Betcha didn’t see that coming.

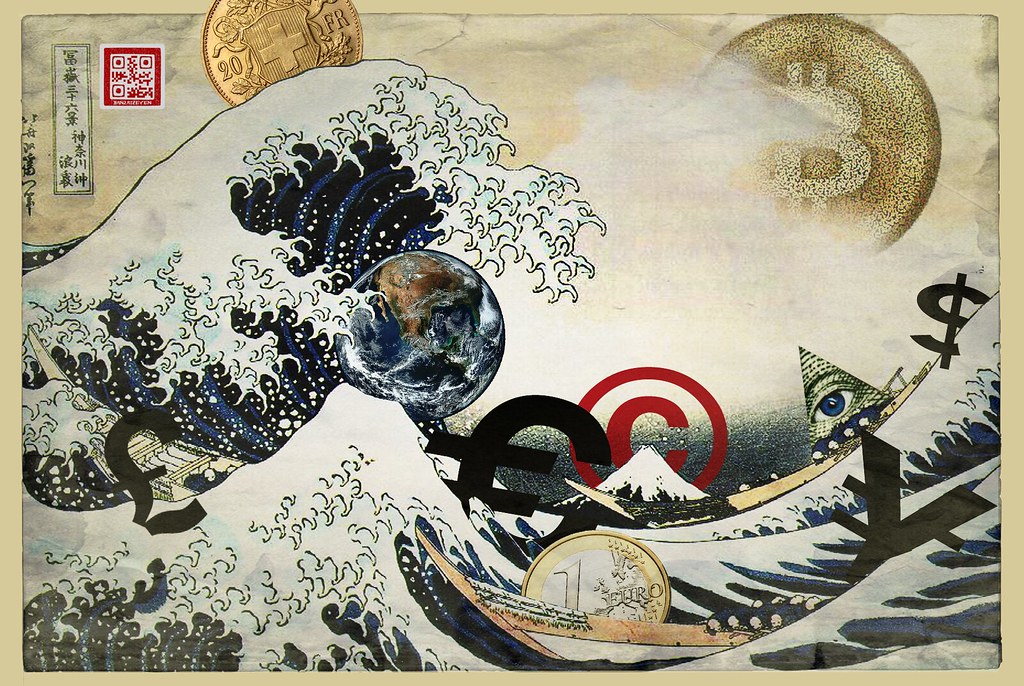

“It’s A Tsunami” – Swiss Franc Soars Most Ever After SNB Abandons EURCHF Floor; Macro Hedge Funds Crushed

Submitted by Tyler Durden on 01/15/2015 06:07 -0500

“As if millions of macro hedge funds suddenly cried out in terror and were suddenly silenced”

Over two decades ago, George Soros took on the Bank of England, and won. Less than two hours ago the Swiss National Bank took on virtually every single macro hedge fund, the vast majority of which were short the Swiss Franc and crushed them, when it announced, first, that it would go further into NIRP, pushing its interest rate on deposit balances even more negative from -0.25% to -0.75%, a move which in itself would have been unprecedented and, second, announcing that the 1.20 EURCHF floor it had instituted in September 2011, the day gold hit its all time nominal high, was no more.

What happened next was truly shock and awe as algo after algo saw their EURCHF 1.1999 stops hit, and moments thereafter the EURCHF pair crashed to less then 0.75, margining out virtually every single long EURCHF position, before finally rebounding to a level just above 1.00, which is where it was trading just before the SNB instituted the currency floor over three years ago.

Visually:

The SNB press release:

Swiss National Bank discontinues minimum exchange rate and lowers interest rate to –0.75%

Target range moved further into negative territory

The Swiss National Bank (SNB) is discontinuing the minimum exchange rate of CHF 1.20 per euro. At the same time, it is lowering the interest rate on sight deposit account balances that exceed a given exemption threshold by 0.5 percentage points, to ?0.75%. It is moving the target range for the three-month Libor further into negative territory, to between –1.25% and -0.25%, from the current range of between -0.75% and 0.25%.

The minimum exchange rate was introduced during a period of exceptional overvaluation of the Swiss franc and an extremely high level of uncertainty on the financial markets. This exceptional and temporary measure protected the Swiss economy from serious harm. While the Swiss franc is still high, the overvaluation has decreased as a whole since the introduction of the minimum exchange rate. The economy was able to take advantage of this phase to adjust to the new situation.

Recently, divergences between the monetary policies of the major currency areas have increased significantly – a trend that is likely to become even more pronounced. The euro has depreciated considerably against the US dollar and this, in turn, has caused the Swiss franc to weaken against the US dollar. In these circumstances, the SNB concluded that enforcing and maintaining the minimum exchange rate for the Swiss franc against the euro is no longer justified.

The SNB is lowering interest rates significantly to ensure that the discontinuation of the minimum exchange rate does not lead to an inappropriate tightening of monetary conditions. The SNB will continue to take account of the exchange rate situation in formulating its monetary policy in future. If necessary, it will therefore remain active in the foreign exchange market to influence monetary conditions.

The resultant move across all currency pairs has seen the EUR and USD sliding, the USDJPY crashing, and US futures tumbling even as European stocks plunged only to kneejerk higher as markets are in clear turmoil and nobody knows just what is going on right now.

