“Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling.” – Ben Bernanke

“The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.” – Alan Greenspan

There you have it – the wisdom of two Ivy League educated economists who are primarily liable for the death of the American middle class. They now receive $250,000 per speaking engagement from the crooked financial parties their monetary policies benefited; write books to try and whitewash their legacies of failure, fraud, and hubris; and bask in the glow of the corporate mainstream media propaganda storyline of them saving the world from financial Armageddon. Never have two men done so much damage to so many people, so quickly, and are not in a prison cell or swinging from a lamppost. Their crimes make Madoff look like a two bit marijuana dealer.

The self-proclaimed Great Depression “expert” Ben Bernanke peddles pabulum about inflation being too low and posing dire risk to the economy, but is blasé that swelling the Federal Reserve balance sheet debt from $900 billion in 2008 to $4.4 trillion today with his digital printing press poses any systematic risk to the country and its citizens. Either his years in academia have blinded him to the reality of his actions upon the lives of real people living in the real world, or his real constituents have not been the American people, but the Wall Street bankers that pulled his puppet strings over the last eight years.

Now that he has passed the Control-P button to Yellen, he is reaping the rewards of bailing out Wall Street and further enriching them with QEfinity. Ben earned a whopping $200,000 per year as Federal Reserve chairman. He now rakes in $250,000 per speech from the very financial interests who benefited from his traitorous monetary machinations. I don’t think he will be invited to speak at any little league banquets by formerly middle class parents whose standard of living has been declining since the 1980s. Is it a requirement that every Federal Reserve chairperson lie, obfuscate, misinform, hide the truth, and do the exact opposite of what they say they will do?

“It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions.” – Ben Bernanke – October 2007

Greenspan, Bernanke and Yellen have always been worried about deflation, while even the government suppressed CPI calculation reveals that inflation has risen by 108% since the day Greenspan assumed office in August 1987. The dollar has lost 52% of its purchasing power in the last 27 years of Fed induced bubbles and busts. And these scholarly academic bozos have been worried about deflation the entire time. Since Nixon closed the gold window in 1971 and unleashed the two headed inflation loving gargoyle of debt issuing bankers and feckless self-serving politicians upon the American people, the dollar has lost 83% of its purchasing power (even using the bastardized BLS figures).

Any critical thinking person with their eyes open knows the official inflation figures have been systematically understated since the 1980’s by at least 3% per year. Should the average American be more worried about deflation or inflation, based upon what has occurred during the 100 years of the Federal Reserve controlling our currency?

I’m sure Greenspan is content and proud, as he succeeded through his own endeavors in rewarding, encouraging and propagating excessive risk taking by the Wall Street cabal during his 19 year reign of error. He exited stage left as the biggest bubble in history, created by his excessively low interest rate policy, blew up and destroyed the 401ks and home values of the middle class. This was the second bubble under his monetary guidance to burst. The third bubble created by these Keynesian acolytes of easy money will burst in the near future, further impoverishing what remains of the middle class and hopefully igniting a long overdue revolution.

Greenspan’s pathetic excuse for a career has benefitted those who owned him, while leaving a trail of casualties that circles the globe. His inflationary dogma, Wall Street enriching doctrine and Keynesian motivated schemes have drained the savings and confiscated the wealth of the middle class through persistent and devastating inflation. And it was done by a man who knew exactly what he was doing.

“Under the gold standard, a free banking system stands as the protector of an economy’s stability and balanced growth… The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit… In the absence of the gold standard, there is no way to protect savings from confiscation through inflation” – Alan Greenspan – 1966

The abandonment of the gold standard in 1971 set in motion four decades of consumer debt accumulation on an epic scale, currency debauchment, and real wage stagnation. The consumer debt accumulation was a consequence of the American middle class being lured into debt by the Too Big To Trust Wall Street banks and their corporate media propaganda machine, as a fallacious response to stagnating real wages when their jobs were shipped to China by mega-corporations using wage arbitrage to boost quarterly profits, their stock prices, and executive bonuses.

The bottom four quintiles have made no progress over the last four decades on an inflation adjusted basis. The middle quintile, representing the middle class, has seen their real household income grow by less than 20% over the last 43 years. And this is using the understated CPI. In reality, even with two spouses working today versus one in 1971, real household income is lower today than it was in 1971.

The more recent data, during the Greenspan/Bernanke inflationary era, is even more disconcerting and destructive. Real median household income has grown at an annualized rate of less than 0.5% over the last thirty years. During the bubblicious years from 2000 through 2014, while Wall Street used control fraud and virtually free money provided by the Fed to siphon off hundreds of billions of ill-gotten profits from the economy, the average middle class family saw their income drop and their debt load soar. This is crony capitalism success at its finest.

The oligarchs count on the fact math challenged, iGadget distracted, Facebook focused, public school educated morons will never understand the impact of inflation on their daily lives. The pliant co-conspirators in the dying legacy media regurgitate nominal government reported income figures which show median household income growing by 30% over the last fourteen years. In reality, the real median household income has FALLEN by 7% since 2000 and 7.5% since its 2008 peak. Again, using a true inflation figure would yield declines exceeding 15%.

Greenspan and Bernanke’s monetary policies loaded the gun; Wall Street bankers cocked the trigger with their no doc negative amortization mortgages, $0 down – 0% interest – 7 year subprime auto loans, introducing the home equity line ATM, and $20,000 lines on dozens of credit cards; the media mouthpieces parroted the stocks for the long run and home prices never fall bullshit storyline, encouraging Americans to pull the trigger; government apparatchiks and bought off politicians and their deficit expanding fiscal policies, pointed the gun; and the American people pulled the trigger by believing this nonsense, blowing their brains all over the fine Corinthian leather interior of their leased BMWs sitting in the driveway in front of their underwater McMansions.

