Guest Post by Nick Giambruno

Every day there are over 2 billion consumer transactions around the world.

Visa, Mastercard, American Express, and other large companies process most of these payments.

Bitcoin, on the other hand, does not have anywhere near the capacity to handle this kind of volume.

The Bitcoin protocol sets the maximum size of each new block at about 1 megabyte (MB).

That means there is a hard limit on the maximum number of transactions the Bitcoin network can process—about 375,000 transactions a day, or about 0.019% of all the world’s consumer transactions.

That’s why it was never possible to record every Starbucks or McDonald’s transaction on the Bitcoin blockchain. It was also never desirable.

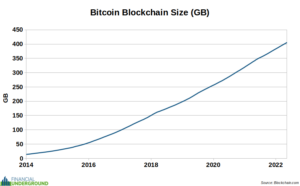

Today—after over 13 years of transaction history—the size of the Bitcoin blockchain has grown to about 420 gigabytes (GB). The small block size means that the Bitcoin blockchain grows slowly and is predictable.

As a result, the average computer can easily handle running a full node now and in the future. That is crucial for Bitcoin to remain decentralized.

As a reminder, the Bitcoin blockchain is simply a public database of transactions distributed to over 14,000 computers worldwide. The computers that retain the entire blockchain and run the Bitcoin software are called “full nodes.”

Full nodes enforce the Bitcoin protocol and consensus rules—like its monetary policy. They can also verify and audit the entire supply and transaction history—without relying on third parties.

Suppose Bitcoin needed to record every consumer transaction on its blockchain—or even a fraction of them—it would require an industrial-scale operation with expensive data centers.

As a result, only large entities could run full nodes.

That would mean the average person would not be able to participate in enforcing the consensus parameters and the protocol. That would be the end of Bitcoin’s decentralization because a few large entities would solely validate and enforce the protocol, which means they would be in charge.

In this scenario, Bitcoin might as well be another PayPal, Visa, or another centralized financial service where you need to ask for permission to do anything. Moreover, it would destroy the one thing that makes Bitcoin such a revolutionary innovation in money.

Remember, Bitcoin’s primary value proposition as a global money depends on it being neutral, censorship-resistant, accessible to everyone, and controlled by nobody.

To have these properties, it’s essential the average person can run a full node.

That’s why Bitcoin has a hard limit on the transactions it can handle each day. It needs to be this way so that the average laptop can easily handle running Bitcoin. That’s what keeps Bitcoin genuinely decentralized and incorruptible, giving it its unique monetary properties.

Does that mean Bitcoin will never be able to scale and achieve widespread adoption?

Absolutely not.

There’s a working solution available to anyone today.

It allows Bitcoin to scale to handle every transaction in the world—without compromising its decentralization and immutability. Moreover, it can process transactions instantly and at practically no cost.

Monetary Layers

When you use your credit card to buy a coffee at Starbucks, the money doesn’t land in Starbucks’ bank account when Visa approves the transaction.

Instead, a payment processor collects the money. It then aggregates a bunch of other transactions over a period. It then uses a commercial bank, which uses the Federal Reserve (the central bank of the US), to move the money from the payment processor’s account to Starbucks’ account for final settlement.

Aside from physical cash transactions, it’s not practical for Starbucks to immediately obtain final settlement. The company doesn’t have to clear with the Federal Reserve each cup of coffee it sells.

Instead, it uses this layered approach with payment processors to facilitate everyday transactions.

All successful financial systems have used a layered approach to scale, including the one based on a gold standard, the current fiat currency system, and now Bitcoin.

Layer 1 – International Final Settlement

The key characteristic of Layer 1 financial transactions is finality. They represent the ability to perform irreversible transactions that can transcend borders.

In the current fiat currency system, Layer 1 involves the central bank clearing transactions for final settlement.

Under a gold standard, the central banks of two nations used to settle balances between themselves with physical gold. Once Country A delivered the physical gold to Country B, there was final settlement.

Transactions on the Bitcoin blockchain are comparable to these. They represent final international settlement and clearance.

Layer 1 transactions are typical for high-value transactions that need security and finality. However, they are inappropriate for most consumer transactions—it’s unnecessary to use a wire transfer to pay for a cup of coffee—which instead can happen on Layer 2.

Layer 2 – Scaling and Convenience

Layer 2 transactions shouldn’t be compared to Layer 1 transactions—they’re totally different.

Layer 2 transactions involve systems built on top of Layer 1 that offer more convenience.

Using a credit card to pay for a cup of coffee is an example of a Layer 2 transaction. It involves a credit card company and a payment processor that enable convenient transactions on top of the Federal Reserve’s clearance for final settlement.

Under a gold-based monetary system, exchanges of physical gold were Layer 1 transactions because they had final settlement. However, they were also inconvenient, especially for smaller purchases.

Transactions involving a gold-backed currency—which are more easily divisible and convenient for daily transactions—are examples of a Layer 2 solution under a gold-based monetary system.

The US dollar under the gold standard would be an example of a Layer 2 system.

As I mentioned earlier, not every transaction in the world will be put on the Bitcoin blockchain (Layer 1).

