Guest Post by Dmitry Orlov

Running a fundraiser (which, by the way, has been a great success—thank you all very much!) has prompted me to think about money more deeply than I normally do. I am no financial expert, and I certainly can’t give you investment advice, but when I figure something out for myself, it makes me want to share my insights. I know that many people see national finances as an impenetrable fog of numbers and acronyms, which they feel is best left up to financial specialists to interpret for them. But try to see national finances as a henhouse, yourself as a hen, and financial specialists as foxes. Perhaps you should pay a little bit of attention—perhaps a bit more than one would expect from a chicken?

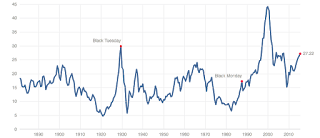

By now many people, even the ones who don’t continuously watch the financial markets, have probably heard that the stock market in the US is in a bubble. Indeed, the price to earnings ratio of stocks is once again scaling the heights previously achieved just twice before: once right before the Black Tuesday event that augured in the Great Depression, and again right around Y2K, when the dot-com bubble burst. On Black Tuesday it was at 30; now it’s at 27.22. Just another 10% is all we need to bring on the next Great Depression! Come on, Americans, you can do it!

These nosebleed-worthy heights are being scaled with an extremely shaky economic environment as a backdrop. If you compensate for the distortions introduced by the US government’s dodgy methodology for measuring inflation, it turns out that the US economy hasn’t grown at all so far this century, but has been shrinking to the tune of 2% a year.

And if you ignore the laughable way the US government computes the unemployment rate, it turns out that the real unemployment rate has grown from 10% at the beginning of the century to around 23% today.

So how can an ever-shrinking economy with a continuously rising unemployment rate be producing ever-higher stock valuations?

Simple! The stock prices are being driven up by the actions of the Federal Reserve. Since the great financial crisis of 2007, when the entire financial system almost collapsed, the Federal Reserve, through its Quantitative Easing (QE), has been making funds available at minimal cost to a set of financial institutions deemed “too big to fail.” (What that means is that they cannot be allowed to fail, because that would almost bring down the entire financial system again, but must be artificially propped up no matter what.) This financial life support has dramatically driven up the Fed’s balance sheet, which now stands at $4.5 trillion (it was less than $1 trillion before the great financial crisis of 2007).

The mechanism by which QE drives up stock prices is indirect, but the connection is easy to trace. The Fed makes money available by buying up various types of securities: lots of mortgage-backed securities (many of them worthless, but the Fed doesn’t care), lots of US Treasuries (and the Fed should care that they don’t become worthless), plus a little of this and that.

By doing so, the Fed artificially drives down interest rates on what are traditionally the safest investments—those that people like to put their savings in if they don’t want to risk losing them. But when the returns on these “safe” investments become lower than the rate of inflation, the risk of loss becomes 100%, and people are forced to choose between other, less “safe” options, and watching their savings slowly evaporate. The pressure to find ways to invest money more gainfully drives money out “safe” investments and into unsafe, speculative ones: stocks, that is. And this has created the bubble in stocks.

At this point, someone might want to ask a perfectly reasonable question: What is the purpose of having a stock market anyway? Well, theoretically, its purpose is to provide public companies with a way to raise money for their operations. Investors look for safe but gainful ways to allocate their capital, and, through their efforts, allocate this capital efficiently, so that it drives an economic expansion, and produces prosperity. But there is no economic expansion, and no prosperity! Maybe that’s because public companies haven’t been making use of the stock market to raise funds to invest in productive activities. And what have they been doing instead? They have been taking advantage of very low interest rates to borrow money, and using that money to buy back their own stock:

Why? Because that drives up the price of their stock, and because their chief executives (who already make 300 times more than their employees) are even more hugely rewarded if the stock price goes up. Hearing this causes some people to exclaim: “Hey, that’s corruption!” No, it’s just the American way of doing business. But what, pray tell, is the difference? In any case, stock buybacks are now going for a new all-time record. (The previous record was set right around when the entire financial system almost collapsed, in 2007.) According to WSJ, “The rise now puts 2015 on pace to reach $1.2 trillion worth of announced buyback programs, shattering the 2007 record of $863 billion in authorized buybacks, Birinyi said Thursday.”

