Tag: economic collapse

Economic Earthquake Ahead? The Cracks Are Spreading Fast

From Brandon Smith

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

Continue reading “Economic Earthquake Ahead? The Cracks Are Spreading Fast”

From Trucker-Boycotts To Grid-Down – There’s Only One Way To Survive A Food Crisis

Authored by Brandon Smith via Alt-Market.us,

If there is one reality that Americans need to accept, it’s that every system has a breaking point and there are no exceptions. Human beings are built to adapt and this has given us incredible resilience, but it also means we have a tendency to wait too long to fix the parts of our society that are broken. Instead, we let the problems build and fester until, sadly, the final straw falls and everything comes crashing down.

Sometimes this collapse is by chance and sometimes it’s by design. In either case the catalyst is the same – The public does not prepare and they don’t take action to correct the people creating the crisis until it’s too late.

In our modern era of invasive technology, economic weakness, nuclear weapons and biowarfare, this is an unsustainable model. We can no longer ignore threats on instability in the hopes that they will go away or that governments will defuse the danger, nor can we simply pick up the pieces over and over again after each calamity. There may come a time when the mess is so big we won’t be able to clean it up. People must plan ahead, and they must stop tolerating the notion of passive involvement in the mechanisms that influence their lives and future.

Bidenomics in Action

Guest Post by Jim Kunstler

“We are at an inflection point, a threshold, where weak, brittle, effete personality structures are a threat to human civilization.” — JD Haltigan

If you’re troubled at all about the state of our country, and even your own small role in it, you might be asking yourself whether the people running things have any idea what they’re doing. Some of these doings happen in the metaphysical realm of finance, for instance America’s national debt ($34-trillion and going up like mad), and the death of the US dollar, along with the bonds that underwrite it. Or the game of hide-the-salami with the repo and reverse repo markets played between the Federal Reserve and the US Treasury to give the broken banking system the appearance of stability when it is actually in deepening ruin.

“This Is Bad, Really Bad…”

Authored by Matthew Piepenburg via GoldSwitzerland.com,

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In many recent articles and interviews, I’ve warned that Powell’s “higher for longer” war against inflation will actually (and ironically) lead to, well… greater inflation.

That is, the rising interest expense (nod to Powell) on Uncle Sam’s fatally rising 33T bar tab will inevitably need to be paid with an inflationary mouse-clicker at the Eccles Building.

I’ve also consistently maintained that Powell’s war on inflation is mostly just optics, as he secretly seeks inflation to help pay down that bar tab with an increasingly inflated/debased USD.

Powell achieves this open lie by publicly declaring a steady decline in inflation by simply misreporting the true CPI number.

As John Williams recently argued, true inflation using an honest (rather than the openly bogus BLS) measure is now closer to 11.5% rather than the officially reported headline rate of 3.7%.

This should come as very little surprise to those whose eyes are open to the Modis Operandi of debt-soaked/failed regimes. As former European Commission President, Jean-Claude Juncker confessed: “When the data is too bad, we just lie.”

But even for those who still believe the current Truman Show inflation (and “soft landing”) narrative out of DC, the Bezos Post or legacy media A, B, or C, there’s more fire adding to the inflationary flames than just bogus narratives and calming platitudes.

In particular, I’m talking about oil-driven inflation, and nothing burns faster.

Scary Flames in the Oil Supply

Left or right, the dumb out of DC just keeps getting dumber.

Between rising rates (nod to Powell), which make capex investing untenable for US oil producers, and a Weekend at Bernie’s White House, which has spent years effectively legislating US oil into oblivion, US energy supply is falling, and we all know that weakening supply leads to higher prices—and inflation.

Meanwhile, Saudi Arabia, whom that same White House called a “pariah state,” has not been warming to Biden’s awkward fist-pumps and increased production pleas, but rather joining other OPEC leaders in cutting, rather than expanding, oil production.

