If our elected leaders are not concerned about the government deficit, should the citizens be worried?

If our elected leaders are not concerned about the government deficit, should the citizens be worried?

Governments worldwide spend more than their total revenue and borrow to make up the difference.

The U.S. Debt Clock shows the US federal debt to be $21.6 trillion, averaging $177,283 per taxpayer.

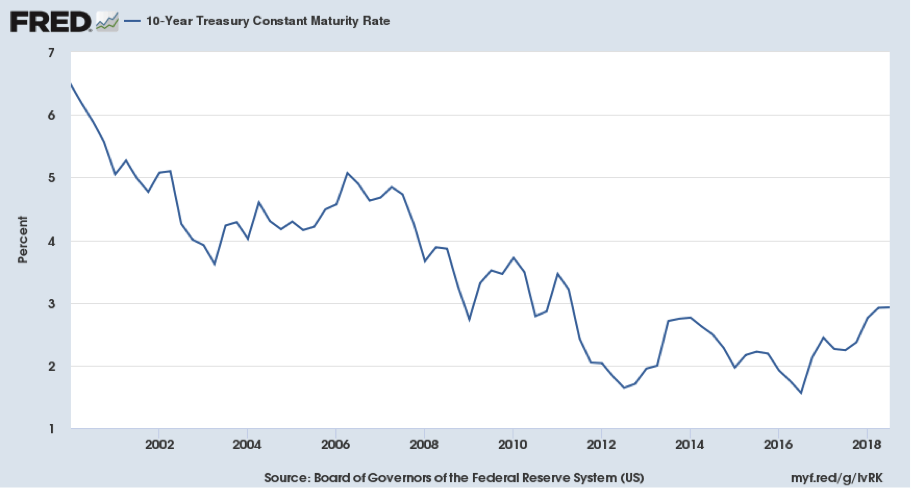

The government now pays interest on $21.6 trillion. Below is a graph tracking the 10-year interest rates on US treasuries.

My brokerage website shows 10-year treasuries are currently paying 3.22%.

Since December 2016, interest rates have roughly doubled, from 1.5% to 3%. The 1.5% increase adds $324 billion in interest cost to the deficit annually and will continue to rise.

The New York Times (NYT) reports, “As Debt Rises, the Government Will Soon Spend More on Interest Than on the Military”:

“The federal government could soon pay more in interest…than it spends on the military, Medicaid or children’s programs.

The run-up in borrowing costs is a one-two punch brought on by the need to finance a fast-growing budget deficit, worsened by tax cuts and steadily rising interest rates that will make the debt more expensive.

…. But the tax cuts passed late last year have created a deeper hole, with the deficit increasing faster than expected.”

The NYT publishes select facts to push their political bias.

I wrote about Nobel Prize-winning economist Paul Krugman’s columns in the NYT. Prior to the election, anticipating a Clinton victory, he wrote, “We should probably be running bigger, not smaller deficits in the medium term.… Yes, we may face some hard choices a couple decades from now…and in any case, there aren’t any choices that must be made now.”

Less than 80 days later, after Clinton lost, he wrote “Deficits Matter Again.”

The media ignores or screams about deficits when it suits their political agenda. We’ve heard this crap for generations.

Do deficits affect us, and what can we do about it?

Nomi Prins tell us, “World’s Most Important Bank Issues Urgent “Zombie Alert”:

It’s been a decade since the world’s major central banks reacted to the financial crisis by cheapening the value of money through record low, zero or negative rates.

…. In its recent…report, the Bureau of International Settlements (BIS) warned that low rates have catalyzed an increase in the number of “zombie” firms…to an all-time high.

Zombie firms are companies “that are at least 10 years old, yet are unable to cover their debt service costs from profits.”….

…. In the late 1980s zombie firms had a 60% chance of staying in that condition the following year, the probability reached 85% in 2016.”