In other asset classes, Treasury yields, understanably plunged across the entire world, and the entire Swiss bond curve lest of the 10 Year is now negative, with the On The Run itself threatening to go negative soon. Crude and other commodities, except gold, are also tumbling, as are most risk assets over concerns what today’s epic margin call will mean when the closing bell arrives.

An immediate, and amusing, soundbite came from the CEO of Swatch Nick Hayek who said that “words fail me” at the SNB action: “Today’s SNB action is a tsunami for the export industry and for tourism, and finally for the entire country.” More from Reuters:

Swatch Group UHR.VX Chief Executive Nick Hayek called the Swiss National Bank’s decision to discontinue the minimum exchange rate on the Swiss franc a “tsunami” for the Alpine country and its economy.

“Words fail me! Jordan is not only the name of the SNB president, but also of a river… and today’s SNB action is a tsunami; for the export industry and for tourism, and finally for the entire country,” Hayek said in an emailed statement on Thursday.

Swiss watchmakers, which are also grappling with weak demand in Asia, are very exposed to moves in the Swiss franc exchange rate because their production costs are largely in Swiss francs, but most of their sales are done abroad.

Shares in Swatch Group fell 15 percent at 1056 GMT, while Richemont CFR.VX was down 14 percent, underperforming a 9 percent drop in the Swiss market index .SSMI following the SNB’s announcement.

“Absolutely shocking … For companies with international operations – translated earnings are going to be lower and if companies make products in Switzerland it is going to hurt margin. It is a terrible day for corporate Switzerland,” Kepler Cheuvreux analyst Jon Cox said

Indeed, in retrospect, it does seem foolhardy that the SNB, whose balance sheet ballooned to record proportions just to defends it currency for over three years would give up so easily. The one silver lining, so to say, is that gold prices in CHF just crashed by some 13%.

However, the best soundbites today will surely come from US hedge funds which are just waking up to the biggest FX shocked in years, and of course, any retail investors who may have been long the EURCHF, and who are not only facing epic margin calls, but are unable to cover their positions, and one after another retail FX brokerage has commenced “Rubling” the Swissy and as CHF pair as suddenly not available for trading.

To say that today will be interesting, is an understatement.

Market Wrap: “It’s Turmoil” – Overnight Gains Wiped Out, Futures Trade Below 2000 On SNB “Shock And Awe”

Submitted by Tyler Durden on 01/15/2015 06:56 -0500

To paraphrase a trader who walked into the biggest FX clusterfuck in years, “it’s total, unprecedented market turmoil.” So while the world gets a grip on what today’s historic move by the SNB means, which judging by the record 13% collapse in the Swiss Stock Market shows clearly that the SNB market put is dead and the SNB may be the first central-banking hedge fund which just folded (we can’t wait to see what the SNB P&L losses on its EURCHF holdings will be), here is what has happened so far for anyone unlucky enough to be walking into the carnage some 2 hours late.

Session highlights courtesy of RanSquawk

SNB surprise the market by calling an end to their minimum exchange rate and lower their interest rate to -0.75%

Initial reaction EUR/CHF briefly fell ~35 points (30%) while USD/CHF dropped its most since 1971. In sympathy EUR/USD printed an 11yr low at 1.1580 and the SMI remains down ~9% for the session

Looking forward SNB’s Jordan is due to hold a press conference to explain today’s decision at 1215GMT/0615CST. Major data from the States come in the form of Empire manufacturing, PPI, Philly Fed, EIA nat gas storage change as well as earnings from the likes of Citigroup, Bank of America and Intel.

**SNB DROPS CHF FLOOR AND CUT RATES**

The trading day was off to a quiet start ahead of US data and earnings later today when the SNB decided to drop the bombshell. In a surprise and unscheduled announcement the SNB called an end to their minimum exchange rate and lowered their interest rate to -0.75%, concluding that the CHF cap was no longer justified. In an initial reaction EUR/CHF dropped like a stone with USD/CHF marking its biggest fall since 1971, while EUR/USD printed an 11yr low at 1.1580. From a stock perspective the SMI fell 8% as the strength in the local currency is likely to impact negatively corporate profits as well as the Swiss economy itself which has already been battling a currency that was too strong even when the floor was in place. The move has also resulted in weakness in the HUF and PLN as both have relatively large loan exposure to Switzerland. Once the dust settled European stock futures bounced off the lows as EUR/CHF pared approximately half of the initial 30% move lower in the cross now trading around 1.05. This also came amid unconfirmed market talk that the SNB were back into the market helping prop up the currency from its lowest level.

Looking ahead we will see how the US interpret the news especially given the timing as we head closer towards the scheduled ECB rate decision due on the 22nd of January where it is broadly expected that the ECB will announce QE. Snap analysis from some banks suggests that the SNB may well have taken pre-emptive action ahead of anticipated ECB action by scrapping the floor as the cost would have been amplified by the drop in the EUR allied to cutting rates in order to deter market participants from parking their cash at the Swiss central bank.

