Covid-19’s effect on global energy markets has been disastrous. OPEC slashed its oil demand forecast last week, and Goldman Sachs doubled down on its bearish oil take and has cut its oil price target by $10 to $53 for the year, as a result of a “demand shock” that is set to collapse Chinese oil consumption by 20%, or as much as 4 million barrels per day.

The sharp decline in demand in China, which by the way, is the world’s largest oil importer, is now stranding oil cargoes off the country’s coast and across Asia.

Bloomberg’s Stephen Stapczynski records footage of an impressive parking lot of tankers and other vessels off the coast of the anchorages of the port of Singapore, one of the largest freight hubs and busiest ports in the world.

Tankers… tankers everywhere.#singapore pic.twitter.com/RCEysNtDKo

— Stephen Stapczynski (@SStapczynski) February 15, 2020

Much of the oil consumption decline is because, as we reported on Friday, China’s economy is faltering as its industrial hubs remain shuttered.

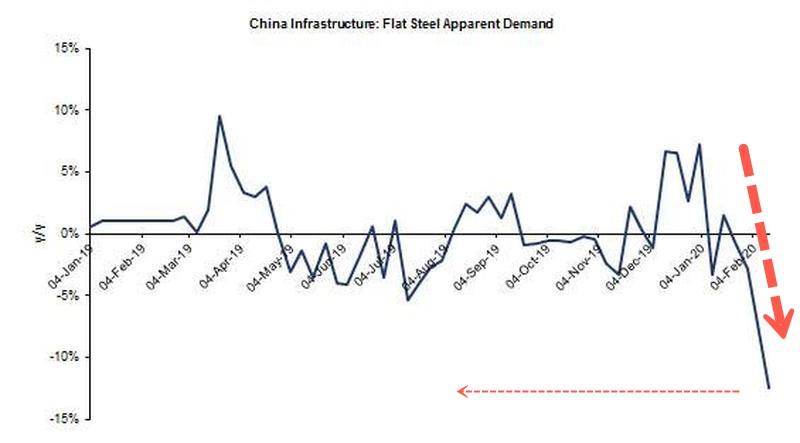

Take a look at the chart below, in the Feb 7-13 week, steel apparent demand is down a whopping 40%, but that’s only because flat steel is down “only” 12% Y/Y as some car plants have ordered their employee to return to work.

