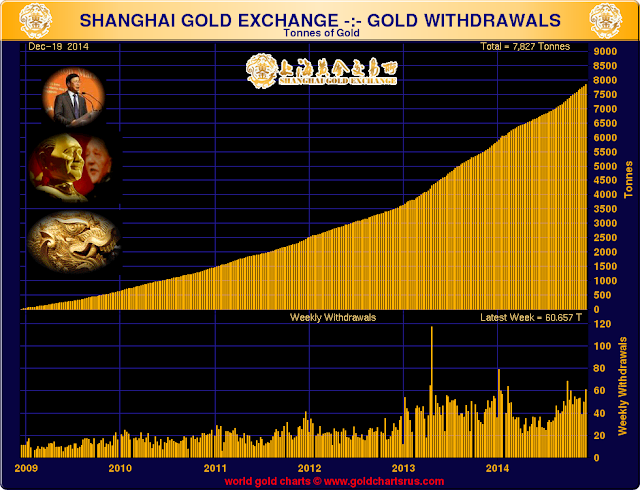

It seems someone is thankful the western financial interests have chosen to suppress the price of the barbaric relic. The west will be left with paper, while the east will hold the metal. China took 60.657 tonnes of gold through the Shanghai Gold Exchange in the week ending December 19th. The existing social order will be swept away in a tsunami of consequences.

Really?

Central banks have ruled the universe for how long? How…how is this going to change exactly?

2014-12-28 06:15 by Karl Denninger

Hidden In This Little Ditty….

Hoh hoh hoh….

Blackrock, like most asset managers, puts forward a year-end review and forward look. This one’s pretty decent, generally speaking. But you have to read these things for content, and remember that Blackrock is selling something — themselves, or more-specifically, their management services.

There’s a real problem in here and unfortunately Blackrock identifies the what and how but not the why:

Corporate earnings are a key risk. Analysts predict double digit growth in 2015, yet such high expectations will be tough to meet. Companies have picked the low-hanging fruit by slashing costs since the financial crisis. How do you generate 10% earnings-per-share growth when nominal GDP growth is just 4%?

It becomes tempting to take on too much leverage, use financial wizardry to reward shareholders or even stretch accounting principles. S&P 500 profits are 86% higher than they would be if accounting standards of the national accounts were used, Pelham Smithers Associates notes. And the gap between the two measures is widening, the research firm finds.

Remember that there are multiple people that have and do claim that this 10% EPS growth is “normal.” They’re wrong and they’ve always been wrong — intentionally wrong. This is pretty-much the definition of a con job — knowingly putting forward something that happens to have a historical basis but intentionally omitting why it happened, particularly when it can’t happen any more.

What led to this 10% EPS growth? The components are pretty simple if you remember that EPS growth is stated in nominal dollars: GDP expansion (nominal) + productivity growth + financial leverage increase.

The problem is that you have to back out financial leverage increase, that is, the expansion of systemic debt in the currency irrespective of the issuer, in order to find real GDP expansion.

This is a basic principle of algebra and equations, which always balance. Since GDP is stated in “dollars” one must adjust the “growth” for the number of dollars that exist.

When you do this what you find is that there has been no expansion at all over the last 30 years; it has all been debt.

This in turn means that the entire “bull market” since 1980 has all been debt-fueled rather than production fueled. It is by definition a ponzi scheme; in order for it to continue the issuance of that debt must continue at an exponentially-expanding rate and in order for that to be possible rates must continue to fall so that you can refinance existing debt, take on more and yet pay the same coupon expense.

For the last 30 years this has been a secular trend. But all trends must eventually end, and zero is one of those boundaries that is pretty firm. As has been said by many with regard to a particular stock’s potential price there is very strong support at zero.

The same is true for interest rates. And as rates approach zero the leverage returned from borrowing goes parabolic. This is the part of the curve we are now in — the terminal part.

Exactly where does it break and reverse? Nobody knows, but if you’re looking for a reason to be “in” right now you’re frankly quite nuts. If you believe the S&P earnings figures then you also have to believe the other government numbers, including the inflation numbers. Why take the risk of being on the wrong end of that cusp if your money is not being eroded by inflation?

