I wrote this on January 3. It was my outlook for 2011. Whenever I think I’m too pessimistic about the world, I go back and read old articles. This article is less than 4 months old and the situation has gotten much worse, much faster than I anticipated. The economy has slowed dramatically, even with the payroll tax cut and Ben’s QE2. I now think the 2nd half of 2011 will be outright recession. Again, my own words prove than I’m actually an optimist compared to what really happens. Think about that the next time you get depressed by one of my articles.

As I began to think about what might happen in 2011, the classic Joseph Heller novel Catch 22 kept entering my mind. Am I sane for thinking such a thing, or am I so insane that asking this question proves that I’m too rational to even think such a thing? In the novel, the “Catch 22” is that “anyone who wants to get out of combat duty isn’t really crazy”. Hence, pilots who request a fitness evaluation are sane, and therefore must fly in combat. At the same time, if an evaluation is not requested by the pilot, he will never receive one (i.e. they can never be found “insane”), meaning he must also fly in combat. Therefore, Catch-22 ensures that no pilot can ever be grounded for being insane – even if he were. The absurdity is captured in this passage:

There was only one catch and that was Catch-22, which specified that a concern for one’s own safety in the face of dangers that were real and immediate was the process of a rational mind. Orr was crazy and could be grounded. All he had to do was ask; and as soon as he did, he would no longer be crazy and would have to fly more missions. Orr would be crazy to fly more missions and sane if he didn’t, but if he was sane, he had to fly them. If he flew them, he was crazy and didn’t have to; but if he didn’t want to, he was sane and had to. Yossarian was moved very deeply by the absolute simplicity of this clause of Catch-22 and let out a respectful whistle. “That’s some catch, that Catch-22,” he observed. “It’s the best there is,” Doc Daneeka agreed. – Catch 22 – Joseph Heller

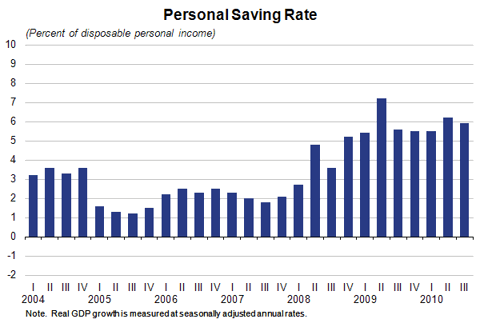

The United States and its leaders are stuck in their own Catch 22. They need the economy to improve in order to generate jobs, but the economy can only improve if people have jobs. They need the economy to recover in order to improve our deficit situation, but if the economy really recovers long term interest rates will increase, further depressing the housing market and increasing the interest expense burden for the US, therefore increasing the deficit. A recovering economy would result in more production and consumption, which would result in more oil consumption driving the price above $100 per barrel, therefore depressing the economy. Americans must save for their retirements as 10,000 Baby Boomers turn 65 every day, but if the savings rate goes back to 10%, the economy will collapse due to lack of consumption. Consumer expenditures account for 71% of GDP and need to revert back to 65% for the US to have a balanced sustainable economy, but a reduction in consumer spending will push the US back into recession, reducing tax revenues and increasing deficits. You can see why Catch 22 is the theme for 2011.

It seems the consensus for 2011 is that the economy will grow 3% to 4%, two million new jobs will be created, corporate profits will rise, and the stock market will rise another 10% to 15%. Sounds pretty good. The problem with this storyline is that it is based on a 2010 that gave the appearance of recovery, but was a hoax propped up by trillions in borrowed funds. On January 1, 2010 the National Debt of the United States rested at $12.3 trillion. On December 31, 2010 the National Debt checked in at $13.9 trillion, an increase of $1.6 trillion.

The Federal Reserve Balance Sheet totaled $2.28 trillion on January 1, 2010. Today, it stands at $2.46 trillion, an increase of $180 billion.

Over this same time frame, the Real GDP of the U.S. has increased approximately $350 billion, and is still below the level reached in the 4th Quarter of 2007. U.S. politicians and Ben Bernanke spent almost $1.8 trillion, or 13% of GDP, in one year to create a miniscule 2.7% increase in GDP. This is reported as a recovery by the mainstream corporate media mouthpieces. On September 18, 2008 the American financial system came within hours of a total meltdown, caused by Wall Street mega-banks and their bought off political cronies in Washington DC. The National Debt on that day stood at $9.7 trillion. The US Government has borrowed $4.2 since that date, a 43% increase in the National Debt in 27 months. The Federal Reserve balance sheet totaled $963 billion in September 2008 and Bernanke has expanded it by $1.5 trillion, a 155% increase in 27 months. Most of the increase was due to the purchase of toxic mortgage backed securities from their Wall Street masters.

Real GDP in the 3rd quarter of 2008 was $13.2 trillion. Real GDP in the 3rd quarter of 2010 was $13.3 trillion.

