Guest Post by Nick Giambruno

Few people know that a quadrillion comes after a trillion.

Even fewer know that a quintillion comes after a quadrillion.

That’s partly because the human brain can’t understand a number so large. It’s also because there aren’t many topics of conversation where these large numbers are relevant.

A trillion is an enormous, almost incomprehensible number.

For example, a trillion seconds ago was about 30,000 BC.

It’s common knowledge that the astronomical US government spending, deficit, and debt figures all reach into the trillions. But other than that, finding something that runs into the trillions is not something most people are familiar with.

What about a quadrillion?

A quadrillion seconds ago was about 32 million years ago.

It’s hard to think of anything so large that people measure it in a quadrillion (a thousand trillions). As far as I know, the only thing that reaches a quadrillion are some estimates of the total notional value of all derivatives in the world.

What about a quintillion?

A quintillion is one with 18 zeros behind it.

A quintillion seconds ago was about 32 billion years ago. For perspective, scientists believe the Big Bang, and thus the universe’s age, to be 13.8 billion years.

What topic of everyday conversation could possibly be so large that people measure it in quintillions?

I know of only one thing: Bitcoin’s hash rate of 209 quintillion calculations per second which helps to make it the most secure computer network in the world.

Hash Rate

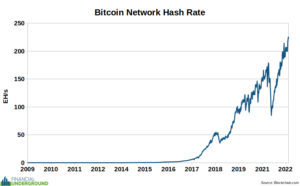

The cumulative computing power of all Bitcoin miners is the overall network’s hash rate.

It refers to the number of hashes—or calculations—per second that Bitcoin miners dedicate to solving the Proof of Work math problems.

The chances of a miner solving the Proof of Work problem—and thus earning the rewards—is proportionate to its hashing power relative to the overall network.

A miner contributing 1% of the overall hash rate should earn 1% of the overall rewards, consisting of new Bitcoins created and the transaction fees.

The hash rate of the overall Bitcoin network recently exceeded 209 quintillion calculations per second, which is expressed in exahash per second (EH/s).

209 quintillion calculations per second is an astonishing and mind-bending amount of computing power.

Remember, one quintillion seconds ago was about 32 billion years ago. For perspective, scientists believe the Big Bang, and thus the universe’s age, to be 13.8 billion years.

That’s what makes the Bitcoin network the world’s most powerful collection of processing power by orders of magnitude—and the most secure.

To even think of attacking Bitcoin, a potential attacker would need to obtain an improbable amount of electricity and computer hardware—over 51% of the network’s aggregate computing power (hash rate). And even then, they would still need to overcome several daunting hurdles.

But let’s assume that happened. The most the attacker could do is double spend their transactions in some of the most recent blocks. They would not be able to create new Bitcoins or modify old transactions. This is what is known as a 51% Attack.

For practical purposes, a 51% Attack would be improbable because it would require compiling more computing power than any entity is capable of doing or conceivably could in the future.

According to some estimates, it would require an attacker to spend scores of billions on computer hardware—and that’s with the unrealistic assumption they could even source the equipment if they had the money—and tens of millions per day on electricity to even have a slight chance at tampering with Bitcoin’s recent transaction history.

Also, the cost to perform a 51% Attack is likely to grow significantly higher as the Difficult Adjustment increases the difficulty of solving the Proof of Work problems and thus the computing power and electricity required to attack the network.

But let’s say someone attempted to make a 51% Attack on Bitcoin.

The return on investment for the attacker would not be attractive. Even if the attack were successful, it would crash the value of Bitcoin.

In short, it would be extremely expensive and challenging to execute with little or no monetary reward.

That’s how powerful economic incentives protect Bitcoin and make attacking it improbable and uneconomic.

Ultimately, anyone who wants to attack Bitcoin will realize that it will be more profitable to buy Bitcoin or mine it honestly than to try to attack it. In other words, if you can’t beat them, join them.

It’s also important that the hash rate is geographically dispersed. Below is a chart that estimates the countries where Bitcoin’s computing power is located.

We can see that China previously held a dominant position, but now the Hash Rate is much more diversified, which makes Bitcoin even more resilient.

It’s also worth noting that just because a particular country is responsible for a certain percentage of the hash rate does not mean all miners within that country are controlled by a single entity.

Here’s the bottom line.

The amount of electricity required to run the Bitcoin network makes it the most secure computer network in the world.

It’s all part of Bitcoin’s ingenious economic incentives, which creates a virtuous cycle.

Step #1: The higher the hash rate, the more difficult it is to attack Bitcoin and the more secure it becomes.

Step #2: The more secure Bitcoin becomes, the more attractive it is as a reliable store of value.

Step #3: The more attractive it is as a store of value, the more people will demand and hold it.