FIXED INCOME/EQUITIES

The European curve is seen flatter this morning as a result of the surprise announcement from the SNB which is likely to further fuel the flames of ECB QE at the looming meeting next Thursday (22nd). Bund futures spiked higher on the release of the Swiss news tripping stops on the rise to further exacerbate the gains with the German 10yr yield now at 0.472%. In equity market the SMI is the standout trading down in excess of 9% as fears that strength in the local currency is likely to impact negatively corporate profits, particularly when there are large export names such as Nestle, Roche and Swatch based in the country.

OTHER FX NEWS

Overnight AUD outperformed bolstered by a stellar December jobs report (Employment Change +37.4k vs. Exp. +5.0k (Prev. +42.7k, Rev. +45.0k) and a fall in the unemployment rate to 6.1% from 6.3%, supported by a surge in full-time employment 41.6k (Prev. 1.8k).

In other news of note, the RBI unexpectedly cut its Repo Rate by 25bps to 7.75% from 8.00% in a surprise move in an attempt to curb falling inflation. The central bank also cut its Reverse Repo Rate by 25bps to 6.75% but kept the cash reserve ratio unchanged at 4.00%. (BBG)

COMMODITIES

Overnight, the commodities complex staged a recovery as Brent crude broke back above the USD 50 handle and WTI rallied to trade near USD 50/bbl it’s the biggest surge in two-and-a-half years. Although, WTI and Brent has since come off best levels in the European session. Furthermore, COMEX copper prices have traded slightly rebounded from yesterday’s sharp decline to 5 and-a-half year lows providing the material sector with some reprieve. As we head toward the North American session, gold is testing its 200DMA at USD 1253.47 and has not traded above there since August 2014.

UBS’ Take On The Swiss Shocker: “The SNB’s Standing Is Undermined… There Could Be A Significant Deflationary Shock”

Submitted by Tyler Durden on 01/15/2015 08:01 -0500

From UBS’ Beat Siegenthaler:

No more floor

The SNB today dropped the 1.20 EURCHF floor while at the same time lowering the negative interest rate on sight deposits to -0.75% from -0.25% previously, as well as moving the 3m Libor target to between -0.25% and -0.75%. The SNB argues that the floor was an exceptional and temporary measure that ‘protected the Swiss economy from serious harm’ but that the economy had had time to adjust to the new situation. It continues to argue that the franc had recently depreciated ‘considerably’ against the dollar. ‘In these circumstances, the SNB concluded that enforcing the minimum exchange rate for the Swiss franc against the euro is no longer justified’.

Dramatic market impact

The announcement has had a dramatic impact on markets with EURCHF initially dropping 40% to almost 0.85. It quickly reversed seemingly with the help of SNB interventions at levels just above parity to the euro. The statement noted that ‘if necessary’ the central bank will ‘remain active in the foreign exchange market to influence monetary conditions’. The SMI equity index dropped by more than 8% on the news and has recovered little since. On the rates side cross currency basis moved around another 20bp lower.

Economic repercussions

It would seem likely that today’s decision will have significant ramifications in Switzerland as very few observers expected the floor to be dropped with some arguing that it looked set to remain in place for years. Unless EURCHF was to recover back to levels much closer to the old 1.20 floor, the economy could be significantly impacted, as seems well reflected in the reaction of equity prices. At levels close to parity many businesses and investment decisions might not be seen as viable anymore and over time a significant volume of economic production could move outside the country. If so, there could be a significant deflationary shock possibly not too dissimilar to the one Switzerland might have suffered had the floor not been introduced in 2011.

Hope of a limited drop

Where will EURCHF settle after today? The big question is whether investors will want to buy Swiss francs despite substantially negative interest rates and at clearly expensive levels. Nevertheless, safe haven flows have so far demonstrated a remarkable stickiness which can be expected to continue as long as global risk aversion reigns. The SNB might be hoping to be able to stabilise EURCHF at around 1.10 which may be deemed a level that the economy can cope with. However, defending such a level might still be quite costly assuming that global risk aversion continues to linger.

Credibility cost

The other question is about the cost of today’s decision for the SNB, both in monetary and credibility terms. The SNB is holding roughly half of their CHF500bn in euros, which implies a loss of possibly not dissimilar to the CHF38bn that the SNB made in profit last year. The monetary impact might thus be manageable. The credibility impact might be harder to gauge though. Domestically, many economic actors relied on what was seen as a ‘promise’ to hold the 1.20 floor. Internationally, following the negative rates confusion back in December today’s decision might be further undermined the standing of the SNB among investors.

As a long-time follower of Bruce Krasting I was/am long FXF. All I can say is “It’s about fucking time.” Don’t know what those guys were thinking trying to peg to the failed monetary experiment of the Euro. Glad they finally got their head out of their ass.

Was it the SNB that just lit the fuse on the gold rocket? Sure looks like it.

Breaking news: Russia will completely stop the delivery of gaz through the Ukraine

First, I was a little skeptical. Then more and more sources confirmed what seems to be a fact: Russia will completely stop the delivery of gaz through the Ukraine and all Russian gaz will now flow through Turkey (see Bloomberg and LifeNews). Not only that, but the Russians have told the Europeans that if they want Russian gaz, they will have to build their own pipeline to Turkey at pay for it all.

