Guest Post by Martin Armstrong

The question of when will central banks fail is a popular one that comes in. Suffice it to say, the turmoil will hit Europe first. While so many people blame the Fed for all sorts of things, you must realize that Roosevelt usurped the Fed during the Great Depression and imposed a single interest rate administered from Washington. It was during April 1942, when the Department of the Treasury requested the Federal Reserve formally to commit to maintaining a low interest-rate peg of 3/8% on short-term Treasury bills.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

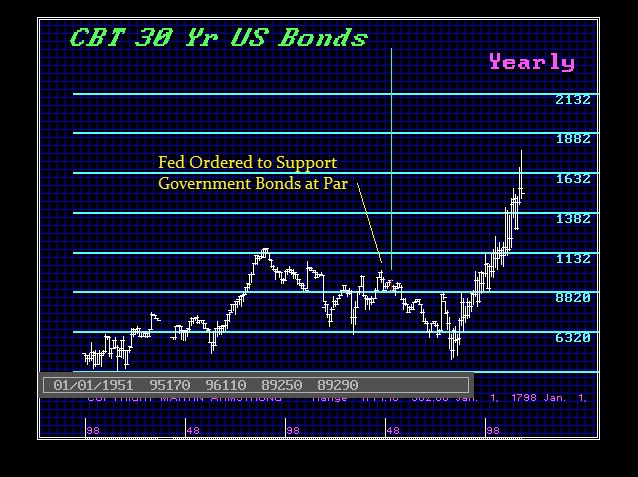

The Fed also implicitly capped the rate on long-term Treasury bonds at 2.5%. This became the known as the “peg” with the express goal to stabilize the securities market and allow the federal government to engage in cheaper debt financing of World War II, which the United States had entered in December 1941. Today, we have extraordinary low rates of interest that have funded government, but has wiped out the real bond markets insofar as being a viable market long-term. The World War II accord to maintain low rates was followed by a collapse in bonds after 1951 once the accord ended. We will see the same outcome moving forward.

At the time, in order for the Fed to maintain the peg, it was ordered to give up control of the size of its portfolio as well as the money stock. That is also what has happened today with Quantitative Easing among all central banks. Frankly, the Fed back then maintained the low interest rate by buying large amounts of government securities, which also increased the money supply domestically at the time. Because the Fed was committed to a specific rate by the peg, it was compelled to keep buying securities even if the members of the Federal Open Market Committee (FOMC) disagreed.

After the war, politicians were afraid of a new depression would emerge as they always fight the last war. They ordered the Fed to maintain the peg even after 1945. The United States entered the Korean War in June 1950. The problem was inflation not deflation. The FOMC of the Fed argued strongly that the continuation of the peg would lead to excessive inflation. A real confrontation with the politicians was brewing all year and they opposed by the Treasury who naturally wanted to keep borrowing at cheap rates.

Everything exploded by February 1951. In inflation had soared reaching 21%. As the Korean War intensified, the Fed faced the possibility of having to monetize a substantial issuance of new government debt coming out to fund that war. This only intensified inflation. Nevertheless, Harry S. Truman became president in 1945 and it was his administration that continued to urge the Fed to maintain the peg.

The financial crisis erupted into a major conflict when Truman invited the entire FOMC to a meeting at the White House. Truman then issued a statement saying that the FOMC had “pledged its support to President Truman to maintain the stability of Government securities as long as the emergency lasts.” In reality, the FOMC had made no such pledge. Conflicting stories began to appear about the dispute in the press. The Fed then made an unprecedented move – they release the minutes of the FOMC’s meeting with the president.

The conflict erupted in full view. The Fed revolted against the politicians. Shortly thereafter, the Fed informed the Treasury that as of February 19th, 1951, it would no longer “maintain the existing situation.” The Treasury was caught in a crisis for it needed to refund existing debt and issue new debt, a situation governments are still in today. They never pay off debt, they simple roll forever.

The government had no choice but to negotiate a compromise under which the Fed would continue to support the price of five-year notes for a short time, but after that the bond market would be on its own. It was on March 4, 1951, when the Treasury and the Fed issued a statement saying they had “reached full accord with respect to debt management and monetary policies to be pursued in furthering their common purpose and to assure the successful financing of the government’s requirements and, at the same time, to minimize monetization of the public debt.”

