PRINCETON, N.J. — Thirty-one percent of nonretired U.S. adults predict they will retire after age 67, the current minimum age for receiving full Social Security retirement benefits. Another 38% expect to retire between the ages of 62 and 67, spanning the existing Social Security age thresholds for benefits eligibility, while 23% expect to stop working before they turn 62 — that is, before becoming eligible for any Social Security retirement benefits.

| U.S. nonretirees% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Will retire before age 62 | 23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will retire between ages 62 and 67 | 38 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will retire at age 68 or older | 31 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unsure | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup, April 6-10, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

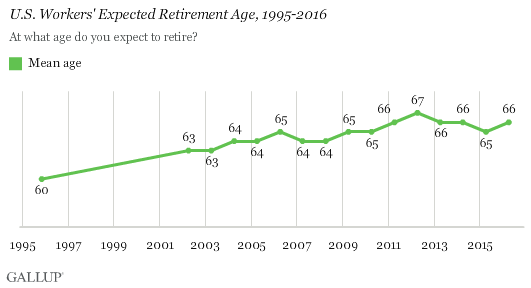

These findings are from Gallup’s 2016 Economy and Personal Finance Poll, conducted April 6-10. The average age at which U.S. workers predict they will retire is 66, consistent with the 65 to 67 age range found since the 2007-2009 recession ended. The expected retirement age is up slightly from about 64 years of age spanning 2004 to 2008, and is up from 60 in 1995.

Lower-income workers plan to retire a bit later, on average, than those earning $75,000 or more annually. Young adults, those aged 18 to 29, plan to retire earlier than middle-aged and older adults, likely reflecting youthful optimism about their future income and savings.

| U.S. nonretireesaverage age | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $30,000 | 70 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $30,000 to less than $75,000 | 69 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75,000 or more | 67 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Age | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 to 29 | 64 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30 to 49 | 70 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50 to 64 | 69 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 65+ | * | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Sample size for 65+ nonretirees is insufficient for reporting | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup, April 6-10, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Four in 10 Current Retirees Retired Before 62

In contrast with current workers’ expectations about retirement, retired Americans report they stopped working at an average 61 years of age, significantly lower than the average 66 years at which today’s nonretired Americans intend to stop working. More specifically, 42% of retirees say they stopped working before age 62, while just 13% continued working until they were 67 or older. Of course, current retirees span an age range of more than 40 years, meaning that some retired decades ago, while others may have retired the day before they were interviewed, and their age at retirement no doubt reflects societal and economic patterns in force at that time.

This doesn’t tell the entire generational story, as approximately one in seven seniors (defined for this analysis as those aged 67 and older) are still in the workforce — working full time, working part time or unemployed. When these are factored into the equation, 26% of adults 67 and older are either still in the workforce (14%) or worked until they were 67 or older before retiring (12%). That is a bit less than the 31% of today’s nonretirees who intend to work past 67. However, the greater discrepancy is in the percentage retiring before age 62: 36% of today’s seniors say they did this, while just 23% of current workers intend to.

| Retirees% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Retired before age 62 | 36 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retired at age 62 to 66 | 36 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retired at age 67 or older | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not yet retired (working or unemployed) | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No opinion | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup, April 6-10, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bottom Line

Myriad factors go into determining the best time to retire, not all of which are within workers’ control. Financial troubles, poor health, family needs or being let go at work can all disrupt the best-laid plans. At the same time, for those who depend on it, the Social Security system forces people to gamble on their life expectancy in deciding whether to retire early with partial benefits or later with full benefits.

Although many of these factors are constant, some have changed in recent decades. As a result, the age at which today’s workers expect to retire is significantly older, on average, than the age current retirees say they already did retire: 66 vs. 61, respectively. Some of that difference undoubtedly reflects the gradual increase, which Congress mandated in 1983, in the Social Security system’s age threshold for receiving full benefits — from 65 to 67. However, that does not explain the higher percentage of nonretirees who plan to work beyond age 67 compared with current retirees who report having worked this long — 31% vs. 26%, respectively.

One factor causing today’s workers to think about delaying retirement could be their recognition that working may be healthier than staying home. A recent Wells Fargo/Gallup Investor and Retirement Optimism Index survey found 67% of nonretired investors — those with $10,000 or more in investments — agreeing that they want to work as long as possible, given the benefits to their physical and mental health. At the same time, unexpected health problems could explain why some current retirees retired early.

In reality, however, many working Americans simply can’t afford to retire. Fewer workers today than in the past say a pension will be a major income source in retirement, and many have been unable to save sufficiently during the economic slowdown of the past decade. Seven in 10 employed adults told Gallup in April that they are worried about not having enough savings for retirement. As a result, they now need to work as long as possible to build up their retirement nest eggs.

At the moment, most workers are forgoing any thought of retiring before 62, the minimum age to receive partial Social Security retirement benefits, while nearly a third are planning to hold off until after age 67. These figures already represent a departure from how today’s seniors have handled retirement, and could easily change further if the economy or the Social Security Administration throws workers any more curve balls.

Historical data are available in Gallup Analytics.

The 23% work for the government.

Bob.

Those retired at taxpayer expense (federal, state, local), including teachers, has to be a significant portion that skews the numbers to earlier retirement.

The other 7 are lying to themselves.

It’s a Racket

mea culpa…Steyn gig to wrong post

Postponing “retirement” so as to collect full benefits??

LOL. Are we not realizing there is no “retirement” money

to be had? There are no jobs for younger workers to “fund”

the SS. Further every immigrant gets a big share…and it adds

up. Result? Zero left for workers/retirees. All of this should be

patently obvious by now. The plan is to steal every last dollar

or promise of a dollar we have and then kill us. Wake up.

Many of those who had retirement accounts wiped out in the last crash never recovered from it.

They really can’t retire, at least not on their own at much if any above the homeless level.

I imagine the same will be true of the next one (which, of course, won’t happen in our lifetimes so we don’t need to worry ourselves with it).

If the little rubes have any reading comprehension skillz they should find themselves a safe space and read the 2015 Social Security Trustees Report. They will be working until death at a minimum. Anyone who is eyeing Social Security Disability should be exploring other options pronto as SSDI is scheduled to be out-o-cash by the end of this year.

http://www.fool.com/retirement/general/2015/07/26/2015-social-security-trustees-report-the-3-things.aspx