Authored by Charles Hugh Smith via OfTwoMinds blog,

Entering commoditized, fiercely competitive low-margin services cannot substitute for the high-margin profits that will be lost as global recession and saturation erode iPhone sales.

Apple has always been equally an enterprise and a secular religion. The Apple Faithful do not tolerate heretics or critics, and non-believers “just don’t get it.”

So the first thing any critic must do is establish their credentials as a Believer:My first Mac model 0001 was the 21,447th made in week 32 of 1984 in Fremont, California. Now that we’ve established that, we can move on to my profound sense of anguished abandonment that Apple ceased producing the iPhone SE, the only form factor that works for me.

But Apple Faithful are accustomed to repeated bouts of anguished abandonment; it’s just one of the burdens the faithful must bear.

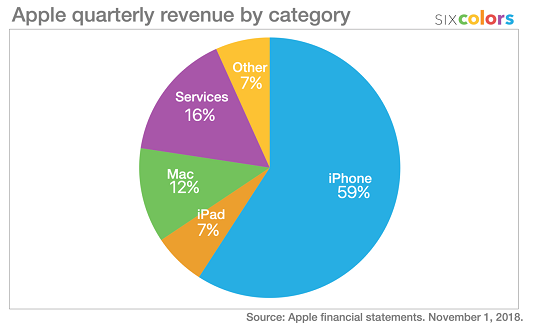

Focusing on the enterprise rather than the religion, Apple’s core–its revenue and profit potential–is rotten. As the charts below illustrate, despite all the happy talk about growing “services,” the hardware-software iPhone generates nearly 60% of Apple’s revenues. The iPhone ecosystem is also the foundation of the “services” currently being hyped as replacement sources of revenue.

The problem is that the proprietary features of the iPhone that have generated strong demand as prices kept rising are reaching diminishing returns. People want the status of owning an iPhone, but there are limits on what the bottom 90% can pay for that status.

The new features of the $1,000 iPhones have also reached diminishing returns. This is analogous with adding memory to a computer or increasing the pixel count in a digital camera: at some point, the added feature no longer has any impact on the user experience.

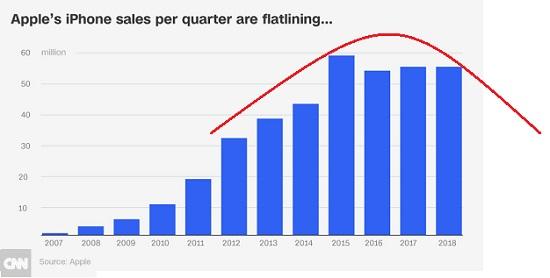

As the second chart illustrates, the market for costly mobile phones is saturated: everyone on the planet who could afford one and wants one has already bought one. As we all know, the “fix” for saturation is to speed up the product cycle so the existing owners are forced to buy a newer and much more costly model every year or two.

But this strategy also has diminishing returns: people get tired of getting ripped off by accelerating replacement cycles and eventually some percentage step off the merry-go-round and switch to a much cheaper and less demanding (product-cycle-wise) alternative.

Then there’s the other problem: without Steve Jobs, there is no “next big thing” at Apple. As I’ve explained many times here and in my books, value flows to scarcity, and Apple’s enormous profits are based on the artificial scarcity Apple has been able to impose on the market by closely guarding its proprietary mix of hardware and software.

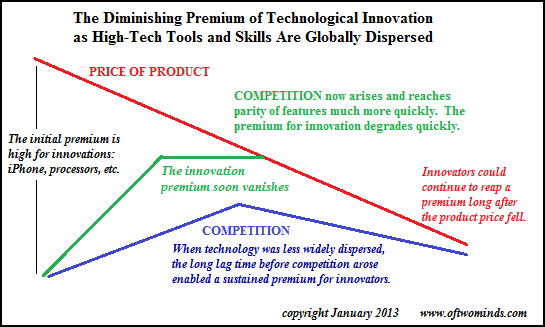

But as this chart attempts to explain, the price innovators can charge as competition increases diminishes as the innovations lose their scarcity value. The faster the advances and product cycles, the faster the erosion of pricing power.

Why the Innovation Premium Is Diminishing (January 16,2013)

The innovations of late-cycle iPhones are out of synch with the price increases.Apple is moving from selling innovations worth an extra couple hundred dollars to resting on its status-symbol laurels as a “luxury brand.”