It was this accord that created a free market in government securities. The likelihood that government debt becomes extinct will appear by 2023. We can see that the bond market began to crash as interest rates were at last free to move. This is the most likely outcome of the voluntary Quantitative Easing that is really a critical issue. This time, the central banks have gone and done this themselves and they are trapped. They cannot sell the debt they have bought and therefore, we are looking at a crisis when that debt has to roll. The European Central Bank holds more than 40% of the government debt for the whole of Europe. Once that matures, who will buy the new debt the next time around? We are looking at a deflationary impact by default.

Central Banking’s and the finance system engineers have shut down the monetary cooling system during the night, whilst von Mises engineers were asleep. The QE and ZIRP valves have been opened a little to let cooling water flow into all that hot Fed money- Unfortuntely, the closed-loop cooling system’s equilibrium cannot be restored and the control loop cannot be closed anymore. Get the fuck out of banks and everything – ‘cos Financial Chernobyl is about to blow – contaminating the entire world – leaving uninhabitable regions for generations to come.

And all that Twat Trump does is continue the US cold war with Rusia, Iran and China

The more things change – the more they stay the same.

Iran iraq war. More recent than 200 years.

Didn’t Iraq attack Iran,probably w/a wink from us?

yeah invaded by Iraq at the request of US – idiot Travis

A crisis, if or when it happens, will be a planned and controlled event with the purpose of being to push the people into the next phase of economic and banking control that the Ruling Elite want the people to be under.

Of course, we could always just avoid the crisis by willingly going there first before we need one to persuade us.

Some countries are already doing that, and they are the ones that will fare best during a crisis if it is needed to make the rest of the world compliant.

“…A crisis, if or when it happens, will be a planned and controlled event with the purpose of being to push the people into the next phase of economic and banking control that the Ruling Elite want the people to be under…”

Yes.

http://philosophyofmetrics.com/

Question for you monetary gurus from an ignorant seeker who knows just enough to be dangerous to himself & anyone who listens to him.

A week or two back there was an article about money & a poster wrote about how Hitler rejected central banks and set up his own system.I looked it up online but it was mostly Nazi bs. However,from what I see,Germany was coming out of the world depression faster than many other countries.They had the $ to re arm w/o starving their people.

Did the Germans create a system outside central banks and was it successful,and could it have been successful in the long term?

Hey TampaRed! You might be interested in this quick link: http://www.webofdebt.com/articles/bankrupt-germany.php

Briefly, my understanding of Hitler’s economic and monetary idea is as follows. After the Weimar hyperinflation Germany was broke, dead broke. So was much of the rest of the world, as the Great Depression had spread all over. Hitler’s approach was to take Germany’s central bank, the Reichsbank, out of private control of the bankers and put it under strict government control. Previously, the Reichsbank (like almost all other central banks) was owned and controlled by the bankers, and the bankers ran it to maximize their own profits, creating fiat money and lending it out at interest. Hitler had the Reichsbank issue fiat money, but only had it issued as payment for real labor and real materials. Yes, it was fiat, but its issuance did not create new debt to be paid to the banks. Instead, the new money put people to work on public projects like building roads, water works, power plants, parks, etc. This not only restored liquidity to the financial operations of ordinary workers, it also increased productivity for German business by making transportation more efficient, by increasing living standards for workers, by supplying easier access to electricity, etc.

One problem for Germany is that most foreign countries (which had their own privately owned and controlled central banks) saw the German system as threatening the power of the financiers. Other countries refused to trade with Germany if it meant normalizing Hitler’s financial system; they would not exchange goods if it meant using German money. I suspect that Hitler may have felt the same way about accepting pure fiat currency from other countries. The German solution to international trade was to set up a system based on barter. If Germany wanted to import 10 tons of cobalt, then someone, somewhere, had to buy an equivalent value of German goods. I cannot tell you the details, but that is the basic idea.

Is the German system a good system? No. But it is just not so bad as what we have now. It is still fiat, but at least has the advantage that issuing money does not simultaneously create an even larger debt to be paid to the bankers in the future. If I had my choice, I would rather support some sort of commodity (precious metals? food? electricity? radioactive ores?) based money, issued by any bank or group which wished, and let it fight in the market to see which money people prefer.. that and prohibit fractional reserve banking.

Over and over in history we see wars being started and fought so that the bankers can continue to keep their monopoly on turning unbacked promises into gold in their pocket. If one were to dig deeper (and I have not done so) I would not be surprised if the start of WWII were to be something that the bankers planned and pushed for, primarily as a way to kill off the competing non-banker German system.

