Guest Post by Martin Armstrong

If asked, of course, I advise to issue long-term debt NOW at these absurd low rates. I also advise individuals to lock in fixed-rate mortgages.

Germany just tried to issue negative interest 30-year bonds with a total offering of 2bn€ of which they only sold 824million were purchased. This is showing that this whole theory of negative interest rates as seen its day. The US is now even considering issuing 50-year and 100-years bonds as interest rates plummet.

I have reviewed the buyers of these negative bonds which now amount to $15 trillion outstanding globally. What is actually taking place in the market is really dominated by punters rather than investors. In other words, the people have been buying them to flip assuming rates would just go lower.

The crisis on the horizon is MASSIVE!!!! These punters are going to get caught as they did with the Russian bonds when they collapsed in 1998 which led to the Long-Term Capital Market crisis. This is a game of musical chairs. Nobody thinks twice as long as rates decline. But the appetite for negative yields does NOT exist insofar as people actually investing in them.

Yields have dipped negative on short-term 30 days paper during panics. The 30-day TBills went negative several times from December 2008 onward. The reason was clear. Capital feared the banks so they were willing to park money at a slightly negative rate.

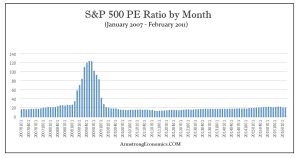

This also corresponds to capital parking in blue-chip equities which created the peak in the PE ratio at the bottom of the crisis.

The trend looks to be getting ready to change when the ECM turns. BUYER BEWARE!!!!

We may yet see the biggest bubble in the modern history of finance explode far worse than the 2007-2009 debacle.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

No one in their right mind will be willing to purchase negative yield bonds AT A LOSS – except the government.

Like the article’s author says, even laddered short-term T-bills in money market funds not invested into stocks will get hammered.

Time to find and alternative hedge.

PIMCO managers selling and government issuing longer term paper doesn’t look good for the dollar. SWMBO (she who must be obeyed) thought I was absolutely nuts for liquidating a 401kplan from a previous job and diversifying to physical metal with the taxable proceeds. Hell, I even thought I was nuts for doing so because the damned banks have been suppressing the market for years …. but that’s about to change soon.

Wrong ed,

When you do not trust the banks you will be happy to store your liquid wealth and pay to have it stored knowing they wont nationalize it, steal it or limit your access to it. But there are no guarantees if shtf bad enough….the govt just may do the same

Bond bond bond, Bond bond the land! Oh bond go up, bond go down, bond go Boom, oh woo-o-woo, nothing left of Babaran!

What do you call it when capitalism and communism become one in the same?

https://www.fastcompany.com/90394048/uh-oh-silicon-valley-is-building-a-chinese-style-social-credit-system

It’s illegal for US companies to discriminate based on race yet they have been discriminating against me for 55 years! If they based insurance rates honestly on race, I would get a discount. We already have many Blue States that are severely socialist so I totally expect the Communist Social Credit System to continue to grow in the USSA.

Communists Have Controlled American Discourse Since 1930’s

Armstrong doesn’t ‘explain’ the impetus for rates to rise. Why? Interest rates can’t. The entire world is awash in debt. Even the slightest rise in rates will trigger a domino effect. Someone explain how rates are going to rise substantially when a global depression encapsulates the entire globe.

Supply and demand. There is very little supply therefore massive inflation. And if anyone will lend they will want a large interest rate because there is a higher risk you can not pay back the loans. Therefore interest rates rise well beyond that of a fed rate. Its called a spread and risk premium. The risk premium spread will be the largest in history. We no longer manufacture much here now so there will be limited supplies causing massive inflation. People will be in major need of liquid dollars. Cash will be king as will PM’s. This allows the govt to keep an official low rate to pay on its debt but the consumer debts will nearly be similar to shadow banking. It will become known as shadow loans or shadow bonds. But the govt debt service interest rates will remain low and fixed while we get screwed.

Wells Fargo stopped making auto loans more than a year ago. They know that the cars are junk before the 7 year 20% loan is paid off . Even those crooks know that this crappy boat won’t float much longer.

Try selling your wife or even strangers on the facts or ideas their savings accounts or checking accounts are owned by the banks and like Greece will steal it and give you access to $50 a day but your $300,000 is taken by the banks and you will take a million days to get it back. They will look at you like they do when you tell them they should be storing preps, stacking silver and buying bullets. You cray cray.