The carnage playing out in the U.S. stock market on Wednesday is likely an amuse-bouche compared with the devastation on the menu for the bulls in the coming months and years, Guggenheim Partners Global Chief Investment Officer Scott Minerd told MarketWatch in an interview.

The prominent CIO on Wednesday said he envisioned the possibility of a dreadful summer and fall for stock-market investors — one in which the Nasdaq Composite Index COMP, -4.73% eventually unravels, plunging 75% from its Nov. 19, 2021, peak (currently it’s down around 28%) and the S&P 500 SPX, -4.04% tumbles 45% from its Jan. 3, 2022, peak (from which presently down 18%) as we head into July.

“That looks a lot like the collapse of the internet bubble,” Minerd said, referring to the implosion of technology stocks in 1999 and early 2000.

What’s driving Minerd’s pessimism? He fears that the Federal Reserve has made it abundantly clear that it is aiming to continue raising interest rates, despite the possibility that it could result in ruction in equity markets and elsewhere.

”What’s clear to me” is that “there is no market put, and I think we’re all waking up to that fact now,” Minerd said.

The CIO was alluding to the so-called Federal Reserve put option, which is shorthand for the belief the U.S. central bank will rush in to rescue tanking markets — an approach that has been denied by previous Fed chairs.

On Tuesday, Fed Chairman Jerome Powell also appeared to be trying to disabuse investors of the notion that the bank should be relied upon to throw investors a buoy as monetary-policy makers attempt to combat an outsize dose of inflation.

“Restoring price stability is an unconditional need. It is something we have to do,” Powell said in an interview Tuesday during the Wall Street Journal’s Future of Everything festival. “There could be some pain involved,” Powell added.

Minerd said that he believed the Fed will continue to raise rates “until they see a clear breaking of the inflation trend” and that “they are wiling to go above a neutral rate,” referring to a level of interest rates that neither stimulates nor restrains the economy.

Earlier this month, the Fed’s rate-setting committee raised the benchmark federal funds rate to a target ranging between 0.75% and 1%. It is expected to raise rates by at least 50 basis points at its June 14-15 gathering, as U.S. inflation stood at an 8.3% annual rate in April, according to the Labor Department, well above the Fed’s target rate of 2%.

The Guggenheim executive said that a May 13 gathering of former Federal Reserve policy makers and prominent economists, including John Taylor, John Cochrane and Michael D. Bordo, hosted by the Hoover Institution just after the Fed’s May meeting, caused him to take a more bearish stance on equities and the market as a whole.

He said attendees at that Hoover conference estimated that the Fed would need to take interest rates to 3.5% to 8% to hit neutral, which suggested to him that the central bank might need to dial up rates until something in the economy or markets, or both, breaks.

The Fed appears to have “very little concern about the continuation of what I think now is a bear market,” Minerd said. If that is the case, “we are probably going to have a pretty severe selloff,” he said. The investor said a severe downturn could give central bankers some pause, but any respite from hikes might not come until a lot of damage is already done.

So, as long as the selloff remains relatively orderly and we don’t get a sudden crash, the Fed is going to continue to raise higher than inflation an unemployment will justify by the time they get [to a neutral rate],” he explained.

Some Wall Street pros, including Wells Fargo & Co. WFC, -3.50% Chief Executive Charlie Scharf, said that it will be hard to avoid a recession against that rate-hike backdrop, and Minerd agreed.

“When you start to line up all the data, a “summer of pain is what we’re heading for,” he noted, adding that by October, things may have reached a bottom.

In a draft of a research report, reviewed by MarketWatch, Minerd said:

With the passage of time as the Fed continues to hike, we will find ourselves experiencing the effects of increasingly restrictive monetary policy. Well before it reaches this terminal rate the Fed will increase the risk of overshooting, causing a financial accident, and starting a recession.

