’ And of course I have none of those and wish none.

Continue reading “No Real Chance of Another Financial Crisis – ‘Silly’”

Guest Post by Jesse

“The sense of responsibility in the financial community for the community as a whole is not small. It is nearly nil.”

John Kenneth Galbraith, The Great Crash of 1929

Here are a few charts that show the rather striking decline in ‘registered’ gold, that is gold available for those standing for delivery, in the Comex warehouses.

‘Standing’ by the way means standing around and waiting for someone to choose to fulfill your request for your contract to be fulfilled with actual bullion before the cut off date.

You can see from the first chart that the likelihood of someone actually standing for delivery and receiving bullion has never been less at The Bucket Shop. Real metal is unfashionable amongst our financial sophisticates.

As for delivery and withdrawal of bullion, it is getting stronger and stronger in the East. Second chart. What can one say at such embarrassing behaviour? What a bunch of rubes!

In Part 1 of this article I discussed the catalyst spark which ignited this Fourth Turning and the seemingly delayed regeneracy. In Part 2 I pondered possible Grey Champion prophet generation leaders who could arise during the regeneracy. In Part 3 I will focus on the economic channel of distress which is likely to be the primary driving force in the next phase of this Crisis.

There are very few people left on this earth who lived through the last Fourth Turning (1929 – 1946). The passing of older generations is a key component in the recurring cycles which propel the world through the seemingly chaotic episodes that paint portraits on the canvas of history. The current alignment of generations is driving this Crisis and will continue to give impetus to the future direction of this Fourth Turning. The alignment during a Fourth Turning is always the same: Old Artists (Silent) die, Prophets (Boomers) enter elderhood, Nomads (Gen X) enter midlife, Heroes (Millennials) enter young adulthood—and a new generation of child Artists (Gen Y) is born. This is an era in which America’s institutional life is torn down and rebuilt from the ground up—always in response to a perceived threat to the nation’s very survival.

For those who understand the theory, there is the potential for impatience and anticipating dire circumstances before the mood of the country turns in response to the 2nd or 3rd perilous incident after the initial catalyst. Neil Howe anticipates the climax of this Crisis arriving in the 2022 to 2025 time frame, with the final resolution happening between 2026 and 2029. Any acceleration in these time frames would likely be catastrophic, bloody, and possibly tragic for mankind. As presented by Strauss and Howe, this Crisis will continue to be driven by the core elements of debt, civic decay, and global disorder, with the volcanic eruption traveling along channels of distress and aggravating problems ignored, neglected, or denied for the last thirty years. Let’s examine the channels of distress which will surely sway the direction of this Crisis.

“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action.” – The Fourth Turning – Strauss & Howe

I think it is priceless. Ray lays out his thoughts on wealth and hedging with gold to the chuckles and sniggers of the pampered ruling class in a very clear and straightforward manner.

There is also another video interview in which Dalio discusses his views with the smirking chimps from CNBC. It is almost a scene out of Huxley’s Brave New World, with Dalio as some kind of monetary savage trying to explain reality to those who have been incubated in an artificial currency regime of King Dollar and know nothing else.

Here is why I think that this is important.

The gold market in particular seems to have bifurcated, or split into two: one market for largely paper speculation and high leverage, and another for the purchase and distribution of actual physical bullion.

Is this a problem?

Guest Post by Jesse

“Benign remedies are for the innocent. Misdeeds, once exposed, have no refuge but in audacity. And they had accomplices in all those who feared the same fate.”

Tacitus, Annals

Gold and silver were hit early on today, and knocked lower on high volume in relatively quiet trade, while the stock market was being pumped higher.

