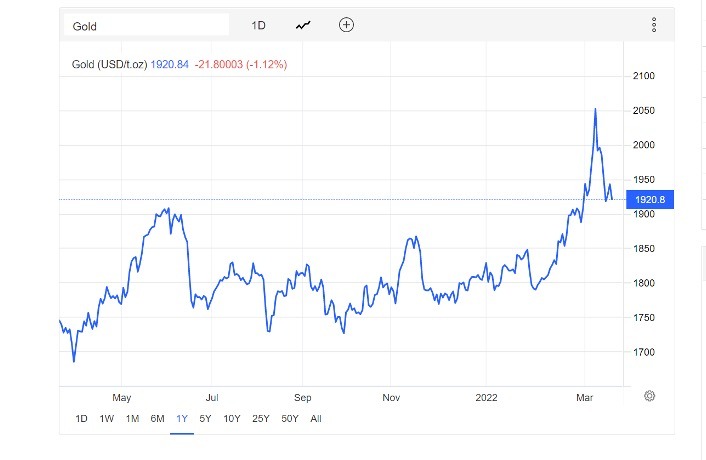

With all the world turmoil, high inflation, war in Ukraine, China rattling their saber, gold has gone up in price. Trading Economics tracks gold prices for the last 12 months.

With all the world turmoil, high inflation, war in Ukraine, China rattling their saber, gold has gone up in price. Trading Economics tracks gold prices for the last 12 months.

Less than a year ago, gold was just under $1,700/oz. It recently hit $2,050/oz. and was knocked down $60/oz. the following day.

Remember the old saying, there is never a bad time to take a profit. Is it time to sell and take profits, or hang on?

The FIRM answer is – “it depends!”

Gold has a special place. Let’s ask, why did I invest in gold or gold stocks? While the asset, (gold/silver or precious metal stocks) might be the same, it can be bought for several purposes.

Here is how I classify it.

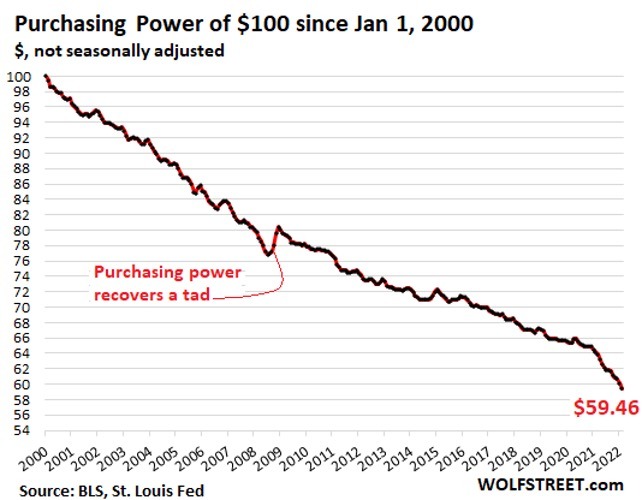

Physical metal – I buy it for insurance (core holdings), the ultimate inflation protection. Gold is real money – paper money always fails. Wolf Street shows how our dollar is tanking:

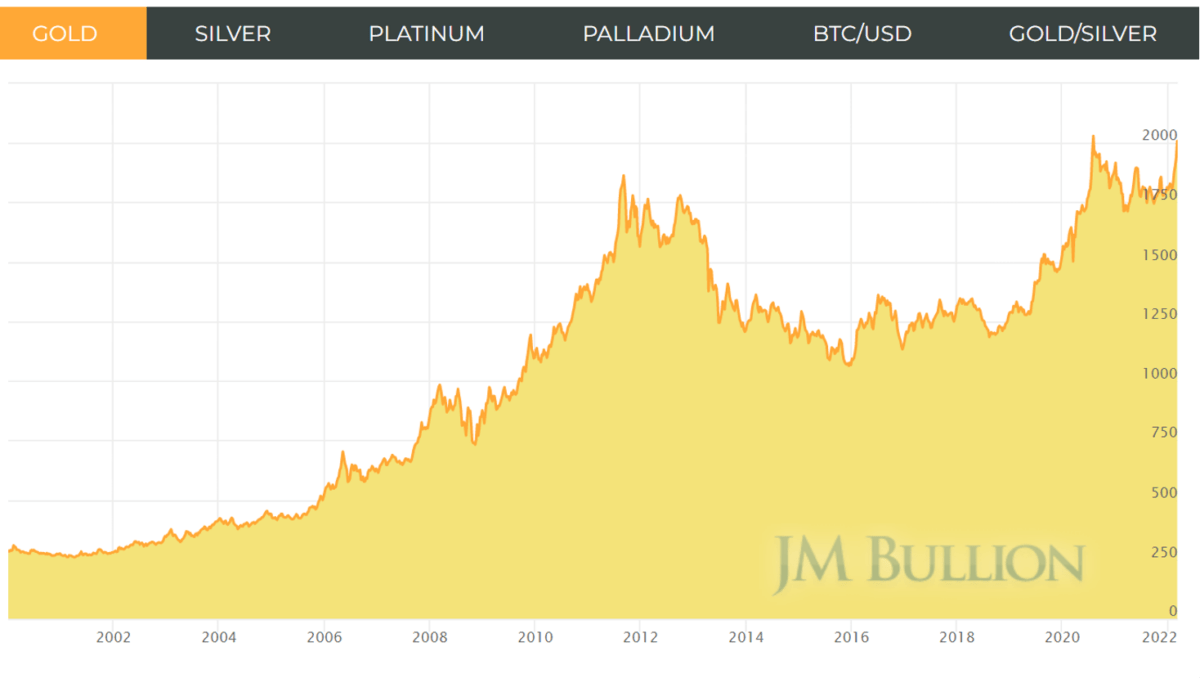

J.M. Bullion shows us gold has gone up almost eightfold during that same time period.

I don’t ever want to sell from our core holdings, the catastrophe would be horrible. I want to pass those assets along to the next generation.

I don’t ever want to sell from our core holdings, the catastrophe would be horrible. I want to pass those assets along to the next generation.

Precious metal can be stored in various places, including your home. Each location bears some cost/risk. A side note… If you store metals at home, DO NOT tell anyone; loose lips, sink ships goes for metal storage at home too.

I don’t own collectibles, but rather coins that are instantly recognizable and their value published daily on world markets. Collectibles claim value because of their rarity and desirability. I don’t want to have to negotiate the value of jewelry or collectibles. Should I ever be forced to sell some core holdings, I want liquidity at the fair market price.

Physical metal #2 – This is the same asset bought for a different purpose, speculation. Your intention is to time the market, buy and sell at the right moment and make profits on your trading. I recommend this is earmarked; held separately.

Metal mining stocks – These are established mining companies that bring metals out of the ground to the market. This is NOT speculating in exploration companies, junior mining stocks hoping to find gold.

Many times, these mining stocks have out-performed metals during high inflation. Their mining costs are fixed. Every $1.00 increase in the price of gold/silver generally goes straight to bottom line profit. In the last year the selling price of their product increased almost 25%. Stockholders should be rewarded with not only stock appreciation, but also increased dividends.

These stocks can be bought as a great hedge against inflation, and for asset appreciation. Remember to segregate this in your mind, and perhaps portfolio. When/if you decide to sell, what was the reason you bought it?

Royalty Companies – These companies generally help finance mining operations. Not only do they earn interest, but they also receive an agreed upon portion of the finished product. When the selling price of the metals go up, it all goes directly to profit. The additional profit can be used to help the company grow, as well as pay increased dividends.

You can buy these for income, stock appreciation and an inflation hedge.

Should I Sell? It Depends…on What?

Let’s look at Royalty Companies first. I hold them primarily for appreciation and income; particularly with fixed income rates being negative. One example is Wheaton Precious Metals (WPM).

When silver prices drop, I will generally add to our holdings. As silver goes up, I have sold covered calls for additional income. Should I feel the silver price is about to reverse, I will sell part of our position. I’ve never sold it all, holding a certain number of shares for inflation protection.

If you bought metal mining companies, is it time to take profits? Where do you feel the price of metals will go, and where you would reinvest the cash? If you need cash, taking some profit would make sense.

