It was a picture-perfect afternoon in Fort Myers, Florida. Jo, Holly, my son Drew, a couple of his college baseball teammates and I decided to take our brand-new boat for a spin in the Gulf.

It was a picture-perfect afternoon in Fort Myers, Florida. Jo, Holly, my son Drew, a couple of his college baseball teammates and I decided to take our brand-new boat for a spin in the Gulf.

I passed my Coast Guard course and was full of confidence. We barreled toward the markers at the entrance of the Caloosahatchee River and I noticed a lot of people waving at us. I smiled and waved back.

BOOM! We ran aground. Jo was folding towels at the stern and went flying past me. Her face hit the cabin door, teeth were flying and she fell inside. I was terrified.

The Coast Guard picked up the girls in a small rubber boat. Jo headed to the hospital. A lot of pain and four implants later, her smile is intact.

We had an unusually low tide. The people who were waving were not smiling, they were warning us and I didn’t realize it. Around midnight, the tide came in and the boys were able to push us to deeper water. One engine worked and we limped into the dock. I shuddered as I typed and relived the incident.

Some Big Boys are frowning and waving their arms!

Shortly after finishing our recent interview with Chuck Butler about inflation, Zerohedge reports, “Bank of America (BofA) Hints That Weimar 2.0 Could Be Coming”:

“It’s no secret that BofA’s Chief Investment Officer has been warning that 2021…is one where real inflation will run amok sooner or later,…he repeats…how events will play out in the coming months, namely ‘the velocity of people will rise’ and ‘the velocity of money will (also) rise’.

…. BofA…expects…2021 to engender rise in velocity of money, with the ‘inflation mutating’ from Wall Street to Main Street, resulting in a pop in the nihilistic bubble.

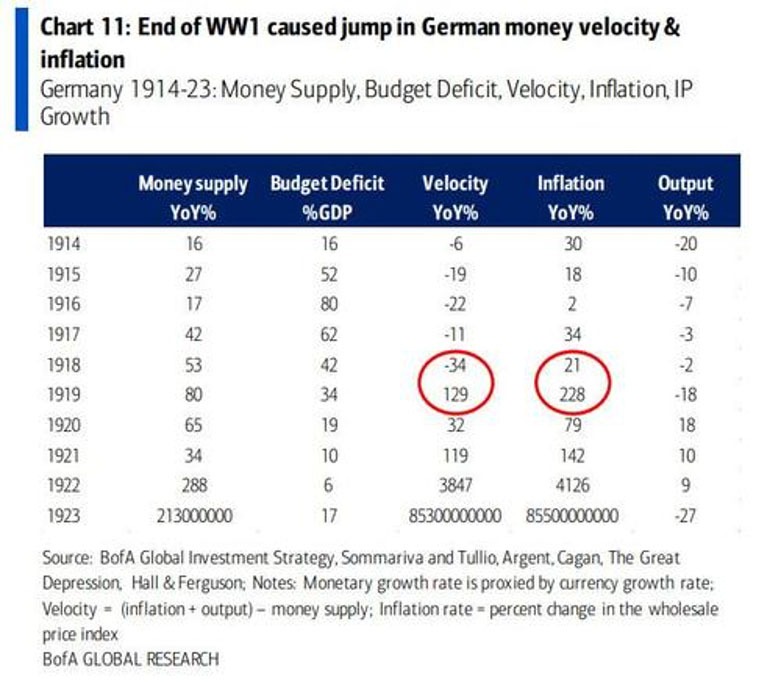

And here is the punchline: BofA reflects back on the post-WW1 Germany as the ‘most epic, extreme analog of surging velocity and inflation following end of war psychology, pent-up savings, lost confidence in currency & authorities’ and specifically the Reichsbank’s monetization of debt, similar of course to what is going on now.

There is, of course, another name for that period: Weimar Germany, and…it is understandable why BofA does not want to mention that particular name.”

Shortly thereafter Zerohedge adds, “Michael Burry Warns Weimar Hyperinflation Is Coming”.