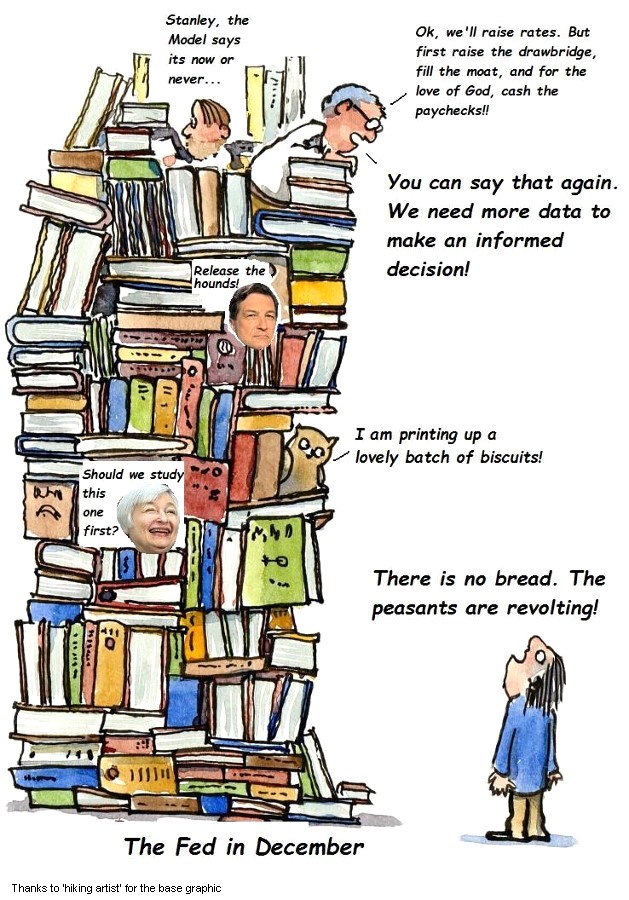

The Fed would like to set the stage for their FOMC meeting next week, and rather badly so. They are afraid to do it with these unstable equity and bond markets, because if they raise and the market breaks, they will be blamed for it. You can see that the IMF and the World Bank have already covered their posteriors by warning. And Larry Summers has also chimed in.

It is not a 25 basis point increase that will break these markets. They are already broken, an accident waiting to happen. The trail of policy errors goes back to the Greenspan chairmanship of the FOMC.

The Comex continues to bleed out, with additional gold and silver leaving their warehouses yesterday.

Registered (deliverable) gold has fallen to 185,314 troy ounces, a low we have not seen since before the year 2000. On a quick calculation pending the final numbers early tomorrow, I would think that the ratio of paper claim to actual deliverable gold at price is now at an unprecedented level of 226:1.

Say what you will, this is not ‘normal.’

Continue reading “When the Unsustainable No Longer Sustains”

Guest Post by Jesse

On the surface this report shows solid economic growth for the US economy during the second quarter of 2015. Unfortunately, all of the usual caveats merit restatement:

— A significant portion of the “solid growth” in this headline number could be the result of understated BEA inflation data. Using deflators from the BLS results in a more modest 2.33% growth rate. And using deflators from the Billion Prices Project puts the growth rate even lower, at 1.28%.

— Per capita real GDP (the number we generally use to evaluate other economies) comes in at about 1.6% using BLS deflators and about 0.6% using the BPP deflators. Keep in mind that population growth alone (not brilliant central bank maneuvers) contributes a 0.72% positive bias to the headline number.

— Once again we wonder how much we should trust numbers that bounce all over the place from revision to revision. One might expect better from a huge (and expensive) bureaucracy operating in the 21st century.

Among major economies, only the Chinese numbers are more suspect.

All that said, we have — on the official record — solid economic growth and 5.3% unemployment.

What more could Ms. Yellen want?

Consumer Metrics Institute, BEA Revises 2nd Quarter 2015 GDP Growth Upward to 3.70%

Continue reading “‘Among Major Economies, Only the Chinese Numbers Are More Suspect’”

Guest Post by Jesse

“I believe myriad global “carry trades” – speculative leveraging of securities – are the unappreciated prevailing source of finance behind interlinked global securities market Bubbles. They amount to this cycle’s government-directed finance unleashed to jump-start a global reflationary cycle.

I’m convinced that perhaps Trillions worth of speculative leverage have accumulated throughout global currency and securities markets at least partially based on the perception that policymakers condone this leverage as integral (as mortgage finance was previously) in the fight against mounting global deflationary forces.”

Doug Noland, Carry Trades and Trend-Following Strategies

The basic diagnosis is correct. But the nature of the disease, and the appropriate remedies, may not be so easily apprehended, except through simple common sense. And that is a rare commodity these days.

Like a dog returns to its vomit, the Fed’s speculative bubble policy enables the one percent to once again feast on the carcass of the real economy.

‘And no one could have ever seen it coming.’

Once is an accident.

Twice is no coincidence.

Remind yourself what has changed since then. Banks have gotten bigger. Schemes and fraud continue.

What will the third time be like? And the fourth?

Continue reading “Leveraged Financial Speculation to GDP in the US at a Familiar Peak, Once Again”

And we are seeing similar phenomenon abroad in the UK with Corbyn and Fararge, and in France with Le Pen.

Obviously I do not know how this will end. I am not necessarily hopeful in the short term. If they were wise, the ‘establishment’ would allow for peaceful evolution, and more forcefully rein in the abuses and plundering being done by themselves and their predatory patrons. And they have shown little wisdom, or self-awareness, existing as they do in hermetically sealed envelopes of money and power.

Guest Post by Jesse

“We are imperial, and we are in decline… People are losing confidence in the Empire.”

This is the key theme of Larry Wilkerson’s presentation. He never really questions whether empire is good or bad, sustainable or not, and at what costs. At least he does not so in the same manner as that great analyst of empire Chalmers Johnson.

It is important to understand what people who are in and near positions of power are thinking if you wish to understand what they are doing, and what they are likely to do. What ought to be done is another matter.

Wilkerson is a Republican establishment insider who has served for many years in the military and the State Department. Here he is giving about a 40 minute presentation to the Centre For International Governance in Canada in 2014.

I find his point of view of things interesting and revealing, even on those points where I may not agree with his perspective. There also seem to be some internal inconsistencies in this thinking.