As an analogy, when toilet paper was worth more than a barrel of oil, we bought Energy Select Sector SPDR fund (XLE). We increased our holdings right after the election, anticipating the new administration would shut down US oil production. We are currently up over 100%. Should I take profits? I’m choosing not to.

Here in Phoenix gas prices have doubled in the last year. Pump prices jumped $.60/gallon in the last week. Nothing appears to be happening that will bring oil prices down; it looks like they will go higher. I asked a friend how high will the public allow gas prices to go before they join the truckers and head to Washington? Should something change, we will sell a portion and take profits.

Let’s discuss physical metals #2. If you bought with the intention of buying and selling down the road at a profit, you must ask yourself, is it time to take some profits? Am I willing to be satisfied to take profit, and not fret if prices continue to rise? No one can time the market perfectly.

| “If they wanted less, they’d go home with more.”

— Said by a casino operator about most gamblers. |

Many years ago, I took craps lessons. The most important lesson is when to quit. I had to teach myself to take my chips, turn my back and be satisfied. I didn’t want to watch and see what happened, it was not relevant…. Profits are good, don’t get greedy!

Core holdings hold a very special place and are treated differently. They are bought and held for insurance, hoping things never get so bad that you are forced to sell to survive. You buy fire insurance and hope you never have a fire.

If gold jumped from $2,000 to $5,000 overnight because of world turmoil, I would hope to not be forced to sell it. You bought it as wealth insurance. Central banks are doing nothing but fueling the inflation flames even more. As inflation continues, there will be many more buyers getting into the game driving the price even higher.

Currently our core holding have more than doubled in value. Were I to sell it, I would have cash. What happens if we have hyperinflation, and the USD is no longer looked upon as the world currency? Where would I invest it safely and not worry about inflation?

The day after gold dropped back under $2,000 Chuck Butler wrote in The Daily Pfennig,

“Today’s Data Cupboard has the stupid CPI prints for Feb…. I read where the White House is leery that this report could show really strong inflation gains last month…. I would think that by now they would have figured out that this inflation isn’t going anywhere but up….

…. Soaring U.S. inflation is expected to continue its surge with no sign of relief in sight, as the costs of consumer goods like gasoline and household items climb to new heights. But then we might not see it that way when the stupid CPI prints today, because of the way it gets calculated…. I’ve explained all that before, so I won’t go into it again today, just be aware that real inflation is only calculated by shadowstats.”

As Chuck predicted, inflation surged and the president told reporters to blame the Russians.

As an aside, I’d encourage all readers to sign up for the The Daily Pfennig. Chuck tells it like it is, no holds barred, and it is FREE. When I open my email each morning, I click on it FIRST.

I’ve been asked, what would cause you to sell some of your core holdings?

Simple – Personal financial Armageddon!

Most investors keep track of their portfolio and their cash flow. The old saying, “Live off the interest, but never touch the principle” applies in a different context. Today’s interest rates are negative when factoring inflation into the equation. So, it must be “Live off your income and keep your portfolio intact.”

We hope for enough positive cash flow to pay our bills for the rest of our life from social security and other sources of income (rental property, part time job, etc.). Should something unexpected happen, like a major medical issue where a family member needed help, you may have to reestablish priorities and tap into your core holdings.

Should inflation cause living costs to rise so dramatically your income does not allow you to meet your obligations, you have little choice but to sell some core holdings.

When do you tap into your core holdings?

When you have little choice, and no other options available. Personally, I would sell the most liquid first like stocks. It would be a delicate balance between selling physical metals and stocks. Liquidity will be important.

The bottom line is simple. You bought your core holdings for insurance and hope you never experience the catastrophe. When precious metal prices rise as they have lately, it’s time to check to make sure you have enough to remain comfortable and sleep well.

If you feel you need more, the pundits recommend you set up a regular buying program, buying in tranches to level out your cost.