Median household income in the United States peaked in 1999. The internet boom, housing boom and now QE boom have done nothing beneficial for middle class Americans. They have been left with lower real income, less home equity, no savings, and no hope for a better tomorrow. Most states saw their median household income peak over a decade ago, with more than half the states experiencing double digit declines and ten states experiencing declines of 19% or higher. It’s clear who has benefitted from the fiscal policies of spendthrift politicians and the spineless inhabitants of the Mariner Eccles Building in the squalid swamplands of Washington D.C. – the pond scum inhabiting that town. The median household income in D.C. stands at an all-time high. Winning!!!!

A former inhabitant of Washington D.C. spoke the truth about inflation and the men who benefit from it in the 1870’s. He was later assassinated.

“Who so ever controls the volume of money in any country is absolute master of all industry and commerce and when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.” – James Garfield

The Federal Reserve, a private bank representing the interests of its Wall Street owners, has been in existence for 100 years. It has managed to diminish the purchasing power of the dollar by 95%, while causing depressions, enabling never ending warfare, allowing politicians to expand the welfare state to immense unsustainable proportions, and enriched its true constituents on Wall Street beyond the comprehension of average Americans. In 2002 Ben Bernanke made his famous helicopter speech where he promised to drop dollars from helicopters to fight off the ever dangerous deflation. After the Fed created 2008 worldwide financial collapse he fired up his helicopters, but dropped trillions of dollars on only one street in America – Wall Street. He dropped turkeys on Main Street, and we all know from Les Nesman what happens when you drop turkeys from helicopters.

Les Nesman: Oh, they’re crashing to the earth right in front of our eyes! One just went through the windshield of a parked car! This is terrible! Everyone’s running around pushing each other. Oh my goodness! Oh, the humanity! People are running about. The turkeys are hitting the ground like sacks of wet cement! Folks, I don’t know how much longer… The crowd is running for their lives.

Arthur Carlson: As God is my witness, I thought turkeys could fly.

The intellectual turkeys running this treacherous institution create a new and larger crisis with each successively desperate gambit to keep their Ponzi scheme alive. Even though Greenspan, Bernanke and Yellen are highly educated, they are incapable or unwilling to focus on the practical long-term implications of their short-term measures to keep this perverted financial scheme from imploding. Denigrating savings and capital investment, while urging debt financed spending on foreign produced trinkets and gadgets passes for economic wisdom in the waning days of our empire. Courageous and truthful leaders are nowhere to be found as the country circles the drain. Farewell middle class. It was nice knowing you.

“There are men regarded today as brilliant economists, who deprecate saving and recommend squandering on a national scale as the way of economic salvation; and when anyone points to what the consequences of these policies will be in the long run, they reply flippantly, as might the prodigal son of a warning father: “In the long run we are all dead.” And such shallow wisecracks pass as devastating epigrams and the ripest wisdom.” – Henry Hazlitt – Economics in One Lesson

“For instance, SAT scores roughly translate to IQ scores”..

Bwahaha!!.. You mean, an aptitude test created and administered by statists in order to evaluate the level of education one has recieved from the highly venerated (sarcasm) American public school system? Are you fucking high?

I hate to boomerang your ridicule back atcha, but if the SAT is the litmus test for intellectual prowess, we are a nation of very, very stupid fucking people. You need to reexamine your stance. Truthfully, I guess I got your goat but Im really not trying to piss you off. In principle, I do get that above average intelligence gives one a tactical advantage in the job market. And if that was the meat of your argument I wouldn’t take issue with it. But youre trying to equate intelligence quotient with income inequality, and there is NO EMPIRICAL DATA to back it up. None. Zip. Zilch. However, theres plenty of evidence to support a host of socioeconomic factors which have nothing to do with test scores. Again, I dont dispute the predilection some people have with intellectual laziness. Hell, even John Wayne said, “lifes tough, but its a lot tougher if youre dumb”, or something along those lines, lol.

Admin – some of what you say is true re manufacturing. But not quite. Remember what I said re the ever progressing 2.5 percent yearly improvement in manufacturing productivity? Here is a chart showing mfg as a percent of total labor force. Please feel free to point out the year or period when globalization inflected the line downward. Here is a hint – it didn’t.

[img &imgrefurl=http://pmpaspeakingofprecision.com/2010/08/31/us-manufacturing-employment-as-a-percentage-of-total-employment/&h=378&w=630&tbnid=__mK_V5s9AveYM:&zoom=1&docid=B5T_Q1RxGey0SM&ei=UeR5U4yMIs7pkgW-woD4Ag&tbm=isch&ved=0CDcQMygAMAA[/img]

&imgrefurl=http://pmpaspeakingofprecision.com/2010/08/31/us-manufacturing-employment-as-a-percentage-of-total-employment/&h=378&w=630&tbnid=__mK_V5s9AveYM:&zoom=1&docid=B5T_Q1RxGey0SM&ei=UeR5U4yMIs7pkgW-woD4Ag&tbm=isch&ved=0CDcQMygAMAA[/img]

Also, you are incorrect re Germany. Their line tracked exactly with the line in this chart, until…. The fall of the USSR. Germany began to loan money to the Eastern European bloc, in exchange for them buying German manufactured goods. Sweet! That, combined with Chinese thirst for luxury goods, etc, stopped the down trend. But German banks are leveraged to the hilt and are hugely insolvent. German wages are low, and German participation rates are even lower than US rates.

Germany is not the shining example you propose.

The fact is, the lower classes will stagnate and fall, while the upper class will continue to thrive, for a time anyway. Low skill high paying jobs are gone.

This shit is my sweet spot. You are far ahead of me re financial stuff, but one thing I understand is manufacturing. Manufacturing jobs are disappearing because manufacturers are so damn efficient. Other reasons too, but you simply cannot outrun that 2.5% efficiency gain each year.

Llpoh

You pick and choose what you respond to. Haven’t IQs always been broken into quintiles? Did IQs as a whole decline from the 1950’s through to today?

If IQ has always determined household income levels than your argument for the top quintile rising at a greater rate over the last 40 years is complete and utter bullshit.

Please enlighten us with your analysis. It is your sweet spot.