The International Monetary Fund(IMF) warns:

| “The world economy is at risk of another financial meltdown, following the failure of governments and regulators to push through all the reforms needed to protect the system from reckless behaviour, (Emphasis mine)…. |

With global debt levels well above those at the time of the last crash in 2008, the risk remains that unregulated parts of the financial system could trigger a global panic….

…. It warned that “large challenges loom for the global economy to prevent a second Great Depression“.

Is the problem government debt – binge borrowing corporations – or both?

I had the privilege of spending time with Jack Kemp, and Senator Connie Mack discussing “supply-side economics”. The idea was by cutting corporate and individual taxes, corporations would use the extra money to reinvest in production facilities and improvements creating more jobs. Individual tax cuts would spur spending while also creating jobs. Both showed me graphs indicating a lag factor. In 2-3 years, gross domestic product and government income tax revenues rose because of an improved economy.

The early returns on the recent tax cuts show that unemployment is coming down and the economy is starting to pick up.

| “The Budget should be balanced, the Treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed, lest Rome will become bankrupt.”

– Cicero 55 B.C. |

I dislike the political melodrama; let’s be honest. While politicos may use the deficit to sell a tax increase to the citizens, I’ve never seen any politician raise taxes intending to use the money to pay off debt.

Clinton instituted a huge tax increase intending to spend the money for social programs. The Speaker of the House, Newt Gingrich, held the reins. Combined with the internet boom, we had a government surplus for a short time.

Whether it is the Bush tax cuts or the Obama spending programs, the political class has little concern about the ever-growing deficits. Not much has changed since Cicero warned the Romans.

|

The Undeniable Truth With few exceptions, the political class doesn’t give a damn about the debt. The politicos use the tax system and government spending to buy votes to keep them in power. They kick the can down the road; secretly hoping any negative consequences happen when they are out of power, enabling them to make political hay and convince the public they should rule forever! Their behavior won’t change; they will continue to pile up debt until the citizens revolt! |

What about the corporate sector?

Mike “Mish” Shedlock tells us “$300 Billion Cash Repatriated in Q1, GS Expects Eventual $1 Trillion in Buybacks”:

“The Tax Cuts and Jobs Act encouraged the repatriation of profits, which had been subject to additional U.S. levies after it was brought home.

…. The repatriated cash is highly unlikely to create many jobs. Most of it will eventually go to buybacks and dividends. (Emphasis mine)

Goldman Sachs (GS) expects that the total buybacks…in 2018 could exceed $1 trillion.

There’s nothing like throwing $1 trillion into an already insanely overvalued market.

Corporations apparently have nothing better to do with the cash.”

I’m not in favor of buying back stock when the market is at an all-time high. It’s a good time to review your investment portfolio.

- Are your holdings paying down debt with their tax savings?

- Are they reinvesting in their business to create additional profit?

- Are they going further in debt by borrowing to buy back stock at an all-time high?

- Can they pay their debts and dividends without hampering their operations?

What about government?

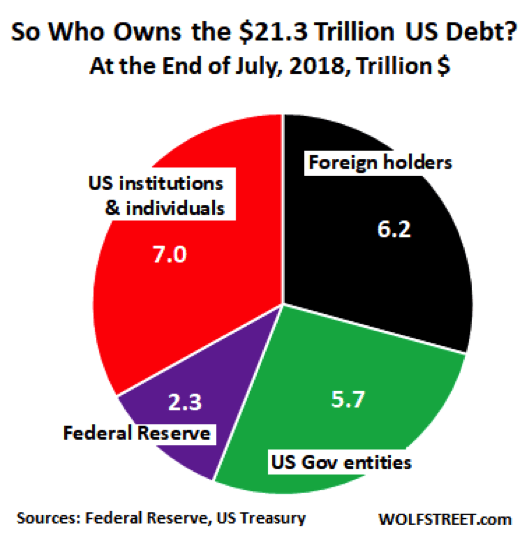

Unlike “Zombie” corporations, governments can continue to borrow and pay their debts as long as there are people willing to lend them money. The bigger the risk, the more they pay in interest. Who is buying US debt?