Consider that many cryptocurrency businesses—like exchanges—perform almost all transactions on their internal ledgers. They only use the Bitcoin blockchain for final settlement.

For example, if you want to trade on an exchange, you’ll typically deposit Bitcoin into your exchange account. That transaction will be recorded on the Bitcoin blockchain.

Once that deposit is complete, all other transactions you perform on the exchange will not be recorded on the Bitcoin blockchain. Instead, they’ll be recorded on the exchange’s internal ledger. You could then complete thousands of trades on the exchange, and none of them will go on the Bitcoin blockchain.

When you are finished trading on the exchange and want to withdraw your Bitcoin to your wallet, that transaction will be recorded on the Bitcoin blockchain.

It’s not just exchanges. Countless other Bitcoin businesses do the same thing. The idea here is that the Bitcoin blockchain is used for final settlement.

So, which Bitcoin transactions should be on Layer 1 and Layer 2?

Those are subjective decisions every individual must make.

The competitive free market for the scarce resource of space on the Bitcoin blockchain will decide its most efficient use and, thus, which transactions should be on Layer 1 or Layer 2.

In other words, whoever is willing to pay the transaction fee to the miners can have their transactions inscribed onto the Bitcoin blockchain (Layer 1).

Larger transactions that demand a high level of security will likely use the Bitcoin blockchain.

Smaller consumer transactions will probably use more convenient Layer 2 solutions, just like they do now and did under the gold standard.

The idea is to keep Bitcoin’s base layer secure and scale by building on top of it. It would make no sense to scale Bitcoin by compromising its Layer 1. That would be bad engineering.

Many Layer 2 solutions for Bitcoin will inevitably emerge. However, the Lightning Network is the most dominant one… and its adoption is about to go parabolic.

The Lightning Network

Numerous Bitcoin Layer 2 solutions are developing, but the Lightning Network is the most prominent and exciting. It’s now ready for prime time.

The Lightning Network is an open, peer-to-peer network built on top of Bitcoin.

On the Lightning Network, people can perform an unlimited number of transactions without needing to add them to the Bitcoin blockchain. It’s unnecessary to delegate custody of funds to a third party—you can always remain in control.

The Lightning Network can eventually handle every consumer transaction in the world—many millions per second.

Unlike Layer 1 transactions on the Bitcoin blockchain, which can take 10 minutes or longer to settle, the Lightning Network has nearly instantaneous speed and almost zero fees.

Unlike Layer 2 solutions under the gold standard and the fiat currency system, the Lightning Network is an open, permissionless network with zero counterparty risk.

It starts with two people opening a payment channel with each other by depositing Bitcoin and creating a smart contract.

(A smart contract is code that executes transactions automatically based on different conditions and inputs for a period of time. Various conditions can be applied to create complex spending rules with all sorts of financial applications.)

The two people can then transact with each other—and any other payment channels they are connected with—an unlimited amount of times. Those transactions are performed on the Lightning Network and will not be recorded on the Bitcoin blockchain.

At any point, either party can close a payment channel. The outstanding Bitcoin balance at that time will be returned to the two people. The transaction to close the payment channel will then be recorded on the Bitcoin blockchain.

In short, Lightning Network transactions are only recorded on the Bitcoin blockchain when payment channels are opened or closed. Everything else occurs off-chain on the Lightning Network.

Think of it as keeping a running tab and settling on the Bitcoin blockchain when either party decides to.

Suppose you want to transact with someone but don’t have a payment channel. It’s possible to do so if the sender and receiver have enough connections in common to create a path to each other. If so, the Lightning Network will automatically find the shortest route and complete the payment without the need to open a payment channel.

It would look like the image below.

Person A wants to send Bitcoin to Person D, but they do not have a payment channel. They do have enough open payment channels with peers in common to create a path, though.

So, the Lightning Network will route the payment from Person A through Person B and Person C finally to Person D.

If this seems complicated, don’t worry. This explains how the Lightning Network works under the hood.

You can use the Lightning Network with a simple smartphone application—Muun is an excellent example. It does all of this in the background without the need for your input.

Here’s the bottom line.

The Lightning Network makes Bitcoin a viable medium of exchange for everyday consumer transactions.

It allows you to use the hardest, most inflation-resistant money mankind has known as easily as your Visa card.

The Lightning Network is the most exciting development for Bitcoin since its creation and could turbocharge its adoption.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Most of TBP commenters are older than dirt and don’t like Bitcoin. I think it’s worth having some and using it p2p (peer to peer) from a cold wallet. A lot more portable and usable than precious metals.

I don’t care how fast it is, if it’s value is subject to wild 10 to 15% swings on a daily basis and if every time I use it there is a reportable taxable transaction, it’s not for me.

And then they blew up all the power plants and poof!

Your tokens will still sit safely with you, in your cold wallet! /s

“Controlled by nobody…”

If it’s electronic media, it’s controlled. And I don’t care what they say, I believe it’s also traceable, but we’ll find out for sure when the NKVD — uh, IRS — start looking to tax Bitcoin somehow, or just to nose their way into peoples’ finances, in the next few months. They just hired 87,000 new Mr. Smiths from “The Matrix.” I doubt they’ll all have desk jobs.

There is no such thing as “free” money in this world.