Sorry of the graph doesn’t show up. It is a straight declining line, dropping around 2.5 percent a year since around 1950.

I sometimes wonder if, when we look back on this particular time in history, we will realize the sacrifices made in the name of wealth.

My own father is one of the most brilliant men that I know. He was one of the developers of a pivotal computer language in the early 1960’s. He had no degree, simply a desire to provide for his family and a mind that was made for solving problems. His love of music, literature, art and nature provided me with the kind of childhood that most people could only dream of and though he did well financially, we lived simply. About ten years into his career he discovered that the higher he climbed in the corporate world, the more profoundly dissatisfied he became with his life and one day out of the blue he decided to chuck it all and open a small shop in the University town where we lived that sold high quality, locally produced food. Mind you this was in the 1970’s, way before anyone used the term organic. He was known locally as the health food nut.

As I grew up I noticed that the fathers of my friends were all wealthy, owned big homes with tennis courts and indoor pools, travelled the world on holidays and sent their children to the finest schools, but none of them appeared to be happy. They were grumpy, distracted, miserable pricks whose sons hated them, whose wives cheated on them and whose lives were built on their acquisitions. My father, on the other hand was well respected by a huge number of people who loved to engage him in discussions on virtually any topic- professors, politicians, economists, pot growers, cops, headmasters, pyrotechnic experts, farmers and bankers. If you expressed an interest in any topic and shared it with him in casual conversation, you could count on the fact that at your next encounter my father would dig into his worn out book bag and bring out carefully clipped articles on whatever it was that had been discussed previously and almost without exception the recipient would stand there in awe of the newly discovered tidbit. It was not unusual for me to find guys like Ralph Nader drinking wine out of a juice glass in our study with my father, or to see him laughing it up with John Nash in the storeroom of his shop. He used to trade fruit smoothies to Stanley Jordan in exchange for having him hookup his pig nose amp in the store and play his unique finger tapping guitar licks for the customers long before there was a recording contract. In short, he chose to put all of his energies into living his life rather than to amassing financial instruments.

My father had the kind of intelligence you would expect from someone in the one percent, but the kind of values rarely seen outside of church yard. While other people added to their stock portfolio, he spent his money on season tickets to the Metropolitan Opera and on hiking the Appalachian trail with his son.

I understand that in the world we inhabit it is virtually impossible to exist without some means of income. As self sufficient as I have become I still pay property taxes, send my children to the dentist, buy fuel for our vehicles and insurance on our home, but what I don’t have to do is be shackled to the accumulation of financial instruments- not the same thing as wealth. Prior to becoming a farmer I owned a business not far from Admin and was one of the one percent and saddled with all that comes with it- the stress, the employee problems, the taxes, the regulatory compliance, the audits, the infrastructure, the sub-contractors and vendors, and every outstretched and open palm looking for a cut. I quite literally felt like a slave to the wealth I was accumulating at the expense of my health, my sanity and even my own family. Never once did my father express an opinion about what I was doing because he knew that it was my life journey and that only my own discovery of what was important in life would be enough to affect the kind of change I would eventually have to make for the betterment of my family and myself.

Last week was a tough one- building fences, cutting timber, moving livestock onto pasture, planting, tilling, building a barn- and each night I climbed into bed physically exhausted, but comforted and surrounded by a loving family on a well tended patch of earth. On the morning of my birthday I received a card and a book from my father and when my wife called me over to give it to me I sat down in the sunshine and opened the cover and read this inscription.

To My Son on his birthday,

I am so proud that you have taken up the noblest task of all.

All my love,

Dad

I no longer have a gold plated insurance policy, don’t own a 401K, earn less than anyone in the FSA and still I feel like a wealthy man. Intelligence is indeed a predictor of income and accumulated wealth can be passed on to subsequent generations as a kickstart towards a future, but the real measure of a man is in the living of his life, the choices he makes and the consequences he lives with. I have no idea what part of the 1% sleep the sleep of the just, feel confident in the love of their wife or the respect of their children, add something to the world rather than strip something off of it, but to believe in my heart that I had been truly successful in life I would rather have that single book with its inscription than a hundred million dollars.

Imagine the kind of world we would live in if more of us felt that way.

“Haven’t IQs always been broken into quintiles? Did IQs as a whole decline from the 1950′s through to today?”

I would guess that what declined between the 1950’s and today isn’t IQ (use of it, certainly) but the US hegemonic advantage. For example human populations in Europe and Asia- I leave out Africa for obvious reasons- has its fair share of right hand side of the bell curve IQ. Where was their middle class during that period? Our industrial, managerial, academic and military superiority during the post war era was the driver of the bell curve masses getting a cut of the pie. Since globalization the middle has been replaced by low wage third-worlders in order to drive up the returns for the top- seems pretty obvious unless I am overlooking something else.

Llpoh

If manufacturers have become so efficient, why have their share of corporate profits fallen from 50% to 20% over the last 40 years?

Inquiring minds want to know.

When I read Hardscrabble’s posts I feel like I’m peaking at the next stage of human evolution.

@Admin – By LLPOH’s logic bankers and stock brokers are far far more intelligent than the manufacturing sector.

Lipoh I’m sorry but I’m not bent that way so you will have to blow your self. I was referring to an even playing field that doesn’t exist in this country anymore. It is easy to make money if you can create it yourself, control other peoples thoughts through media ownership, regulation that stifles competition, and an educational system that creates dumb down people like domesticated sheep. Watch the time machine and you will understand what I’m talking about. Competition, accountability of ones actions and true freedom is the creator of intelligence and wealth. Lobotomized cattle chewing their cud watching reality shows doesn’t create higher thinking. When motivation to excel is destroyed you end up with an oligarchy as we have today. Now you can reply with a very high IQ response such as blow me.

“peeking” not “peaking”. Sorry about that.

@hardscabble farmer: I would, without doubt, have loved to have met you Dad. For that matter, I would like to meet you and your family too. You have your head on straight, your priorities perfect and I’m glad to read comments from a smart, happy man..

