Authored by Chris Martenson via PeakProsperity.com,

“When it becomes serious, you have to lie”

The recent statements from the Federal Reserve and the other major world central banks (the ECB, BoJ, BoE and PBoC) are alarming because their actions are completely out of alignment with what they’re telling us.

Their words seek to soothe us that “everything’s fine” and the global economy is doing quite well. But their behavior reflects a desperate anxiety.

Put more frankly; we’re being lied to.

Case in point: On October 4, Federal Reserve Chairman Jerome Powell publicly claimed the US economy is “in a good place”. Yet somehow, despite the US banking system already having approximately $1.5 trillion in reserves, the Fed is suddenly pumping in an additional $60 billion per month to keep things propped up.

Do drastic, urgent measures like this reflect an economy that’s “in a good place”?

The Fed’s Rescue Was Never Real

Remember, after a full decade of providing “emergency stimulus measures” the US Federal Reserve stopped its quantitative easing program (aka, printing money) a few years back.

Mission Accomplished, it declared. We’ve saved the system.

But that cessation was meaningless. Because the European Central Bank (ECB) stepped right in to take over the Fed’s stimulus baton and started aggressively growing its own balance sheet — keeping the global pool of new money growing.

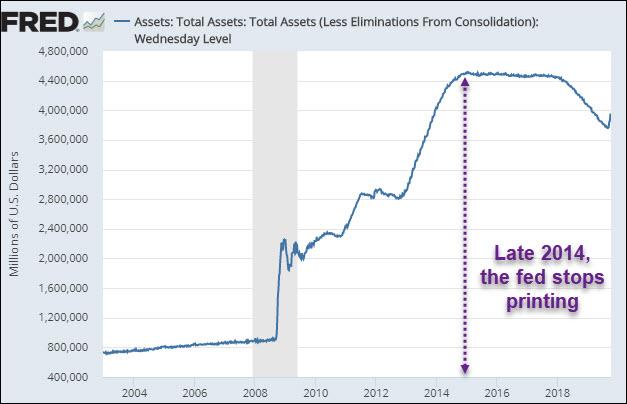

Let’s look at the data. First, we see here how the Fed indeed stopped growing its balance sheet in 2014:

And we can note other important insights in this chart.

For starters, you can clearly see how in 2008, the Fed printed up more money in just a few weeks than it had in the nearly 100 years of operations prior.

The flat parts of the curve in this chart are were the Fed paused its printing efforts. And at each of these plateaus, without the tailwind of fresh new hundreds of $billions created from thin air, the equity markets stopped rising and even (gasp!) threatened to decline.

So what did the Fed do in response? It resumed the money printing.

The above chart is really a monument to failure. The initial $trillions of printed money didn’t solve things, and so more printed $trillions followed.

Every trick in the book has been used. QE. Operation Twist. Jawboning by Bernanke, Yellen and now Powell. More jawboning and tweets from the President and his administration. And now, fresh interest rate cuts and a resumption of QE (but don’t call it that!) by the Fed.

Collectively, these efforts have horsewhipped stocks and bonds higher and higher over the past decade — which was the intent. But it seems the higher they go (and thus further distorted from their underlying valuation fundamentals), the Fed becomes ever more frightened of a correction.

So now let’s look at what happened after the Fed passed along the money printing baton to the ECB.

We can clearly see in the chart below that when the Fed stopped its printing in 2014, the ECB stepped right in and carried things on until this year:

During the years of ECB printing (and printing by other world central banks) stocks and bonds continued powering higher. That is, until the ECB slowed its efforts in late 2018, as the Federal Reserve was raising its federal funds rate.

You see, 2019 was supposed to be the year when the major central banks were supposed to start unwinding their massive balance sheets in earnest. And, in doing so, start to undo the massive market distortions caused by their prior actions.

And what happened in late 2018? The markets started rolling over fast and hard.

Panicked, the central banks have rushed back to “rescue” the system. And in the process, are showing that they’ll likely never “unwind” the $trillions they’ve been printing from thin air.