“One day after the Weimar tweetstorm below,…Burry tweeted the following:

‘People say I didn’t warn last time. I did, but no one listened. So I warn this time. And still, no one listens. But I will have proof I warned.’

Indeed he will.

None other than the Big Short, Michael Burry …. picked up on the theme of Weimar Germany and specifically its hyperinflation, as the blueprint for what comes next in a lengthy tweetstorm.”

Quoting a Burry tweet:

“The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increases while retail sales, PMI stage V recovery. Trillions more stimulus & re-opening to boost demand as employee and supply chain costs skyrocket.”

Why aren’t people listening?

We have been inundated with inflation cries since the 2008 bailout. When the government creates fake money out of thin air, isn’t that supposed to cause inflation? Why hasn’t it happened?

James Rickards article, “Hyperinflation Can Happen Much Faster Than You Think” is an easy-to-understand primer:

“Many investors assume that the root cause of hyperinflation is governments printing money to cover deficits. Money printing does contribute to hyperinflation, but it is not a complete explanation.

…. The other essential ingredient is velocity, or the turnover of money. If central banks print money and that money is left in banks and not used by consumers, then actual inflation can be low.

This is the situation in the U.S. today. The Federal Reserve has expanded the base money supply by over $6 trillion since 2008, with over $3 trillion of that coming since last February alone.

But very little actual inflation has resulted, or at least very little official inflation. (Emphasis mine) This is because the velocity of money has been decreasing. Banks have not been lending much, and consumers haven’t been spending much of the new money. It’s just sitting in the banks.”

Rickards explains inflation is psychological, and self-destructive:

“Money printing first turns into inflation, and then hyperinflation, when consumers and businesses lose confidence in price stability and see more inflation on the horizon. At that point, money is dumped in exchange for current consumption or hard assets, thus increasing velocity.

As inflation velocity spikes up, expectations of more inflation grow, and the process accelerates and feeds on itself. In extreme cases, consumers will spend their entire paycheck on groceries, gasoline and gold the minute they receive it.

They know holding their money in the bank will result in their hard-earned pay being wiped out. The important point is that hyperinflation is not just a monetary phenomenon – it’s first and foremost a psychological or behavioral phenomenon.” (Emphasis mine)

What about money supply and velocity?

When it comes to the facts, I look to John Williams at www.shadowstats.com. How much has the money supply increased and how much is in the hands of consumers to spend?

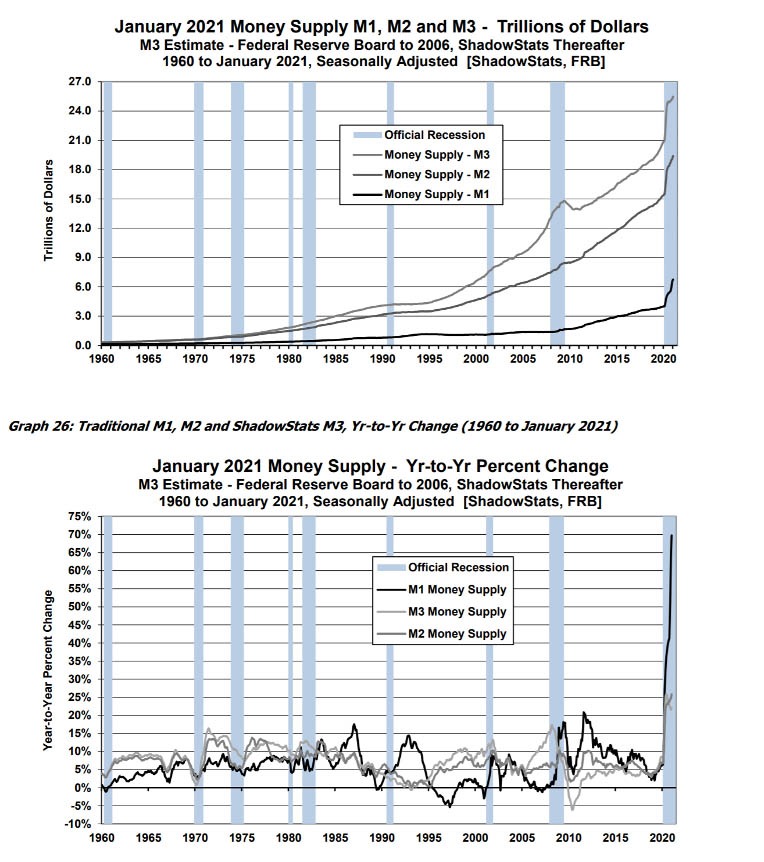

John’s February 15, 2020 commentary provides the following graphs:

What is M0, M1, M2 and M3?