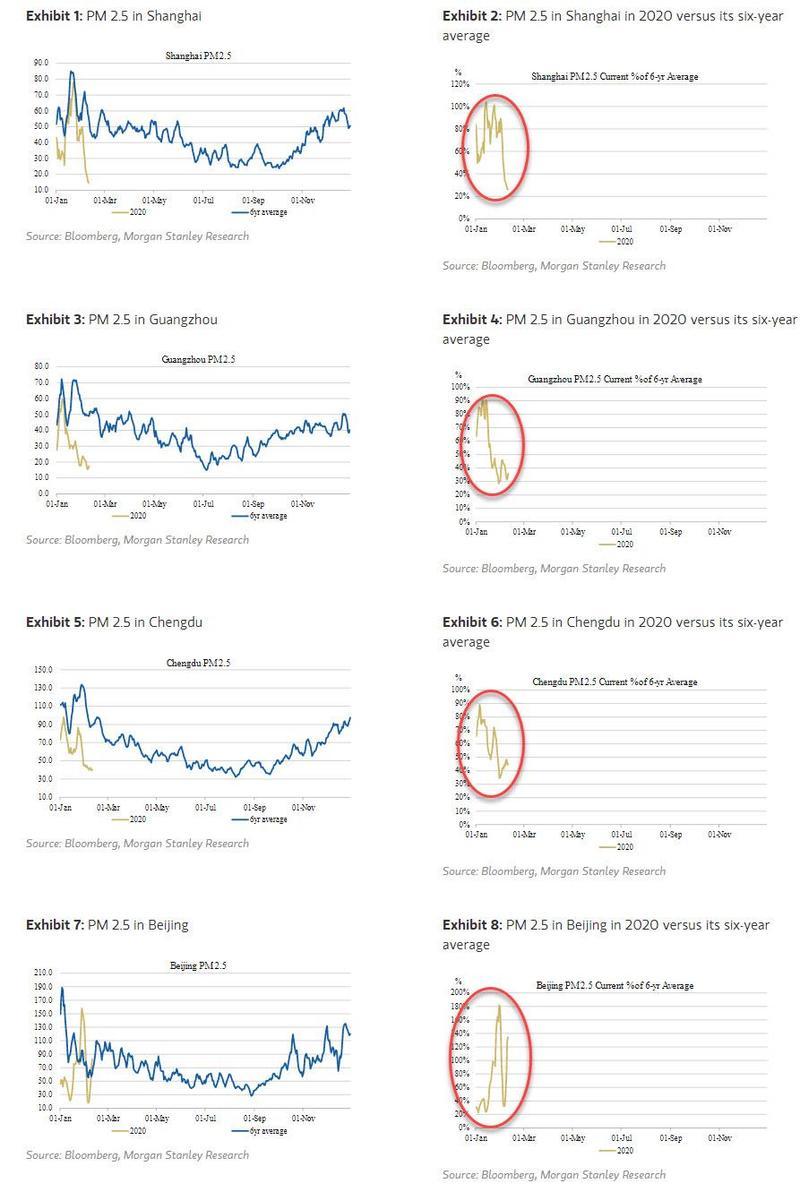

Real-time measurements of air pollution (a proxy for industrial output), daily coal consumption (a proxy for electricity usage and manufacturing), and traffic congestion levels (a proxy for commerce and mobility) suggest that the second-largest economy in the world has frozen. This all indicates the demand for energy products to power machines and vehicles has abruptly stopped.

A significant bottleneck for Very Large Crude Carriers (VLCCs) deliveries to China is developing, forcing some ports to reject new tanker loads, contributing to a parking lot of tankers sitting off the coast and in other regions in Asia.

Some cargos have been diverted to Singapore, Malaysia, South Korea, but even in those regions, tanker traffic jams are building.

Crude storage in China filled up near full capacity last summer, mostly due to declining demand thanks to a decelerating economy.

China’s overall crude storage is around 760 million barrels, versus a peak of 780 million barrels last June.

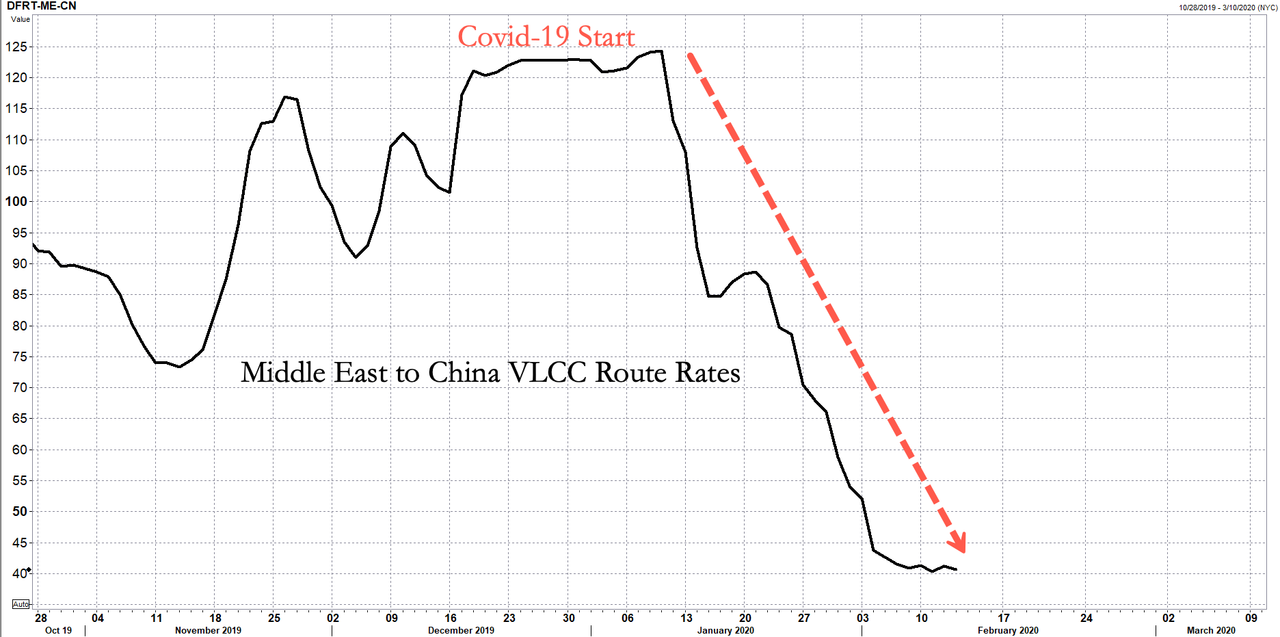

Middle East traders who export crude via VLCCs to China reported weaker demand. VLCC rates from the Middle East to China have plunged since the virus outbreak began early last month.