Hope you get to the end of the line with your core holdings intact. Your heirs cost basis will adjust to the current market price. The challenge is in educating them to hold on and hope they pass it on to their children.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

“Hard assets don’t lose their value during hyperinflation”. Who was Hugo Stinnes, Germany’s “inflation king”?

https://www.wealthplaybook.ca/post/who-was-hugo-the-inflation-king-of-1920-s-germany-stinnes

I’m definitely not a Bitcoin fan. this article shows the similarities in 1920s Germany to today.

https://www.wealthplaybook.ca/post/parallels-between-today-s-events-the-hyperinflation-of-1920-s-weimar-germany

I want to see videos of people trying to buy food or pay bills with their Gold. I grew up watching cowboy movies so maybe shaving gold coins down to dust that you can carry in a little bag would work. Scale sales should explode. I would wait for SHTF times(worse than now) and pay off large items with gold if you have that much.

Diversify and buy some Bitcoin. Do you own a place to live free and clear?

I want to see people trying to pay for bills and food when their untraceable, unhackable, safe and secure crypto disappears… poof. Or when the govt decides it doesn’t like your opinions… poof…

We’ll just completely ignore the three or four times in the last year that the crypto market was robbed or that a government can freeze the untraceable crypto… and buy a byte, nothing, and be happy about it…

There’s nothing quite like the heft and feel of a crypto-laden thumb drive in your pocket.

Gold is for wealth and you can buy it in 1/10th, 1/4th, 1/2, and 1 ounce coins.

Silver is for smaller purchases, pre 1964 90% silver dimes, quarters, will work well for barter at some point sfter TSHTF. One ounce and half ounce silver coins will work for larger purchases.

If it is not in your hands you don’t own it…I don’t care what it is.

Counter party risk will become death to all but hard assests under your direct control and well armed ans practiced defense of.

Cash will be King for a short while after the coming economic implosion…no one knows how long…credit/digital fiat/ATMs etc. will gone in a puff of road runner smoke. Bank Bail Ins will take over.

And before some one says it all the other forms of Prep: spiritural, water, food, shelter, defense, essentials, tribe/community, medical, barter, should come before PM’s.

If you want to buy gold remember 1932. President Roosevelt,a truly evil SOB,made holding gold buillion illegal.Take a look at the penalty for ignoring that directive.If you have bought gold coins,the GOVERNMENT knows what you have.The only safe way to avoid confiscation is to own gold jewelry.Buy gold wedding bands at a pawn shop.Bring your own scale,and know how to figure out the rings value in pure gold. Unless it’s been changed, gold sales over 600 bucks HAVE to be reported,so buy small rings. 1930 America was in a depression,but the country and the dollar was strong.If you think a desparate Uncle Sam, whose card has been declined,won’t swat your ass for your gold coins,wake the hell up.

yeah but this time around, if they do, they will be declaring gold ‘illegal’ at the same time as declaring everything else, pretty much merely being alive and not a slave, also ‘illegal’. if you have extra wealth for long term savings, put it in gold, sure. but the more important metals will be lead and steel. some copper as well.

Well said Mark. I had a long comment roughed out (from 5 decades experience), but it got so long I didn’t have time to post or proof it. I’m always late to the party because in still working a 50 hour week..

I’ll pose a question. From Omar Khayams’ Rubyiat concerning wine sellers: “I wonder what the vinters buy… one half so precious as what they sell?”

Hi,

If you took a one ounce gold piece to the grocery store you would leave with more carts full of worthless paper for change than groceries. Barter will be another story.

I suggest you look into “junk silver”. Many pundits feel that will be more inclined to use for barter, plus it would be much safer to carry.

Best regards,

Dennis Miller

In a post apocalyptic economy, the last thing you want to be known as is a guy who holds physical gold.

No. Its time will come.

Yes, to me.

LOL. Like ammo, it’s always a good time to buy physical Au or Ag…at least until we come out the other side of this mess. But be careful not to make the mistake I made: absolutely forgetting where it was buried on the Indian reservation.

as well try to avoid the mistake i made: crossing the italian border trying to get home (working up in europe, home is further south and east) , with one’s life savings in the car. got it all officially robbed from me, and 6 months of lawyers etc only resulted in ‘fuck you we took it because we can’ . perfect timing too just as tshtf.

That’s the problem with international borders; know the PM-relevant rules (and the likely odds of detection) before you cross.