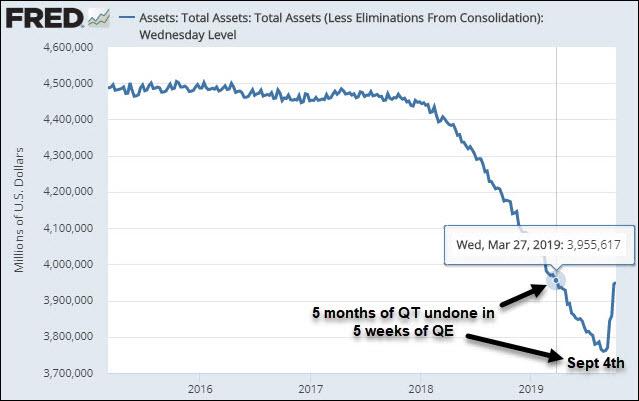

Looking again at the Fed’s balance sheet:

We see that, starting in 2017, the Fed began the slow process of trying to remove some of the liquidity it has injected into the system over the past decade.

It didn’t get very far.

Worried about recessionary signs and wobbly stocks (still within a few percentages of their all-time highs, mind you), the Fed’s most recent actions have undone 5 months of ‘tightening’ in just five blistering weeks of panic.

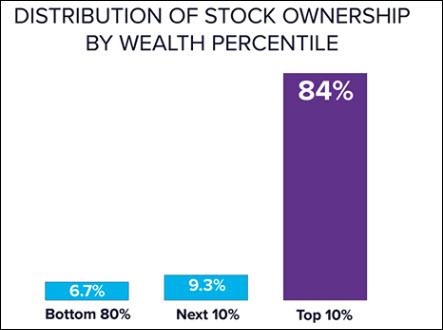

It’s enormously concerning that the stock market is now the sole focus of central banking. The stock market is a terrifically poor instrument by which to try and guide anything (except the growth in apparent wealth of the ultra-rich – it’s very good at that).

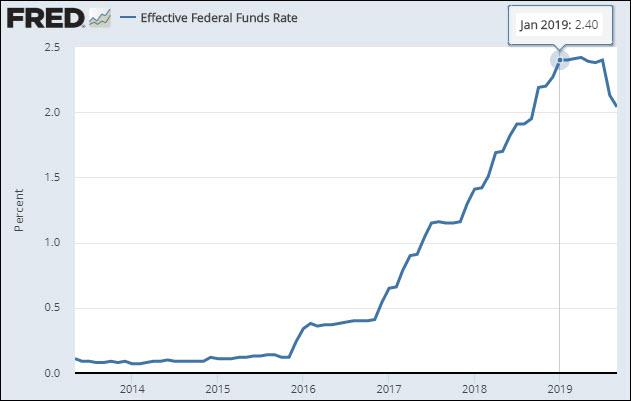

Remember, the Fed stopped printing in and began raising rates in order to build up some wiggle room to deal with the next recession when it inevitably arrives.

But that never came to pass.

The last rate hike was in January and the Fed is now back to lowering rates. With the federal funds rate at a measly 2.0% today and likely headed lower from here, the Fed has practically no wiggle room to speak of at this point:

“When it becomes serious, you have to lie”

The above is a quote from Claude Junker, of the EU technocracy, explaining (in 2014) why he believed lying is necessary during financial emergencies.

Fast forward to last week. When Jerome Powell tried to explain why the Fed is suddenly back in the business of printing $60 billion per month (out of thin air) to buy more US Treasury bills, he came off sounding like he’d ripped a page out of Junker’s playbook.

Is he now lying because “It’s serious”?

“I want to emphasize that growth of our balance sheet for reserve management purposes should in no way be confused with the large-scale asset purchase programs that we deployed after the financial crisis,” he said. “Neither the recent technical issues nor the purchases of Treasury bills we are contemplating to resolve them should materially affect the stance of monetary policy.”

“In no sense, is this QE,” Powell said in a moderated discussion after delivering his speech.

Not QE?