Wolf Richter, writes, “Who Bought the $1.47 Trillion of New US National Debt over the Past 12 Months?”:

By the end of July, the US gross national debt (increased) $1.47 trillion from July last year…. Here’s who bought or shed this paper over those 12 months:

Foreign official and private-sector holders shed $21 billion….

The US government (pension funds, Social Security, etc.) shed $44 billion….

The Federal Reserve shed $128 billion through the end of July as part of its QE Unwind, reducing its pile to $2.337 trillion by the end of July….

So…who bought? American institutional and individual investors, directly and indirectly, through bond funds, corporate or state pension funds…added $1.66 trillion to their holdings over those 12 months!

And here’s how…US debt is now divvied up:

American private-sector investors are buying with a new-found passion….

The fact that the 10-year yield is still so low…shows that there is huge demand for long-term maturities…. And this demand for US Treasuries is…coming from…American investors.”

| Government debt is generational theft. One generation borrows and spends, leaving the next generation to pay for it. |

The U. S. Debt Clock shows personal debt averages $58,000 per taxpayer. It is dwarfed in comparison to the combined government debt and unfunded promises totaling over $1.1 million per taxpayer.

The U. S. Debt Clock shows personal debt averages $58,000 per taxpayer. It is dwarfed in comparison to the combined government debt and unfunded promises totaling over $1.1 million per taxpayer.

Should we be concerned about government debt?

Darn right! Tax increases can’t pay off our politicians’ debts. Those supporting tax increases want the money to spend buying more votes. Politicos will fuel inflation – paying interest with devalued, worthless dollars.

| When the inevitable downturn comes, the stock market will crash, people will be hurt, the banks will be saved, and the politicos will protect themselves – just like always. |

What can we do?

No one knows exactly when it will collapse, many are predicting 2020. (I’m sure the deep state hopes it comes just before the election.) We can’t prevent it, but we can protect ourselves:

- Hold a good portion of “inflation protecting” type assets, particularly gold.

- While 10-year yields are rising, I’m only buying short-term CD’s and bonds I plan to hold until maturity. If inflation comes, and interest rates rise the bond market will collapse.

- Avoid bond funds. Expect liquidity problems. Some funds may have to sell their better bonds to cover redemptions. The price of the fund may take years to recover.

- Review your portfolio regularly. Dump anything close to a “zombie” corporation.

- Keep your stop losses current.

Government deficits matter regardless of which political party is in control. Do we really want to leave this mess to our children and grandchildren? Reigning in the Fed and banks, a balanced budget amendment and congressional term limits would be a good place to start.

In the meantime, when the bubble bursts there will be some terrific values available for those who prepared and have the cash to act!

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

Should We Worry About Government Deficit?

That’s a trick question, isn’t it?

Blah blah blah, wok wok wok.

The current system will continue until people realize that there is no intention of retiring government debt by repaying it in a currency value near to that which was borrowed. At that point, we will all see that this is not “debt” as “debt” is commonly understood, it is just a mirage or (less charitably) a lie. When the “debt” (US Treasury securities) is acknowledged to never be repaid, those securities (bonds and bills) will no longer serve as “assets”. When that trusty “asset” no longer holds any value, and faith in ever restoring value to that instrument is gone, then there either has to be w sudden and wholesale, voluntary exchange of that asset class for another, or the entire notion of accounting and balance sheets, and repaying any debt incurred with anything of value will collapse.

We will see one or the other relatively soon, maybe both in sequence. Not tomorrow, and not next year, but pretty soon. 5 years 10? As soon as the Masters of the Universe figure out the best way to pull off the switcheroo (IMF SDR is my best guess) it wi begin in earnest.

And if you hold gold or silver, DO NOT tell ANYONE you have it. Not your friends, kids, or spouse. Just keep it quietly out of sight, and you may have something to trade if times get that tough. If anyone finds out about it, they will take it from you by law or simple private force.