Traders Paradise offers this explanation:

- M0 and M1, also called narrow money, normally include coins and notes in circulation and other money equivalents that are easily convertible into cash.

- M2 includes M1 plus short-term time deposits in banks and 24-hour money market funds.

- M3 includes M2 plus longer-term time deposits and money market funds with more than 24-hour maturity.

We see the increases Rickards discussed; and particularly a sharp spike in the last year. Fuel is being added to the equation for sure!

Hyperinflation is generally defined as prices increasing 50% or more in a single month. You can have terrible, destructive inflation without meeting the hyperinflation standard.

Rickards explains:

“Hyperinflation doesn’t emerge instantaneously. It begins slowly with normal inflation and then accelerates violently at an increasing rate until it becomes hyperinflation. This is critical for investors to understand because much of the damage to your wealth actually occurs at the inflationary stage, not the hyperinflationary stage. (Emphasis mine)

The hyperinflation of Weimar Germany is a good example of this.

In January 1919, the exchange rate of German reichsmarks to U.S. dollars was 8.2 to 1. By January 1922, three years later, the exchange rate was 207.82 to 1. The reichsmark had lost 96% of its value in three years. By the standard definition, this is not hyperinflation because it…was never 50% in any single month.

By the end of 1922, hyperinflation had struck Germany, with the reichsmark going from 3,180 to one dollar in October to 7,183 to one dollar in November. …. The reichsmark did lose half its value in a single month, thus meeting the definition of hyperinflation.

One year later, in November 1923, the exchange rate was 4.2 trillion reichsmarks to one dollar. History tends to focus on 1923 when the currency was debased 58 billion percent. But that extreme hyperinflation of 1923 was just a matter of destroying the remaining 4% of people’s wealth at an accelerating rate. The real damage was done from 1919-1922, before hyperinflation, when the first 96% was lost.“ (Emphasis mine)

This Zerohedge provided graph illustrates his point:

Rickards is waving his arms:

“If you think this can’t happen here or now, think again. …. Something like this started in the late 1970s. The U.S. dollar suffered 50% inflation in the five years from 1977-1981. We were taking off toward hyperinflation, relatively close to where Germany was in 1920.

Most wealth in savings and fixed income claims had been lost already. Hyperinflation in America was prevented by the combined actions of Paul Volcker and Ronald Reagan, but it was a close call.

Today the Federal Reserve assumes if inflation moves up to 3% or more in the U.S., they can gently dial it back to their preferred 2% target. …. That change is not easy to cause, and once it happens, it is even harder to reverse.

If inflation does hit 3%, it is more likely to go to 6% or higher, rather than back down to 2%. The process will feed on itself and be difficult to stop.

| Sadly, there are no Volckers or Reagans on the horizon today. There are only weak political leaders and misguided central bankers.” |

My parents were nearing retirement during the high inflation Carter years. Their nest egg was in Certificates of Deposit, and they lost nearly half their buying power. It was impossible for them to recover their lost wealth during their remaining working years.

Here is what we know

- No one I know is crying wolf. They are genuinely concerned and feel it is just a matter of time.

- The government is inflating the money supply, inflation and velocity is picking up.

- Food and gas prices are already close to 6%. Consumers are not fooled by the official government numbers.

- Paul Volker and Ronald Reagan wouldn’t have a chance today.

I understand Bill Gates is buying a lot of farmland. Might he be telling us something?

Hopefully, we will never get to the hyperinflation stage; but protecting our wealth from damaging inflation is a major concern. Hard assets, precious metals, and holding foreign currency is a good place to start!