Well, what about the fact that the Fed is conjuring $60 billion of new money into existence each month and shoving that into the banking system?

And what about the fact that these new Quantities of money are Easing financial conditions and expanding the Fed’s balance sheet again?

You mean other than those similarities, it’s definitely not QE, Jerome?

Even Wall Street agrees with me:

“I think what the Fed Chairman decides to call it is inconsequential,” Yousef Abbasi, global market strategist for U.S. institutional equities at INTL FCStone told MarketWatch. “From what’s been discussed, it’s exactly what was once called QE. They would be buying securities and increasing liquidity and that is easing. However you want to refer to it, ultimately it’s supportive of equities,” he said.

Mike O’Rourke, chief market strategist at Jones Trading said in an interview that balance-sheet expansion may be different because it will involve the purchasing of short-term government debt rather than long-term debt, but that the effect is to enable private banks to maintain larger balance sheets and take on more risk. “This is very QE-like,” he said.

Yes, this is “very QE-like.” Indistinguishably QE-like.

Further, it has to be noted that the decision to suddenly restart the QE program was made mid-cycle, that is between FOMC meetings. This is a good indicator that things are “serious”, as the Fed typically doesn’t like to appear as if it’s been caught off-guard.

So, from my perch: something BIG and concerning is afoot in the economy, the Fed is secretly panicking, and they’re lying to us about it.

Things Are Now “Serious”

Here in late 2019, both the Federal Reserve and the ECB are now both easing again – or back to ‘fraudulent money printing’ as I prefer to label it.

Perhaps a definition is in order. A fraud is meant to deceive while removing something of value from one or more parties.

When printing money, the central banks say they are doing it to protect the economy, jobs and the financial system.

But what’s actually happening is that wealth is flowing like a raging river towards a select few individuals and corporations.

It’s critical to understand that the central banks cannot print up prosperity. All they can do, being redistributive organizations, is take purchasing power away from one side and hand it to another.

So the key question to be asking now is: Who’s winning and who’s losing?

Well, here in the US, we already know that it’s the tippy-top 0.1% that is doing almost all of the ‘winning.’ The next 0.9% are doing pretty well, too. But by the time we get just slightly below the top 10%, we run out of “winners”.

Ergo, the bottom ~90% of us are the losers:

This enrages me enormously. It’s such an obvious scam to reveal, but somehow the US press is entirely NOT up to the task.

For some insane reason, it has become normalized for the ultra-wealthy to grab everything for themselves, leaving little left over for today’s lower classes or for future generations.

When did such magnificent greed become normal? How is any of this okay with anybody?

Increasingly, we’re seeing that more and more people are NOT OK with that. The Yellow Vest protests in France, the uprisings in Ecuador and Hong Kong, the climate protests, the Extinction Rebellion movement — all of these are forms of rejection of destructive blind greed.

They are also predictive signs that our social and political systems are becoming badly stressed. When people finally start losing hope, they turn on their “leadership” and revolt.

In other words, It’s now becoming serious.

By now the central banks should have realized that their efforts to perpetually boost asset prices are unraveling the main social contracts upon which our very social stability and relative political peace rest.

But if they have, they aren’t demonstrating any signs of it. Instead, they’re still pretending everything is “in a good place”

The core predicament facing the Fed and its central banking brethren is that reality can be delayed but not dismissed.

The pressures of instability continue to mount exponentially the more the central planners try to contain and (literally) paper over them.

It’s no longer an issue of keeping stock prices attractively high. It’s about accelerating social inequality, the rejection of capitalism and globalization, rising geopolitical divisions, resource scarcity, and the loss of liberty, health and happiness. The central planners’ extractive policies are now manifesting in all of these ills.

How much longer can they keep the system from exploding outside their control?

In Part 2: Why The Fed Will Fail, we look closely at the key economic indicators that are convincing us that there’s not much time left before things violently correct.

At tipping points like now, it’s critical to remember that cycle ends are processes (i.e. slow), but reversals are events. They happen fast.

And once they start, only those who have already prepared in advance are ready for what comes next.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access).

