Guest Post by Simon Black

Earlier this week we talked about why the economic consequences of this pandemic could last a lot longer than what a lot of people expect.

Now, I say all of this from a position of complete ignorance and uncertainty. Nobody knows what’s going to happen next, or how long this pandemic will last.

But to simply expect that everything will return to normal in a few weeks– and willfully ignore the countless other possibilities– seems a bit foolish.

Worldwide, the number of deaths from Covid-19 reached 138,000. That’s more than double the number of deaths from 10 days ago. So it’s still growing.

Singapore was initially successful in controlling the virus outbreak. But they’re now experiencing a nasty second wave of infections.

In the US alone, more than 20 million people have lost their jobs so far, and the government’s $350 billion program to bail out small businesses has already run out of money.

It’s great to hope for the best. But let’s be realistic: there are a lot of reasons why the economic consequences of this pandemic could be long-lasting.

And that’s what brings me to real assets.

If the negative consequences linger, it’s reasonable to expect that governments and central banks will shovel piles of cash into their economies at a feverish pace.

Most developed nations have started this already.

In Australia, the government has passed at least $130 billion in stimulus measures so far– a princely sum in a country where the population is just 25 million people.

The British government has passed hundreds of billions worth of loan guarantees, grants, and tax cuts.

Germany’s government has passed more than 750 billion euros worth of loans and stimulus programs.

Canada’s central bank slashed its benchmark interest rate to 0.25%, and cut bank reserve requirements, in addition to billions of dollars in stimulus programs.

And the United States government has spent trillions of dollars already; plus the Federal Reserve has conjured more than a trillion dollars out of thin air to loan money to banks and businesses.

It’s likely they’ll keep printing money if the economic pain persists.

Second wave of outbreaks? Print another trillion dollars to bail out businesses.

Massive corporate layoffs? Print another 2 trillion dollars to bail out employees.

Skyrocketing loan defaults? Print another 5 trillion dollars to bail out the banks.

Now, consider that they’d be printing all this money at a time when economies are shrinking by 20% or more.

So we’d see a tidal wave new money flooding into an economy where fewer goods and services are being produced.

This is precisely how a currency loses value: if there’s less stuff in an economy, but more paper money, it means all the stuff has to become more expensive relative to the paper money.

That’s ultimately what inflation is.

Throughout history whenever this situation has arisen, it’s almost invariably been a good idea to own real assets, i.e. direct ownership of an asset that cannot be conjured out of thin air by a central bank.

Real assets include things like productive land, shares of a well-managed private business, or physical gold and silver.

These are assets that cannot be willed into existence by a government or central bank. And they don’t simply exist on paper, or as an entry on a balance sheet.

They’re real. And they tend to do very well in an inflationary environment where ridiculous sums of money are being printed.

Most people don’t have an easy opportunity to buy productive land or shares of a well-managed private business.

But gold and silver are totally within reach. And here’s something really interesting about them:

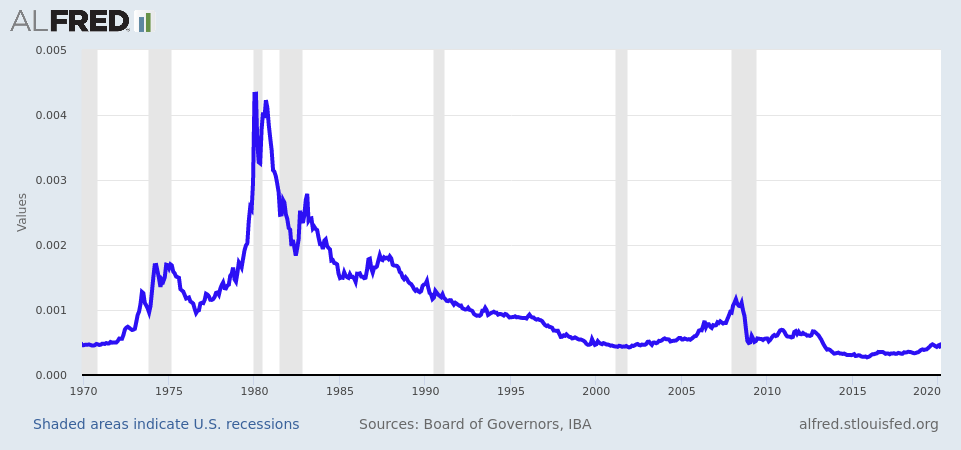

The chart below shows you the ratio over the past 50 years between the price of gold and the “M0 monetary base”.

