Guest Post by Martin Armstrong

I think sometimes I am not always specific in what I say because in my mind I have drawn a distinction that I have not articulated in words. As Einstein said, he thought in concepts, not words. That is a very true statement that has been largely ignored by most programmers who try to mimic the brain with neural networks. That is why IBM’s Watson was unable to find cures. As a programmer, I should know better. You really have to break down every single step in an action to be able to code it. How do you move your arm? It begins with a thought which then moves all the various elements for you to raise your hand up in a classroom.

That confession aside, when I speak of the “rich” who do not make money from wages but investments, I am not referring to the corporate organizations that are not single individuals but are honestly bureaucratic private replicas of government. I have attended board meetings of some of the largest public corporations in the world. I find them to be the same in structure as governments. I was called into a major auto company to resolve a $1 billion loss in hedging. They then referred me to a parent company that held stock in their corporation, for they had the same trade. The parent company had made hedging decisions at the board level and because they lost money by second-guessing their hedging decisions, they passed a resolution that once they took a hedging position, they would let it expire. By the end of the fiscal year, the two were merged to hide the $1 billion loss in the parent company.

There is a substantial difference between an individual who runs a small business and a major public corporation which has become bureaucratic. That is why Apple first removed Steve Jobs because he did not comply with bureaucratic procedures. When they then lost all creativity, they begged him to return.

Insofar as “human nature never changes,” once again I am not speaking of an individual but collectively as a society. We each have our own cycle in this journey for knowledge. If we are not complete fools who blame everyone else for their own mistakes (like Hillary), then we mature and learn from our mistakes. As children, parents inevitably warn their child not to place their finger in the flame of a candle. We all still do because we simply must experience that pain before we understand the power of fire and what it does.

Insofar as “human nature never changes,” once again I am not speaking of an individual but collectively as a society. We each have our own cycle in this journey for knowledge. If we are not complete fools who blame everyone else for their own mistakes (like Hillary), then we mature and learn from our mistakes. As children, parents inevitably warn their child not to place their finger in the flame of a candle. We all still do because we simply must experience that pain before we understand the power of fire and what it does.

I have also explained that there are no degrees you can get in trading. We all must be self-taught. The very concept of supply and demand was born in the mind of John Law (1671-1729). Since he was charged with murder for killing another man in a fair dual that was declared illegal, everyone else took advantage and plagiarized his discovery including Adam Smith. John Law gave birth to the concept of supply and demand because he was a trader on the floor of the first exchange in Amsterdam. There are some things you will NEVER discover unless you actually are involved in the experience.

Therefore, my statement that “human nature never changes” does not refer to an individual, for most intelligent people do not believe what they may have believed when they were a teenager. Mark Twain’s famous quote is spot-on: “When I was a boy of 14, my father was so ignorant I could hardly stand to have the old man around. But when I got to be 21, I was astonished at how much the old man had learned in seven years.” There is even the quote of King Oscar II on how we are all socialists before 25 and become realists after 25 when we have to pay taxes.

You also mention that Moses renounced, in the name of God, as well the practice of usury. I have stated that we had usury laws up until Paul Volcker wanted to raise interest rates using Keynesian Economics to enable him to raise the discount rate to 14% in March 1981. Congress was eliminating usury laws by March 31, 1980. In order to fight inflation using Keynesianism, they never restored usury rates and thus they transferred a huge amount of wealth to bankers as they were now able to charge 20% on credit cards with no problem.

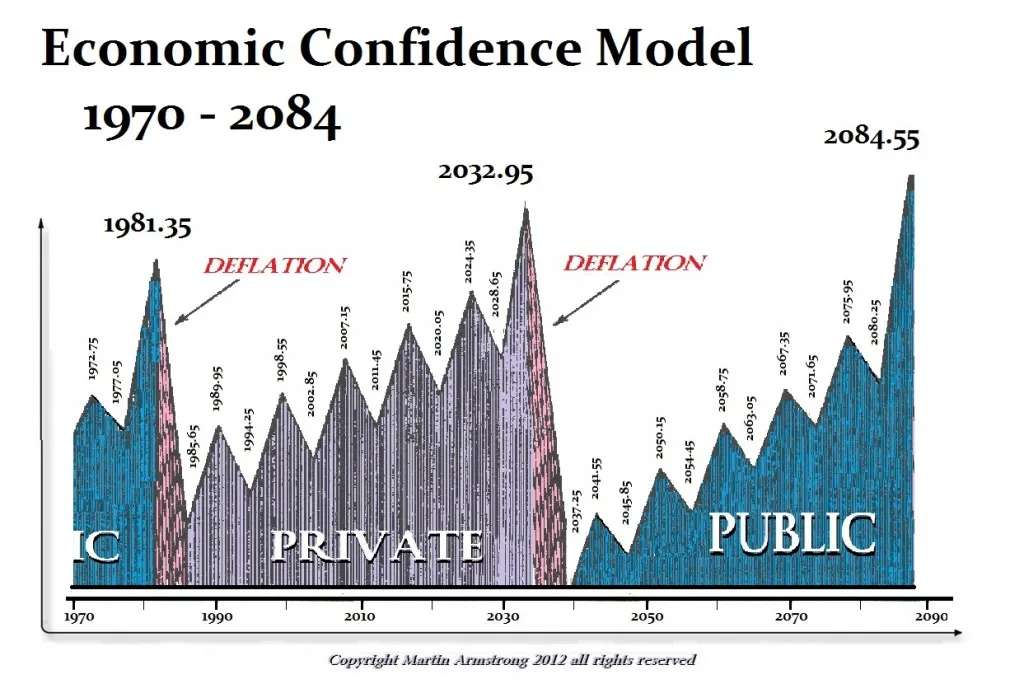

Private waves are inherently more volatile but the usury laws were all abandoned going into the peak of the Public Wave as the government was fighting for control. The government becomes much more aggressive and totalitarian during a Private Wave as they are losing power. But as they lose power, they ultimately turn against the very oligarchs who fed them to rise from the outset. The next financial crisis may not see Goldman Sachs walking on water. Politicians will turn against their benefactors to survive. This is typical during the final stages of the last 8.6-year wave within a Private Wave formation.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I’ve always found his writing style peculiar, but in this article he came across as almost human.