Since Hussman’s letters can get quite technical, I’ve picked out the essential message. There is nowhere to hide. Stocks and bonds are both extremely overvalued. So is real estate, collectibles and art.

We continue to observe one of the most overvalued, overbought, overbullish syndromes in the historical record, combined – and this feature is central – with deterioration in market internals suggestive of a shift toward risk-averse preferences among investors. The resulting combination places current conditions among instances that we identify as a “Who’s Who of Awful times to Invest” (see last week’s comment: Plan to Exit Stocks in the Next 8 Years? Exit Now). Based on historical outcomes associated with those prior instances (which prior to the current market cycle, include only 1929, 1972, 1987, 2000 and 2007), we continue to view the stock market as vulnerable to significant downside risk both in the near-term and over the completion of the present market cycle.

The early weeks of 2015 are the first time in history that both 10-year Treasury yields and our estimates of prospective 10-year nominal total returns for the S&P 500 have both declined below 2% annually. Even at the 2000 peak, when our 10-year total return projections were negative, the 10-year Treasury yield was 6.8%, and small capitalization stocks showed reasonable value, particularly on a relative basis. Presently, long-term bonds provide nowhere to hide, and median equity valuations exceed those at the 2000 peak on price/earnings, price/revenue, and enterprise value/EBITDA. Because of yield-seeking speculation, stock and bond prices today are already where they are likely to be many years from today. Prices are likely to experience an interesting and volatile trip to nowhere in the interim.

If we allow a slightly nearer reversion to historically normal valuations at some point before 2023, the 16-year projection of 4.94% would represent 8 years at X% followed by 8 years at 10%, implying an 8-year projected total return for the S&P 500 of nothing at all. Again, that strikes us as just about right.

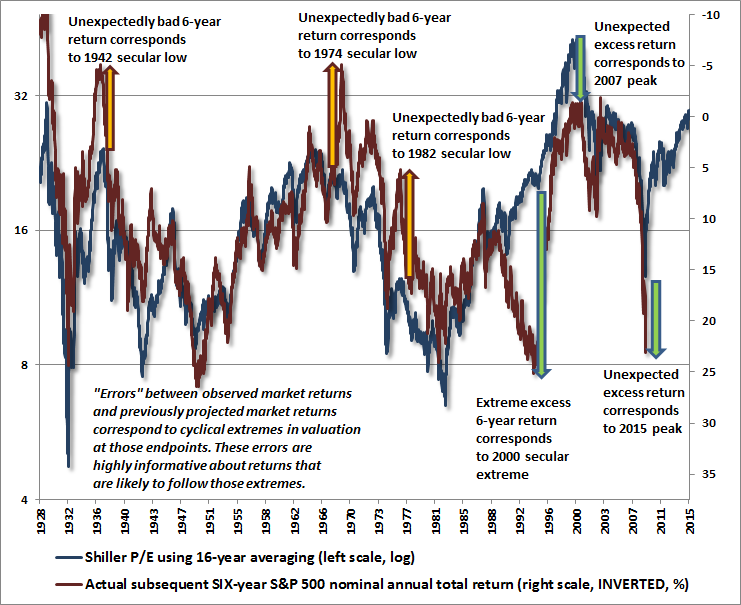

What you’ll observe is that while valuations were somewhat depressed relative to historical norms at the 2009 lows, actual market returns since then have substantially overshot what one would have projected at the time. What does that difference mean? It means that stock prices today (6 years after 2009) have advanced well beyond normal valuations, all the way to steep overvaluation. At present, the Shiller-16 (along with a broad range of other historically reliable valuation measures having strong correlation with actual subsequent returns) projects negative total returns for stocks on a 6-year horizon, even assuming continued growth in GDP, revenues, earnings, and other fundamentals. Indeed, current valuations match the levels observed at the 1929 peak. That certainly doesn’t imply that catastrophic losses are likely to follow (stocks lost 85% of their value from 1929 to 1932 as valuations collapsed from historic highs to historic lows). Still, we believe that projecting a loss for the S&P 500, including dividends, on a 6-year horizon, is an evidence-based estimate, reflecting assumptions that are very much in the middle-of-the road. In other words, we see that expectation as just about right.

Read John Hussman’s Weekly Letter

Stock prices never got “cheap” by historical standards in 2003 or 2009.

They’ve been in nut-case overvaluation since 1995, in fact, unless we posit that this is a “new era.”