That may work well in a global expansion, i.e. the past 10 years, but as the world economy contracts (don’t dare call it recession), that strategy will not yield the same results it did in the expansionary cycle.

Lastly, the “services” Apple is entering are commoditized and extremely competitive, markets in which it has very little proprietary territory to defend.Payment systems and credit cards are commoditized markets: there is very little differentiating the options and the host of competitors is expanding rapidly.

Many competitors are well-funded and experienced in maintaining customer loyalty. Payment systems and credit cards aren’t a sideline as they are for Apple; these are the banks’ bread and butter and they will not make it easy for Apple to carve off a proprietary territory.

As I’ve also noted, commoditized products and services have low profit margins.Apple generated its tens of billions of dollars in profits by reaping extraordinary margins; those margins cannot be transferred to commoditized services.

The content creation and delivery sector is also commoditized and fiercely competitive. There is very little to differentiate the services and generate scarcity value, and as the global recession deepens, consumers will be paring back their subscriptions, not adding them. There is quite a lot of free content out there and those on a budget have many options.

What happens to Apple’s “growth story” once iPhone sales decline and the much-hyped services generate a mere trickle of net profit?

Apple is facing a secular decline in its proprietary flagship that generated huge profit margins. Entering commoditized, fiercely competitive low-margin services cannot substitute for the high-margin profits that will be lost as global recession and saturation erode iPhone sales.

* * *

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 ebook, $12 print, $13.08 audiobook): Read the first section for free in PDF format. My new mystery The Adventures of the Consulting Philosopher: The Disappearance of Drake is a ridiculously affordable $1.29 (Kindle) or $8.95 (print); read the first chapters for free (PDF). My book Money and Work Unchained is now $6.95 for the Kindle ebook and $15 for the print edition. Read the first section for free in PDF format. If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I agree about the Iphone se.I work in a large antique store where I work on antiques and move them around. I need a phone the can slip in my pocket, and I can use my bluetooth to talk to other staff while my hands are otherwise occupied. All this trend to bigger and bigger screens just means they are more prone to break. Small phones are structurally stiffer. and less prone to flex and crack the screen. The other thing is in my pocket they don’t fall to the floor if they are bumped, as they do when they are in a holder attached to my belt. So yes, I am going to miss the Iphone se too, since all of Apples other phones are too big for my use.

” All this trend to bigger and bigger screens”

A couple months back I was walking into WallyWorld when I saw undoubtably one of the largest females of the human species that I had ever seen (that store does get lots of WT)-the woman must have been at least 350#, but, to her credit she was upright as she waddled along. Anyway, in the back pocket of her size 86XXXL “slacks” was one of those big screen phones, nicely tucked inside a pocket that must have been at least 9″W x 12″H. That girl’s phone was never going to fall outta her pocket.

And my 900 dollar phone only cost me 6 billion in taxpayers subsidies. More proof muh free market capitalism is keeping muh consumer goods affordable for US poor consumer units . Chief Red-Ass approves this message.

Discover Where Corporations are Getting Taxpayer Assistance Across the United States

https://www.goodjobsfirst.org/subsidy-tracker

the foxconn subsidies,were those from the us govt or the chicoms?

Jobs wanted to do this more than a decade ago with AppleTV.

Now it is simply ME TOO! Does the new Apple service give anything new or innovative?

Why couldn’t Apple come up with 5G equipment like Huawei? or something similar? They didn’t have the engineers?

Jobs came back once after being fired and saved Apple from that Pepsi marketing guy (cannot recall his name) more than 20 years ago. Newsflash to Apple Shareholders: He’s not coming back again.

Apple pie anyone?

Liberal progressives infesting the western tech industry. They are sand and bubblegum in the machine and Jobs was legit forceful enough to keep them heads down and out of the way so that the unpleasant feedback could get through and the better job could be done.

Now there is nobody there to slow down the parasites that have been waiting dormant in every department slogging everyone else down.

There are few western tech companies that aren’t absolutely bogged down this this vermin. But that’s just my almost 25 year perspective of from the inside talking.

Same thing is happening to HP with their cash-cow printer supplies losing market interest-the company has nothing coming along with those kinds of profit margins.