As you can see, right now this ratio is well below its long-term average.

(M0 is just one method economists use to measure the supply of money in the US economy. But using other methods, like M2 money supply, the ratio is still below its long-term average.)

This low ratio suggests that the gold price is cheap relative to the amount of money in the economy right now. And it stands to reason that the amount of money in the economy is going to increase a LOT.

And that means the price of gold could also increase a lot.

But if gold is relatively cheap, silver is even cheaper.

As I wrote to you on Monday, the gold / silver ratio is near an all-time high. In other words, it takes twice as much silver to buy a single ounce of gold relative to the long-term average.

So while there’s a good case that the price of gold can increase quite a bit, it’s possible that the price of silver could rise even more.

There are, of course, risks. Nothing is certain, especially in this environment.

But there are some inexpensive ways to bet on rising gold and silver prices where you could make potentially 10x your money or more, even with limited amounts of capital.

We’ll talk about these next week.

For now, stay safe and healthy.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

More gold dealer propaganda. If their gold is so valuable, and going up in value, and money is going down in value, why are they so eager to trade you their gold for your money? Because it is a lie. There is more money being destroyed than there is being printed. Every time a debt is defaulted on, that money disappears. That is the side of the equation they never tell you. Right now, more money is being destroyed than printed by a huge amount, that means assets are all going to lose value……

I’m going to wait for Professor Fleabaggs to explain that to me, right now I disagree but what do I know? Nothing.

CEE Dog. Funny you should mention it. I read the article and want to first express thoughts on the authors shilling for TPTB. “The economic consequenses of this pandemic”. I’ll correct his spelling for him. It’s a “PlanScamDemic”. Real or not it’s being used to mask the economic, political, and moral consequenses of Money by Fiat that were one nerve ending away from imploding like Bldg. #7.

Gold dealers are eager to swap your dollars for gold because they are just like any other market maker or middle man. The earn a commission or in their parlence a Premium. Of course they will promote the product to increase the size or number of contracts. It’s their job. Dealers buy gold from the same markets they sell it to in addition to buying from mints but they try not to have excess inventory on hand because it represents idle money to them no matter their own private investment stance.

Every time a debt is defaulted on the money continues to exist somewhere, it just changes custodians. The defaulted debt also does not disappear, it only changes custodians. Someones name is on that debt, somewhere. Dollars can be shredded out of existance but not the debt or I.O.U.. If you dig a ditch for X amount of promised goods, services, or an exchange medium and the other party reneges, your energy remains in that ditch. You will go hungry(Debt burden) unless you can get satisfaction. Just because he defaults and you agree to it, someone owns the ditch and the energy put into digging it. If he pays up then he becomes custodian of that energy and your hunger(Debt burden) is releived. If he writes you a bad check and your Grocer accepts it then he is the new custodian of that debt and the check writer is still custodian of the energy that dug it. The Central bank is the check writer. You are the ditch digger. The grocer can recover the loss by raising prices. Other ditch diggers now share the hunger (Debt burden). Being No-Dots, they have no power to raise prices so one of their children is shredded out of existance to settle the debt.

Gold cannot be wished into existance nor shredded out of existance. If you had demanded gold in hand as you dug the ditch, you, the grocer, and other ditch diggers and their children would still be solvent. We chose not to by giving the Feds a wink and a nod with the income tax and creation of the Fed. Now we are starting to get hungry. Gold will buy the same amount of bread it always did and always will.

It is not an investment as much as it is wealth preservation well suited for times like these. If anyone buys stocks or bonds in this enviroment with their nest egg instead of their speculation money they are betting on red 48 or it’s equivilant. Money can be made in gold but that’s a secondary benefit. Preserving your sweat(energy) and your children should be the immediate goal.

Jdog says just enough truth to appear legit, much like his father. He appears to be in love with the sound of his keystrokes. Not that I’m exempt it’s just that we have different daddy’s.

Thank you for that, Flea!

My buddy the flat-earther tells me to buy crypto’s. I said the same thing to him – if crypto’s are worth more than normal money, why do they want my normal money in exchange for their crypto’s? You don’t understand, he says. There’s a limited number of bitcoins. Sure there is, buddy. They made them out of nothing, but somehow they can’t make more. He’s right that I can’t understand the complexities of blockchain algorithms, but neither can most of the people who think they own crypto’s.