Putin and Miller

The Europeans appear to be shell-shocked. Maros Sefcovic, the European Commission’s vice president for energy union, declared that this decision made “no economic sense”. As if the nonstop economic and political warfare waged by the EU against Russia did make any sense!

I can image the faces of the Eurobureaucrats when Alexei Miller, the head of Gazprom, told them that “now it is up to them to put in place the necessary infrastructure starting from the Turkish-Greek border” while the Russian Energy Minister Novak added that “the decision has been made, we are diversifying and eliminating the risks of unreliable countries that caused problems in past years, including for European consumers.”

In other words, the EU just lost it all and so did the Ukraine. Keep in mind that the EU has no other options then to purchase the Russian gas from Turkey while Russia can simply do without gaz exports to Europe because China has already signed a contract covering the exact same amount of gaz and possibly much more.

Let’s see now how the infinitely corrupt, arrogant, criminally irresponsible European elites will cope with an agriculture choking in useless surplus stocks, a society waging ideological war on 1.6 billion Muslims, and now with no energy.

The always irreplaceable Poles have come up with a brilliant strategy it appears: they will “not really” invite Putin to the commemoration of the liberation of Auschwitz even though Auschwitz was liberated by the Soviet military. I am sure that Putin will be both impressed and heartbroken.

Nowadays every time I hear any news out of Europe, I always think that Victoria Nuland’s famous “f**k the EU” and how Boris Johnson, the Mayor of London, called his colleagues the “great supine protoplasmic invertebrate jellies”. I share exactly the same sentiments: let them “Charlies” now freeze in their own pathetic mediocrity.

The Saker

So just how many fucking Euros did the Swiss National Bank buy since it pegged the the Swiss Franc?

I take it the result of the rise in the Swiss Franc from 1.20 Swiss Francs to buy one Euro to .75 Swiss Francs to buy 1 Euro resulted from dumping the Euro out of the Vaults of the Swiss Bank?

Switzerland took a bath. But might as well hedge against disaster if The Greek elections don’t go the way the thugs in Brussels want.

” … a [European] society waging ideological war on 1.6 billion Muslims ” —- The Deluded Saker

The motherfuckin’ pussified libtard politically correct Eurotrash are waging idealogical war on 1.6 billion mooslims??? Are you shittin’ me?

I guess he’s unaware that a hundred thousand German citizens (and those from other Eurocrap nations also) have protested IN FAVOR OF loving and accepting mooslims?

The Saker has turned into one big deluded dick.

The Swiss Central bank lost 60 billion francs in one day.

60 billion francs …. or about 20 minutes on that debt clock thingy on the right.

Thanks Administrator. That a lot of money for a country of 8 million people. Over 2.5 trillion U.S. dollars if the Fed did this. Or about a loss of $7,500 per person .

Excuse me for being a simple minded person. Why didn’t exporters just tell all their employes to just take a pay cut every time the Swiss Franc rose in value?

The exporter could reduce their prices and the employee would be able to buy just as much with a reduced salary via deflation?

2015-01-15 09:29 by Karl Denninger

Here It Comes (Swissy)

Gee, what do you think this means?

(Reuters) – The Swiss National Bank (SNB) shocked financial markets on Thursday by scrapping a three-year-old cap on the franc, sending the safe-haven currency soaring through the 1.20 per euro limit and stoking fears about the export-reliant Swiss economy.

The Swissy blew upward roughly 30% against the Euro in seconds.

Note that currency traders are frequently levered 50 or even 100:1, and derivatives written against currency positions are often levered to that sort of degree as well — or more. The reason this is “allowed” by various regulators is that it is believed that no currency will actually go to zero, or at least not so quickly as to be unable to be dealt with.

Well?

Anyone offsides on this trade when it blew has an asteroid lodged up their butthole this morning.

The lesson here is similar to that learned (painfully) by anyone short BlackBerry yesterday afternoon, and then again by anyone who chased that trade when the stock blew upward by 30% in seconds — if you are on margin and do something like this, and are wrong, you’re dead several hundred times over and your smoking corpse instantly becomes someone else’s problem.

The premise that such things “can’t happen” is flatly false — and every time this sort of thing happens someone tries to offload the explosion on others — their customers or the taxpayer, usually.

Any such attempt must be treated as theft by extortion, at gunpoint — because it is — and those who advocate or execute same must find that not only is their demand turned back but they must find themselves in the dock facing life imprisonment for their attempt at armed robbery of an entire nation.

Here’s looking at you, Bernanke (among others.)

Swim, fucker

It looks like Putin wants to place a bet on the currency Rusian Roulette Wheel as well by divorcing the petro dollar.

I would prefer to get paid in a currency that is increasing in value as opposed to decreasing in value. Hey, that’s me.

But Putin is taking the opposite bet. That traders will buy futures in Rubles to buy Russian Oil and that the future Ruble will appreciate.

All the while Putin will be selling dollars to buy Rubles and print Rubles all at the same time!

Yeah, talk about Hyper-Inflation.

For presumly a shrewed man Putin is awefully dumb. Then again his shrewdness was all about being a thug.