MA

@LLOPH,

How large would a book have to be in able to tell the stories of all the wars, problems and dysfunction intelligence has caused?

Bernanke helping Main Street with his helicopters

The notion that income = intelligence is such a load of bollocks.

You can make money all sorts of ways including theft, fraud, luck, rich parents, winning the lottery, not being handicapped, not being black, not being born in a poor country, etc etc.

None of the above have anything to do whatsoever with intelligence.

One fact is true: those who have money, THINK they are more intelligent.

Last note: those who think the middle class don’t matter – really need to get out more. The reason the United States and Europe are nice places to live is because they have civil societies – civil societies built by and composed of a more or less successful integration of all levels of society.

Can the same be said for hellholes? Are the most successful in these hellholes the most intelligent? Or merely the most willing and able to victimize their brethren?

Last note:

It was said: “The top 5 or 10 percent will do well. The rest better do something to lift their game, or they are screwed.”

One of the ways the rest can ‘do something’ to lift their game is to throw down the top 5 or 10 percent.

Of course, the author of this quote actually is either intentionally misleading or ignorant. The causes of inequality and the destruction of the middle class are not due to the 5 or 10 percent. They are due to the top 0.5%.

To the truly rich, the top 5 or 10 percent are no different than the rest. Just not yet consumed or are useful tools.

Comparing IQ from the 1950’s to today is an exercise in futility. Do you think IQ Tests are the same today as back then? They are not. IQ tests have been dumbed down. Dumbasses were a minority when I was a kid, Today, it seems every other person I meet is a dumbass. We’re dumber than before, and getting dumber with every passing year.

“The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.”

– Alan Greenspan

Well, well. well… Another of Alpo’s good friends, a lucky member of the saintly Chosenites’ relishing his role in hiding the destruction to his despised inferiors’ – the lowly Goyim of the West (or as I prefer, the Bolsheviks’ within and their usual Jews’ News media-mafia-apologists’ celebrating and covering for their banking-brethrens’ unspeakable crimes against humanity):

“…In interviews on two high-profile television programs — with Maria Bartiromo on CNBC and with Leslie Stahl on CBS’ 60 Minutes — Greenspan admitted, with smug satisfaction, to willfully deceiving Congress when addressing them under oath about some of the most important Fed policies affecting the national and global economies. This blatant deception — in essence, lying — Greenspan brazenly, but casually, described as “purposeful obfuscation” and “destructive syntax.”

Were his interviewers outraged by this shocking confession? Far from it; the revelation only seemed to deepen their awe and fascination. The September 17 on-screen performance of CNBC’s Bartiromo was especially embarrassing to watch. Ms. Bartiromo, supposedly the consummate news professional, wavered between star-struck hero-worship and giggling girlie flirtation.

Here is the crucial exchange between the breathless Bartiromo and Greenspan:

Maria Bartiromo: All of these important economic events you are overseeing — the most important institution, and leading things. And then not only are you dealing with these crises, but then you’ve got to convey what’s going on to people. That means Congress, the president, the media, the public. So what? You come up with Green-speak.

Alan Greenspan: Otherwise known as Fed-speak.

Maria Bartiromo: What is it?

Alan Greenspan: It’s a — a language of purposeful obfuscation to avoid certain questions coming up, which you know you can’t answer, and saying — “I will not answer or basically no comment is, in fact, an answer.” So, you end up with when, say, a congressman asks you a question, and don’t wanna say, “No comment,” or “I won’t answer,” or something like that. So, I proceed with four or five sentences which get increasingly obscure. The congressman thinks I answered the question and goes onto the next one. [Emphasis added.]

Likewise, in his September 13 interview on 60 Minutes, Greenspan proudly paraded his record of deceit and misdirection. CBS’ Leslie Stahl tells us that “in public Greenspan was inscrutable whenever Congress asked about interest rates. He resorted to an indecipherable, Delphic dialect known as ‘Fed-speak.’” The 60 Minutes transcript then proceeds with this account of their conversation:

“I would engage in some form of syntax destruction, which sounded as though I were … answering the question, but, in fact, had not,” Greenspan admits, with a chuckle.

At one hearing, Greenspan said, “Modest pre-emptive actions can obviate the need of more drastic actions at a later date, and that could destabilize the economy.”

“Very profound,” Greenspan says, after listening to his testimony.

Greenspan personally worked on these “profound” comments.

“But what would often happen is you’d get two newspapers with opposing headlines, coming out of the same hearing,” Stahl remarks.

“I succeeded. I succeeded,” Greenspan says.

Succeeded? Succeeded in deceiving many (but not all!) of the congressmen to whom he was testifying. Succeeded in deceiving the American people as a whole. Succeeded in maintaining his mythical status as the all-wise, all-powerful Wizard of Oz of monetary policy.

But he succeeded in this ongoing deception for 19 years (and continues today as the venerable Fed chief emeritus) only through the indispensable assistance of the major media. Instead of serving as the watchdogs of the public interest as they are supposed to, they have become the lapdogs of the big banking-big business-big government interests that are hijacking our economy and our country.

Instead of, like Toto, pulling back the curtain to expose the Wizard’s deception and sham powers, they lick the Wizard’s hand and help him maintain the dangerous and unconstitutional power that the Federal Reserve system exercises over our economic and political destiny. While some of his media fan club have merely canonized him with sainthood, others among the Greenspan hosanna choir have actually elevated him to divine status.

One of the most shameless examples along those lines was the Time magazine cover story of February 15, 1999 by Joshua Cooper Ramo. Along with the ostentatious headline, “The Committee to Save the World,” the cover featured the beaming visages of Federal Reserve Chairman Alan Greenspan, then-Treasury Secretary Robert Rubin, and then-Deputy Treasury Secretary (and later Treasury Secretary) Lawrence Summers, with this riveting subtitle: “The inside story of how the Three Marketeers have prevented a global economic meltdown — so far.” This Time glorification attributed superhuman powers and virtues to the Greenspan-led trio, dubbing them “the Trinity.”