How many people who think they own gold really own gold-plated tungsten? “Oh, but I got this here certificate from the US Mint.” Because that piece of paper makes it totally different. And when the proverbial shit hits the fan and they try to barter their supposed silver coins for food or ammo, why do they think anyone will trust their coins to be legit?

Iska- I had a long talk with the investment broker who is next door to me in the office condos just yesterday. He related that his clients have LOST ALL THE GAINS they made last year.

I related that I cashed out of the rigged casino over 10 years ago and went in to hard assets, land and metals. I’m up over 100%, how are you doing with your money these days Iska?

Bea, I didn’t cash out, I simply lost all my 401K money in the casino.

https://www.youtube.com/watch?v=5vMx63ZCd88

It’s ok EC, we are all serfs anyway.

I am old enough to be happy with what I have. I recall a quote I carried with me for a long time back when I didn’t really understand what it meant. It said that lust (concupiscence but also strong desire, greed) is a poison of the blood that drains all the life from it. Enough is enough if you know to call it early.

I can drink more than you said the young stud. Yes, said the old sot, but you can’t get drunker than me.

A US dollar is a debt instrument. An ounce of physical gold or silver is the opposite (an asset).

That’s the way my simpleton mind sees it.

Silver/gold ETFs get beat down and propped up like a roller coaster, but physical has been rather steady. However, at the moment there is a disconnect between silver market price and spot price, due to availability. $15/oz silver market price but Silver Eagle 1-oz. coins selling for $25 today.

Yeah and the buy back price of that silver eagle for 25? [closer to almost 28 at most sites right now that I see] Currently, that buyback is 19 dollars – you won’t get back the 25 or 28 dollars you have in it. So its only a good asset assuming you want to hang onto till the buyback is able to be equal to what you have in it or hope that whatever world at the time you need to break out and use that silver and gold has a value worth trading for something – other assets or consumables like food. Assuming at that time anyone cares for silver and gold if the world is struggling to provide enough food to go around. Then all the gold or silver wont mean much at all. Not trying to down PM’s – its the one area I wish I had invested in earlier – real physical PM’s at better than current prices – just wonder if PM’s really are a salvation to savings

I do admit – the flight to PM’s right now has made it harder to start investing into PM’s at current prices and realize much if any gains – at least short term. long term – if this economy continues – prices will continue to go up for sure IMO

Yeah, it’s just a hedge and hope that holding a little physical gold/silver will break out big in the next few years. However, that would be a result of a big drop in US dollar value, so it’s a give-take proposition–gain on precious metals, lose dollar value in savings/401k, etc.

If the world goes totally to the shitter and gold/silver goes ballistic, then really bad times are upon us. Seems like we are headed there. My holdings in metals is minimal. Bullets may be as valuable as precious metals, ounce-for-ounce, if CW2.0 breaks out.

You really going to sell/trade bullets to someone you don’t know (or know but don’t trust)? You’re braver than I am.

If I need to trade a few Silver Eagles for bullets, I might deal with a stranger. But I get to load my ammo first, then hand over the Silver Eagle(s) and shoot the motherfucker and take back my money.

So you just going to shoot them and take what they’ve got???

Come on, Annie. This is TBP, after all. Lighten up!

10X return? Then my 10 silver eagles will only be worth about $1500. When is the 100X or better yet 1000X return coming? $15 each times 10 times 1000 looks like $150000! Now you’re talking real money! I could retire in luxury!

$150000 sounds like a great return till you realize by that time its worth that – in dollars, that $150000 is now the price for a loaf of bread…

Damn, did I forget the sarcasm font again???

LOL – no I got the sarcasm, especially after the last statement of retiring in luxury 🙂

I just wanted to point out the irony that 150k wont mean much at that point — you get a hella return in dollars but the return while good in numbers don’t equate to jack sqaut – course that loaf of bread might be quite the buy by then

…and then the day comes it buys a single slice

Misfit.

A 15.00 oz. of silver will buy that loaf at 150,000 but 15$ in fiat will only buy 1/150th of a loaf. That’s the purpose of PM’s, wealth preservation. Bullets and food will still carry the day though.

haha.

The irony of using a computer generated picture of PM bars for an article about ‘Real’ assets.

“pandemics historically lead to deflation”

she looks hot & has a sweet voice so i’m sure she’s correct —

https://www.investmentwatchblog.com/danielle-park-historically-pandemics-lead-to-deflation/