Guest Post by Nouriel Roubini

US President Donald Trump, in partnership with congressional Republicans, is pursuing tax cuts that will blow up the fiscal deficit and add to the public debt, while benefiting the rich at the expense of middle- and working-class Americans. Once again, Trump has not hesitated to betray the people he conned into voting for him.

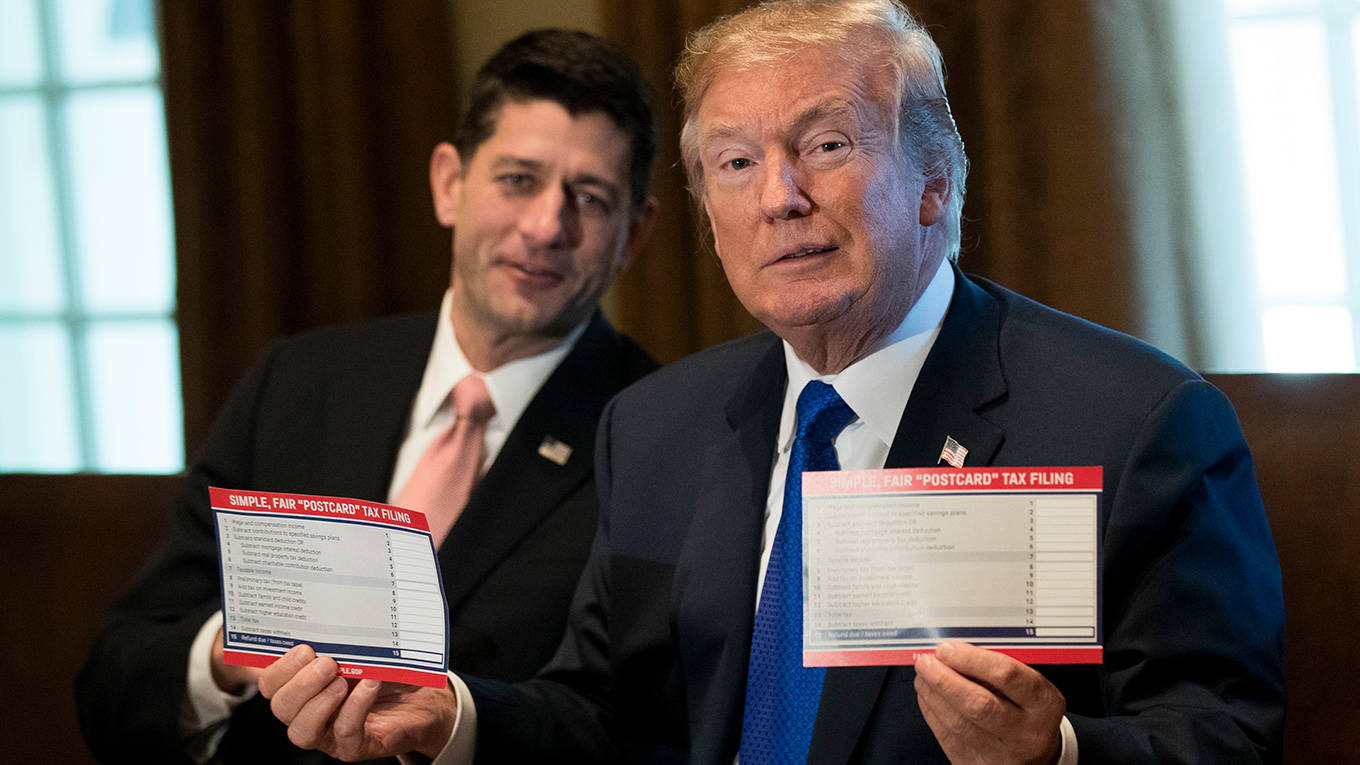

After multiple failed attempts to “repeal and replace” the 2010 Affordable Care Act (Obamacare), US President Donald Trump’s administration now hopes to achieve its first legislative victory with a massive tax giveaway that it has wrapped in the language of “tax reform.” To that end, Republicans in the US Congress have just unveiled a bill that, if enacted, could vastly widen the deficit and increase the public debt by as much as $4 trillion over the next decade.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Worse still, the Republican plan is designed to funnel most of the benefits to the rich. It would lower the corporate tax rate from 35% to 20%, reduce the tax on capital gains (investment profits), eliminate the estate tax, and introduce other changes that benefit the wealthy.