Think about these facts for one minute. Your leaders have borrowed $5.7 trillion from future unborn generations and have increased GDP by $100 billion. The financial crisis, caused by excessive debt creation by Wall Street and ridiculously low interest rates set by the Federal Reserve, 30 years in the making, erupted in 2008. The response to a crisis caused by too much debt and interest rates manipulated too low was to create an immense amount of additional debt and reduce interest rates to zero. The patient has terminal cancer and the doctors have injected the patient with more cancer cells and a massive dose of morphine. The knowledge about how we achieved the 2010 “recovery” is essential to understanding what could happen in 2011.

Confidence Game

Ben Bernanke, Timothy Geithner, Barack Obama, the Wall Street banks, and the corporate mainstream media are playing a giant confidence game. It is a desperate gamble. The plan has been to convince the population of the US that the economy is in full recovery mode. By convincing the masses that things are recovering, they will begin to spend and buy stocks. If they spend, companies will gain confidence and start hiring workers. More jobs will create increasing confidence, reinforcing the recovery story, and leading to the stock market soaring to new heights. As the market rises, the average Joe will be drawn into the market and it will go higher. Tax revenues will rise as corporate profits, wages and capital gains increase. This will reduce the deficit. This is the plan and it appears to be working so far. But, Catch 22 will kick in during 2011.

Retail sales are up 6.5% over 2009 as consumers have been convinced to whip out one of their 15 credit cards and buy some more iPads, Flat screen TVs, Ugg boots and Tiffany diamond pendants. Consumer non-revolving debt for autos, student loans, boats and mobile homes is at an all-time high as the government run financing arms of GMAC and Sallie Mae have issued loans to anyone that can fog a mirror with their breath. Total consumer credit card debt has been flat for 2010 as banks have written it off as fast as consumers can charge it. The savings rate has begun to fall again as Americans are being convinced to live today and not worry about tomorrow. Of course, the current savings rate of 5.9% would be 2% if the government was not dishing out billions in transfer payments. Wages have declined by $127 billion from the 3rd Quarter of 2008, while government transfer payments for unemployment and other social programs have increased by $441 billion, all borrowed.

Both the government and its citizens are living the old adage:

Everybody wants to get to heaven, but no one wants to practice what is required to get there.

The government politicians and bureaucrats promise to cut unsustainable spending as soon as the economy recovers. The economy has been recovering for the last 6 quarters, according to GDP figures, but there are absolutely no government efforts to cut spending. This is proof that politicians always lie. It will never be the right time to cut spending. Another faux crisis will be used as a reason to continue unfunded spending increases. Having consumer spending account for 70% of GDP is unbalanced and unsustainable. Everyone knows that consumer spending needs to revert back to 65% of GDP and the Savings Rate needs to rise to 8% or higher in order to ensure the long-term fiscal health of the country. Savings and investment are what sustain countries over time. Borrowing and spending is a recipe for failure and bankruptcy. The facts are that consumer expenditures as a percentage of GDP have actually risen since 2007 and Congress and Obama just cut payroll taxes in an effort to encourage Americans to spend even more borrowed money. Catch 22 is alive and well.

The first half of 2011 is guaranteed to give the appearance of recovery. The lame-duck Congress “compromise” will pump hundreds of billions of borrowed dollars into the economy. The continuation of unemployment benefits for 99 weeks (supposedly to help employment) and the 2% payroll tax cut will goose consumer spending. Ben Bernanke and his QE2 stimulus for poor Wall Street bankers is pumping $75 billion per month ($3 to $4 billion per day) directly into the stock market. Since Ben gave Wall Street the all clear signal in late August, the NASDAQ has soared 25%. Despite the fact that there are 362,000 less Americans employed than were employed in August 2010, the mainstream media will continue to tout the jobs recovery. The goal of all these efforts is to boost confidence and spending. Everything being done by those in power has the seeds of its own destruction built in. The Catch 22 will assert itself in the 2nd half of 2011.

Housing Catch 22

Ben Bernanke, an Ivy League PhD who should understand the concept of standard deviation, missed a 3 standard deviation bubble in housing as ironically pointed out by a recent Dallas Federal Reserve report.

Home prices still need to fall 23%, just to revert to its long-term mean. That is a fact that even Bernanke should be able to grasp (maybe not). Anyone who argues that housing has bottomed and will resume growth either has an agenda (NAR) or is a clueless dope (Bernanke). A new perfect storm is brewing for housing in 2011 and will not subside until late 2012. You may have thought those bad mortgages had been all written off. You would be wrong. There will be in excess of $200 billion of adjustable rate mortgages that reset between 2011 and 2012, with in excess of $125 billion being the dreaded Alt-A mortgages. This is a recipe for millions of new foreclosures.

![[SNLCreditSuisse.jpg]](https://3.bp.blogspot.com/_pMscxxELHEg/S41iYJmDurI/AAAAAAAAHpo/DfLns3uE_J8/s1600/SNLCreditSuisse.jpg)

According to the Dallas Fed, in addition to the 3.9 million homes on the market, there is a shadow inventory of 6 million homes that will be coming on the market due to foreclosure. About 3.6 million housing units, representing 2.7% of the total housing stock, are vacant and being held off the market. These are not occasional-use homes visited by people whose usual residence is elsewhere but units that are vacant year-round. Presumably, many are among the 6 million distressed properties that are listed as at least 60 days delinquent, in foreclosure or foreclosed in banks’ inventories.

