Off the keyboard of RE

Follow us on Twitter @doomstead666

Friend us on Facebook

Published on the Doomstead Diner on November 6, 2014

Discuss this article at the Economics Table inside the Diner

Over the course of the last week, we have had two MAJOR Black Swans come in for a landing.

The first one actually has been ongoing for a couple of weeks now, the collapsing price in the Oil Market, plunging from its recent “set point’ at around $90/barrel to $77 for WTI as I write this article:

The second Swan came in the form of an announcement by BoJ Chief Psycho Kuroda that the BoJ would ENGAGE Warp Drive on the Printing Press and buy up every last JGB the Nip Goobermint sells in order to meet their ever increasing need for cash. The Yen was already sliding, this announcement however sent it on a Downhill Run worthy of an Olympic ski course.

Flip this upside down to get JPYUSD. Nobody publishes it that way, I wonder why?

Are these two events unrelated coincidence? Of course not.

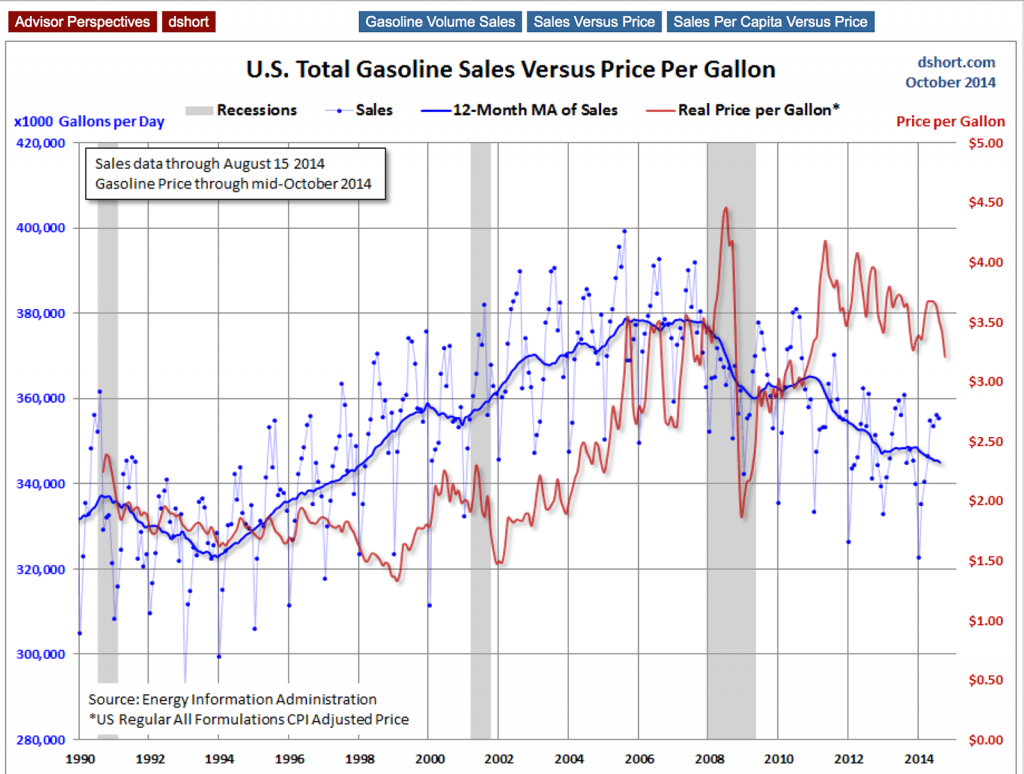

Demand Destruction has taken hold all across the globe now, and Oil consumption is dropping everywhere. Here in the FSoA, we’ve seen a 10% drop in gasoline consumption since 2008, and the end to this is nowhere in sight either.

Fewer miles driven means fewer Japanese Carz sold here in the FSoA, and it is no different over in Eurotrashland, in fact it is worse over there, particularly in the PIIGS Nations. Fewer Japanese carz sold means a ballooning trade deficit for Japan, and their trade surplus over the years is the only thing that kept them able to support ever increasing Goobermint deficits, which now have reached the Ionosphere and soon will encompass the entire solar system, including UR-ANUS.

Global Deficits in aggregate soon will reach the Edge of the Visible Universe.

Going Where No Man Has Gone Before in Debt

What Psycho Kuroda-san wants to do here is devalue the Yen so far that Amerikans can by Japanese Carz for Pocket Change, and with Gas Prices dropping at the pump EVERYBODY hopes this will stimulate Demand and Happy Motoring Amerikans will once again start burning oil as fast as the Saudis can pump it out of the ground.

What Psycho Kuroda-san wants to do here is devalue the Yen so far that Amerikans can by Japanese Carz for Pocket Change, and with Gas Prices dropping at the pump EVERYBODY hopes this will stimulate Demand and Happy Motoring Amerikans will once again start burning oil as fast as the Saudis can pump it out of the ground.