Gee, what a geopolitical shocker…

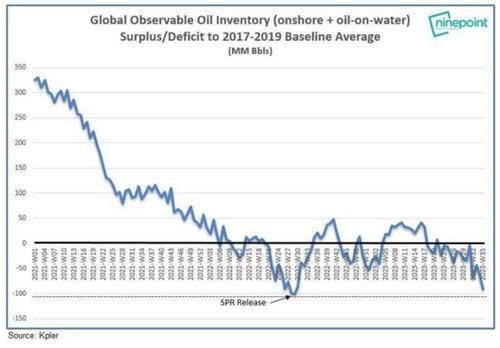

Net result, both national and global oil inventories are falling, and falling hard.

The Awkward Oil Two-Step

The once “go green” White House realized that the world, and inflation scales, still revolves around oil, especially after sanctioning Western Europe’s former energy supplier in one of the most short-sighted (i.e., stupid) policy decisions since the Iraq war.

This may explain why Biden changed his stripes and why there was a sudden pivot toward allowing greater US shale output in 2023 by pumping more cash into those shale fields at a pace not seen in 3 years.

Unfortunately, however, this may be too little too late (like Powell’s QT) to prevent oil price shocks and higher inflation into year end, thus adding insult to an already injured (and rising) US CPI measure of inflation.

As oil supply tightens, oil prices, and hence inflation rates, rise together with bond yields and interest rates—a perfect storm for over-inflated bond, stock, and real estate markets.

Those prices and inflation rates would be even worse if Chinese oil demand rises—which is why current Western headlines are literally praying for China to implode first. This might explain why The Economist has had two consecutive cover stories about an imploding China.

See how big media and big government sleep together?

Tying it Together

Regardless, we need to tie all this together.

If, as I see it, inflation (however misreported) becomes obviously more real and felt, the consequent rising bond yields will make the USD stronger and Uncle Sam’s bar tab more expensive, which hardy bodes well for America’s twin deficit black-hole of unpayable debt unless…

…Unless the Fed starts printing more fake and inflationary money to buy its own IOUs and weaken its export-killing, and BRICS-ignoring, USD.

Again, no matter how I turn the macros, the Fed will eventually have no choice but to pivot toward more instant liquidity and hence more inflationary policies to save/monetize its broke(n) bond markets.

Once this inevitability becomes a headline, the temporarily rising USD will be seen for what most of the informed world already recognizes—just another fiat monster backing a world reserve currency in the hands of a nation whose debt to GDP and deficit to GDP ratios mirror that of any other banana republic.

Reality is Hard to Look at Directly, But not for the BRICS

Many in the US or EU may not wish to see this. Bad news, like death and the sun, is hard to stare into.

But the BRICS nations, no strangers themselves to embarrassing balance sheets, are seeing this clearly.

Although I never bought into the gold-backed BRICS currency hype, I have zero doubt that this amalgam of commodity-heavy nations has a common enemy in the current US-dominated (and USD-driven) international trade system, whose hegemonic days are now numbered and whose alliances, as we warned from day-1 of the Putin sanctions (economic suicide), are forever de-dollarizing away from DC.

Moreover, the BRICS don’t need an “official” gold backed currency to trade their real assets in gold rather than Dollars. All they have to do, as Marcus Krall and I recently discussed, is request payment for their exports in gold.

The BRICS+ nations are hardly the perfect marriage of unlimited trust and efficient coordination. Nevertheless, they share an existential threat from an over-priced USD and negative-returning UST.

Furthermore, and as I recently noted at the Rule Symposium, they may not trust each other completely, but they do trust gold completely.

System Change is Now a Matter of Survival

Never has the phrase the “enemy of my enemy is my friend” found a better home than among the rising list of BRICS+ actors who recognize that their very survival hinges upon escaping the suffocating death of paying > $14T of USD-dominated debts whose rising costs (rates) they can no longer afford lest they become vassals of DC.

As Luke Gromen recently observed, from the perspective of the BRICS nations, it’s “either hang together or hang separately.”

A Changing Petrodollar?

China, for example, can not abide forever by a petrodollar system of oil purchases. As the world’s largest oil importer, it mathematically recognizes that it will eventually run out of dollars to buy that oil.

In short, China needs to come up with a better plan—outside the Greenback.

And they will.

By the way, have you noticed the next BRIC in the wall? It’s Saudi Arabia.

See a trend? See a looming change in oil currencies?