Now, please note that it is not the purpose of a stock market to keep shareholders happy through borrowing and stock buybacks: this is unproductive for the economy as a whole. Also please note that this can’t go on forever. The Fed has been lowering interest rates more or less continuously since 1982, when the then Fed Chairman Paul Volcker succeeded in fighting off inflation by briefly hiking the rate up above 18%. Continuously dropping interest rates make it possible for big financial players to gamble with borrowed money almost risk-free. If they gain—great; if they lose—they can still be sure of being able to roll over their debts at a lower rate, and play again.

But then in 2009 the Fed funds rate went to zero, and stayed there. This condition has a fancy name: Zero Interest Rate (Monetary) Policy, or ZIRP. Because it’s an actual “policy,” that makes it all right; it’s the difference between falling flat on your face because you tripped and stretching out on the sidewalk just to do some yoga.

The rate would like to go negative, but it can’t. Because, you know, that’s the kind of debt even I wouldn’t turn down (by the way, I don’t have any debt). It’s the kind of debt where you give me your money, and then you keep paying me periodically to hold on to it, or spend it, or gamble it away—that’s none of your business—until forever, because I have no intention of ever paying you back; I’ll just keep rolling it over at ever more negative interest rates, and you will have to go on lowering them, because if you don’t I might cut down on my gambling and crash the financial system again. If you agree to these terms, then you might as well also give away your wallet and your car keys—just to see what happens.

The Fed dropping interest rates below zero would be approximately as funny as that. And so the Fed funds rate is stuck at zero: it can’t go down and it can’t go up. The Fed keeps making periodic threats about raising it—by a whopping 1/4 of 1%—and this causes a brief swoon in the financial markets each time, but then everything goes back to normal (if you want to call it that). If the Fed ever did raise the rate, that would pop the bubble, and we’d be right back to collapsing like it’s 2007.

It is worth noting that these financial shenanigans are having a profound effect on the real economy of jobs and goods and services: they are starving it. Many observers have noted that the Fed’s actions are driving up wealth inequality to ever-greater heights. But this is just blah-blah-blah: wealth inequality in the US has been on the rise practically forever, with just a few minor setbacks here and there, so there is nothing new here. Ever-increasing wealth inequality is as American as eating out of a bag, neck tattoos, gaudy diamond engagement rings, knee-length swimming trousers and Mickey Mouse. They might as well claim that Fed policies are making Americans fat, lazy and stupid. Are they?

But the ever more bloated financial sector is definitely crowding out the other sectors of the economy—ones which actually produce goods and services that people use. No matter how easy monetary policy becomes, the opportunities to invest in the real economy just aren’t there. Consider:

• You want to invest in agribusiness? Well, Americans are already fat as pigs; the last thing they need is more high fructose corn syrup.

• You want to invest in the automotive industry? Well, the people are already spending an average of 14% of their waking hours driving mostly short distances, sitting in traffic, breathing carbon monoxide and giving themselves mild but progressive brain damage; where do you want to go with that?

• You want to invest in gadgets? Well, Americans are already glued to a screen of one sort or another throughout most of their waking hours. Sure, there are lots of business plans out there, but most of them look a lot like this:

1. Monetize sexting (or whatever)

2. ???

3. Profit!

(By the way, I think that’s called Snapchat, and its valuation is around $15 billion.) But none of them seem like real breakthroughs, because they still require people to be glued to their little screens 24/7, and we have already achieved that. We’d need to make gadgets for their gadgets to play with, to free up their time so that they can get something useful accomplished, but nobody has figured out how to do that yet.

• You want to invest in military hardware? Well, nobody wants tired old American stuff; just about everybody—even our friends the Iraqis, and now even the Saudis—are interested in buying Russian. Plus the Americans don’t even know what to do with the stuff they already have. Accidentally give some more of it to ISIS or to the Yemenis? Abandon it in Afghanistan for the Taliban to play with? The latest plan is to stockpile it on Russia’s borders, so that the Russians can use it for target practice, blowing it up with their long-range artillery without having to invade anyone.

And so on.

And so all that Americans can do with all this free money is gamble with it. There are lots of worthwhile ways to spend money—build public transportation, for instance—but the problem is that none of them make money. And that, stupid though it seems, is a requirement. But creating a huge, wasteful financial casino alongside the real economy doesn’t help the real economy—it crowds it out. And it doesn’t really make money either; it makes bubbles. This should in some measure explain the more or less continuous economic shrinkage that has been happening in the US so far this century.