“In gas markets, a one Chinese company declared force majeure, potentially allowing it to walk away from contractual commitments. The measure was rejected by Total SA and Royal Dutch Shell Plc. There are now 12 empty liquefied gas carriers sitting off the coast of Qatar, one of the world’s biggest producers. While the precise reasons for the idling vessels aren’t known, the timing coincides with ship diversions, cargo cancellations and reduced demand in Asia since the virus took hold. Oil tankers have been dawdling off China,” reported Bloomberg.

The parking lot of tankers developing off the coast of not just China but other countries in the region have forced some traders to transfer crude to less expensive tankers to save on demurrage costs, over the fear cargos could be moored offshore for an extended period as an economic crisis in China unfolds.

And to summarize what we know so far: China’s economy is collapsing, crude consumption is plunging, which has forced refiners to cut runs as a glut is developing, has now led to tanker parking lots moored off the shores of many countries in Asia.

What is also known is that bunker fuel prices at major ports in Asia, including Singapore, Hong Kong, South Korea, Taiwan, and Japan, have been declining since the virus outbreak began early last month.

The world is bracing for a huge virus shock from China, not seen in over a decade – this could easily tilt the world into recession.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

So good at predicting shit in real time, yet no good at predicting shit in advance.

China is just looking for another handout.

We Deplorables will not be sheading a lot of tears for Oil and Financial Oligarchs; besides, their whole Fiat Bubble Ponzi had burst and Economy was downhill before the Coronavirus Pandemic anyway. It’s End Times for the FSA Maggots having The Eddy Minimum, a Global Depression, and Plague at the same time. People, get ready now for a Mega-earthquake, Super-volcano and wars that fulfill the Four Horsemen Vision.

I’ll just meet the Lord in the air before all that begins thank you. You do realize those horsemen are corralled until the dispensation of grace is ended, right? Horsemen equal wrath, the antithesis of grace. Be comforted.

1 Thessalonians 5:9-11 KJB… “For God hath not appointed us to wrath, but to obtain salvation by our Lord Jesus Christ, Who died for us, that, whether we wake or sleep, we should live together with him. Wherefore comfort yourselves together, and edify one another, even as also ye do.”

You are correct, “the son of perdition” comes along first for everyone to see, with the rest bringing up the rear.

Will be glad never to have laid eyes on the abomination.

1 John 4: 15-19

Whosoever shall confess that Jesus is the Son of God, God dwelleth in him, and he in God.

And we have known and believed the love that God hath to us. God is love; and he that dwelleth in love dwelleth in God, and God in him.

Herein is our love made perfect, that we may have boldness in the day of judgment: because as he is, so are we in this world.

There is no fear in love; but perfect love casteth out fear: because fear hath torment. He that feareth is not made perfect in love.

We love him, because he first loved us.

Thank you Jesus.

Well Pastor, if I’m wrong about the Four Horsemen’s starting gate, I’m right about the rest. And if you’re wrong about their starting gate, I hope you’re right about the rest.

Read and understand what was given to Paul brother. This is so very knowable.

This oil tanker article I stuck on the bottom of this rant for another dot to connect.

A rumination for your consideration. Things that make you go Hmmmmmmmm.

It appears at this point in time that the Chinese virus MAY be the Black Swan Nuclear Bomb for much of the world’s financial system?

WHY? THE COUNTRY IS SHUT DOWN COMPLETELY. See this review. Electronic components, Wal Mart products, car components, everything to ZERO.

The explosion has gone off, but like all the old films of nuclear explosions, the world wide shock waves are just beginning.

https://www.zerohedge.com/economics/china-disintegrating-steel-demand-property-sales-traffic-all-approaching-zero

Consider that in the next two weeks the shock waves will be felt big time, as we live in a just in time, ZERO inventory, manufacturing and distribution world.

Fiat has just closed a car plant in Serbia due to lack of parts. The first one.

However, with the entire world resting on the USA stock market, what then?

The world’s financial markets in the biggest, “Everything Bubble”, ever, are still complacent, apathetic, and Risk Free, from belief in the FED Put.

https://realinvestmentadvice.com/market-believes-it-has-immunity-to-risks/

BIG Question is, IF the markets take a nose dive of some size, will there be a big move into Gold as the safe haven?

Much of the gold market is in the gold ETF, like other ETF holdings, there is NO cash, only the asset for the ETF.

If the ETF gets sold, the assets therein have to get sold, Gold, Stocks, Bonds, whatever. The rule: “When tide goes out, ALL boats go down.”

Cash looks to be the ONLY safe haven of all, as the ONLY, *asset* that will not evaporate. OR maybe the FED can keep the markets levitated?

Ursal.

Sorry Ursal but cash does and will evaporate. Whether you mean cash in T-Bills or currency it is now at 2cents per dollar in buying power, whereas Gold and Silver will buy the same amount of bread yesterday, today, and tomorrow. Gold ETF’s are a fools game. Any gold they have is of the promise variety in someone else’s vault who promised to send it to the ETF along with a check.