The coup de grace for the housing market will be Ben Bernake’s ode to Catch 22. In his November 4 OP-ED piece he had this to say about his $600 billion QE2:

“Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance.” – Housing sage Ben Bernanke

On the day Bernanke wrote these immortal words 30 Year Mortgage rates were 4.2%. Today, two months later, they stand at 5.0%. This should be a real boon to refinancing and the avalanche of mortgage resets coming down the pike. It seems that money printing and a debt financed “recovery” leads to higher long-term interest rates. The more convincing the recovery, the higher interest rates will go. The higher interest rates go, the further the housing market will drop. The further housing prices drop, the number of underwater homeowners will grow to 30%. This will lead to more foreclosures. Approximately 50% of all the assets on banks books are backed by real estate. Billions in bank losses are in the pipeline. Do you see the Catch 22 in Bernanke’s master plan? The Dallas Fed sees it:

This unease highlights the housing market’s fragility and suggests there may be no pain-free path to the eventual righting of the market. No perfect solution to the housing crisis exists. The latest price declines will undoubtedly cause more economic dislocation. As the crisis enters its fifth year, uncertainty is as prevalent as ever and continues to hinder a more robust economic recovery. Given that time has not proven beneficial in rendering pricing clarity, allowing the market to clear may be the path of least distress. – Dallas Fed

Quantitative Easing Catch 22

Ben Bernanke’s quantitative easing (dropping dollars from helicopters) is riddled with Catch-22 implications. Bernanke revealed his plan in his 2002 speech about deflation:

“The U.S. government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost.”

The expectations of most when reading Ben’s words were that his helicopters would drop the dollars across America. What he has done is load up his helicopters with trillions of dollars and circled above Wall Street for two years continuously dropping his load. Bernanke’s quantitative easing, which will triple the Fed’s balance sheet by June of 2011, began in earnest in early 2009. The price for a gallon on gasoline was $1.62. Today, it is $3.05, an 88% increase in two years. Gold was $814 an ounce. Today, it is $1,421 an ounce, a 61% increase in two years. In the last year, the prices for copper, silver, cotton, wheat, corn, coffee and other commodities have risen in price by 30% to 90%.

Quantitative easing has been sold to the public as a way to avoid the terrible ravages of deflation. The fact is there are less jobs, lower wages, lower home prices, zero returns on bank deposits, higher fuel costs, higher food costs, higher real estate taxes, higher medical insurance premiums and huge jaw dropping bonuses for the bankers on Wall Street. Somehow the government has spun this toxic mix into a CPI which has resulted in fixed income senior citizens getting no increases in their pitiful Social Security payments for two years. You can judge where Ben’s Helicopters have dropped the $2 trillion. Quantitative easing has benefited only Wall Street bankers and the 1% wealthiest Americans. The $1.4 trillion of toxic mortgage backed securities on The Fed’s balance sheet are worth less than $700 billion. How will they unload this toxic waste? The Treasuries they have bought drop in value as interest rates rise. Quantitative easing’s Catch 22 is that it can never be unwound without destroying the Fed and the US economy.

The USD dollar index was at 89 in early 2009. Today, it stands at 79, an 11% decline, which is phenomenal considering that Europe has imploded over this same time frame. Bernanke’s master plan is for the USD to fall and ease the burden of our $14 trillion in debt. He just wants it to fall slowly. Foreigners know what he is doing and are stealthily getting out of their USD positions. This explains much of the rise in gold, silver and commodities. The rise in oil to $91 a barrel will not be a top. The Catch-22 of a declining dollar is that prices of all imported goods go up. If the dollar falls another 10%, the price of oil will rise above $120 a barrel and push the economy back into recession. Then there is the little issue of at what level of printing and debasing the currency does the rest of the world lose its remaining confidence in Ben and the USD.

A few other “minor” issues for 2011 include:

- The imminent collapse of the European Union as Greece, Ireland, Portugal and Spain are effectively bankrupt. Spain is the size of the other three countries combined and has a 20% unemployment rate. The Germans are losing patience with these spendthrift countries. Debt does matter.

- State and local governments were able to put off hard choices for another year, as Washington DC handed out hundreds of billions in pork. California will have a $19 billion budget deficit; Illinois will have a $17 billion budget deficit; New Jersey will have a $10.5 billion budget deficit; New York will have a $9 billion budget deficit. A US Congress filled with Tea Party newcomers will refuse to bailout these spendthrift states. Substantial government employee layoffs are a lock.

- There is a growing probability that China will experience a hard landing as their own quantitative easing has resulted in inflation surging to a 28 month high of 5.1%, with food inflation skyrocketing to 11.7%. Poor families spend up to half of their income on food. Rapidly rising prices severely burden poor people and can spark civil unrest if too many of them can’t afford food.