Just saying…

As I warned months ago, this Saudi trend away from DC and closer to Shanghai could eventually be a key driver in slowly unwinding the current petrodollar system between a once “friendly” US-Saudi relationship toward a now weakening relationship which hitherto ensured the global demand (and hence the survival) of an otherwise debased paper Dollar.

If the petrodollar system radically or even slowly unwinds, this will do far more to destroy demand and the inherent purchasing power of the USD (and send gold skyrocketing) than any gold-backed BRICS trade currency.

And yet with all the recent sensationalism preceding the BRICS summit in South Africa, almost no one saw this—at least not in the legacy media.

Imagine that…

Other Tricks Up the BRICS Sleeve: More USD Assets than Liabilities

Aside from knee-capping the USD via a shift (gradual or sudden) in the petrodollar trade, it’s worth noting that but for South Africa, the remaining BRICS nations have more USD assets than liabilities, which means they can start dumping USTs to the detriment of Uncle Sam in order to raise USDs.

Many idealogues and US-thinktankers still think the US has all the power over these silly little BRICS nations who allegedly suffer from a dollar shortage.

The chest-puffers still see the USD as all-powerful and all-controlling, after all, just ask Iraq or Libya…

But the dollar-forever crowd is missing the forest for the trees or the basic math of fantasy debt.

If you haven’t noticed, the US just added an extra $1.9 trillion of insane borrowing to the back end of 2023.

And they did this as rates are rising and with the Fed still in full QT/suicide mode.

This mathematically places downward price pressure on bonds and hence upward cost pressure on yields, a scenario America simply can’t play out for much longer at $95T+ in combined public, household and corporate debt.

If the BRICS nations chose to add a layer of US asset dumping to this toxic mix, the ramifications for Uncle Sam would be even more staggering/painful for a debt-based system already on the cliff’s edge.

This is Bad, Really Bad

To repeat: The macros, no matter how I turn them, have never been this bad, this vulnerable and this foreseeable.

The US is now trapped in a vicious circle of debt for which there is no way out other than a currency-destroying return to more artificial, QE “stimulus” and the mother of all inflationary waves.

The horizon is now clear: Yields are up, twin deficits are up, inflation, even the mis-reported kind, is up, and yes, GDP is up too, but as I recently wrote, debt-driven GDP growth is not growth, but just debt.

Unless DC cuts spending at record levels (which kills election results for political opportunists and thus won’t happen), the only tool Washington DC has is more fake money and more real inflation, which means the Dollar in your wallet, checking account or portfolio is about to insult you.

Brace Yourselves, Because What They Have Planned Is Going To Absolutely Devastate The US Economy

Authored by Michael Snyder via The Economic Collapse blog,

Do you remember what happened in 2008? Many people believe that another historic financial disaster is coming and that it will absolutely devastate the U.S. economy. Earlier this week, I wrote about an investor named Michael Burry that has actually bet 1.6 billion dollars that the stock market is going to crash. He made all the right moves in 2008, and he fully intends to be proven right once again in 2023. Of course current conditions definitely resemble 2008 in so many ways. The residential housing market is so dead right now, and commercial real estate prices are plummeting at a very frightening pace. Unfortunately, officials at the Federal Reserve are making it quite clear that they are not done strangling the economy.

This week, mortgage rates jumped above the 7 percent mark to the highest level that we have seen in more than 20 years…

7 Trends Which Indicate That Economic Disaster Is Approaching Very Rapidly

Authored by Michael Snyder via The Economic Collapse blog,

The economic meltdown that is coming should not be a surprise to anyone.

Throughout U.S. history, there have always been signs that a major downturn was coming, and that is precisely what we are witnessing right now. Tax revenues are way down, demand for trucking services is way down, demand for cardboard boxes is way down, the money supply is shrinking at the fastest pace in modern history, and the Conference Board’s index of leading economic indicators has already declined for 15 months in a row. At this point, anyone that cannot see what is coming has got to be willingly blind.