“Did the Germans create a system outside central banks…”

Yes but they still had a central bank. It was not run by outsiders though. The global bankers attacked the Germans money supply but were not successful. The Germans worked out barter deals with other countries exchanging manufactured goods and materials for minerals and other materials. When our farmers were hanging themselves in their barns in Kansas the German worker was taking vacations.

“… and was it successful,and could it have been successful in the long term?…”

It was successful but long term would depend on how much currency it issued compared to the “actual” GNP of the country. If they issued too much currency compared to the economic activity in the country then you would have inflation as people seeing too much money would attempt to exchange it for hard material goods like land, gold, etc.

Thank you Jason & Sam.

I also have a question to pose to all the financially literate folks here:

How would a central bank failure play out? What would be the signs that it is beginning? I know this will be speculation, but I’d like to hear some speculation on this point.

Of course, our current situation is unprecedented. Never before has there been a whole world’s worth of interconnected central banks.

To anon’s point above: I don’t care if it’s caused by elites on purpose, or because people wake up or if there’s fucking aliens involved. No matter the cause, speculate on effects.

Look up the French Assignat 1789-1796 and the Weimar Republic Mark 1923 which were fiat currencies (like the dollar) that were way over printed by the government like the dollar: hyperinflation results. Obama doubled the Treasury debt (but not the total currency supply) in eight years to pay for his legacy (welfare & warfare). A rule of thumb is: If you double the money supply, you double the prices in about two years. Obama will have caused at least 30% inflation of prices (soon); how many working Americans (the welfare maggots will be taken care of) can afford 30% price inflation without a raise in pay?

“No matter the cause, speculate on effects.”

Common people without fanfare, will quietly go back to the tried and true nature of using gold and silver, being the only things used to settle outstanding debts, between consenting parties. Gold being the ultimate extinguisher of debt, as it is recognized around the world.

Precious metals are no one’s (think government) proxy……

If you believe that money is a store of value, then the issuer must back that store, with more than an empty promise.

While fiat has had a fine romp in the last 45 years, and pushed precious metals to the back of the room, history teaches us that a fiat promise is just that; at some point in time it will get broken. And that’s when the people will make the right choice for themselves and their children’s future.

Gold based money is stupid. An example. A guy finds gold on his property and digs it up. He gets rich. A guy figures out a way to increase the speed of a computer 10,000 times yet he has to trade his increase to the guy that just happened to have found gold laying around. That’s stupid nonsense. The computer guy created REAL VALUE. The gold guy did not. The gold system is arbitrary and has nothing to do with what the economy is actually doing. Stupid.

How many gold mines have you developed? Dug one up in your backyard lately?

The gold producers (Franco-Nevada, Goldcorp, various “primary” metal producers like Freeport-McMoran who finds traces of gold in all that copper ore) have to develop new mines as the old ones play out. We’ve been mining gold for millenia, so a lot of the “easy find” gold has been found – and new large deposits are in a downtrend.

Sutter’s Creek was found by the sight of nuggets lying in a stream – this is rare nowadays. Modern “gold prospecting” can occasionally find a vein of ore that breaks the surface – but more likely, drills holes and pulls cores until it finds a vein, meters or hundreds of meters underground, and “delineates” it – drills a whole bunch MORE holes until you know how deep, how thick, how wide and how long the vein is. Then you get to mine it – assuming it’s located in a jurisdiction that doesn’t just nationalize it, tax it to negative returns or forbid mining on environmental grounds.

When Franco-Nevada sells an ounce, that ounce is gone from its reserves – and a new ounce must be found to take it’s place. Finding that new ounce can take a lot of time, effort and money itself – and THEN you have to fight off the central bankers selling paper contracts with no intent to deliver physical gold, suppressing the price you can sell your real physical ounce for.

It’s just not that simple!

No expert here, but I do read a lot. From what I gather, it seems we will be approaching the end when central banks raise interest rates to defend their currencies. When the bond market blows, lights out. I wouldn’t be surprised to see the world’s 3rd largest economy, Japan, as the dead canary in the coal mine. Just my two cents.

I think we are witnessing the failure in real time. CB’s have no choice but to keep rates low no matter how much jaw boning they do about raising them when the chicken guts are in alignment with Kim Kardasian’s vajayjay. Failure takes awhile, it takes time for conditioned populations to lose faith in what they believe is normal. Failure looks like zero and negative interest rates. Failure is stagflation then deflation then hyperinflation.