In fact, it has been the greatest period of insane optimism ever. People have pawned everything, and then pawned their future earnings, and then the pawnshop took all those IOU’s and it PAWNED THEM….multiple times over.

Wimpy promised two hamburgers next week in payment for eating a hamburger today. Popeye took that “2 burgers next week” and promised 4 next week to Olive Oil, and she took the “4 promised next week” and promised 8 next month to Brutus….and so on, and so on.

Each participant then put the future burgers they were owed into their asset ledger, and (feeling wealthy) went out on a shopping spree….placing it on credit cards because their wealth will all flow in before the bills are due.

All of it rests on Wimpy, a known deadbeat, who hasn’t met a demand to satisfy an IOU in his life.

Everyone thus thinks they “own” that wealth. They think they’ll collect their pension payments, “their” social security payments, “their” Medicare-paid services, their 15% annual increase in “their” stock/bond portfolio, and that anytime they wish, they can go to the bank and withdraw “their” cash.

They think they own the house in which they live and trust that they’ll always be able to make the mortgage payment and afford whatever property taxes rise to.

What if all this is an illusion, that stocks someday (before they “cash out”) collapse to a miniscule percentage of now, that the bank actually owes more than the sum of depositors’ funds, and that the future ability of their future politicians to dispense all those trillions of dollars in promises turns out to rest on borrowing “money” from those who have none?

Phenomenal, unimaginably immense shared trust got us to scale to these altitudes. When trust evaporates, so too should all the valuations, taking into nothingness the visions of wealth and payments and such.

d c Sunset

You nailed it square on the head!!

If there is nowhere to hide, then pay off your debt!

@a cruel accountant:

The problem as I see it is one of cash flow.

Job 1. Maintain some sort of cash flow because life’s necessities cost money.

Job 2. Keep what I have; I didn’t save money because I wanted to light cigars with Franklins. If I can’t save my savings, why didn’t I just take more extravagant vacations or buy a bunch of useless toys (boats, jet skis, snow mobiles, sports cars, etc.) like the people I think are imprudent?

My savings (if kept) can tide me over a period of no cash flow, but it can’t support me for the rest of my life as is. I need cash flow, which means either a job or yield on my savings. Neither looks all that attractive right now, with decent jobs in decline and basically zero yield on safe investments.

Save money in bonds? Who are these idiots today who are buying the bottomless well of IOU’s issued by Uncle Sam? or worse, IOU’s issued by corporations in order to pump up their share prices?

Save money “in stocks?” I could buy a bunch of AAPL shares, or just go straight for the gold with HASBRO! Apple is a fashion/TOY company, not a tech firm. Yet its business is worth more than Exxon/Mobil, a major provider of the juice that runs the WORLD!

I could put the money in the bank, but the bank simply uses that as capital to extend more loans. In the aggregate, I’m pretty sure that on an assets (marked to market) to liabilities (M-to-M) basis, the world’s banks are in a negative balance sheet condition.

Stuff the mattress with 100’s?

Fire.

Home invasion magnet.

Thanks but no thanks, not a decent option.

Buy gold?

Gold is priced in dollars, not in loaves of bread or gallons of gasoline. Gold today floats in its own (relatively small) market. Silver did that in 1930, too, while gold’s price was fixed then. Silver cratered in the Depression, but gold was money (by legal fiat.) Today, gold is not money. It’s a metal in a market. It can go up vs dollars and it can go down vs dollars. At the moment its going down. If banks close, bonds tank and stocks plummet, what will gold do?

Beats me. No one knows for sure. But if the quantity of dollars available to chase it shrinks, unless people’s desire to own gold skyrockets, the presumption should be that gold will decline in dollar terms. This may happen, it may not. NO ONE KNOWS. But those pounding the table with fundamental explanations for why to own gold now sound exactly the same as those doing so in 1981, 1982, 1983, 1984…all the way to 2001, during which buy-and-holders of gold were crushed in a >90% real loss.

No one knows the future. Everything today is over-loved. I’d like to see something, *anything* get super-un-loved, almost hated, so I can buy it when everyone else has sold it. Gold got that way in 2001 and I ignored the signals. I don’t intend to do that again.

[img [/img]

[/img]

DC Sunset,

Hit the nail on the head, NO ONE KNOWS. Central Fund of Canada closed at 11.49 close to its 52 week low and at a 9.2% discount. 60/40% Gold to Silver ratio. As Muck About says, whose who loose the least wins.

No one knows what ANYTHING is really WORTH. Due to all the lies and obfuscation, we’ve lost price discovery.