The Saudis themselves have promised to be the Walmart of Oil Wholesalers and sell their Oil at Low, Low Prices Every Day into the forseeable future, because they too have hefty obligations in subsidies to keep their population from rising up and beheading the Saudi Princes. What they have lost in high prices they hope to make up for in VOLUME!

Sadly for the Saudi Royal Family, it appears they will have some difficulty getting this Oil to Market however, since they seem to have Pipelines mysteriously BLOWING UP, another mere coincidence of course. Pipelines Blow Up regularly over there, nothing to see here, please move along.

Even if the pipelines remain intact however, it is unlikely that the Happy Motoring Amerikans are going to start increasing consumption again just because Gas Prices drop even $1/Gallon here. Millions of formerly Middle Class Amerikans have completely dropped out of the “Workforce”, and they can’t afford to drive around willy nilly at ANY price. They divested themselves of their cars already, and they aren’t buying enough new ones from Toyota because they can’t afford car payments either, even at ZIRP for 5 years! Unless the newly elected Republican Majority magically starts creating Jobs that pay better than Minimum Wage, there is ZERO chance these folks will be Happy Motoring ever again.

Besides this problem on the Consumption End, there is still more Blowback from Low Oil Prices on the Extraction end just around the corner here if Low, Low Prices Every Day continue for any significant period of time, which is the enormous DEBT BUBBLE worked up by the Energy Extraction Industry here during the “Fracking Miracle”, which dimwitted Pols and Energy Shills and the Corporate Media have been selling non-stop as the Ticket to “Energy Independence”.

![]()

Depending on the particular play and the costs involved in production, generally speaking only the very best of these plays can bring in Oil at under $80/barrel, so anyone drilling for it in less than perfect locations starts losing money with each well they drill, and the more they drill, the more they lose. They borrow more money to keep drilling, because to stop is to realize the losses, and nobody wants to do that! At some point though, and sooner rather than later if the prices stay below $80, the copious debt money being issued to these folks from Wall Street will stop flowing, many companies will go Belly Up and production at all but the best places will be shut in.

Depending on the particular play and the costs involved in production, generally speaking only the very best of these plays can bring in Oil at under $80/barrel, so anyone drilling for it in less than perfect locations starts losing money with each well they drill, and the more they drill, the more they lose. They borrow more money to keep drilling, because to stop is to realize the losses, and nobody wants to do that! At some point though, and sooner rather than later if the prices stay below $80, the copious debt money being issued to these folks from Wall Street will stop flowing, many companies will go Belly Up and production at all but the best places will be shut in.

Don’t believe me? Read the report DRILLING DEEPER from the Post Carbon Institute for 300+ Detailed pages to get a picture of this nonsense. We will have a Podcast discussing the Drilling Deeper report with Author David Hughes up in the next couple of weeks here on the Doomstead Diner.

Don’t believe me? Read the report DRILLING DEEPER from the Post Carbon Institute for 300+ Detailed pages to get a picture of this nonsense. We will have a Podcast discussing the Drilling Deeper report with Author David Hughes up in the next couple of weeks here on the Doomstead Diner.

Don’t believe David Hughes? Go to Bloomberg in the Heart of the MSM/Wall Street Oligopoly:

“There’s a lot of Kool-Aid that’s being drunk now by investors,” Tim Gramatovich, who helps manage more than $800 million as chief investment officer of Santa Barbara, California-based Peritus Asset Management LLC. “People lose their discipline. They stop doing the math. They stop doing the accounting. They’re just dreaming the dream, and that’s what’s happening with the shale boom.”

Will this cut the supply sufficiently to outpace the ongoing Demand Destruction and finally get Oil prices to start climbing upward again? Eventually, it probably will, except by the time this occurs about the only people left able to afford the $200/barrel Oil still produced will be the 1% still on the Gravy Train of Funny Money from Da Fed.

Can 1% of the population pay for all the Road Maintenance, Bridge Repair and drive enough miles every day to keep Gas Stations open along their driving routes to fill up? Of course not, this is a volume bizness, and in order to build out the whole system it required constant Growth, issuance of ever more Debt on the supposition this growth would continue in Perpetuity, which of course is an impossibility on a Finite Planet with Finite Resources.

Has the Oil Run Out here? No it hasn’t, and it never will, but most of what is left will never come up from the rock formations it is wedged into, or deep under the sea or way up in the Arctic Ocean, where the costs for producing it are even higher than the tight oil formations in Marcellus and Eagle Ford, which already are higher than the Consumers of the Oil can afford to pay.

It doesn’t matter who gets elected into office here, the only solution to this problem is reduction in per capita energy consumption, and this will occur either through enforced rationing or “Conservation by Other Means” as Steve on Economic Undertow likes to phrase it, the reduction will occur as more and more people simply cannot afford to buy the Oil, or the products made with it.

Since most of our current economy is based on this, it has nowhere to go but DOWN now, which means fewer Jobz in this economy, lower tax receipts and further Defaults at all levels from Goobermint to Corporations to Consumers, and further Defaults means a reduction in the total Money Supply, because the money supply is entirely based on Debt and the belief that the Debt will at some point be repaid, which it will not be. It is all IRREDEEMABLE DEBT.