The caca will be falling from the sky when we see helicopter money and we will (I propose that ZIRP was a form of helicopter $ for stock buybacks). Helicopter $ when done outright is when we’re in deep mud and the CB’s options are down to just literally throwing money out the windows at that point. Eventually people will realize it’s just worthless paper and digits that only represents faith and credit and they’ll be discarded. Societal cohesion will be torn and likewise violence will occur – lots of scores to be settled out there.

Look at http://philosophyofmetrics.com/

He talks a great deal about currency and how the world money masters are attempting or will move to a SDR backed money supply that will be global. The problem with this is that they will determine how much currency is in your economy. If they don’t like what you’re doing they can strangle your currency and strangle you in the process.

Here’s how money is created.

http://www.mindcontagion.org/fed/createmoney.html

Yes I know I didn’t answer your question because I’m not sure that I or anyone can. The Central Bank can be deliberately collapsed internally or by external forces. The external would be that other countries banks would refuse to take their currency. It’s ALL about do people trust that the amount of money supply is equal to the amount needed. For example the US has way more money out than needed but it does work because other countries use the US dollar for trading. World wide people and institutions also “park” their money in dollars as it’s a set store of value. So a lot of dollars are just parked. If they were to sell all those off it would cause inflation on the US and collapse in the dollars value. This would be seen as an end of the world event but actually it would only be for a while. The lower dollar would make US exports EXTREMELY attractive leading to a great deal of economic activity meaning we would be selling goods and in turn getting our dollars back. Raising the price of the dollar. The lag between new economic activity and the fall of the dollar would be hell though if not managed. It’s highly possible that the dollar could be attacked by the worlds bankers to control us.

In actuality the FED can’t be destroyed if they don’t allow it. Any currency attack on the dollar would in the long term fail as the US has a big economy that could substitute production from overseas to the US but not immediately. Hence the short term pain.

Old time banks before central banks were based on gold so they kept say 10% gold in the vault and then lent out the rest. If everyone went for their money at once then the bank, never having 100% of their gold on hand, would go broke and shut their doors. The FED is backed by “faith” so either you believe or you don’t. Making a determination of if it has failed is a matter of faith. If everyone one day decided it failed and the dollar was no good then…it would be no good. As long as people decide that they can get so many “donuts’ or “whatever” per dollar that seems fair to them then the dollar will continue to be seen as good.

That’s kind of the way I look at it as well, Ticky. What all the financial gurus, economists, central bankers, etc. never take into account is that it’s basest level money is simply a social agreement–even real money (read Gold) only has value because everyone believes it does. Hell, the natives of South America use to throw gold and emeralds in the lakes as part of religious ceremonies. They used salt for money–which many may mock, but ultimately salt has far more utilitarian value than gold.

Anyway, we all know that the fiat currency system MUST and therefore WILL break. The process is what is the huge unknown. Will there be a top-down default tsunami or do the CBs still have enough clout to force hyperinflation instead (obviously still bad but they would much prefer this to deflation)? What if 2008 starts again, but this time the governments either can’t or won’t bail them out? Would they do bail-ins or shut off credit outflows? What if every credit card in the country got shut down over a few weeks? Could you even imagine the chaos? And it wouldn’t even have to happen at that level…what would happen if the shipping companies couldn’t get credit to buy their gas and diesel? Or the other way around and the gas stations couldn’t get credit to buy the gas? Could it be everything above and more all at once?

What do you get if you cross an elephant with a rhinoceros?

elephino

“…it’s basest level money is simply a social agreement–even real money (read Gold) only has value because everyone believes it does…”

I agree 100%.

“…Anyway, we all know that the fiat currency system MUST and therefore WILL break…”

Don’t agree it has to be this way. It will happen if mismanaged which it has been but it doesn’t have to be this way. If fiat money is pegged to economic production then it can be a good a store of value as anything else. It also needs to expand under conditions of hoarding. When the top 1% have most all the money in their hands and they refuse to invest in production the money supply shrinks. I think this is what’s happening now. people like Bill Gates have so much money that to get them to invest it takes enormous, higher than you’ll find, profits or it has to be something that they just feel like is worth doing. After all they have so much money that there’s no big upside to investing. I think psychologically the really, really, super richest biggest fear is losing what they have. Not making more money is not a problem to them.