- The Tea Party members of Congress are likely to cause as much trouble for Republicans as Democrats. If they decide to make a stand on raising the debt ceiling early in 2011, all hell could break loose in the debt and stock markets.

The government’s confidence game is destined to fail due to Catch-22. Will the consensus forecast of a growing economy, rising corporate profits, 10% to 15% stock market gains, 2 million new jobs, and a housing recovery come true in 2011? No it will not. By mid-year confidence in Ben’s master plan will wane. He is trapped in the paradox of Catch-22. When you start hearing about QE3 you’ll know that the gig is up. If Bernanke is foolish enough to propose QE3 you can expect gold, silver and oil to go parabolic. Enjoy 2011. I don’t think Ben Bernanke will.

“That’s some catch, that Catch-22.” -Yossarian

Good article. This one will generate a ton of traffic on many blogs.

Smokey

I felt like Kramer. I’ve been battling you with one hand for two days while writing this article with the other hand. It is more fun trading insults.

I thought you may be working on a feature article. Especially after you didn’t take the bait today.

~~ The Federal Reserve Balance Sheet totaled $2.28 trillion on January 1, 2010. Today, it stands at $2.46 trillion, an increase of $180 billion. ~~

Absolootleh Mahvahlos! I am in debt to a bankrupt organization. I’ll never have to pay!

Ah! Jeez, Jim. I think I will run down to the liquor store tomorrow and buy 50 cases of good booze (including a case or four of Bailey’s Irish Cream when I need to mellow out!) to allow me to pickle every available organ this year.

What’s a rational person to do when every fact you state is backed by data, true and points only to higher and deeper as far as shit is concerned?

I quit working for a salary in the Fall of 1996 and since I figured out what was going on back in 1973/4 (working overseas at the time) and have managed to shield savings from what has happened since, I am now working really hard to educate children and grandchildren. A tough sell for a boomer and and an Xer. The X’ers are going to catch it in the rear but I may have time to salvage a couple of boomer children as they already smell something sour in the air.

Thanks again for a fine feature article. I need to stop commenting on threads and write more articles. But it’s so much more fun to read Stuck, SSS and llpoh’s posts (Smokey is getting boring and needs to work harder at being relevant – I mean shit only goes so far) than it is to settle down, outline and write a piece that hasn’t been covered ten times on other web sites.

Happy New Year (in spite of the article), Jim, and I sincerely hope that 2011 is much more happier and less stressful year for you, Avalon and the kids than 2010 turned out to be.

I get this creepy feeling when Smokey talks about ‘bait’ that he is talking about his favorite and deeply calloused organ.

Another “Wow” moment from Jim Quinn.

To argue with him, it should be a sin.

Soon another 12 thousand will visit and holler.

Each of them should pay one measly dollar.

==========================================

Nothing to argue with in that post. Nothing. All I can do is add my own two cents.

2011 will see an increase in riots and wars across the globe.

Look at all the turmoil in the streets of Europe and all over the globe. Lebanon is hardly in the news, but is ready to explode. Then there is Somalia, Iraq, Nigeria, Korea,, and many others.

It will spread here, I believe. Mabe soon, mabe a bit longer. But it’s coming.

The song below is from Bright Eyes. An amateur I believe. Haunting. Beautiful. Scary. Stucky really really believes all of you will love it. The video is incredible. Please check it out. You will really like it, I promise.

.

–

death may come invisible, or in the holy wall of fire.

in the breath between the markers, on some black I-80 mile.

from the madness of the government, to the vengeance of the sea.

well everything is eclipsed by the shape of destiny.

so love me now, hell is coming.

you kiss my mouth, hell is here.

little soldier, little insect, you know war it has no heart,

it will kill ye in the sunshine, or happily in the the dark.

where kindness is a card game, or a bent up cigarette.

in the trenches, in the hard rain, with a bullet and a bet.

he says help me out, hell is coming.

but could you do it now? hell is here.

see the sterile soil, poisoned sky, yellow water,

the final scraps of light bringing new tears.

well wake, baby, wake.

but leave that blanket around you, there’s nowhere else safe.

i’m leaving this place, but there’s nothing i’m planning to take;

just you, just you, just you, just you-

Its become a self defeating economy. People cant afford to consume due to stagnant wages and cant compete with people make 5 bucks a day in foreign lands. We dont even create enough jobs for those coming of age, or graduating, and entering the work force.

A great post. Highly informative. Much better than reading fucking witch stories.

Muck

It almost blew my mind when I was crunching the numbers and saw that we had gone $5.7 trillion further into debt and generated a $100 billion increase in GDP. It is mind numbing how badly we are fucked.

The general thesis of this article is that no matter what is done, we are screwed.

With that in mind, does it really matter if Helicopter Ben keeps the Printing Press running 24/7? As soon as he shuts it off, we get fucked all the same just in a different position.