Only partially right. M see Milton Freidman “Money Miscief”.

I’m thinking the US is in a different position. As the global economy collapses US assets will increase in value. Some of those assets will be government bonds which will in effect pay a negative interest rate. Similar, to what happened in Switzerland.

So, people will pay us real money just on the prospect of maybe getting 90% of it back.

The issue with Soverign debt is always the type of tax that will be used to service it. If the tax has no impact on people’s behavior then it’s nothing to worry about. And if your Krugman that’s the case.

If you were to hold rates at about 3%, GDP growth at 3%, and no abnormally large increases in govt spending; the “can” could actually continue to be kicked for decades yet.

Rates will go up. Unfunded liabilities will, increasingly, need to be paid. But the bigger problem is that the “Everything Bubble” is ready to pop. Some believe that it has already begun to do so — wherein the stock market crashes, the housing market tanks (again), and we enter a recession. Then government spending drastically increases (bailouts, TARP, whatnot). The Fed has the option of Zero or negative rates continuing indefinitely on the one hand; and inflation leading to hyperinflation on the other hand.

https://ixquick-proxy.com/do/spg/show_picture.pl?l=english&rais=1&oiu=https%3A%2F%2Fupload.wikimedia.org%2Fwikipedia%2Fcommons%2F6%2F64%2FExponential.svg&sp=d6ff0f09125ea0296144905ec4703193

If we’re at 5 or 6 along the x-axis of that graph, and you use your hand to cover everything to the right of 5x or 6x; then everything seems rosy. The popping of the “everything bubble” pushes us rightward along the X-axis. Recession shoves us rightward along the X-axis. Increased spending shoves us rightward along the X-axis.

If FedGov does everything wrong (as is its wont), instead of the debt doubling to $40T in twenty years, it doubles in ten (or less). Instead of having 20 yrs of solid GDP growth to cover that jump, we get 10 yrs of recession and anemic growth. Instead of steady government spending, we get bailouts, bail-ins, ZIRP, etc, … oh, and increasing taxes. Instead of interest on the debt at $500B, it rises to $1T. That’s when exponential growth bites FedGov in the ass. Interest on the debt starts eating into government spending at an increasing rate. We arrive at the really steep part of the exponential curve.

I could be wrong. And, of course, I’m a pessimist … I don’t think the country will make it that long.

Brian,

Please publish your address, even though we know you don’t have any precious metals. We all do it here, ya know?

Nope. The USA is riding the free shit tiger. We can’t get off because he will eat us. We passed the point of no return long ago..Prepare for the inevitable collapse by investing in real assets. Those would be land, real property, tools, technical ability. Oh yeah, lead because you will need to protect your stuff.

Hi,

If you owe the bank $1,000 and can’t repay you are in trouble. If you owe them $100 million and can’t repay, the bank is in trouble.

I agree, we are well past the point of no return. All we can do is try to protect ourselves from a collapse that we don’t know for sure what it will look like, and when it will happen. Nor do we know how a desperate government will respond….perhaps confiscating assets.

Do the best you can.

Best regards,

Dennis Miller

“While 10-year yields are rising, I’m only buying short-term CD’s and bonds I plan to hold until maturity. If inflation comes, and interest rates rise the bond market will collapse.”

How many times must I repeat, it is impossible to have “inflation” amidst a bond market collapse.

Interest rates rise because people pay less for debt. It’s that simple. The price of debt is FALLING. That price is established each time debt is sold, and it applies to all existing debt at that point. When the price of one 10-year note falls, the price of ALL 10-year notes fall, including the one you bought last week, last month and last year.

People can decide to pay less for debt for TWO reasons:

1. They think they’ll be paid back in less-valuable dollars, AKA inflation expectations.

2. They question whether they’ll get paid AT ALL (worrying about return OF their money, not ON their money.)

Rising rates probably reflect more of #2 than #1 now. It’s not inflation “people fear.” It’s a continuation of the decline in the value of the debt that they buy. This is the definition of a bear market.