But in terms of the amount of adulatory attention devoted to Greenspan, recent media coverage gives new meaning to the word “excess.” On September 17, in addition to the hour-long interview with Maria Bartiromo, the NBC corporate family (CNBC/MSNBC/NBC) featured excerpts from the interview on its news segments and on programs such as Squawk Box, Squawk on the Street, The Call, Power Lunch, Street Signs, Closing Bell, Kudlow & Company, On the Money, and Fast Money. Not to mention a one-on-one interview with Matt Lauer on NBC’s popular Today Show.

CNBC’s marathon of Green-speak programming included: “Greenspan: Power, Money and the American Dream,” “The Greenspan Legacy,” “Greenspan on Global Growth,” “Greenspan’s New Book,” “Greenspan, Iraq & Oil,” “Greenspan on U.S. Consumers,” “The Maestro & the Professor,” “Greenspan on Foreign Investment,” “Greenspan Speaks,” “Greenspan and the Professor,” “Worldly Tenure,” “Honors and Accolades,” and “Greenspan Retrospective.” Many of these segments were recycled and then re-recycled for maximum overkill.”

Monday, 29 October 2007 01:00

Taking Delight in Deception: Greenspan’s “Purposeful Obfuscation”

http://www.thenewamerican.com/economy/commentary/item/3944-taking-delight-in-deception-greenspans-purposeful-obfuscation

Great article. History will remember Greenspan, Bernanke, and Yellen as the biggest criminals in history (along with Abe). Inflation and debt have wiped out this country. We peddle our debt to other countries in exchange for goods, which is insane really, but they’re dumb enough to fall for it, the legacy of our empire.

These three Jewish banksters have wiped out the middle class, and anyone with a job. They’ve wiped out the solvency of this country, and indebted our entire nation. They’ve allowed the profligate spending by the criminal socialist politicians, allowing them to spend $1 trillion a year they don’t have. Our public/private debt is $58 trillion, more than 400% of GDP.

Inflation is the silent tax, and we’ve been lied to for decades about real inflation rates. The government takes half your earnings in taxes, and inflation takes 10-11% a year, and you try to survive on what’s left. Our economy is going to implode in a smoking pile of debt, thanks to the Fed and criminal political class, who employ 142 million people (union government drone employees, welfare recipients, and disability). Without the Fed, socialism could not happen here. Simply stringing these people by a rope won’t undo the damage they’ve done. There’s a special place in hell for them, I’m hoping.

Hello llpoh. You are very rich, ergo, you must be very smart. Hurray for you. I am jealous.

Admin – I already responded to the question re why the top “quintile” is still rising, and the others not. The economy has changed. The jobs that used to pay the bottom sectors well have disappeared. And fact is, the jibs that disappeared were overpaid to begin with. So the bottom quintiles are now left with service jobs, that truly do not pay well. Why is that difficult to understand?

Re your point as to why manufacturing corps are making less profit – seems to me they are under a lot of global competition. And internal competition – as fewer people are employed in mfg, the competition intensifies. it is very hard to turn a profit in mfg. My profits, for instance, are directly related to how many employees I have, more than anything else. Fewer employees means lower profits, by and large. Manufacturing, as an industry, is small, so therefore profits are harder to come by.

I notice you did not point out the deflection point on the chart that should exist because of your globalization argument, and I note you ignored my comments which blew up your ill-thought out comments on Germany.

You just think you know everything. As I said, mfg is my patch, and I have spent almost 40 years in it, during which time it has been a very difficult time indeed. It is an area I well and truly understand.

The biggest impact to mfg over the years is the steady, never-ending 2.5 percent per year increase in efficiency gain. It is the same as what happened to agriculture – where half the population used to be required in agriculture, it is now two percent.

Globalization, in my opinion, is more affecting non-mfg jobs – high value support jobs are flowing to low cost countries, leaving behind a higher percent of low value service jobs.

The chart re mfg jobs as a percentage of total jobs shows mfg job losses in a straight line decline for half a century. It is what it is. Globolazation or not, it will continue. Unless of course the US develops an Eastern Bloc to exploit as has Germany.

Sorry LLpoh. I’m not buying your argument. It’s the middle quintile we are talking about here. You remember. This is an article about the MIDDLE class. The middle class incomes are in the $51,000 per year range. That is not your Wal-mart employees and burger flippers. Your misdirection with that line is worthless.

The top quintile is rising due to the top .01% siphoning billions from the economy through their capture of the economic system, political system and financial system. The vast majority of the top quintile have also seen their incomes stagnate.

The financialization of the economy by you Ivy Leaguers is the main reason for the growing inequality. IQ has very little to do with it. The scum on Wall Street do not have high IQs. They have a high level of immorality and sociopathic tendencies.

Your chart does not show a steady long term decline in manufacturing jobs. It shows an extremely moderate decline from after WWII until 1971 (30% to 26% over 20 years). After Nixon closed the gold window and unleashed the debt based consumption economy the % plunged from 26% to 9% over the next 40 years.

This was not due to efficiency gains. This was due to conglomerates like GE off-shoring their manufacturing to countries where they could pay slave labor wages, while pumping up their profits, stock prices and executive bonuses. Then they sold their shitty products back in America to people who used debt to buy the crap. You don’t need to have an IQ in the top quintile to see who won and who lost.

TPC – only idiots are in mfg. manufacturing is equivalent to making buggywhips. It is doomed in the long-run, and in terminal decline.

I did my best to stir this pot, but with limited success. Only folks coming out to play are those that think income is evenly distributed based on other than ability. Go figure.

By the way, smart folks do do the most damage. That is the nature of things. Except of course Bush and Obama are both morons, so maybe I have that wrong.

By the way, smart folks do do the most damage -llpoh

I concur.

Greenspan knew that things were about to blow up in 2008, he did nothing, he approved of the transfer of wealth, thru nefarious means, upward.

And people look up to this intelligent shyster.

Socialize the debt – privatize the profit.