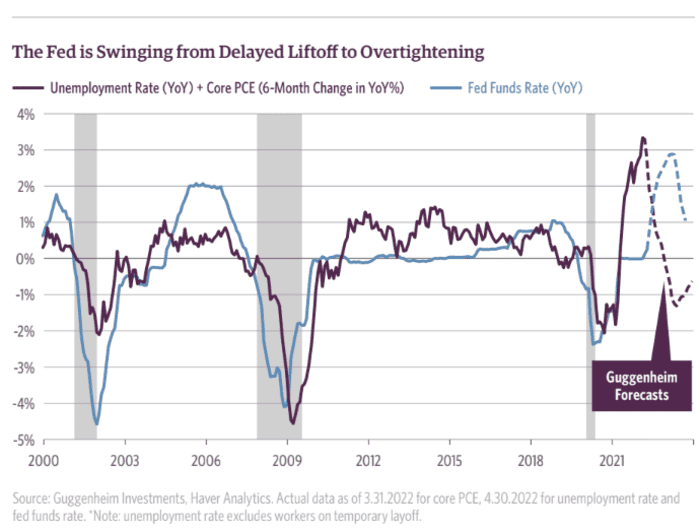

Minerd said that Fed is headed toward overtightening financial conditions just as employment show some softness.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

It’s going to be a summer of “mostly” peaceful rioting.

Going to be another summer of “The Cases”. The plannedemic ain’t over. Case-demic incoming, to start in Fla then move north. Then a dip. Then another case-demic in fall when WHO can test out their new world-governing-body powers.

Prepare for a lot of deja vu.

at $10 to $12/gal gasoline, how big can the riots get?

No significant interest rate increase will happen. We will not see 5% in the next decade.

When you have MASSIVE debt, the last thing you will allow is an appropriate rate hike.

This all ends in default, hyperinflation and riots. It’s all downhill until the shots are fired now.

“When you have MASSIVE debt, the last thing you will allow is an appropriate rate hike”

sure, if you mean well. they don’t.

see, the “federal” “reserve” debt dollar pyramid scheme is backstopped (by law) by the assets and collateral of the united states. default initiates asset and collateral confiscations.

and that’s the intent. since 1913.

first you destroy the insurance on the assets, and then you destroy the assets themselves.

food for future thought.

Good one No Name!

“The Nasdaq Composite could plunge 75% from peak, S&P 500 skid 45% from its top”

would still be overvalued.

Could, could, could. Maybe, maybe, maybe. I think, I think, I think. Probably, probably, probably. Might, might, might.

Ditto. 🙂

Lots of time with Caesar. Your pic is different!

Tomorrow Market Watch will advise to Buy the dip…..

I have agreed with ‘BUY THE DIP’ with Silver since right after the Hunt Brother’s got their asses kicked by the Banksters in the early 80’s, and in Gold since 1999.

Historical economics are a cycle…just as sucker fiat (in all its digital forms – including the slaughter house stock market) is the proven greatest con of those willing to use their real ‘money’ to see what was behind the EGRESS???

“this way to the egress”

The world’s financial system is irreparably broken. The year it actually broke is for historians to write.

We currently live in an in-between time: after the system is broken and before the new one based on CBDC is quite ready to be rolled out.

The goal is to keep the wood over everyone’s eyes long enough until the test phase (in the Caribbean where UBI has already been partially implemented, in China where 150 million people already have digital wallets) is over and the implementation is far enough along as to be irreversible.

It is an honor to live in these times, because our choices can shape the outcome of history maybe in ways like never before.

I think Scott Minerd is in for a Summer of pain with a 45% drop in vascular blood flow if he doesn’t drop 10 stone most ricky tick.

More chins than a Chinese phone book, as they used to say.

Everything Bubble is popping. “Slowly and then all at once”, looks to apply.

When the FED’s *TWO* STOCK TRADING, aka “Manipulation” OFFICES CANNOT PREVENT A 1,000 point down day???

But pain au chocolat if your shorts are not too loose & not too tight but are just right & linedance-drying-after-laundering in the fresh air… Better to be the bear, than to hafta outrun the bears, in their Goldman Sachs, Goldilocks.

https://www.kingarthurbaking.com/recipes/pain-au-chocolat-recipe

Since 19 & 13? Nah. Since 17 & 76. At least with the au courant cabal.

The whirld’s “financial system” has always repaired to the breakroom to practice the breakdance moves that’ll “break the banks” one more time…for all the “old” times.

UhOh! ‘warning’ of “summer/fall”. Friday the 13th might have been a tad obvious, even to me.

This Friday then?

Really. With the price of diesel, what is the american trucker convoy supposed to do? Can’t remember which coast they are headed to or from at this point.

Drastic times call for drastic measures. North to South then?

With all reasonability it should of crashed years ago. There is no logic to be found in the stock market what so ever. So quit trying to imply it makes one ounce of sense. It will collapse when the consortium says so, not one second sooner.