The most annoying aspect nowadays is waiting for the Sword of Damocles to fall. You kno its coming down eventually, its constantly hanging over your head and hanging by a thread, but with one bit of trickery after another, the Sword just keeps hanging there. Very annoying.

RE

Muck About says——–” (Smokey is getting boring and needs to work harder at being relevant—-I mean shit only goes so far. ) “——-Let’s see. Yesterday Smokey said Kill Bill was desperately trying for relevance, so I’ll plagiarize that thought and put Smokey in his place today. And I’ll suck up to SSS, Stuck, and llpoh since none of them have packed my shit on this blog.

Anybody check out how this thread has morphed over on Zero Hedge? It’s turned into a debate on whether the FSofA Military will fire on its own citizens, and whether J6P will take down the FSofA Goobermint with his Smith & Wesson .45 and Shotgun.

Gotta love the internet.

RE

RE

The comments on ZH always go off into tangents far removed from the article. I think there were 2 out of 100 comments related to the article.

you guys sound just like the suckers from the late 70’s and early 90’s,

don’t pull out too soon you’ll miss out on all the pleasure…

Let’s see. Yesterday Smokey said Kill Bill was desperately trying for relevance -Smokey

More delusional diarrhea. I could care less about being relevant. If I did I would write some intellectual sounding bovine plop to impress the pink globs residing in your soft skulls. I like Jims site for what he writes not about what you think is relevant to anything. Your like this moth traveling around a yellow porch light wanting to be noticed by those that find your existence moot.

Just wanted to say thanks.

Great concise article.

Damn. Another doom and gloom feature article with which I completely agree. Just the thing to ruin the New Year.

Give me something to think about to write an article to help the country, Admin. Energy? Immigration? Government spending ? Name it, I’ll think about it and do my best to write something, if possible, to provide a solution. Hint: Blowing up Goldman Sucks is not a solution, although that may not be a bad idea.

We know the problems. Let’s discuss some solutions. I’m in. Anyone else?

SSS

Your passion is nuclear energy. I’d love an article on the benefits of nuclear energy.

The population in the developed world are suffering due to the hangover from excessive borrowings from lenders who lent to anyone on the street to maximise their own bonuses.

The problems have been compounded by Outsourcing and Rampant Speculation allowed in all the exchanges. The problems are hereto stay as till date no one in the political arena has even acknowledged the problems let alone find solution to them.

The too big to fail bunch of banksters have a lot of influence on the political class, the rule makers and the rule enforcers due to their enormous purchasing power. So irrespective of the position in the government, everyone works for the benefit of the banksters.

The rest of the population have to be dumped with lots of problems like unemployment, high cost of living (thanks to speculation in commodity exchanges), foreclosures, etc. so that they don’t devote their thoughts to the root of all problems and revolt against the comfortable arrangement between the banksters, central bankers and the governments.

This too big to fail group has grown more powerful in size and influence in the last two years and is likely to end up being too big to bail bringing down complete economies of countries with them

http://www.marketoracle.co.uk/Article24581.html

Admin, thanks for an updated reality check. Keep it up.

Admin: Man, there a lot of people sucking this article up. You might be famous somewhere outside your basement one of these days!

Muck

The left wing blog Daily Kos refers to me as a winger, whatever the fuck that means.

http://www.dailykos.com/story/2011/1/3/933083/-Stiglitz,-Krugman:-The-Catch-22-of-Deep-Hole-Economics

The graph dipicting the “National Debt from 1940 to to Present” is showing this debt now rising at an exponential rate, yet I do not see the effect of this debt passing through the economy in the form of hyperinflation of the money or even the velocity of the currency increasing. What am I missing here? How come all this expendature of funds are not rolling through the economy and really heating things up?

No organization can spend money they don’t have exponentially and not cause their own demise. This also shows me that our government is not capable of stimulating the economy with their spending, but are quite capable of stagnating and destroying it with oversight, excessive regulation, and taxation; which is exactly what is going on.

Not a good picture of the future.

When you say “The United States and its leaders are stuck in their own Catch 22. They need the economy to improve in order to generate jobs, but the economy can only improve if people have jobs,” you have just much made the case for Keynesian stimulus – and if things are bad enough, the case also for a WPA/CCC government jobs program…. break the hiring and spending logjams with a stick of fiscal deficit dynamite.

It could be paid for with a financial transaction tax….

Daily Koz is crap. If they don’t like you, that’s gold.

Excellent article. Brilliant depiction of the precept that no matter what we do, we’re screwed. It’s just a matter of the timing. That’s what the idiots at The daily Koz don’t get. They’re still waiting for Oblahma to pull off his miracles and give them their hope and change. Oblahma and their Nobel prize winning dickweed economist Krugman…Jeez

BTW…Happy New Year everyone. We are living in interesting times.

Admin: You’re right, I have no idea what a “winger” is unless it Kos’ shorthand for “right winger”

I don’t think anyone on this board qualifies as “the raging, status-quo-supporting fools on the rightwing”. He must be talking about the currently clueless Republicans now in charge of screwing things up (that’s both good and bad).