I have no problem with moral capitalism, but Greenspan is effectively saying…

Go eat cake America.

Goodness, the clueless author above continues to dig into the hole:

“My profits, for instance, are directly related to how many employees I have, more than anything else. Fewer employees means lower profits, by and large. Manufacturing, as an industry, is small, so therefore profits are harder to come by. ”

This is completely idiotic, as the entire offshoring movement can attest to. The real reason why jobs are moving offshore is bad government policy starting with health care, extending into taxation schemes, detouring into financial feudalism and culminating in an incestuous corporate management clique.

The expensive and relatively poor health care available to even employee Americans – you know, the one consuming 18% of US GDP – means corporations must pay employees more and more to give that sector of the US ‘economy’ (I put quotes in because this part is anything but economic) its pound of (literal) flesh. This large section of an already high living wage due to Americans paying over 25% of pre-tax income on housing (i.e. asset price inflation), combined with tax policies which literally reward the offshoring of jobs via transfer schemes, is why corporations move jobs offshore. Combine this with executives who are rewarded for the short term financial illusion of greater productivity – it doesn’t surprise me at all why jobs are moving out.

Of course, the above author doesn’t seem to understand any of that.

Are you sure you’re one of the smart ones?

c1ue – what on earth do you do for a living? I run/own a manufacturing business. Yet you think you know more about my business than I do? You are really less than bright, aren’t you?

Corporations move overseas because of a range of reasons, but they all come down to one thing – money. First, the corporate tax rate in the US is the highest in the world. Second, wages are very high in the US – even at the minimum wage, wages are very high relative to many other nations. Third, there is massive red-tape and EPA issues, etc., that drive up costs. Fourth, many other nations offer larger pools of skilled employees ( for instance, if you have a need, you LITERALLY can hire THOUSANDS of engineers in China in a week. It would be impossible to EVER fill those positions in the US, much less to do that in a week.).

What does bad government policy have to do with the cost of labor being cheaper elsewhere? What do you propose, you Einstein you – huge import taxes?

Government policy could have reduced the corporate tax rate, the cost of red tape, etc. It would not have effected the decline in manufacturing employees to the extent of eliminating the decline – it would have flattened the slope of the decline somewhat, but not eliminated it.

Here is a little tidbit – the US is a major exporter of manufactured goods. The US exports around a trillion dollars in manufactured goods per year. What do you think would happen to the export market if the US put in place import taxes?

Your point re transfer schemes is idiotic. Transfer schemes are used to transfer costs to the US, and away from offshore entities so as to put the profits in the offshore entities. The problem is not the transfer scheme, as you put it, the problem is that the US corporate tax rate is the highest in the world.

So what would happen if the transfer schemes were eliminated? Well, the corporations would move ENTIRELY offshore, now wouldn’t they. The problem is ENTIRELY the absurd corporate tax rate.

And finally, you say “Combine this with executives who are rewarded for the short term financial illusion of greater productivity”, which proves you are a total, blithering idiot.

Greater productivity is no illusion. If CEOs are rewarded for increasing productivity, then I applaud them, I cheer them, I congratulate them on their success. That is high achievement indeed. Business desperately needs increased productivity in order to survive and thrive.

Unfortunately, it is rare that executives are rewarded for this. Instead, they tend to be rewarded for increasing share prices, or for increasing profits. Those indeed can be “short term financial illusions”, and they are rampantly manipulated and abused by executives.

Here is another attempt to post the chart showing manufacturing as a percentage of all jobs:

[img [/img]

[/img]

Jeezus, Llpoh, our trade deficit is $500 billion a year. That’s half a trillion a year leaving the country. What difference does it make how much we export? And instead of having $500 billion a year to invest in CAPEX and other assets, we just give it away. It’s too late for import taxes, the jobs are gone.

China, Korea, Japan, every other Asian country limits their imports, severely. We export jets, weapons, some heavy machinery, and tech. And tech is getting slaughtered, thanks to the NSA and loss of trust in our government. Cisco lost $2 billion in sales to China thanks to the NSA, Brazil, Germany, England, India all are reducing tech spending significantly thanks to our fascist government and the NSA. Our government and Wall Street have wiped out this country. Well, that’s all I wanted to say.

I figured Admin would post this data from ZH, but he hasn’t. These are the highest paying jobs. Keep in mind being on welfare pays the equivalent of $54,000 a year in cash, free food, free healthcare and other benefits. Being on welfare is one of the best paying professions available today.

[img [/img]

[/img]

Top paying industries:

[img [/img]

[/img]

Top hiring professions:

[img [/img]

[/img]

This is the end of a country, the end of an empire, in chart form. 3 out of 5 of the top hiring goes to government or government-controlled monopolies. Game over

As you can see from the graph, there has been a steady decline in manufacturing jobs for fifty years, uninterrupted. Globalization will have added somewhat to the decline, but in the end, manufacturing is in steady decline owing to steady gains in productivity.

In 2010 the decline has flattened a bit, as productivity increases slowed, primarily as a result of many of the computer-driven productivity gains having been absorbed.

With or without globalization, manufacturing jobs would continue in decline. They are not coming back. Manufacturing jobs were the backbone of middle-class America. The US had a virtual monopoly on manufacturing in the world, but that monopoly has been broken. The monopoly allowed high wages to be paid to manufacturing employees. That is no longer the case – manufacturers shift to lower wage states, for instance, where costs of labor are lower. Manufacturing no longer offers a solid middle-class income in many instances – wages are falling in manufacturing, and will likely continue to do so.

As manufacturing jobs are being lost, they are being replaced, if at all, by low paying service jobs.

The fact is, the middle-class was an artificial bubble created by a US manufacturing monopoly. The monopoly has been broken. So now there will be a return to the mean trend line – see Europe for what that mean entails.