As if this could not have been predicted when they tied their currency to the EU back in the aftermath of our outlying disaster of ’08.

What is artificially maintained usually cannot be naturally maintained after it is completely destroyed.

Funny shit.

Then comes @Mark, ” …Why didn’t exporters just tell all their employes to just take a pay cut every time the Swiss Franc rose in value?…”

Maybe because the Swiss, along with the rest of Europe, and don’t forget our following of their economic policies, do not have enough exports to make up for what must be imported.

I know this concept is completely outside the realm of what most of my fellow citizens think is possible. But I know, with conviction, that we are in the same, but worse off, boat.

Europe decided a few decades back to regulate and strangle industry and small business at every level. They offshored their wealth producing jobs, while importing foreigners, and virtually strangling all non-government mandated/connected businesses out of existence. Enter Asia.

So, seeing the beauty of covering up loss of middle class and industry, they doubled down on government spending and then lying about it. Wars, “health,” diversity, wealth and fame for our keepers.

The truth is the West is toast once the Asians decide our money isn’t worth shit. Russia, India, China, Brazil are all taking hits against OUR reserve status. What happens in places like Japan and now Switzerland is going to be very telling. AND, we have already seen part of this play out in Cyprus.

Currency takes a hit, markets take hits, panic takes hold, stealing from savers is the stated, and documented, and tried and true, plan to kick the can a little bit more.

Which will destroy another remaining strata of the productive middle, thus solidifying the continued path to destruction.

Or not. As all the “smart” investors I know are repeating (ad nauseum), “can’t happen here,” “reserve status,” “full faith and credit,” “world needs our crap,” “exports,” “energy” and my absolute favorite, “the markets ALWAYS come back.”

Good luck all. Our wait appears to be nearing its end…

TE but the Swiss don’t need to export as much as they import. Because people Trust their currency as a store of value. The same can’t be said of the countries that export to them.

The company Swatch is up in arms today. Why should they be? They now import commodities and perhaps manufacturing equipment at a much lower price. Why not just cut their prices 30% and employees salaries 30%?

Why should a currency make that much of a difference to a profitable business that manufactures something that others want?

True, any suppliers to an exporter will be put out of business by a foreign competitor. But why don’t they reduce wages as well until they are competitive?

Are Unions involved? They certainly would be in France. If so, the person who works at Swatch would not agree to huge pay cuts if the local grocery clerks salary stay the same.

But then again with respect to the grocery store clerk we are talking about the same thing again and that’s Deflation .

We are fast approaching a new economic model that will have to take account for currency fluctuations. How it shakes out is anyone’s guess.

I have never been good with this currency stuff.

I would appreciate it if someone would use little words and household analogies to explain to me what all this fuss is about – who is screwed and why?

Did the SNB work in conjunction with the BIS and all the other CB’s – or is this a renegade act?

Who benefits in either scenario?

It was suspicious that Japan went QE crazy the day after we “supposedly” started to taper – could this be another curiosity?

@Mark, good points IF the bulk of their daily requirements/needs (food, medicines, toilet paper, taxes, computer chips and energy) is not imported.

Exporting overpriced watches CANNOT make up for the hit on importing tonight’s dinner and heat for your furnace.

So say Swatch reacts faster than any age-old behemoth of a company/organization has EVER moved, and resets the salaries (which, seeing as how it is Switzerland, may very well be mandated by law and not able to be reduced, see what happened when our automakers followed this model with their union contracts, 95% pay when laid off equates to corporate bankruptcy when sales cannot compensate). Will the increases in imported energy be affordable to a person with a 30% reduction in pay?

THAT is what I’m talking about. Maybe I’m wrong, but I believe the Swiss went along with the shutting down of productive businesses in the name of global positioning, safety and the like.

@Olga, that is a great idea. I still don’t have a firm grasp of currency, especially foreign not closely related to US. gov fiat, and an article like that would be great. Anybody here have the chops to produce it already?

Blast From The (Recent) Past: Jim Grant Nails The SNB Decision

Via Jim Grant,

The Balance Sheet That Ate Switzerland

(Grant’s, September 19, 2014) Like a celebrity in flight from the paparazzi, the Swiss Confederation demands protection from its pesky admirers. To beat back the unwanted appreciation of the Swissie, the Swiss National Bank is–once again–vowing to move heaven and earth. Now under way is a speculation. Prompted by a friend (that’s you, Harlan Batrus), we venture that the SNB will sooner or later be forced to permit the franc to appreciate and thus to enrich the holders of low-priced, three-year call options on the Swiss/euro exchange rate. It’s a long shot, to be sure–the options are cheap for a reason–but we judge that the prospective reward is worth the obvious risk.

Curiously, for all the damage that Swiss private banks have suffered at the hands of American regulators, and for all the Federal Reserve’s throat clearing about the supposed imminent rise in dollar interest rates, the franc is still, for many, the monetary bolt-hole of choice. To the Swiss, whose exports generate 54% of Switzerland’s GDP, it’s a kind of popularity they can live without–indeed, they insist, must live without.

So the SNB prints francs. It drew a monetary line in the sand three years ago: The franc shall not rally through the 1.20-to-the-euro mark, the authorities commanded in September 2011. To enforce this dictum, they bought euros with newly created francs (the cost of production of the home currency being essentially zero). What to do with the rising euro mountain? Invest it, of course.