The higher something is pumped in this fashion the more catastrophic the collapse. 80 or even 90% collapses in stock prices are not that unusual, and 50% declines are utterly common. One must look at horizons; it’s all fine and well to say that “over time stocks return more” but this assumes you don’t need the money during one of the declines!

If you’re that good at planning what’s on tap for your life and capital requirements then have at it, but right now you’re not being paid for the risk — a level of risk that’s materially higher today than it was in 1999 — or 2007.

Gold target 700 or less

http://youtu.be/q9gnBe37k34

“China took 60.657 tonnes of gold through the Shanghai Gold Exchange in the week ending December 19th.”

—-from the chart

Damn, that’s over $2 billion in gold in 1 week by 1 country. China must have a seriously large safety deposit box.

Gee…do I buy treasuries or gold at depressed prices…such difficult decisions.

John b watch the video I posted and follow that advice like your fucking life depends on it it.

Thank me later!!

you also have to remember that China received 2 billion dollars in physical gold in the end of December because they have a trade agreement with Russian now and their trading in gold Russia is buying goods from China in gold in China is buying oil from Russia in gold both of them are taking the American dollar and buying gold. better have yourself some food and water golden silver price Jesus for life the God of Abraham Isaac and Jacob

Gold Held In NY Fed Vault Drops To Lowest In 21st Century After Biggest Monthly Withdrawal Since 2001

Submitted by Tyler Durden on 12/29/2014 17:21 -0500

Exactly one month ago we observed that, as expected in the aftermath of the Netherlands’ shocking and still not fully-explained gold repatriation from the NY Fed, the amount of foreign earmarked gold on deposit with the Fed had just experienced a 42 ton withdrawal: the single largest outflow of gold held at the NY Fed in over a decade, going back all the way to 2001. This had brought the total amount of YTD gold withdrawals from the NY Fed to a whopping 119 tons: the most since the Lehman collapse.

However, because this total was insufficient to cover just the Dutch repatriation of gold from the NY Fed (which amounted to 122 tons), we knew there would be more activity when the November data hit. Sure enough, earlier today the Fed reported the total amount of earmarked gold (or gold “held in foreign and international accounts and valued at $42.22 per fine troy ounce; not included in the gold stock of the United States”) for the month of November: at $8.184 billion, this was a $60 million drop from the previous month (or it would be at the $42.22/ounce “price”; at market prices the value of the withdrawn gold is about $1.7 billion).

In actual tonnage terms, this means that in November some 47.1 tons of gold were withdrawn from the NY Fed, bringing the Fed’s total earmarked gold to just 6,029 tonnes: the biggest single monthly outflow going back to the turn of the century. This is also the lowest amount of gold held at the NY Fed vault located at 33 Liberty street (and just across from the even bigger vault located at 1 Chase Manhattan Plaza) in the 21st century.

[img [/img]

[/img]

But even more notable is that with the November data, we now know that all of the Dutch repatriated gold is fully accounted for.

Which brings up a far more important question: net of the Netherlands withdrawals, there is some 44 tons of extra gold that has been also quietly redeemed (by another entity). The question is who: is it now the turn of Austria to reveal in a few weeks that it too, secretly, withdrew some 40+ tons of gold from “safe keeping” in the US? Or was it Belgium? Or did the Dutch simply decide to haul back some more. Or did Germany finally get over its “logistical complications” which prevented it from transporting more than just a laughable 5 tons in 2013? And most importantly, did Germany finally grow a pair and decide not to let “diplomatic difficulties” stand between it and its gold?

We should have the official answer shortly, but we know one thing: it sure wasn’t Ukraine.

Sensetti, I listened to that interview and Hunter called him on that bullshit advice of having your wealth in an investment account in your own name. Dent started to backpedal to qualify what he said.

I’m not saying he’s wrong about metals but if you understand metals advantage, you’re not looking for it to appreciate. Appreciation is a potential side effect and it might just turn out that I can pay my house off with one or two ounces of gold but that is not what I own it for. I’ll take advantage if it happens but I don’t have any plan to ever sell metals. My hope would be that I’m able to borrow against it tax free using it as collateral if/when I need to use that asset. What Dent is talking about are the commodity traders leveraging up and trading on margin. Regardless of what happens to the traders, my pile of shiny stuff remains intact, shiny and unencumbered.