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

What did Trump have to do or trade for the bankers to step back on the monetary gas for him?

“The Fed Is Lying To Us”

When have they told the truth?

My take, shared by some others is that some institution’s derivatives book has blown up. I also believe the Fed is buying the US governments debt via primary dealers because nation states have stopped doing so.

Likely Deustche, there were 2 semi-desperate merger attempts recently, and their book is 40+ trillion, New York will nuke the EU through Germany and even BOJ before they fall, so there is some firewall there. Oil is possibly the driver, its hard for me to estimate how much is sold for dollars these days, a cornocopia of stories weekly of less and less global energy sales in dollars. Coupled with ramped up domestic production at staggering losses for years could produce dislocations that would require similar easing.

Perhaps all of these plus others, god knows it’s the biggest pile of paper shit the world has ever seen, when it catches on, it will probably burn to holdings.

Quite likely not one, but multiple intertwined banks have liquidity problems. Shale oil, IPO market topping out, bond yields, and international trade issues will make for an incredible crack-up boom.

Trump got his drop in interest rates, but that’s a temporary patch to help his re-election campaign. SHTF sooner or later and I’m betting the Big Five Banks and especially DooshaBank are all part of it.

FWIW, I had to visit Atlanta twice in the last week, father in a nursing home (his last days on earth). Parents live in a small old condo near a VERY wealthy part of town (they aren’t). Driving thru I noticed a lot more ‘for sale’ signs on homes ($800K to $3.0M) than I’ve seen in a long time (years). Makes me think the economy is slowing / tightening when I see that many high end properties for sale. Those folks probably got laid off or baling before the SHTF?

Hear you. Sister has been trying to sell a house in an exclusive area of Ma. for 1.75. Just accepted a lowball of 1.20. She even has a double lot; enough room to build another house & pool. Chinese buyers; they know value and how to squeeze. Gotta hand it to ’em.

My Mother sold a house in Jersey in 2014 for $300k my parents paid $13k for it in 1954. It took them 30 years to pay the Banksters off for the loan. The old Chinese couple showed up at the closing with the money in cash in a suitcase.

They had a son who bought a house across the street a year earlier and did the same thing.

Hear ya Mark. I was born and raised in Alexandria, Va. outside DC. Folks bought a 1 story, 3 bd. house w/ full basement in ’59 for 19.5 T. Wife and I went there in 2014 and asked the Vietnamese guy that owned it if we could take some pics after explaining I grew up there. Asked him what the current appraisal was he told me 1.15 M. What a trip.

In my area it’s Jewish Orthodox real estate LLC’s buying up land.

They are latching onto foreclosed properties as income opportunities and purchasing large tracts of undeveloped land surrounding residential areas they aren’t able to buy into. I’ve literally had to insult or run Frum realty agents off because they have become so annoying, but at some point, I am selling the house. Downturn or not they’ll still be buying simply because they need the space.

When that happens I’ll be looking in the rear view mirror with the middle finger stuck up.

e.d. ott,

Better years too early then one day too late…just saying buddy.

The USA is one of the last places you can earn small rates of return when in a world of negative interest rates. Therefore, many outside the USA are chasing rates here and investing here. It is vital we keep our rates within a certain spread to keep that positive and confidence high. Many see investing in treasury’s here as a risk free spread/return as it is backed by the usa govt.

Here in the usa banks borrow short term and lend long term and the spread is their return. Many banks also use bonds and the spread as risk free return as it is backed by the govt. However, when the govt starts destroying its tax base by sending jobs overseas, importing low iq unskilled from third worlds, and eviscerating the incentives for the middle class from earning a living it collapses. When colleges start accepting the dumber student because of color, religion, or because they grew up poor vs allowing and rewarding and placing on scholarship the deserving student, when this narrative and social policy hits corporations they will do the same. They will be full of low paid incompetents and profits will suffer.