CFA fashion, the central bankers are diversifying across asset classes and currencies. Among these asset classes are equities, and among these currencies is the dollar. As of June 30, the Swiss managers held $27 billion in 2,533 different U.S. stocks, according to the bank’s latest 13-F report (the gnomes file with the SEC just like ordinary big hitters, say George Soros or Goldman Sachs Asset Management).

Here’s a metaphysical head scratcher. The Europeans conjure euros, which the Swiss buy with their newly materialized francs. The managers exchange the euros for dollars (also produced by taps on a keyboard) and with that scrip buy ownership interests in real businesses. The equities are genuine. The money, legally and practically speaking, is itself real–you never mind having a little more of it. But what is its substance? We mean, how is it different from air?

In any case, observes colleague Evan Lorenz, the scale of the Swiss operations is titanic. He reports that, from December 2007 to July 2014, the SNB’s balance sheet expanded to the equivalent of 83% of Swiss GDP from 23% of Swiss GDP. For perspective, over approximately the same span of years–and after three successive QE programs that boosted the Federal Reserve’s assets by $3.5 trillion–the Fed’s balance sheet as a percent of U.S. output expanded to 25% from 6%.

Swiss interest rates have shriveled as the SNB’s balance sheet has grown. Thus, in January 2008, the average rate on 10-year, fixed-rate mortgages was an already low 4.17%; as of June 2014, 10-year loans were offered at an average of 2.25%. “In other words,” Lorenz points out, “Swiss homeowners can borrow more cheaply than Uncle Sam.” They can and they do. From December 2007 to June of this year, Swiss mortgage debt as a share of GDP surged to 146% from 127%. (Between the first quarter of 2009 and the first quarter of 2014, chastened Americans reduced America’s mortgage debt as a share of American GDP to 55% from 74%.)

In these stupendous interventions, the SNB is hardly unique. Nor is it alone as it attempts to undo, through administrative means, the distortions it creates through monetary policy. New “macro-prudential” directives have tightened standards for home-loan amortization schedules, minimum down payments, affordability, bank capital ratios, etc.

Though the UBS Swiss Real Estate Bubble Index continues to flash “risk,” the mortgage market cooled a bit in the first half of the year, Philippe Béguelin, an editor at Finanz und Wirtschaft in Zurisch, advises Lorenz. Then, too, the foreign exchange market cooled late in 2013, which allowed the SNB to cease and desist from franc printing. Thus, the central bank’s assets declined to CHF 492.6 billion in February from a peak of CHF 511.7 billion in March 2013.

Russia’s accession of Crimea at the end of February reheated the forex market. ISIS and the Scottish referendum have continued to turn up the temperature. Business activity in China continues to dwindle (electricity production fell 2.2%, measured year-over-year, in August), and European growth registers barely above the zero line. On Sept. 4, Mario Draghi unveiled a plan for a kind of euro-zone QE. So growth in the SNB’s balance sheet has resumed. In July, the latest month for which figures are available, footings reached CHF 517.3 billion in July, a new high.

“If the drumbeat of bad news continues, why wouldn’t investors move more cash into Switzerland?” Lorenz inquires. “Successive rounds of easy money have made the opportunity cost of parking assets in Switzerland much lower today than at the outset of the SNB’s currency ceiling. True, the Swiss 10-year yield has declined to 0.49% from 0.93% since Nov. 1, 2011. But yields on the Irish, Spanish and Greek 10 years have also plummeted–to 1.88%, 2.33% and 5.69%, respectively, from 14.08%, 7.62% and 37.1%, respectively, at their euro-panic peaks. It no longer avails the income seeker much to gamble on second- and third-tier sovereign credits. Swiss yields are at rock bottom, but so are the rest of them. On the combined, undoubted authority of Deutsche Bank, Business Insider and Bloomberg, Dutch yields stand at a 500-year low.”

It’s a funny old world when frightened people turn to the Swissie, which the SNB is again mass-producing, rather than to gold, which nobody can mass produce. While the franc yields something to gold’s nothing, the spread is narrowing. And if as Thomas Moser, an alternate member of the SNB’s policy-setting Governing Board, suggested in a Sept. 10 interview with The Wall Street Journal, the SNB finally has recourse to negative rates, the barbarous relic will outyield the franc. Way back in the 1970s, relates Christopher Fildes, a delegation of foreign newspapermen were visiting the old Union Bank of Switzerland in Zurich. In response to a casual remark about the proverbial strength of the franc, a Swiss banker scoffed. “We do not say ‘as good as gold,'” declared this eminence. “Gold is not as good as the Swiss franc.” And now?

A bet on a higher Swiss/euro exchange rate implies that the SNB will stop intervening. What monetary or political forces might converge to persuade the bank that a strong franc is the lesser of two or more evils? “John Bull can stand anything but he can’t stand 2%,” the saying goes. It’s clear to listen to their anguished cries that broad segments of the life insurance industry can’t stand one-half of 1%. The Tokyo Stock Exchange TOPIX Insurance Index is essentially unchanged since 1994, the year that Japan government bond yields began their inexorable slide. “We are the collateral victims of the monetary policy which has been designed to help governments and banks after the financial crisis,” Denis Kessler, the CEO of Scor SE, the world’s fifth-largest reinsurer, complained at a London conference on June 24. “We were not at the heart of the crisis nor did we create the crisis.”