The following are 7 trends which indicate that economic disaster is approaching very rapidly…

Continue reading “7 Trends Which Indicate That Economic Disaster Is Approaching Very Rapidly”

MARCH OF FOLLY: FALL OF AMERICAN EMPIRE

“Folly is a child of power.” ― Barbara W. Tuchman, The March of Folly: From Troy to Vietnam

“A phenomenon noticeable throughout history regardless of place or period is the pursuit by governments of policies contrary to their own interests. Mankind, it seems, makes a poorer performance of government than of almost any other human activity. In this sphere, wisdom, which may be defined as the exercise of judgment acting on experience, common sense, and available information, is less operative and more frustrated than it should be. Why do holders of high office so often act contrary to the way reason points and enlightened self-interest suggests? Why does intelligent mental process seem so often not to function?” ― Barbara W. Tuchman, The March of Folly: From Troy to Vietnam

The term “folly” is particularly apt at this stage in the decline of the great American empire. Folly is defined as: criminally or tragically foolish actions or conduct; an excessively costly or unprofitable undertaking. If ever a word captured the actions of American political leaders in the 21st Century and reflect the tragic downfall of an empire borne out of the ashes of the Second World War, it is the term “folly”.

For the last two decades I’ve been befuddled by the inane foolishness of our leaders, as they have driven the nation into a bottomless pit of debt at an astoundingly ridiculous pace, initiated military conflict across the globe, and in the last three years initiated anti-human policies guaranteed to destroy our economic system, depopulate the planet, increase human suffering, and turn the world into a techno-gulag where we will own nothing, eat bugs, and bow down to the commands of globalist overlords.

Here’s Why The Collapse of the Empire Can Be Quite Entertaining

Guest Post by Chris MacIntosh

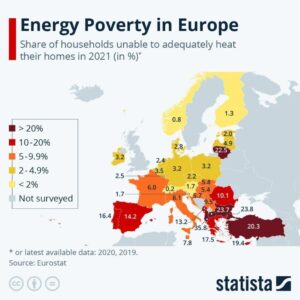

Statistica put out this handy chart giving us a visual of the roll out of poverty in Europe.

Without Russian gas, Europe has a shortage of energy, which has led to rising heating bills where the bulk of the costs are borne by households. In the UK alone, one in three households are expected to be pushed into energy poverty this winter. Continue reading “Here’s Why The Collapse of the Empire Can Be Quite Entertaining”

Hiding from Opportunity

Guest Post by Jeff Thomas

“Birds born in a cage think flying is an illness.” – Alejandro Jodorowsky

As a consultant on internationalisation, I regularly have occasion to advise people on the finer points of safeguarding their wealth and themselves from becoming casualties of declining governments.

It’s no secret that such governments have a decided inclination to legislate rapacious controls over their citizens, in the form of taxation, capital controls, confiscation and limitation over expatriation to less Orwellian jurisdictions.

In most cases, those seeking consultation have either already begun expatriating their wealth and/or themselves, or have made the decision to do so and are in the process of identifying those jurisdictions that may benefit them most. As such, they’re taking positive action to avail themselves of opportunities outside their home jurisdictions. Continue reading “Hiding from Opportunity”

Decline of Empire: Parallels Between the U.S. and Rome, Part I

Guest Post by Doug Casey

As some of you know, I’m an aficionado of ancient history. I thought it might be worthwhile to discuss what happened to Rome and based on that, what’s likely to happen to the U.S. Spoiler alert: There are some similarities between the U.S. and Rome.

But before continuing, please seat yourself comfortably. This article will necessarily cover exactly those things you’re never supposed to talk about—religion and politics—and do what you’re never supposed to do, namely, bad-mouth the military.

There are good reasons for looking to Rome rather than any other civilization when trying to see where the U.S. is headed. Everyone knows Rome declined, but few people understand why. And, I think, even fewer realize that the U.S. is now well along the same path for pretty much the same reasons, which I’ll explore shortly. Continue reading “Decline of Empire: Parallels Between the U.S. and Rome, Part I”

Perfect Storm Arrives: “Massive Wave” Of Car Repossessions And Loan Defaults To Trigger Auto Market Disaster, Cripple US Economy

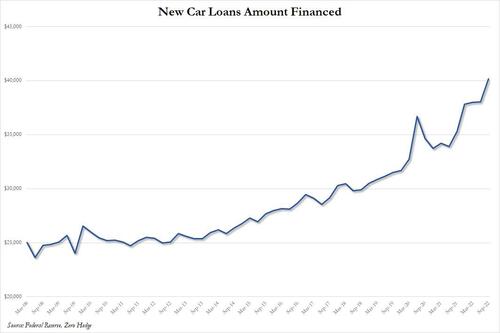

For almost a year now, we have been dutifully tracking several key datasets within the auto sector to find the critical inflection point in this perhaps most leading of economic indicators which will presage not only a crushing auto loan crisis, but also signal the arrival of a full-blown recession, one which even the NBER won’t be able to ignore, as the US consumers are once again tapped out. We believe that moment has now arrived.