Like the Republicans’ health-care proposals, their tax plan offers little to struggling middle- and working-class households. Trump continues to govern as a pluto-populist – a plutocrat pretending to be a populist – who has not hesitated to betray the people he conned into voting for him.

Before releasing the current plan, congressional Republicans passed resolutions to reduce taxes by $1.5 trillion over the next decade. But the actual tax cut will likely be much larger. The proposal to lower the corporate tax rate to 20%, for example, implies a $2.5 trillion tax cut, once other tax cuts in the plan are considered. To keep the tax cuts below $1.5 trillion, one would have to keep the corporate rate at or above 28% and broaden the tax base.

To make up for this difference, the bill proposes a cap on the mortgage-interest deduction for homeowners, and on the deductibility of property tax, as well as eliminating other tax benefits for the middle class. It would eliminate or cap the income-tax deduction for state and local taxes – again, squeezing the middle class to cover tax cuts for the rich.

The problem is that eliminating the state and local tax deduction would provide just $1.3 trillion in revenue over the next decade. And because this change would hurt middle-income families, many Republicans in high-tax states such as New York, New Jersey, and California will oppose it. If congressional Republicans and the Trump administration end up keeping the state and local tax deduction, their tax cuts will add $3.8 trillion to the public debt over the next decade.

Moreover, Republicans want their tax cuts to be permanent. Yet they are trying to enact their bill through the congressional budget reconciliation process, which requires any tax cuts that add to the deficit after ten years to be temporary. Even if the Republican plan really did keep the cuts at $1.5 trillion, it still would not comply with this rule.

Trump and congressional Republicans argue that tax cuts will boost economic growth, and thus revenues. But standard dynamic scoring models show that increased growth would offset the cost by only one third, at most: the US would face $1 trillion, rather than $1.5 trillion, in lost revenues.

So, how will the Republicans fudge these fiscal rules? For starters, like President George W. Bush’s administration, they will set the personal income tax cuts to expire after ten years. This will give them plenty of time to enjoy the political gains of tax cuts – starting with the midterm elections in 2018 – long before the bill comes due.

But corporate tax cuts are another matter, because making them temporary would defeat the purpose. Companies operate with a much longer time horizon than households, and are unlikely to boost investment in response to cuts that last only ten years.

To get around this problem, Trump and the Republicans might decide to bend or manipulate congressional rules. Or they might rely on unorthodox and untested economic models to claim that their cuts actually are revenue-neutral, and will have a much larger impact on growth than what standard models project.

Most mainstream economists would estimate that a tax cut of the size being proposed would increase US potential growth by 20 basis points, at most, taking the growth rate from around 2% to 2.2% over time. Yet Trump and his advisers have clung to the false claim that growth will increase to 3% or even 4%.

If this far-fetched projection sounds like voodoo economics all over again, that’s because it is. Voodoo economics came into parlance in the 1980 presidential election, when George H. W. Bush criticized Ronald Reagan for claiming that his planned tax cuts would pay for themselves. Bush was vindicated just a few years later, when the Reagan administration’s tax cuts blew a huge hole in US public finances.

And yet Republican administrations have persisted in pursuing unsustainable and undesirable tax cuts benefiting primarily the rich, leading to ever-larger deficits and trillions of dollars of additional public debt. The Republicans’ eagerness to pass reckless tax cuts once in power gives the lie to their claims of fiscal rectitude.

Making matters worse, America’s pluto-populist president is peddling a tax plan that will further increase economic inequality at a time when income and wealth gaps are already widening, owing to the effects of globalization, trade, migration, new labor-saving technologies, and market consolidation in many sectors.

Given that the rich tend to save more than middle- and working-class people, who must spend a larger proportion of their incomes on basic necessities, the Trump tax plan will do little for economic growth; it may even decrease it. And it will add far more to the US’s excessively high public-debt burden. It is fake reform, brought to us by an alt-fact administration and a party that has lost its economic bearings.

Nouriel Roubini, a professor at NYU’s Stern School of Business and CEO of Roubini Macro Associates, was Senior Economist for International Affairs in the White House’s Council of Economic Advisers during the Clinton Administration. He has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank.

The American people want higher taxes, not tax cuts.

Reducing the corporate income tax doesn’t equate to a tax cut for the rich. Isn’t it true that a lot of profits US companies derive from overseas operations stay overseas because of the high US corporate rate? Bringing it down may well encourage investment in the US. It’s also true, if not a truism that corporations don’t pay taxes, people do. Taxes are just built into the cost of doing business.