More money printing or sub-zero rates may once again set a fire under Swiss house prices, macro-prudential policies notwithstanding. It may ruin the life insurers. At some point, the Swiss National Bank would have to decide whether propping up the export sector is worth the cost. If these circumstances, a bet (and, to be clear, it is very much a bet) on the franc appreciating against the euro might pay. A three-year, at-the-money option on the franc appreciating against the euro is priced at 3.7% of notional today according to Bloomberg. To return to its high of 1.03 francs per euro on Aug. 10, 2011, the franc would appreciate by 17%.

While there is nothing especially exotic about this option, it is available only to institutional investors with an International Swaps and Derivatives Association agreement in place with a too-big-to-fail bank. For readers not so situated, there is always gold, which–in our opinion–the franc is no longer as good as.

TE

The price for heating your furnace and energy just got a whole lot cheaper for individuals and manufacturers in Switzerland today.

This is the whole point. Trust in government and morality have actual real tangible value.

Switzerland just isn’t as big and diverse as the United States to be the world currency.

Can Russia and Putin. Your Joking.

Can China eventually?

China doesn’t have extensive pension obligations, social welfare and Medicare or Obama care. Can they meet future obligations to pay a 30 year bond?

Maybe?

Eventually maybe Economists will come to see Richardos Comaritive Advantage is not what a country manufactures but rather how morally bankrupt, corrupt , and unable to live up to trust that investors put into a society and its government.

If people in a society understood this tenet they would compete to be more honest and trust worthy then other societies. And honesty would be tangibly rewarded.

It looks we are going down the dumbbell evil root however. And will eventually pay the price. Because people want their free lunch and the politician who gives it to them. Not realizing by not getting that free lunch they would have had a lifetime buffet , the curtesy of other more corrupt governments.

Largest Retail FX Broker Stock Crashes 90% As Swiss Contagion Spreads

Submitted by Tyler Durden on 01/16/2015 08:26 -0500

As we first reported last night, FXCM was among the first of many retail FX brokers (and the largest) to see its clients suffer massive losses from yesterday’s Swiss Franc surge following the SNB decision to unleash market forces. There are now at least 4 retail FX brokers (FXCM, Excel Markets, OANDA, and Alpari) who have announced “issues” but FXCM, being among the largest and publicly traded is the most transparent example of wjust what can go wrong when average joes are allowed 100:1 leverage. FXCM is now stuck chasing clients for money they do not (and will never) have.. and its stock is down 90%, trading a $2 this morning (down from $17 on Wednesday). As Credit Suisse notes, time is running out as regulators “tend to be impatient once capital requirements are breached.”

“FXCM is now stuck chasing clients for money they do not (and will never) have.. and its stock is down 90%…”

I wonder how many profitable stocks will be sold to pay for the loss’s of yesterdays move, and if that selling could start a ripple that grows to a tsunami?

“I have never been good with this currency stuff. I would appreciate it if someone would use little words and household analogies to explain to me what all this fuss is about – who is screwed and why?” —— Olga

Me no understand either! I mean, if the measly dollar in my pocket goes up 25% …. AIN’T THAT A GOOD THING …. at least for ME?? I guess not, but I don’t know why not.

Sooo, here is a SUGGESTION for Admin’s next Epic Post … write a tutorial for numnuts such as myself explaining exactly what you suggested, Olga. I honestly believe MANY would benefit and appreciate it.

Speaking of more dollars, is this a good thing, or a bad thing?

“WASHINGTON — The Internal Revenue Service is considering a temporary shutdown due to budget cuts, IRS Commissioner John Koskinen said, according to a report in Politico. Koskinen said that would be the “last option,” but every day the IRS would shut would save the agency $29 million. Koskinen has also warned IRS employees that overtime would be suspended and a hiring freeze enacted.”

No onion.

@Mark, (hello and welcome, btw), how did the Swiss get an energy rate cut? Didn’t Russia just fuck over Europe when it comes to heating their homes?

So, it occurs to me this morning that wasn’t it just Switzerland who went to the world’s only 100% digital currency country a couple years back?

Their citizens may find out the idiocy of trusting technology when you larder is empty.

With only digital “currency,” it will be SO easy to limit the expenditures of every single person, every single transaction, in the country.

If I could find a way to legally invest in the upcoming Swiss Black Market, I’d be in in a heartbeat.

Alright dammit, ignore the comment about cashless. That is Sweden, not Switzerland. Hey, at least I was close.

Still might be a great time to invest in black markets.

@Card, yep heard that a few days ago.

My gut feeling is that anytime a government agency is not working is a better time for us. Might just be my inherent dislike of idiocy bias.

They cut NOTHING from spending in Washington, the freaking budget and promises do nothing but GROW from here to eternity. All the “fixes” suggested never do anything but grow the spending bigger and bigger.

