Bruce Wilds/Advancing Time Blog

In a YouTube video Mike Green, Chief Strategist at Simplify Asset Management, attacks the idea of hyperinflation and inflation. He is not alone in pushing back on the idea inflation is about to run rampant. Despite the price rises we have been seeing, many economists claim that while inflation is likely to remain elevated for the near future we are now seeing projections it will peak in the first half of this year.

During an amazing, almost two-hour video interview, Green shares his macro view of the economy, inflation, markets, and the dynamics of today’s equity and fixed income markets. In the video titled; The Un-Consensus on Today’s Macro & Inflation, Green claims the base effects driving inflation are becoming more challenging and will not allow for it to remain elevated. He also shares his view of how stock markets have become less efficient and more ‘inelastic’ due to the proliferation of passive index investing, and where that might lead.

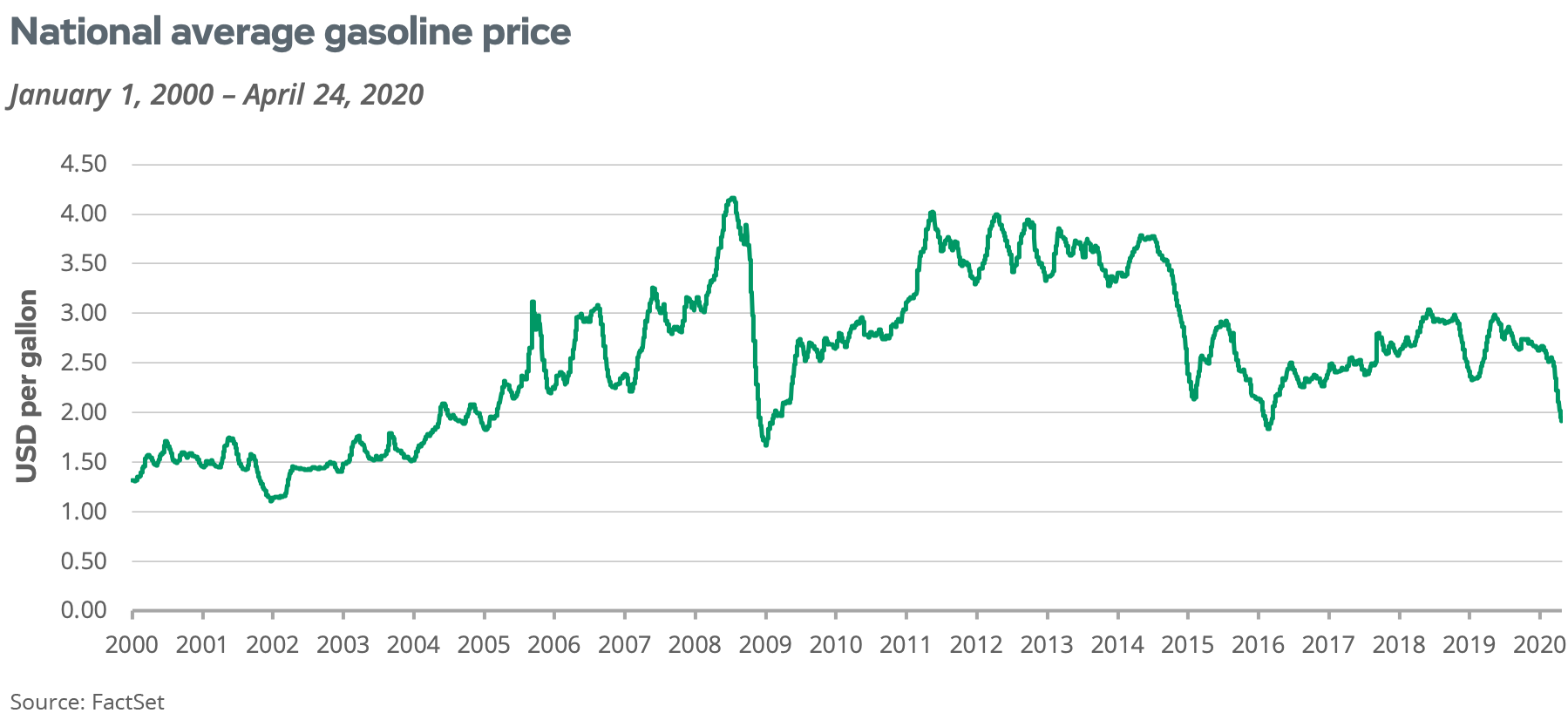

While price is said to be located at the intersection of supply and demand, manipulation and interventions have muddied this picture. Green keys in on the fact that price shocks and distortions have a way of working through the system, when prices rise in the capitalist system, we generally see an increase in the supply of that commodity or service. He also points to the strong role demographics play in the economy. It is important to remember while price hikes can appear inflationary they are not a big issue if they last only a short time. The price of gas from 2000 until today is an example of how wildly prices can swing. In short, if prices do not stay elevated or continue to climb, they do not add to inflation.

|

| We Have Witnessed Wild Price Swings In Gas Prices Over The Years |

In my mind, what happens to the value of the dollar and the three other major fiat currencies remains the wild card. As of yet, their fate is still up in the air. Fiat currencies have the potential to play a much larger part in the “end game” than most people imagine. A shift in preferred consumption or investment choices matter and how people react if and when they lose faith in fiat currencies is a major deal. The order in which currencies fail is also important, being the last to fail will yield huge benefits to those that hold it.

One place where I strongly agree with Green occurs about 126.15 minutes into the conversation. This is where he paints the case a stock or the market could suddenly fall like a stone. He does an excellent job of questioning the notion of the “efficient market” hypotenuses. Price insensitive buying and selling has destroyed true price discovery. Of particular concern is the area of passive investments. The distortions we are witnessing today are explained by some of his thoughts on this subject.

|

| Uncharted Territory Equals Danger |

Stock buybacks, computer-driven trading based on things such as momentum are a huge part of the trend he warns has corrupted the financial system. Many investors are ignoring fundamentals. In the commodity markets, when a price moves hard in one direction a market hits a limit and locks. It is only by going farther into the future that you can execute a trade, this is not a solution to wild swings but generally considered a way to halt further financial losses.

When all is said and done, Green and I agree on several important issues. Baby boomers lulled into thinking that current trends will continue are taking on massive end-of-life risks. While young traders may have time to build a new nest egg for retirement the older generation does not have such a luxury. While I disagree with some of Green’s conclusions, overall I give him a thumbs up for his video and many of the points he raises.

Below is the link to Green’s YouTube video; https://www.youtube.com/watch?v=WqZ9Ii_F7a0

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

He lies so people keep investing in equities and he can keep his job a while longer.

The gears on hyperinflation are gummed up by interdependencies and debt destruction. Maybe they are shaking the trees for now and the storm from the east is yet to come. Most the money is shaking down to too few hand snatching too few fungible assets, imo. Pre-inflation-inflation. Timing they control to a degree.

I noticed zero mention of the supply chain in the article. I agree with EWS, he’s fucking scum.

I would suggest all start watching THE MAVERICK OF WALL STREET videos. One of the best sources I have found in decades. The simple fact remains … Inflation has always been … always … a monetary phenomenon. Right out of the horse’s (Keynes) mouth.

I thought it was Uncle Milty that said that not Keynes. Absolutely true whoever said it……..All the frauds that pushed MMT….MFers!

I don’t trust any of the commentators. I listen to the information they present and make my own opinion. Following a pied piper will get you slaughtered every time.