For Americans, one reason Canadian Maple Leafs are attractive is that, as an (obvious) product of Canada, they can be returned to Canada with no reporting requirement, at least to the Canadian side. They can also be exported from Canada with no reporting requirement (at least that was the case 10 years ago). The above definitely does not apply to American Eagles.

Mr N, let’s not get into a big bidding war here; we can deal.

Indeed, I find myself short of funds at the moment. Hopefully he has enough for all.

Friend, that’s why we have plastic and I hope he has enough to use up all our plastic.

My first exposure to economic ideas was in a Government/Econ class when I was a senior in high school. I was told to dread the teacher and the class, but I found it interesting (as interesting as I found any class anyway) and certainly none to difficult.

At some point she went into the Weimar hyperinflation. I didn’t know the terms Game Theory or Positive Feedback Loops at the time, but I grasped the concepts. At one point she asked the class, rhetorically, “do you think hyperinflation would ever be possible with the dollar?”

I remember, very specifically, thinking “No. I think it is inevitable.” Now, immediately after some very quick math, I figured that it wouldn’t happen until at least 2011 and to an 18-year-old kid in 1994, this was an impossible amount of time into the future.

It is inevitable, of course, the dollar–in it’s current form–will be destroyed at some point. And with what I know now about the Fourth Turning and cycles, it will almost certainly be within the next 5 years. What does it look like? That is the question. Will at least some dollar-denominated wealth make its way into the next currency? Almost certainly. If not, we are looking at something very Mad Max like. IMO, some money in the system is good, as long as there is some out of the system as well. Personally, I have an IRA that I trade. Almost all in mining and royalty stocks. This makes sense to me. It keeps me on top of things, as I check it every day, and it also gives me a long time horizon….it’s gotta stay in there for essentially the next 20 years. If it goes to zero value in that time…well, that means there are much bigger fish to fry than anything so quaint as funding retirement.

Should you sell your gold?

Do you have less ammo then gold? Cause it is going to be a simple maff problem……

The number one cost input for Gold mining is diesel fuel which has risen significantly since last year. Most mines appear to be remotely located in hostile environments and the diesel has to be trucked in. Parker Schnabel and those Gold Rush guys will be paying $10 a gallon if not more this year.

Another factor is the USD. Gold at $2,000 an ounce is less valuable with a USD of 90 than a USD of 99 where it is roughly today. Since Gold wealth should be reckoned strictly in how many ounces you have, the attached fiat numbers are irrelevant in the long run. HR

Gold is money. For five thousand years.

Rhetorical question. If it wasn’t, why would central banks even hold it?

The majority of Americans have long been propagandized, brainwashed, and dumbed down about Gold and Silver just as they have been about everything else.

The vast majority’s knowledge of economic history rivals their lack of knowledge of every other aspect of history.

According to a recent survey results, a combined 12% of Americans own gold, while a combined 14.7% own silver.

https://www.prnewswire.com/news-releases/new-survey-reveals-12-of-the-american-population-owns-gold-while-14-7-owns-silver-300942963.html

As the controlled demolition and take down of the Unites States/Dollar moves forward Bill Holter explains it well.

The Average American is dumb as shyte. Then there is Affirmative Action.

Ladies and Gentlemen,

The key word is “Demonetization”, of the gold & silver as a currency, obviously replaced with the infinite amount of paper DEBT dollars as the ONLY possible currency.

Do please remember that the FED has ONLY One mandate, that is to insure the profits of the member banks.

Banks are NOT banks anymore but just huge hedge funds, trading their own stock and anything else out of public eye in their SEC approved Dark Pool accounts.

Gold as a currency in east India where gold in jewelry form is very much in use as the family’s store of wealth and used as a currency. Women wear the family wealth.

The monstrous problem of the USD loss of purchasing power, now accelerated much faster than ever does not look to slow or stop near term.

you sell gold to buy land, armaments, that sort of thing. maybe to get yourself out of a bad jam if you get yourself into one.

otherwise hold on to it for when you need it for the above.

I see Russia is buying, not selling gold. Pushing the values of the ruble up.

There are only two times when you sell an investment: 1) when you need the money 2) when a better investment is available.