@McMike: Don’t give the bastards any more money from any source. They’ll just spend it rather than debt reduction and lowering interest thereon or doing anything else that has to be done to fill up the hole in which we stand (slowly enough so we can climb out).

@Akhil Khanna: Right on. Too bad the insight you provide leads straight to hell..

@Muckabout. I am not necessarily endorsing Keynes per se. I was merely stating that the Catch 22 argument is a Keynes argument. \

However, if I had to chose between directing $14 trillion in value towards bankers to trickle down, or $14 trillion to citizens to spend on whatever they want, I’m with Keynes. Trickle down has been tried. Low taxes and deregulation (despite protestations above) have been tried, and failed. For whatever its worth, the last time massive full stimulus was tried; it worked. If we must put the defibrillator paddles on something, put them on the middle class directly.

The “third way” is to stimulate nothing: bankers, middle class, farmers, jobs exporters, stuff importers, oil drillers, or “defense”. That has its appeal. (As long as we survive the transition without mass starvation, civil disorder, or a screeching slide into retributive fascism.)

McMike

Deregulation? Do you mean the 58,000 page IRS rules, the millions of rules and regulations that small businesses must comply with, the 14,000 forms you must file with 15 agencies to get anything done in this country? That deregulation? Or is it the 3,000 page financial reform bill or the 2,500 page Obamacare bill?

You are actually contending that the Keynes stimulus in the 1930’s worked? You are either a fool or a tool. The unemployment rate was still 18% in 1939 after six years of government stimulus you nitwit.

Keynesianism is a crock of shit. It has never worked and never will work.

@McMike: Sorry, too late.

As a nation, we cannot “stimulate” squat with borrowed money. You cannot spend yourself out of an inflationary depression (into which we are sliding) using money that is printed by the Federal Reserve to buy (legally) Treasury debt and (illegally) MBSes, CDOs and various pieces of worthless trash that’s “marked to miracle”.

The $14 trillion you speak of will either be printed (figure of speech but you know what I mean) into excess bank reserves where they will (as they are now) being recycled into the Fed which pays those same banks interest on deposited excess reserves.

As Richard Russell said (over and over), “The choice is to print or die.” Then you get print and die sooner than later.

Raisning the national income and reduce spending is a must and need to start now.

Install a federal sales tax of 10% to European level, and the debth will be halfed in 5 years, (pehaps this is my “winged” estimate), maybe someone of the readers can calculate this?

@admin. I am not the only fool/tool around. Citing lengths of congressional bills and exaggerating the amount of supposedly draconian regulations (‘millions”) that mythical small businesses must contend with is merely hyperbole. Compliance requirements are a real issue, but hardly the show stopper that some ideologues tend to hyperventilate about.

Perhaps you should complain also about taxes – don’t let the fact that we are in the lowest tax rate paradigm in decades get in the way of a good rant.

McMike

Enlighten us with the success of Keynesianism in the 1930s. We are breathlessly awaiting your wisdom on the subject. Facts please.

@Muckabout. Actually you can stimulate your way into all sorts of things. That is how most business start and grow: they borrow to finance it. The key question is now how big is the debt, it is can you service the debt in the future or not; which is dependent only on the future outcome of the invested proceeds.

The current “supply side” scam going on between banks & treasury has nothing to do with anything except piracy dressed up as monetary policy. The taxpayers are merely financing the recapitalization and bonuses of Wall Street “banks.” No one involved in the scam believes anything about it except for its effectiveness at enriching themselves.

Like I said before, if we are going to give trillions of deficit dollars to anyone, I would prefer it be to the middle class.

As for @Admin’s claim about unemployment levels, I would say that driving unemployment down from the 25%+ down to 18% is not bad at all.

I’m getting real tired of all these great articles about how bad it’s going to get. C’mon already! Let’s have a real collapse and start hanging rich people from the lamppost! Oh, wait a moment, I want to be a rich man. I’ll get back to you when I get rid of that foolish idea.

@Admin. Let’s not and say we did.

Your idea of “facts” is a rigged game. Lay out a bunch of statistics and then pin them all on the tail of a preconceived one-size-fits-all donkey. No thanks, I’d rather argue whether fossils prove the validity of creationism.

My new year’s resolution is to no longer engage in pointless tiresome “debates” with entrenched ideologues, closed minds, and above all, sarcastic dogmatists. Hyperbole and cant are so 2010. (And free market fundamentalism is so 2007).

Happy new year. May you get your wish – and we experience complete systemic collapse – at which point the ghost of Ayn Rand will surely rise up and save us all.

McMike

You are the typical liberal Krugman dicksucker. You have no facts. Liberal hate spewing douchebags never do. Go fuck yourself and crawl back to your friends at Huffington Post and the Daily Kos.

Unemployment was less than 5% in 1929 and a Keynesian shouts from the mountaintops that 18% unemployment after 6 years of massive stimulus is a success.