Government policy has hastened the decline, to be sure and certain. And the US has squander the opportunity to replace the lost manufacturing jobs with high-skill, value-adding jobs in science and tech. The US spent its money on “things” – widgets, free-shit for the FSA, etc., rather than investing its capital wisely for the future. It allowed its education system to fail, it spent hugely on wars, it allowed its infrastructure to crumble, it permitted inflation to erode its capital, as Admin so rightly decries, etc ad naseum.

The US had a huge advantage and head start, but pissed its advantage and its capital away not on investing for the future, but on instant gratification, and allowed its sense of entitlement to over-ride good, common sense.

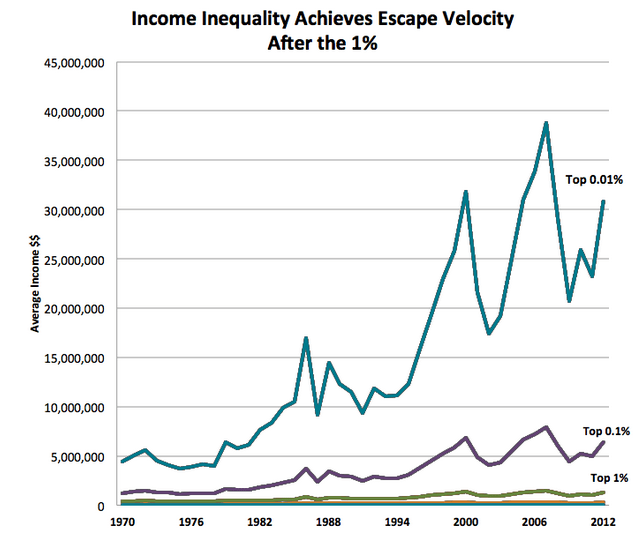

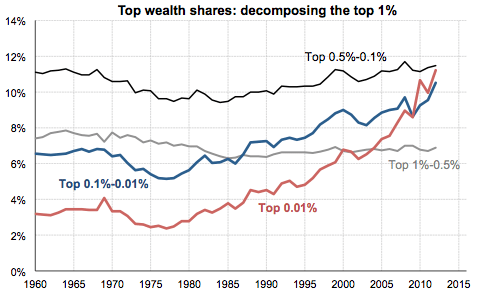

Read the graphs and weep for America. Not even the top 1% has made much headway in the last 40 years. Those .01% must have really really really high IQs.

[img [/img]

[/img]

[img [/img]

[/img]

AWD – if you look at the components of what is imported, take a gander at SERVICES being imported. The issue, as I said, is not so much that we are now importing so much manufactured goods as it is that we are importing services. Not to mention oil products, etc.

We import around $500 billion more manufactured goods than we export. If we added that to the current total manufacturing output, it would be around a 25% increase in manufacturing jobs – less the fact that the US is more efficient. That would increase the percentage of jobs in manufacturing from around 8% to around 10%. The 10% percent would continue to fall at 2.5% per year.

So it means that the graph would shift a few years – globalization has pulled forward the demise of manufacturing by a handful of years. Which is what I have been saying – it is an issue, but it is not THE issue. The issue re manufacturing is that by becoming increasingly efficient, the industry is gradually eliminating itself.

The bigger issue is the accelerating globalization of high paying service jobs – now that is going to be a real problem.

And I do not know how you will prevent a company from sending work electronically back and forth. I do not see how import taxes, etc., will keep that from happening.

You don’t need a high IQ to get some government drone to do what you want. Just some inherited capital.

Admin – what say you pick the high point in 1955 of around 33% falling to around 23% 15 years later. As always, you cherry-pick your numbers. There has been a steady slope downward since 1955. Prior to that, you had the recovery from WWII going on.

Nice logarithmic graph that distorts the increased income of some sectors. Again, nice cherry-pick.

Admin – as you well know, I agree with much of your premise. But the fact is, the middle class was unsustainable, and owed its position to 1) the hugely beneficial position the US found itself in post WW11, and 2) it held its position via huge consumption of debt.

Yes, much is to be laid at the doorstep of banksters etc. – they have certainly expedited the crisis. But there is no way that the middle class was going to keep its position. It was artificial and unsustainable.

Sorry llpoh. Look at the 1960s. There was a moderate decline from 29% to 26%. This was the hey day of the middle class. The manufacturing sector was not destined to disappear in America. It happened due to choices by corporate executives, politicians and Americans lured into debt by bankers. If Nixon had not closed the gold window, the explosion of debt would not have been allowed to happen. The consumer society would have been dead on arrival and the extreme disparity between the ultra rich and the middle class would not have happened.

Those graphs tell the truth. There is nothing distorted about them. Virtually the entire growth in incomes of the top 1% have been reaped by the .01%. Those are called facts.

The middle class DID NOT exist due to huge debt. The freaking credit card didn’t exist until 1969. The middle class of the 1960s was created through hard work, saving, and buying things with cash. The middle class began to die in 1971 when we allowed bankers and politicians to call the shots. The middle class was not artificial and unsustainable.

“”Median household income in the United States peaked in 1999. The internet boom, housing boom and now QE boom have done nothing beneficial for middle class Americans. They have been left with lower real income, less home equity, no savings, and no hope for a better tomorrow. Most states saw their median household income peak over a decade ago, with more than half the states experiencing double digit declines and ten states experiencing declines of 19% or higher. It’s clear who has benefitted from the fiscal policies of spendthrift politicians and the spineless inhabitants of the Mariner Eccles Building in the squalid swamplands of Washington D.C. – the pond scum inhabiting that town. The median household income in D.C. stands at an all-time high. Winning!!!!””

Is it wrong of me that I really was ROFLMAO on this paragraph? I mean, we know the folks at the top are not incompetent. So…..they really are winning! Too funny. America: You got what you voted for! And guess what? America will do it again in 2016. 2017-2020 should be interesting years.

And I do not know how you will prevent a company from sending work electronically back and forth. -llpoh

I do. When that ‘service desk’ [lol] or ‘tech support’ [what support?] [in India or elsewhere] don’t understand what you are trying to say, and you end up hanging up then people wont buy that product.