The fucking IRS was gifted thousands of employees and millions – if not billions – of dollars from O’care, I don’t know what shit the Feds are pulling, but there has to be some political hackery going on that will end up screwing us.

Instead of shutting down, they should work overtime dismantling the entire thing. It is not like our net tax dollars actually pay for anything anymore, taxes are used to prove whom owns our labors and talents, by the time we back out the cost of government collection, my bet is that the tax revenue left is a small drop in the spending bucket.

All I know is that when I look around this country and world, I see a HELL of a lot more Federal $$$ than what I see on the bullshit profit and loss they show us. Nearly EVERY “growing” business in my part of the state can trace their “growth” directly back to Fed Fiat. I’m seeing very little non-government paid for/mandated/supported success.

Don’t worry though, CONgress loves punishing us for their failures, I’m sure that the shut downs will only affect those taxpayers that have to pay. The free shit armies’ yearly Federal bonus checks will still be sent, probably not even delayed.

I ran a small public accounting office for around three years, I figured out by my second year that this is how the accounting world goes forth after college.

Top few percent of grads, if physically acceptable, are picked up by the big accounting houses (regional and national) and Fortune 1000 corporations. This group is where Controllers, CEOs and CFOs, CPA’s, CMA’s and VP of Finance types come from. Old boys club and unless born/married in, you have to be invited fresh out of college usually. Little known truths that most choose to ignore.

The meaty middle mainly used to go out and take jobs in the smaller companies and industries. These ones would be the guys that start as bookkeepers and accounting clerks, then work their way up to GMs and Accounting Managers/Directors or Controllers. You cannot become a CPA this way as you have to have auditing experience and it is mainly the national firms that are accepted auditors.

Finally, you have the bottom of the class. They may be stupid, or stoned, or drunk, or a student athlete, but they still received the same piece of paper as the two groups above. So they go forth, the smart private companies figure out they truly have no understanding of their own specialty, and the lucky ones (really freaking lucky) end up in government.

Though these bastards are paid WAY above their skill set, and they are promised this pay FOR LIFE, with luxury insurance benefits until the day they die (or their widows), AND they get more paid days off than god, the IRS walks around with huge chips on their shoulders, attitudes, and they are some of the biggest bullies I’ve ever met. They think the accountant they are dealing with is rich, then if they see that they actually make less than they do, they figure you are a thief because why else would you work cheap?

So, to bring an end to a long rant about the IRS, I think that evil delayed, is still a small relief. And better than nothing.

Damn, TE, that was a long rant.

Did you get your sales taxes done yesterday? We couldn’t file sales, use or withholding taxes electronically yesterday, the idiots weren’t ready even though they wanted it in electronic form, we had to resort to killing trees and send it on paper.

“Sooo, here is a SUGGESTION for Admin’s next Epic Post … write a tutorial for numnuts such as myself explaining exactly what you suggested, Olga. I honestly believe MANY would benefit and appreciate it.”

Stuck, talk the admin into explaining bond and treasury yields, I read and I read but my mind wanders.

@Card, I hate the IRS, simply hate them. The things I’ve heard their bastard agents say to people, along with the things I’ve seen them do, leaves me with no choice to harbor a deep mistrust and decades long bad taste.

I filed my withholding (no sales taxes, we are wholesale/out of state only) by mail. My understanding was that I don’t have start filing electronically until I pay January’s taxes in February. I figure I’ll be filing a paper form or mailing checks for awhile yet. After all it took them a couple years to allow online payment after they had their online form filing system up.

Doesn’t it seem that these complex systems are reaching closer to critical mass? Complexity upon complexity to the point they have forced our surrender.

The one problem our beloved protectors and bureaucrats are not acknowledging is that once something becomes more painful than productive, the production will cease. Isn’t doing business in Michigan ever nearing that point? Cripes, the freaking morons.

“The one problem our beloved protectors and bureaucrats are not acknowledging is that once something becomes more painful than productive, the production will cease. Isn’t doing business in Michigan ever nearing that point? Cripes, the freaking morons.”

I was hoping for five more years, but I’m not so sure us little guys are going to make it that long. There is just too much that is wrong with the system of taxation/government we have now, it will never be unraveled in time.

The way things are in politics and the way people believe in government, I fear nationalization of business will be next.

GOOD DAY

I’m David, i am from Delaware State, 7 DICKERSON ST HARRINGTON, DE 19952-1302

I AM ON THIS SITE TO SHARE BRIEFLY HOW I WAS HELPED AND WAS ABLE TO GET A LOAN THAT I HAVE BEEN BIDDING FOR, OVER A LONG TIME NOW..

I APPLIED FOR A LOAN IN ” HALIFAX ” AND I GOT MY LOAN FROM THEM. WITH A LOW COST OF INSURANCE, AND I GOT MY LOAN AT 4.50%.

ARE YOU LOOKING FOR A LOAN FOR ANY PROJECT? CONTACT HALIFAX BANK PLC FOR A STRESS FREE AND FAST LOAN.

THANK YOU, AND I WISH YOU GOOD LUCK IN ALL YOUR ENDEAVORS.

DAVID WADDLER (FACEBOOK ID)

CONTACT EMAIL: [email protected]