It is also worth noting that, dire though these negative effects already seem, Americans have by no means seen the worst of it yet. The story one commonly hears is that the US is the richest country on earth. Well, that may be true, on average, if you include financial wealth (which tends to be rather ephemeral), overvalued real estate (which is another great big bubble), promises that won’t be kept (such as the various retirement schemes that will never pay out) and much else that isn’t quite real. But it is definitely true that the US also has the largest group of incredibly poor people—much poorer than the poorest person in the poorest country on Earth.

Their wealth is measured in the hundreds of thousands of dollars—but with a negative sign in front. They are deep in debt from investing in overvalued real estate (most houses in the US aren’t really worth the skinny little sticks that hold up their roofs), or from getting an overpriced higher education (which has qualified them to serve coffee), or from running up other kinds of debt. Some of them may still look rich and prosperous for the moment, but that’s only because… you guessed it, four whole decades of ever-lower interest rates! Once interest rates start ticking up, and their entire incomes are gobbled up by interest payments, they will start looking as destitute as they actually are.

How might this transition come about? Well, it might be catastrophic: some day some fat pig of a trader comes back from his 1000-calorie buffet lunch and passes a massive volume of gas. His explosive flatulence causes his colleagues to either faint, projectile vomit all over their trading terminals, or run for the exits. In the meantime, their high-frequency trading algorithms, left unattended, flash-crash the entire financial system to kingdom come.

But let’s not wax apocalyptic here, because a much more mundane scenario will do just as well. Some day soon the stock market suffers a wee drop. This causes a little bit of a shuffle toward the exits and into “safe” investments in the form of US government debt. But that day there are a few more sellers of US government debt than usual, and the price of it drops. That’s because over a third of it is held by foreign entities, many of which have been working hard to get out of the US dollar for some time now. China is at the top of the list with $1.3 trillion in US Treasuries, and has been busy signing bilateral trade agreements that circumvent the dollar system. Spooked by the sudden drop, foreigners start dumping US Treasuries. The traders see an advantage in getting out of stocks and into the suddenly much cheaper Treasuries, the trickle turns into a stampede, and stocks and Treasuries both crash because there are now many more sellers than buyers of either.

Next, the sellers of Treasuries rush to sell off their hoard of US dollars for other currencies—the ones they now use to trade with each other—and the dollar drops in value. The resulting scene looks like this. The stock market has cratered (so it’s time to break open your child’s piggybank and buy her a handful of railroad and utility stocks). US Treasuries are trading at a fraction of their face value, promising huge gains once they reach maturity—but to be paid out in worthless dollars. The Fed is helpless to do much of anything except print-print-print more worthless dollars as long as there is more paper and the lights are still on. The US Treasury starts trying to issue debt denominated in foreign currencies—with poor results, because foreign investors think that the US is too risky. The terms “capital controls” and “national default” are thrown around, just like they are in Greece at this very moment.

Regardless of what the Fed tries to do or say, the effective new interest rates are much higher, and most borrowers are no longer able to roll over, never mind expand, their debt. This includes the federal government, US states and municipalities, and corporations: kiss your benefits and your retirements good-bye. For importers, securing access to imports, such as oil, now involves borrowing in foreign currencies—at exorbitant rates of interest because the US is now a bad credit risk.

It is only at this point that I imagine an appreciably large number of Americans will put down whatever they happen to be mindlessly stuffing into their faces, pull their eyeballs away from the nearest screen, look at each other and ask: “Why did this happen?” Well, I am no financial expert, and yet I was able to piece all of this together based on freely available information, much of it from the US Government and the Federal Reserve, the rest from sources such as shadowstats.com, which I know and trust, and from having watched things collapse at other times and in other places.

So, let me ask you some questions: What, if anything, is unclear to you about any of this? Does any of this come as a surprise? Why do you think this is this so difficult for so many people to understand? and, What are you waiting for?

[img [/img]

[/img]

The real crash comes not when we realize that the emperor has no clothes, but when we realize that none of us do…when we realize that our entire economy is one enormous circle jerk. We all use electronics to sell electronics and service electronics and replace electronics and make newer and better electronics. When we realize, collectively, that none of us really NEED any of this shit and then promptly realize that the shit we do really need and have been taking for granted for decades (you know food, water, heat, light, air) don’t just naturally show up at your door according to your whims.

The Mother Of All Bear Markets Is Coming

It’s just a matter of time.

The scenario Orlov describes has already taken place — in 2008. The severity and relative finality of it all is still a debatable question. QE has been used as replacement money for what was vaporized in “The Great Recession”. It has been only a partial replacement, and a partial success. So far, it has bought us seven years of keeping things going — to whatever endgame yet to be experienced…