The tax base will go down, student debt up (by deserving students not getting scholarships but getting a loan that cannot be paid back because a third worlders took their job at half the pay). These deserving students will be over qualified, under employed and their will and spirit crushed. When the taxes are increased stifling incentive, the tax base (payments) suffer and the risk rises in risk free rates of return disincentivizing foreign investment into treasury’s and then, then you have a rubber band crisis over night. Rates shoot up, the fed will intervene in a huge way more than the current repo rates. The banks will quit lending because the short rates are higher than long rates. The banks cannot lend long because they would lose money. Then housing collapses because nobody can sell (cash out of realty) and nobody can buy a home unless they pay literally in cash.

While this could open alt markets to mortgages like social lending, if it goes on too long and the credibility and stability of these “social lending programs” catches on and gain legitimacy the banks created their own competitors. They will cause an implosion to crush the competitor they created.

Currently we only see social lending on the micro loan market. When it goes mainstream for larger mortgages watch out. If the inverted yield curve remains inverted for a long period it will create this monster, By necessity. You may recall 2008 was a liquidity crisis and it started in commercial paper, the overnight markets, as well. When you interrupt business so fast it has a rubber band breaking point immediately. And severely. When we see the current 60 billion fed overnight jump to over 250 billion daily for a sustained period like 60 days it is surely a bigger longer term problem because that will then become normalized. And, its not normal especially if the yield curve remains inverted during this time.

That fear, along with dollar weakening and the evisceration of the tax base will cause inflation while at the same time fewer dollars available because foreign investment will dry up. Normal inflation is due to too many dollars in the system. This will be inflation with too few dollars. Which will cause massive money printing. Increasing the usa debt and devaluing the dollar bigly. Cash, and PM’s will be king when the higher priced homes cannot be sold. This is when gold can be made illegal to own again fyi. Why junk silver is best. It is still legal currency. Take note.

Fyi foreign gold coins are still regulated under the gold act and can be interpreted as trading with a foreign entity/enemy. You need to understand the gold act and much of it still exists especially issues related to when the usa is in wartime. NK and usa are legally still at war and is one reason to keep the vice on gold. Read about this know this understand the issues relating to gold. Govts globally will reset as gold will become part of the basket as a fundamental reserve base. Making gold a major liability for citizen owners.

Just so we can be assured you are not talking to your alter ego (or your Altar EGO, since it is Sunday), I will share a story about gold.

I’m sure others will remember the story about someone inheriting gold coins which were illegal for the ancestor to own. Those coins had to be forfeited to the US government without compensation. Great-grandpappy broke the law and there is apparently NO statute of limitations when it comes to gold seizure.

The moral to this story? Melt the coins or at least scratch the date…

The gold being referenced is the 1933 St. Gaudens, none of which were authorized to be sold to the public from the Mint. There’s a big controversy over the definition of bullion and a numismatic collectible where law is concerned. Much of the “confiscation” relied on the public’s willingness to comply with the law and many collectibles are still on today’s market because certain items were given an exception under the Act, unlike the unreleased 1933 St. Gaudens coins.

The court upheld the government’s claim because the gold was still under Mint jurisdiction, but once it goes on the market and is legally sold to the public due process is involved and some sort compensation is called for.

Will you trust the government to give you fair value? Given their actions in the past I don’t trust them with guns OR money.

Please don’t melt the coins. Please. I can’t tell you how much history is lost due to decisions like these. I agree that the 1933s shouldn’t have been confiscated, but it is a permanent loss of our history when people decide to melt specie. You’ll lose condition and key date rarities.

One of the reasons FDR didn’t seize coins with numismatic value was because he was a philatelist and his cousin Teddy was a numismatist.

The moral of the story should be to buy gold with minimal but some numismatic value, like common date St. Gaudens.

The Federal Reserve Banking System : Lying cheating and financially screwing the bulk of the American population while enriching the Circle Jerk Club Of Wall Street To K-Street to Capitol Street . “THEY” have conspired against the citizens of the American Republic by involving us in wars for which “THEY” profit and we pay in our blood and our treasure . Yes “The Fed” cheating and lying from 1917 to now without interruption !

It’s a big club and we are not in it !