It was costly to implement and it doesnt work.

Okay, Llpoh.

It seems I made a mistake, which I need to correct. I said being on welfare paid $54,000 a year, but it’s actually $57,327. I found the article on ZH http://www.zerohedge.com/news/2013-11-30/other-america-taxpayers-are-fools-working-stupid

So, being on welfare actually pay MORE than all the jobs listed below. And $57,327 is tax free, you’d have to earn $69,000 a year pre-tax to make the same as a welfare parasite.

So, I stand corrected. Being on welfare is THE best job and profession available today. Maybe that’s why 100 million people are on welfare.

[img [/img]

[/img]

“the single mom is better off earnings gross income of $29,000 with $57,327 in net income & benefits than to earn gross income of $69,000 with net income and benefits of $57,045.”

No jobs or professions pay as much as being on welfare

[img [/img]

[/img]

KB – I am not talking about call centers – but that is happening, too. I am talking about accounting jobs, computer tech jobs, analysis jobs, strategic jobs, banking, etc. – high paying jobs that are flooding offshore.

Hell, I cannot even begin to know all the service jobs that will be exported – people lots smarter than me are busy thinking about what jobs can be done via electronic link.

KB – I am not talking about call centers – but that is happening, too. I am talking about accounting jobs, computer tech jobs, analysis jobs, strategic jobs, banking, etc. – high paying jobs that are flooding offshore. -llpoh

Ah, but are they of higher intelligence than me or you?

Okay, I understand, I know some folks in Canada, some of their kids are going to Hanoi to learn finance.

Admin – I believe that the middle class was an aberration and was inherently unsustainable. I totally agree with you re the impact that the financial sector/government/corruption/general evilness has had.

But that said, I think that they have simply expedited the inevitable. Given the global nature of economies, and given the uniquely beneficial situation the US found itself in post WW2 no longer exists, I believe it is absolutely unavoidable that the middle-class as the US knew it in the 50s, 60s, 70s, etc., was going to implode. It has been more rapid and will be much deeper than need be, but it was inevitable nonetheless.

As I have said many times, 5% of the world’s population consuming 20+% of the world’s resources is simply not a sustainable position, and is sure and certain to come to an end.

AWD – if the US had spent the welfare money making itself more productive, there is a chance that the collapse could have been minimized, especially when combined with controlling/eliminating the things Admin is talking about. The US consumed when it should have been investing in the future.

As ever, we are largely in agreement.

KB – they may not be smarter than you and me, but they are at least as smart as the folks that do those jobs in the US, and they will work cheaper and longer.

i would ask if smart forlks are so smart why do they always do things behind closed doors…have lobbyists…pay off poloticians manupulate lye and tell untruths …..maybe thats what u think smarts is…abolish the federal reserve act/irs….constitute executive order 11110.

KB – they may not be smarter than you and me, but they are at least as smart as the folks that do those jobs in the US, and they will work cheaper and longer. -llpoh

I agree with that, but the damage it does to the country they claim to love, and fly its flag, does damage it economically for bottom line interests.

But, then intelligence does not always mean higher pay…

i would ask if smart forlks are so smart why do they always do things behind closed doors -anon

Yet these same politicians will have the capitol police remove you while at the same time advancing govt tracking under the meme of ‘You have no right to privacy in a public place.’

Then shouldnt these pols offices be loaded with cameras?

Admin – the decline in the sixties was around 2% per year – much as I have been saying. That drop has, and will, continue year on year. Manufacturing gets more efficient. Thus the fall in mfg jobs as a percent of total jobs. It was destined to happen. It could have been delayed, but not prevented.

Currently the US makes a couple of trillion dollars worth of manufactured goods per year. If 26 percent of all persons currently worked in mfg – as in 1970, then that would be almost $7 trillion per year being produced. The US would need to be exporting around $5 trillion a year in that event. Not going to happen.

Admin – manufacturing is doomed the same way as agriculture jobs were doomed. Manufacturing jobs will continue to dwindle until such point as virtually all manufacturing jobs are automated. Then it will level out. It is not there yet. Give it another 20 years.

The middle class was created by the monopoly the US had in manufacturing. Even if that monopoly continued, the jobs would be disappearing at 2% a year.

That there is serious abuse by the .01 percent I do not dispute.

Wow. Admin, that was the truth told as well as I have heard it. Bravo. It is a shame there is no mainstream venue by which to spread this eloquent and concise penning.

For fuck sake, we finally hit 100+ posts. Admin works hard on this stuff, and every one of his posts deserves 100, 200, 300 comments. Get with the program, you loafers. I did the best I could this time to get things going, but we need more out of y’all.

If you could not find a problem with something I said here, you were not trying hard enough.

[img [/img]

[/img]

““Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling.” – Ben Bernanke”

God forbid you should ever get more for your dollar(the assumption seems to be that unless prices are rising, people will be constrained from spending, when, given the normal condition of prices dropping due to productivity gains (as with computers) they would be enabled to buy more goods, creating new jobs- but it is perfectly copasetic in Ben’s book if you are kicked into a higher tax bracket with no increase in real income. The 1758% price rise in England (see Telegraph.co.uk) is thanks to Ben’s ilk across the pond- the Keynestone Kops Run amok- the thing that really frightens them is the thought of their printing presses being broken up by saboteurs (as in workers jamming their sabots into machinery that was ruining their lives)

Greenspan – Master of Obfuscation.

Alpo – Master of Diversion.

Admin – Master of the Fine Art of Vivisecting Opponents in a Debate (even when off-topic)

I’ll donate… I am amazed in all the talk here of IQ’s, such flagrant use and direction of foul language and ad-hominem attack. Is that what intelligence brings to the modern-day table of discourse? I can say one thing for 100% certainty: Using the oft-cited ‘1950’ time frame to present, for all our technological advancement and ‘smarts’, we are infinitely more ‘coarse’. And since ‘technology’ has little or nothing to do with that aspect of human nature, what could it possibly be? After all, we’re so much better off today than we were back then…