Step #4: As more people hold and demand it, the higher the price goes.

Step #5: The higher the price goes, the more people are incentivized to get into mining Bitcoin.

Step #6: The more computing power dedicated to Bitcoin mining, the higher the hash rate and the more secure it becomes. Go back to step 1.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

and then the power went out.

Hash rate immediately goes to zero.

But it still can’t be hacked!

Your bank probably has a generator, so you are good, right?

… if it’s the size of the San Onofre nuclear power plant …

TWO San Onofre’s!

Is your “money” digital right now?

and then people just stopped using bitcoin.

Imagine if all that electricity was put to productive use.

Most of it becomes useful instead of purged. Then imagine all the banking and attendant activity that goes on now. Cryptos use excess energy and reduce energy use in myriad ways.

Tell that to the small towns out West where the ‘miners’ opened up shop … and drained all the local load …

Send me the article. I live “out West” and there were some miners along the Columbia River using hydroelectric power that goes to waste when demand is low.

Wait. What? Productive Use? Please. Next you’ll be talkin’ CRAZY. Like Stopping Flaring Natural Gas at the wellhead so people can be warm. This Winter.

We NEED The Liquids for Pharmaceuticals and plastic production.

Gee, if it is so secure, why does it get stolen all the time?

Oh, and if they are so secure, why have around 1/3 of all bitcoins been lost already?

Its so secure I want to get rid of all my money, gold, silver, real estate, bottle caps and collections of lint so that I can get in on the digital currencies of the future…

how about you?!?!?

Do that if you want to, Brian. Yet the better course might be to hold all of those things, fewer FRNs, and Bitcoin.

Early on it was used to buy pizzas and given out as curiosities. If people would only keep cryptos under their own control, they wouldn’t get stolen. Do you keep your fiat in some doofus online site? And cash doesn’t get stolen? And inflated away to zero over time?

And then the sun burped and quadrillions of hashmarks cried out in fear.

Counting the grains of sand at the beach doesn’t make them valuable.

What a waste of energy.

I don’t see how it makes economic sense. The ROI seems dismal.

I’ll stick with less esoteric silver and gold. But thanks for the thought experiment.

ROI? Whose, yours or the miners’? Mine is lovely. The miners do it because they make a profit that does vary with the price, but why the hell would they keep doing it if they were not operating at a profit? Go ahead and “stick” with metals, but why not metals and crypto and land and so on? Works for me and the result is not anywhere near “dismal.”

I don’t trust monetary systems created by pseudonymous shadows. Mystery entity “Satoshi Nakamoto” in this long-running case. Call me old-fashioned with my historical inclination for reputation.

“What the fuck” for $1000, Alex.

Q: Amount of money Zelensky will ask from the USA to defeat Russia.

A: What is 3 quintillion.

And that’s just for his cocaine.

Quintillion – a billion billions. Easy peasy.

These comments remind me of the time in New York when horseshit was getting so plentiful that the street cleaners could not keep up with it. Some one got the idea of putting barrels of water on a wagon pulled by horses that had holes drilled into them that would wash the street somewhat. The street cleaners unionized and protested with signs that read, “Down with labor-saving devices!” Sounds about parallel to protests against crypto.

“somewhat”

But let’s say someone attempted to make a 51% Attack on Bitcoin.

The return on investment for the attacker would not be attractive. Even if the attack were successful, it would crash the value of Bitcoin.

Every aspect of reality is under attack right now. Why would anyone think Bitcoin will escape unscathed? Besides, a ‘51% attack’ becomes substantially easier if the other 49% has some kind of ‘accident’ – a run in with climate change, for example.

What a waste of time, money, and human effort.

This is navel gazing taken to extremes. Creating something to perform a function that the human mind cannot grasp.

Bravo Science!, you’ve done it again.

Why Grandma, what big data centers you have.

The better to spy on you, my dear.

Northern Virginia leads the world in the data center market

Data centers are centralized locations where computing and networking equipment is concentrated for the purpose of collecting, storing, processing, distributing or allowing access to large amounts of data. At present there are about 166 data centers in Northern Virginia, with about 27 located in Fairfax County and most of the rest in Loudoun and Prince William counties, according to Baxtel, a data center information site. In fact, Loudoun County brands its concentration of data centers as “Data Center Alley.”

https://www.fairfaxcountyeda.org/northern-virginia-leads-world-data-center-market/

Govt can’t let the NSA Utah Data Center have ALL the fun storing, sorting, and searching a lifetime of the people’s minutiae. Not while the taxpayer isn’t too destitute to pay subcontractors.

https://bitcoinmagazine.com/business/russia-to-legalize-use-of-crypto-in-international-trade