But what makes his perspective important is that it represents a mainstream view of many professional politicians and ‘the Establishment’ in America. Not the hard right of the Republican party, but much of what constitutes the recurring political establishment of the US.

Continue reading “Lawrence Wilkerson: Travails of Empire – Oil, Debt, Gold and the Imperial Dollar”

Guest Post by Jesse

China shocked the world markets overnight by devaluing their currency by the most in two decades.

A devaluation of this sort is designed to improve the domestic economy by stimulating exports, lowering domestic costs of production relative to other sources, and to inhibit imports by raising their relative prices.

In other words, China clearly signaled that the US dollar, to which they were matching their own currency, is overvalued relative to the state of the global economy, and especially their own.

China is ‘the canary in the coal mine’ for the global economy, a major source of labor and supply. Their own economy is sick because demand from overseas is down.

And why is demand lower? Because multinational corporations and the banking system have been financializing nearly everything to increase corporate profits and the wealth of a very few, pretty much at the expense of everyone else.

So if the people do not have the money to buy, and cannot keep increasing their private debt to service consumption because of the predatory lending and fees in the system, guess what happens to aggregate demand? Duh.

Guest Post by Jesse

“Gold has worked down from Alexander’s time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory.”

Bernard M. Baruch

Asia continues to add significant amounts of gold bullion to their wealth reserves.

Wall Street and its sycophants would like us to consider gold to be just ‘a pet rock’ or ‘like trading sardines.’ And yet central banks have turned to be net buyers, and Asia and the Mideast continue to buy bullion in record amounts. Talk to the Chan.

One of the few coherent things Alan Greenspan said was that statists of all persuasions, both right and left, have ‘an almost hysterical antagonism towards gold.’ This is because gold resists their will to power over others.

So why isn’t gold ‘working’ at this moment in history?

Guest Post by Jesse

“Find out just what people will submit to, and you have found out the exact amount of injustice and wrong which will be imposed upon them; and these will continue until they are resisted with either words or blows or both. The limits of tyrants are prescribed by the endurance of those whom they oppress.”

Thomas Paine

Greek Prime Minister Alexis Tsipras seems to have folded precipitously, after apparently having taken all other options off the table including a Grexit, a movement toward the burgeoning China Development Bank, an impasse.

His strategy seemed a bit out of joint. I have heard that Victoria Nuland made him a personal offer he could not refuse, and he did not wish to offer a ‘principled resignation’ as did Varoufakis.

(Note: I am now mulling this and a few other things over in light of this new interview by Varoufakis.)

It could be that he was then taken aback and surprised by the sheer ferocity of the European (German) proposal, which was to essentially make Greek into a protectorate, and to visit a looting of national assets, given that the loans being granted are completely unpayable and the collateral will be forfeit.

Guest Post by Jesse

Perhaps the Greeks made a mistake, and relied too much on rationality, on a belief in a Eurozone in which good sense and reason would prevail. As it was, the Germans were willing to ruthlessly crush the Greek banking system, while the ECB and IMF stood idly by, fomenting a financial panic and humanitarian disaster in order to displace a sovereign government and put an entire nation ‘in its place.’ We certainly have seen this kind of example made before.

This was an exercise in raw power. It was a financial blitzkrieg, an act of economic warfare and reckless destruction on a people that ought to be condemned by the free world. But this kind of ruthless abuse of financial systems seems to be the accepted thing now amongst the developed economies. And we might view Greece as a sort of an experiment in a new form of warfare and ruthlessness, as were Guernica, Warsaw, and Lidice.

It is a shame if the Greeks have not prepared for Grexit, although there are still clearly options despite the naysayers who see only difficulties in everything. Freedom is rarely the easier way.

The lesson that the countries of the Eurozone cannot trust Germany to act with wisdom and goodwill was known, but now we also see that restraint is also not in their repetoire. If one can read between the lines, it would be a pity if the rest of the European countries do not start planning now for their own active exit from such an failed concept as the European Monetary Union.

Continue reading “The Greek Deal From Germany – Reading Between the Lines – Darkness Over the Earth”

“…and then they come for the others: the dissidents, the different, and the other.

And sometimes, for those who just happen to be where we do not wish them to be.

Once people have been sufficiently desensitized, over time made utterly apathetic to the condition of their fellow human beings, and provided an official rationale in the form of symbols and slogans, for murder, torture, and even the most heinous crimes out of fear and a taste for violence, almost anything is possible.

And in the end, the people are driven mad by their complicity. They imagine themselves as other than human, first as some types of superior beings. But when that illusion falters, and the romantic allure of their symbols and slogans become tattered, And after a time they find their refuge, merely as beasts.

Great worldly power can at first appear to be awe inspiring, almost beautiful, in its scope and majesty. How can we possibly oppose something so vast, so shocking in its scope and reach. But as we draw closer, we may at times perceive the smell of decay, and corruption, the rot beneath the appearance of the glamour. And perhaps, drawing close enough, we may even catch a glimpse of the diseased eyes and evil leer behind the mask. But by then, alas, we are his.”