But first, for those readers who are unfamiliar with the space, we urge you to read some of our recent articles on the topic of car prices – which alongside housing, has been the biggest driver of inflation in the past 18 months – and more specifically how these are funded my the US middle class, i.e., car loans, and last but not least, the interest rate paid for said loans. Here are a few places to start:

- Are We Headed For An “Auto Loan Crisis” As Delinquencies Begin To Rise? – July 7

- A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market – July 25

- American Drivers Go Deeper Into Debt As Inflation Pushes Car Loans To Record Highs – Aug 29

- Credit Card Rates Just Hit A Record As The Average Car Loan Rises To Fresh All Time High – Oct 9

- New-Car Loan-Rates Set To Hit 14-Year High As Affordability Crisis Worsens – Nov 3

So while the big picture is clear – Americans are using ever more debt to fund record new car prices – fast-forwarding to today, we have observed two ominous new developments: the latest consumer credit report from the Fed revealed a dramatic spike in the amount of new car loans, which increased by more than $2,000 in one quarter, from just over $38,000 (a record), to $40,155 (a new record).

Nine Meals from Anarchy

In 1906, Alfred Henry Lewis stated, “There are only nine meals between mankind and anarchy.” Since then, his observation has been echoed by people as disparate as Robert Heinlein and Leon Trotsky.

The key here is that, unlike all other commodities, food is the one essential that cannot be postponed. If there were a shortage of, say, shoes, we could make do for months or even years. A shortage of gasoline would be worse, but we could survive it, through mass transport or even walking, if necessary.

But food is different. If there were an interruption in the supply of food, fear would set in immediately. And, if the resumption of the food supply were uncertain, the fear would become pronounced. After only nine missed meals, it’s not unlikely that we’d panic and be prepared to commit a crime to acquire food. If we were to see our neighbour with a loaf of bread, and we owned a gun, we might well say, “I’m sorry, you’re a good neighbour and we’ve been friends for years, but my children haven’t eaten today – I have to have that bread – even if I have to shoot you.” Continue reading “Nine Meals from Anarchy”

The #1 Warning Sign Capital Controls Are Coming Soon and 4 Ways To Beat Them

The carnage always comes by surprise… weekends and holidays are the perfect time to catch people off guard.

The government declares a surprise bank holiday and shuts all the banks—mere hours after they denied they were even thinking about such actions.

Capital controls are imposed to stop citizens from taking their money out of the country.

Cash-sniffing dogs, which make drug-sniffing dogs look friendly, show up at airports and border crossings.

At this point, your money is trapped. The government is free to help itself to as much of it as it wants, like an all-you-can-steal buffet. Continue reading “The #1 Warning Sign Capital Controls Are Coming Soon and 4 Ways To Beat Them”

The Height of Idiocy

Guest Post by Doug Casey

“The only element in the universe more common than hydrogen is stupidity.”

– Einstein

I’m not a fortune teller. In fact, the only things anybody knows about predicting – even if you gussy the concept up by calling it “forecasting” – are 1.) Predict often and 2.) Never give both the time and the event.

The worst offenders are those who pretend they know where the economy’s headed.

“When Will They Learn?”

Guest Post by Jeff Thomas

Dependency upon government is a disease. Once it has been caught, it becomes chronic and does not reverse itself in a population until the system collapses under its own weight.

For many years, frustrated colleagues of mine who are either conservative or libertarian have posed the rhetorical question, “When will those liberals learn?” Surely, at some point (they reason), liberals will recognise that bailouts, entitlements, and a “planned” society simply do not work. It’s not even a question of whether liberalism is a laudable concept. The problem is that it just… doesn’t… work.