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

The boat wreck story was OK. Too bad about Mrs. Miller’s teefis. I don’t get the rest.

I remember the inflation of the late 70’s early 80’s. When Volker slammed on the brakes and sent interest rates soaring it was a jarring shock to the psyche. That’s what it took-a mental paradigm shift. It knocked all of us on our asses and it worked.

Hey, Dennis boating in the Gulf (notoriously shallow) off Sarasota we had a saying. “You have run aground, will run aground or you are aground. Me too.

What about putting all your money into stocks and bitcoin?

This guys says put it all in tulipcoins: https://www.theinstitutionalriskanalyst.com/post/bitcoin-gses-the-rising-tide-of-fraud

that article links to https://crypto-anonymous-2021.medium.com/the-bit-short-inside-cryptos-doomsday-machine-f8dcf78a64d3

As much as I believe we have been and continue to be heading towards insolvency and the loss of the extravagance of being the “Reserve Currency”, the warnings lack clarity as to what action is best to take. Yes, most authors will say rush to hard assets and commodities, but, in reality, as much as this collapse may resemble previous and historical events… the magnitude, however, of this one will be on a entirely different scale. This world has never been more intertwined with the speed of markets and communication at unprecedented levels which have been layered together with over 70+ plus years under the Bretton Woods Agreement, with 1971 being a “mere” adjustment to creating divergence from sound money. This complex codependency creates an inherently systemic and chaotic outcome very likely. The results, of which, will yield potentially devastating shifts in the fabric of all systems (financial, political, and societal). The amount of desperation of 1st World developed nations scrambling to remain relevant and in power and control will crush the many and maintain the few. We keep making the assumptions of how to come out the other side relying on the precepts that, all of what we have and are, we will be allowed to keep and preserve. That type of thinking may leave us stranded and immobile with the great swathe of the unprepared.

The challenging aspect to planning and preparing for the certain paradigm shifts will be the time scale. A day is like a thousand years to the Lord, and a thousand years is like a day. 2 Peter 3:8 I quote this passage to emphasize that it is very difficult to sooth say when the implosion will occur and under what auspice. Whether it a series of false flags, endless lock downs, a nuclear exchange (this one is nothing but game over), we can’t expect to understand from what field this shall come. Being mobile and not tied to things, having family and friends, investing in skills and knowledge, maintaining national and local situational vigilance may be the only real things you have in your backpack when its time to go and avoid the great series of storms that will fall. I’m not trying to be vague, but conceptually suggest moving away from the idea that stocking up, prepping, and having yours will allow you to sidestep the grab and reach of a collapsing government.

Here! Hear!

If I weren’t on phone I might post this. Hope others read it and comment.

I’d disagree with this. Prepping will do one of two things.

One, because we don’t know the severity of the coming crash, it just could allow you to weather thru the coming storm. You know the saying… better to have it and not need it, than need it and not have it.

Secondly, assuming the worst and you will need to walk away. Prepping will have bought you some much needed time to consider and plot the way ahead. Merely hastily reacting to a problem is oft times a bad thing. Seen this in my diving adventures when I worked as a dive master. People ending up pan icing and making dumb mistakes that otherwise were more of an annoyance. Good comment overall, sound.

FWIW, Armstrong states there is no way in hell the U.S. can ever have hyperinflation. The reason being the U.S. has the largest bond market and the reserve currency. He’s usually right more than wrong, so we shall see.

Didn’t .gov stop counting M1 over a decade ago? Where did those responsible for the graph find M1?

No sign of inflation here – yet – let alone hyperinflation which will require an alternative currency for people to use. Just like the US dollar in Zimbabwe or Venezuela.

https://fred.stlouisfed.org/series/M2V

Likely we will see an economic depression first, following a short sudden boost as the economies open up.

Am glad to see your comment. How long a depression? Because I think we are already quite depressed.

Chapter 13 of my book describes the likely scenario for a permanently changed world.. Yes I do believe we are already in a depression, covered up for now, by the Fed, QE and fudged stats. But they can’t cover up reality indefinitely even as they can’t cover up the origins of this contrived plandemic.