At some point, the HERD may become more fearful of a decline in value of debt, and try to sell theirs. Sell for what? Shorter-dated debt, mostly. Logically, this should set off a cascade of declining prices for shakier or longer-dated debt. Corporate debt should be CRUSHED. It mostly yields less than 6% right now and appears to be in a bear market, so that yield is still ridiculously too low to compensate for the risk, so a stampede out of it seems plausible. Even long-dated treasuries will likely get hammered eventually.

The debt didn’t matter while debt was in a bull market, just as Netflix’s insane stock rally didn’t matter while the rally continued. In a bull market no high is too high (or interest rate too low when debt is rallying…until it hit zero.) But the obverse of that coin is that stocks or debt can go to ZERO. And in my view, most of them should.

Where does one hide when all markets rose together and all markets will likely fall together. It should be like rats scurrying from one side of a burning boat to the other, with nowhere to go but to drown or roast.

It’s like this: If you were expecting a pension (future cash payments, which is an IOU, AKA a Debt) and you had the choice between waiting for the pension to paying over decades or take the current cash value in a lump sum TODAY, which would you choose? The answer depends on the trust you have in your getting the (larger quantity of) money later, vs Bird In The Hand. If everyone panics and decides on Bird In Hand, the result will be an electronic bank run that makes the disruptions of 1987 look like nothing.

What keeps people from choosing Bird-in-the-hand option the early withdrawal penalties. I’m guessing that will keep most people from doing it.

No. We should not worry about the deficit. If our elected officials and endless ranks of desk-jockey-bureaucrats aren’t concerned about it, we should obviously not worry about it as they would never accidentally or on purpose do anything to harm Americans. We are in good hands people!

Whew! I’ve been worried but your soothing words put me back into my dreamland state of being. Thanks

It’s obvious the debt per American, exceeding over $1 million, will never be paid. No amount of program cuts or tax increases can come close to dealing with it; the average American barely makes that over a lifetime. That leaves two choices; default or inflating it away. Left to choose on their own, governments always choose the latter. Regardless, if you hold currency in American dollars–and the same goes for Canadian, Euro, Chinese and every other currency–you’ll be wiped out. This is a certainty because it’s simple math. The debt can’t be paid, so it won’t be. Hard assets may be our only hope, though the government will get their greedy mitts on much of that as well.

There are two ways to get out of debt: 1. spend less, pay off the debt (slow and painful), and 2. spend more and go bankrupt (fast and exciting). Only people who lack experience in monetary matters will choose the first way. Or lend money to people who have this sort of experience.

Hey, hey, couple of us know a little Deutsch hier mein freund

I have gone around the subject of hope with a friend. He believes one must believe in something to have hope. In his case Jesus. He says:

I have found that hope is not free. You have to believe in something to have hope.

Hope is an act of freewill and if you can’t or won’t believe in something or someone, then hope can’t exist.

On the church asking a doctor if a healing is a miricle he, the doctor, believes that science one day may explain what has happened, that is a hope which arises from his belief in science.

The church asks because it is looking for an rational, dare we say a scientific explanation, that disproves the claim of miracle because it believes faith without reason is superstition.

“If one can rule out the impossible, what remains, regardless of how improbable. is possible.” Sherlock Holmes/Bayesian Probability.

I counter that one can have hope as it is free, cannot be purchased or sold nor bargained and once can have it even if an oppressor says all hope is lost. I gave him an example of physics and a stone catapulted at one. Judging from the arc one can reason that they will not be hit. One hopes they are right.

As per debt, I know that we are all worm food eventually and it matters not the government debt as we really cannot do anything about it in our lifetimes. Maybe after the turning for those remaining the debt question can be pondered.

“Is the problem government debt – binge borrowing corporations – or both?”

Errrrr…. The FED is the problem. Other than an outstretched hand and chaos, what do they bring?