The GDP of the US was $91 billion in 1930 and $92 billion in 1939. You spend billions on make work bullshit projects and you raise GDp by $1 billion in 9 years.

Only numbskulls, nitwits, Krugmans, and McMikes could possibly believe that Keynesianism works.

I love Krugman!! YOU could learn from him. And yes, I did suck his dick. He also sucked mine. It’s the first time I found favor with the trickle down theory as his 64 ounces of cum oozed out of my mounth down to my toes.

The folks at Daily Kos prefer ass fucking as opposed to blow jobs. My ass is very tight so I had to refuse.

Since you refuse to truly answer my astute economic questions I will ask you something easier. When can I blow you? I want to take you in, all of you. I know we can be friends that way. This is not a joke post. When can I suck you off??

Stuck, your a pip.

@Admin. Apparently your comment tool allows multiple people to use the same nic. The latest post (1:00 pm) was not me. I have no intent to continue this waste of everyone’s breath.

McMike

You have no intent to continue this waste of your breath because you have no facts to back up your ideology. Liberal Krugman worshippers never do. They just get pissed off when they are called on it. Then they storm away in a huff. Don’t let the door hit you in your fat ass on the way out.

McMike is a classic example of my fascination with this blog. There are some smart people here, which is fine. But the real appeal is a never ending supply of mongoloids utterly convinced that they have the solutions to fix everything. Liberal douchebags who have been spouting rancid shit that Mommy and Daddy taught them long ago. They throw up on this site with their academia fantasy land delusions and expect to be taken seriously as they speak with strong conviction. Then they get all pissed off when people on the blog don’t buy their shit. They might as well be selling pixie dust. None of that shit flies here, except with a couple of douchebags who are beyond fixing.

That fake McMike was not me either.

Keep wanking fellas, the caricatures of your oponents are as real as the centerfolds of your fantasies.

McMike

You keep promising to leave, but you keep coming back. Any facts yet? Put a call into the Krugmanator.

2011 will be exactly the same as 2010, only worse.

.

.

It’s the most wonderful time of the year.

With the Feds printing money,

And Big Ben bull-shitting you,

“Be of good cheer,”

It’s the most wonderful time of the year.

Our currency is toasting,

While the banks are a roasting and

Geitner sniffs up more Blow.

There’ll be scary Foreclosures and

Tales of a glorious America

Long, long ago.

It’s the most wonderful time of the year.

There’ll be much more to suffer

Your life will be rougher,

When Congress comes near.

It’s the most wonderful time of the year.

Jim, I think you left out one thing in your analysis.That is the destructive nature of the Federal Reserve and their ability to de-value our currency over the last 98 years by 95%.

Roughly 1.53 million consumer bankruptcy petitions were filed in 2010, up 9 percent from 1.41 million in 2009, according to the American Bankruptcy Institute, citing data from the National Bankruptcy Research Center.

Filings in December totaled 118,146, up 4 percent from a year earlier and 3 percent from November’s total.

The full-year total is the highest since the 2.04 million recorded in 2005, when there was a rush to seek bankruptcy protection ahead of a stricter federal law taking effect in October of that year.

See, we are in a recovery!!

This should be required reading for every American and illegal immigrant currently “frequenting” the Land of LIberty! Great stuff!

“The United States and its leaders are stuck in their own Catch 22. They need the economy to improve in order to generate jobs, but the economy can only improve if people have jobs. They need the economy to recover in order to improve our deficit situation, but if the economy really recovers long term interest rates will increase, further depressing the housing market and increasing the interest expense burden for the US, therefore increasing the deficit. A recovering economy would result in more production and consumption, which would result in more oil consumption driving the price above $100 per barrel, therefore depressing the economy. Americans must save for their retirements as 10,000 Baby Boomers turn 65 every day, but if the savings rate goes back to 10%, the economy will collapse due to lack of consumption. Consumer expenditures account for 71% of GDP and need to revert back to 65% for the US to have a balanced sustainable economy, but a reduction in consumer spending will push the US back into recession, reducing tax revenues and increasing deficits. You can see why Catch 22 is the theme for 2011.”

A rock and a hard place for sure!

[img &imgrefurl=http://www.123rf.com/photo_3634764_stuck-between-a-rock-and-a-hard-place.html&usg=__YuxQ-O91T-mWSkBoKjDR3RMnuVI=&h=400&w=267&sz=17&hl=en&start=39&zoom=1&tbnid=JwvkRyP0dGmV0M:&tbnh=150&tbnw=124&prev=/images%3Fq%3Drock%2Band%2Ba%2Bhard%2Bplace%2Bpicture%26um%3D1%26hl%3Den%26sa%3DX%26rlz%3D1T4GWYE_enUS264US264%26biw%3D1259%26bih%3D597%26tbs%3Disch:10%2C811&um=1&itbs=1&iact=hc&vpx=631&vpy=224&dur=358&hovh=275&hovw=183&tx=91&ty=142&ei=UsYiTYOWD4n0swOqhYTICg&oei=XsUiTd_gCIq8sAOYlPWaCg&esq=6&page=3&ndsp=21&ved=1t:429,r:3,s:39&biw=1259&bih=597[/img]

