Guest Post by Jesse

Gresham’s law is an economic principle that states ‘when a government overvalues one type of money and undervalues another, the undervalued money will leave the country or disappear from circulation into hoards, while the overvalued money will flood into circulation.’

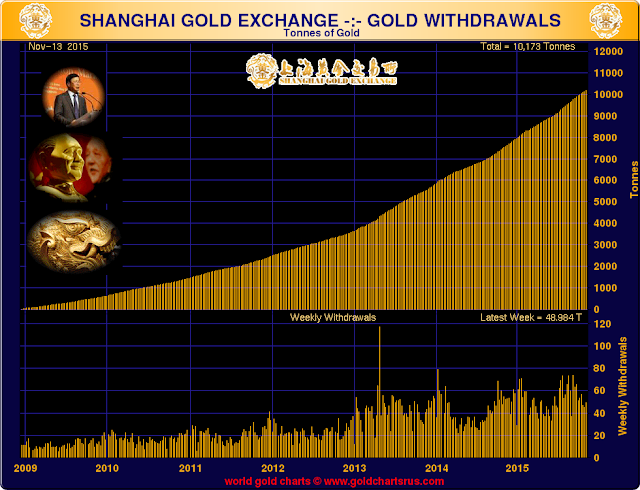

Notice the ‘sea change’ that occurred with Shanghai gold flows starting in 2013.

There were about 49 tonnes, or 1,575,000 troy ounces, of gold delivered from Shanghai in the latest week.

No matter what the pundits say about ‘gold bugs’ and all that sort of nonsensical disparagement, the central banks of the world have been net buyers of gold since about 2007, and the major countries of The Silk Road are buying gold bullion by the tonne each and every week.

Are they all unenlightened idiots? Goldbugs?

Are the central bankers of the world fools and dupes?

Or are we being misled by the global Banks? Hard to believe, right?

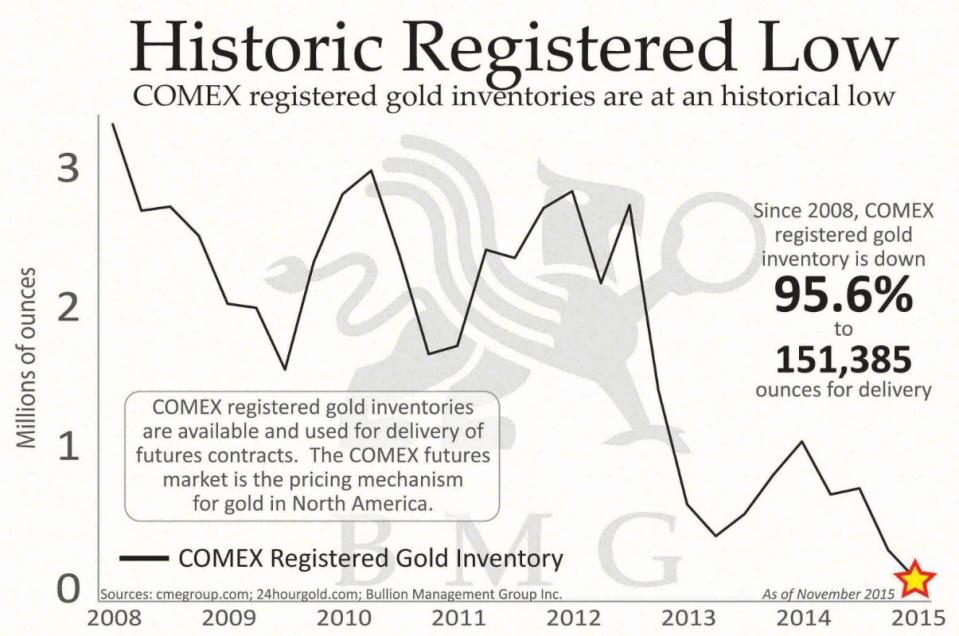

Gold bullion is moving from West to East.