You’re not suggesting that corporations will reduce prices once they get their tax cut are you?

Better than reducing prices would be returning that money here to boost their domestic production and create higher employment of Americans IMO.

There are, of course, those who oppose these things for various reasons but I am not among them.

Believe it or not, when costs go down, prices usually follow.

Uh……….

“….was Senior Economist for International Affairs in the White House’s Council of Economic Advisers during the Clinton Administration. He has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank.”

And we all know the clintons, the IMF, da fed and the World Bank have the little guys best interest in mind, right Nouri?

Try again.

Expecting an honest analysis from Roubini one may as well expect this swarthy middle eastern hustler to curse Allah. Trump should yank his green card and ship him back to Istanbul and let Erdogan execute him.

He is Jewish, not Muslim.

You’ve entered the “No Facts” zone.

But Nouriel, don’t the rich all ready pay a disproportionate share of the taxes since their tax rate is higher than the poor or the middle class???

“And yet Republican administrations have persisted in pursuing unsustainable and undesirable tax cuts benefiting primarily the rich, leading to ever-larger deficits and trillions of dollars of additional public debt. ”

Let’s be fair Nouriel; How about that Democrat Obama – didn’t he bless the wealthy and Mega Corporations and Banksters with QE’s and ZIRP for 8 years? Didn’t he increase US Debt by 9 Trillion?

His claimed point would be better made by giving real life examples of how much the tax cuts would be for the various income classes.

All this misses the blue whale in the room. Once gov’t has spent the money there are only 3 ways to make up for it; raise taxes; have the fed print ‘money’ to cover; or borrow it. Printing the money debases the currency which eventually destroys it and bankrupts everyone. Do I really have to explain how bad debt is to TBPer’s? Of the 3 options, free market economists agree that raising taxes does the least amount of damage. In a moral society the spending would be covered entirely by raising taxes. If we all were actually paying the taxes required to cover gov’t spending in no time there would be a rebellion against it, especially-block your ears warmongers-for waging war. So, instead of insisting we live moral lives we have lying, bullshit artists like trump and Roubini dream up a racket of one sort or another to lead the sheep a bit further down the garden path at the end of which will be a brick wall the trumpster didn’t have in mind.

Exactly!

Spending = Taxes in the long run. The rest is just a financing decision. And inflation just debases savings, so it’s a tax too.

This is why I can’t be a Big Dog Libertarian. There is no fucking way that 20 trillion in federal debt alone will EVER be paid back and it would be immoral to even think of attempting to do so by raising taxes. The next generation has no obligation to be enslaved by the poor behavior of the previous ones.

No. Fuck that shit. Default is the only way. Let the fucker burn to the ground. Even if the central authorities (and banks, lol) somehow managed to survive the carnage, nobody would lend them any money for several generations. Lest you think me irresponsible, my 401K would be toast as well…

Mine was a philosophical point, not a practical one. Any fool knows raising taxes to pay off $20 trillion is not an option, much less the hundreds of trillions more in contingent liabilities. And you don’t have to wish for the default. It will happen as sure as night follows day. That’s a given so I wouldn’t sweat the details on tax schemes too much. It’s what happens after the crash is the point I was trying to make. How an honorable society might be organized. Plus that I can’t miss an opportunity to rag on trumpeters for not understanding that he’s not the lessor of two evils but the newer of two evils.

Was watching a program on VICE tv last night. According to this program the amount of money in off shore bank accounts total 21 trillion dollars if you can believe it . That’s corporate and personal wealth combined that Americans have stored away .They had done all the foot work to track down these bank accounts. Many of these bank accounts were in the Bahamas. Amazing how the wealthy and their lawyers can figure out how to hide money.

Since almost all of our modern money originated from debt obligations and almost none of it can be repaid, only the tiny fraction that has velocity does anything. Trillions used to mean something. It has lost all meaning. Rabini should get a useful job for once in his life and pray for forgiveness for his great sins indicated by his resume.

What Roubini says isn’t wrong, but he misses the forest for the trees.

The mortgage interest deduction and the state income tax deduction both benefit the Democratic stronghold coast states the most: California, New York, Massachusetts, etc.

The increase in the standard deduction doesn’t help the people who pay no taxes, but it does help all of the people on the lower end who do.

Like it or not – these proposals very much are 99% vs. 1%

Talk about “blowing a hole in the budget” Mr. Roubini, are you forgetting Obama put us into more debt than every other President COMBINED??????