Revelation 18: 17-19 (but read the whole chapter)

17 For in one hour so great riches is come to nought. And every shipmaster, and all the company in ships, and sailors, and as many as trade by sea, stood afar off,

18 And cried when they saw the smoke of her burning, saying, What city is like unto this great city!

19 And they cast dust on their heads, and cried, weeping and wailing, saying, Alas, alas that great city, wherein were made rich all that had ships in the sea by reason of her costliness! for in one hour is she made desolate.

Just a note there are little or no US Flagged merchant vessels built by Americans and operating with American crews any more . The industry was crushed by the Circle Jerk Of Wall Street To K-Street to Capitol Street . So as Americans across the country lost there industrial jobs their benefits , retirement , homes and local tax bases faltered (wonder why?) the Circle Jerk club made and pissed away fortunes while throwing American working people overboard for 40 years .

For God Sake wake up people we had to lease merchant ships from china to supply our troops in the Middle East WTF ! Guess who’s father in law is a shipping Chi Com billionaire “Mitch Mc Connel” anybody else see a pattern here ? Meanwhile the Capitol Street traitors to the American Working people bailed out their rich circle jerk buddies and piled up more debt on unemployed or underemployed Americans .

Well BOHICA cause here it comes again !

As good old Mr T says “SOMEBODY GOT TO PAY”!

Well Circle Jerk fuck off we Americans are tapped out !

Maybe your Chi-Com or India or Korean or Saudi wild bunch will come thru for your sorry asses !

Don’t forget to swallow when you perform that sex act on your fucking knees !

Looks like the Normandy invasion!!!

question 4 you guys–

i’m currently talking to a developer about selling a piece of my parent’s real estate–should i quit negotiating & take his latest offer if he can close quickly or hold out even if the market collapses–the property is about 3 acres with four low income rental homes–

this is assuming i can close but the $ would just go into the bank & not be invested–

Red.

I’ll tell you what the wife and I did with our improved lots in Cedar Key just up the road from you. We started recieving offers in the mail from local realtors there in 2006 at the height of the frenzy. All the good stuff in the state had already been driven in to stratosphere by then. I told my wife to send a form letter to all of them and tell them we want x amount free and clear after all fees etc. A month later we received a cashiers check for all of them conditional on us signing the form she sent at a local title co. You might make a similar binding offer and see. J. P. Morgan said always leave the buyer a little room to make money.

If you think we might still have a functioning country when the dust settles, why not keep it for the rental income. You already have the experience in that area. Just a thought.

thanks flea,see below–

this link is from weather dot com (warning if you go to their site,they are known to be aggressive about tracking you across the web) that says between water under & on the ground,combined w/snow melt & future rain,this year might be as bad as last year 4 flooding & crop yield–

https://weather.com/safety/floods/news/2020-02-13-spring-flood-risk-plains-midwest-south

TR- I would say the answer may depend on what “close quickly” means. At present, IMO, we still have a few weeks before we know what the virus is going to do, BUT judging by what has already happened, I don’t see how anybody dodges this bullet; every economy that depends on China is going to take a hit. Pretty soon, shelves at certain retail behemoths will be growing thin.

IF it were your money, I would say take the risk. Take the latest/sell now. Withdraw as much as possible/wire transfer and invest in “hard” currency/food/etc. If you can’t hold it, you don’t own it.

BUT, since it is not yours and assuming the land is owned/paid for, well, get a copy of the deed. For tax purposes, they keep those at the courthouse, anymore (easier to rob folks that way). Land is a real asset. You can’t eat it but it has “improvements” (shelter) and you can grow on it. That is . . . if you sell and there is no further investment, I say don’t give real property to a fiat bank.

And as far as crops, this guy is my go-to for that info (this one’s kinda scary):

Hope this helps.

niebo & flea,

thanks 4 replying–i will probably have mom take the $ and run,i don’t want prices to collapse again & then have to hold it or sell 4 less than we could get today–

i want to get it out of her estate b/c she’s 86 & in poor health but worry about a collapse of the system if the stuff hits the fan when the fan is on high,and she is too insecure to do anything but put the $ in the bank–

edit–by close quickly i mean within 2-3 weeks,even if it means leaving a few bucks on the table–

Red.

My Mom and my wife were both like that. Can you persuade her to at least consider putting it in the banks safe deposit boxes in the form of PM’s or T-bills. Too easy for them to vaporize her account with a bail in.

At 86, she is a Depression baby – approaching this situation now from that perspective may help your cause. And however it goes, you can’t go wrong doing right by her, so go for it, and God bless you.