Financial Gimmickry has kept this Ponzi going here for a long time, but there are some Hard Limits that gimmickry cannot fix, and one of them is Consumers who just will not BUY oil, because they don’t have the money to buy it. This is not a “Choice” Consumers are making, it is not a “Paradox of Thrift”, the endless reams of Toilet Paper Da Fed and the BoJ are printing are not filtering out to the end consumers. You do not have an Economy when you have Sellers but No (or really too few) Buyers. That is Common Fucking Sense.

CALL ALAN!

It’s the FINAL COUNTDOWN now.

RE

I hope to make it to town today to get a haircut. My spirits plummet if I look like a deranged bumpkin. I wonder about the guy at the garage saying my slipping fan belt was the result of a failing tortioner and besides the car is shit and I should junk it and buy one of his used ones. When the battery went dead I realized finally that the alternator had come loose. So I pried it up with a crowbar and tightened the bolt. Seems to be fine. Of course the shocks are gone, but I know where all the potholes are. Besides, it’s all down hill to town and I should be able to make it back with that load of kindling as long as I take the back road so as to not drive by the police station sounding like I’m on an over torqued Harley due to the rotten muffler on my 20 year old Ford Escort. Hey don’t laugh. It was paid for 15 years ago. Happy motoring!

I laugh at all the commercials on the tube for expensive European car’s that nobody can afford.

Its also amazing reading so many comments on the web about how great everything is. And what a great job the president is doing. The whole country is in denial.

What an amazingly infantile view of economics. Gas prices going down as a black swan? And what in the world do suburban sheeple know about common sense (gee daddy…how do I pour oil in this here little hole in my new fangled generator I might need if the world ends…how?….BECAUSE PRICE FOR THE FUEL IS GETTING MORE AFFORDABLE)?

Here is a clue for those still firmly entrenched in BAU and/or are as stupid as run of the mill suburban sheeple….gas prices going down sooner or later leads to prices going up, just as they have for decades. This happens because the basic market forces exist, and while suburban sheeple might not be familiar with them, many others are.

And those who have common sense (which doesn’t include suburban sheeple who can’t fix their own damn simple car problems) also understand that the best way to not give a crap about fuel prices is to not use as more than necessary, and let the ignorant city sheeple bitch their way into early heart attacks getting excited over it. We all know the type, they MUST drive a car for some reason, and it MUST use gasoline because damned if they are going to find an alternative, being suburban sheeple….and goodness where are we going to park our RV in suburbia!! The horror!

Thanks Reverse Engineer for keeping us updated on sheeple thinking and capabilities, its good to know that suburban sheeple are just as ignorant now as they were the last time I ventured into the big city…

[img [/img]

[/img]

Oil, as it traverses the seas, about 30 days, changes ownership, on average, 12 times, by people that never take actual posession of it.

What the drop in oil prices is, is a return to its true value. Walmart will probably see an uptick as other big box retailers and so also if these oil prices hold an uptick in savings for Joe Sixpack and more capital to be fractionalized by the banks.

Fracking is about to hit the shitter, IMO, as when oil goes below 80 a barrel so goes fracking.

“Fracking is about to hit the shitter, IMO, as when oil goes below 80 a barrel so goes fracking. “– KB

[img [/img]

[/img]

WTI below $78.

There will be some new Ghost Towns in ND soon.

[img [/img]

[/img]

RE

Bah. Wrong graph.

[img [/img]

[/img]

Bill says: Oil, as it traverses the seas, about 30 days, changes ownership, on average, 12 times, by people that never take actual posession of it.

So when buying and selling a commodity, there are always the winners and losers. Direction of the price doesn’t matter, there is money to be made when it moves in either direction.

But the consumer is only interested when it goes one way. Which according to the economic genius with no common fucking sense is now a black swan.

Bill says:

Fracking is about to hit the shitter, IMO, as when oil goes below 80 a barrel so goes fracking.

Between about 1948 and 1955 there were more than 100,000 frack jobs that had already been completed. The price of oil between 1948 and 1955 varied from about $7-$4 nominal perhaps? $25-$22/bbl in 2008 dollars?

Seems like if they could be doing frac jobs under those price conditions, oil might have to fall a little farther to stop the companies from doing it anymore.

And certainly they won’t stop doing it for natural gas just because oil prices are coming down and/or returning to normal, folks are continue to demand natural gas to heat their homes and water, and the EPA is nearly requiring it for future power generation.

I have a sense or ESP flash that MKing is present.

The local gold mines, Tropico and Golden Queen, on hold since ’96, are coming back on line. They will be tunneling instead of strip mining but still, why did Rio Tinto wait so long?

Gail Tverberg put up a pretty good one on Our Finite World

Also, Steve Ludlum on Economic Undertow dropped on a good analysis

Ugo Bardi on Resource Crisis has 2 good ones up now

http://cassandralegacy.blogspot.com/2014/11/the-oil-crash-it-is-happening-now.html

http://cassandralegacy.blogspot.com/2014/11/the-crash-of-oil-prices-and-european.html

RE