&imgrefurl=http://www.123rf.com/photo_3634764_stuck-between-a-rock-and-a-hard-place.html&usg=__YuxQ-O91T-mWSkBoKjDR3RMnuVI=&h=400&w=267&sz=17&hl=en&start=39&zoom=1&tbnid=JwvkRyP0dGmV0M:&tbnh=150&tbnw=124&prev=/images%3Fq%3Drock%2Band%2Ba%2Bhard%2Bplace%2Bpicture%26um%3D1%26hl%3Den%26sa%3DX%26rlz%3D1T4GWYE_enUS264US264%26biw%3D1259%26bih%3D597%26tbs%3Disch:10%2C811&um=1&itbs=1&iact=hc&vpx=631&vpy=224&dur=358&hovh=275&hovw=183&tx=91&ty=142&ei=UsYiTYOWD4n0swOqhYTICg&oei=XsUiTd_gCIq8sAOYlPWaCg&esq=6&page=3&ndsp=21&ved=1t:429,r:3,s:39&biw=1259&bih=597[/img]

headed straight to

2011 will bring public worker strikes just like you’ve seen in Greece, Italy, etc.

=============================================================

A prominent Republican consultant, former White House aide Ed Rogers, wrote in the Washington Post Sunday that the biggest political shock of 2011 was likely to be “public-sector labor strikes and demonstrations that could stray into civil disorder as state and local governments cut budgets… The same kind of protests that have rocked Paris, London and Rome could erupt in California, New York and Illinois.”

Stuck

Don’t worry. Union workers are too lazy to riot.

Admin: WTF! Did your thumb machine croak at triple digits? I didn’t know you edited comments right off the board! Come to think of it, being as you are “The Admin” you can damn well do whatever you want. Just as well… Stuck was getting too big a head over all those digits anyhow.

I read all the real news i can find.This is a good article.I think people are to afraid to riot…execept the sleeping masses.They will probably riot and get thier name on a terrorist list somewhere and mysteriously end up dead.The bottom line is ‘they’ are going to control the people thru healthcare,food stamps,economy,TSA, whatever it takes to bring the country down so ‘they’ can have thier new world order. Its already been established that the people in charge have an agenda,and that is to set the antichrist at the top of the heap.Then they wont even have to ask to rob cheat and steal. Hey wait ..they apparently dont have to ask now.

Good article… I only have issue with one point (and I may be wrong)….I believe that the states will be bailed out….only after agreeing to give more power to the federal govt.

I think Bernanke will do it through purchases of state and possibly muni debt….especially for Chicago/new York …etc

Otherwise, this is the best you’ve done IMO

“As I began to think about what might happen in 2011, …”

Dear Jim, let me tell you what IS GOING to happen in 2011.

The federal government will hit the national debt ceiling in March warned our wonderful Treasury sec. today. What’s going to happen is Congress will extend the debt ceiling by another trillion dollar.

Problem solved, just like converting water to wine by some prophet of celestial power.

One trillion dollar is about 80% the GDP of Canada. By a flick of magic, Congress will simply borrow the equivalent of this amount of output by a debt to future generation. Congress has already borrowed the equivalent of more than 10 Canada’s to be repaid by this and future generations labor.

USA will be noted by historians as the only country in the history of the world deliberately commit suicide.

there will be ashes…..

prepare yourself, we will rise

we have two oceans, we’re a real bitch to take over

wait until china starts offering us welfare….and we take it

No one knows the end game

bottom line, you can’t consume more than you produce forever………….good luck to us

buy guns, gold, silver, and freeze dried food

Goldman Sachs says the market is going up in 2011. We better listen, huh? The stock market and all the governments facts and figures are no longer to be believed. Bernanke and Co has so messed things up that there is no going back and Paul Volker wants no part of it with his recent resignation. Good thing for us that the gold and silver dollar values are going up.

@Apollo

“The federal government will hit the national debt ceiling in March warned our wonderful Treasury sec. today. What’s going to happen is Congress will extend the debt ceiling by another trillion dollar. ”

Not before the Republicans insist that cuts to Social Security benefits are made! According to Republican Senator Lindsey Graham’s recent statements, the only way the so called fiscally conservative Republicans will sign off on raising the debt ceiling, the Dems and Osama, I mean Obama, will have to make the concession of cutting spending to Social Security and Medicare!

Here is a link to a video (since I am having difficulties figuring out how to actually post vids and pics on here) with an interview of Graham:

http://videocafe.crooksandliars.com/heather/lindsey-graham-dont-allow-debt-ceiling-be-ra

Don’t believe a word out of Lindsey Graham’s mouth. He is a low-life weasel.

I don’t disagree with you there Admin; however, this seems to fit into the “austerity” agenda that the IMF has “suggested” for the U.S.