For almost a year now, we have been dutifully tracking several key datasets within the auto sector to find the critical inflection point in this perhaps most leading of economic indicators which will presage not only a crushing auto loan crisis, but also signal the arrival of a full-blown recession, one which even the NBER won’t be able to ignore, as the US consumers are once again tapped out. We believe that moment has now arrived.

But first, for those readers who are unfamiliar with the space, we urge you to read some of our recent articles on the topic of car prices – which alongside housing, has been the biggest driver of inflation in the past 18 months – and more specifically how these are funded my the US middle class, i.e., car loans, and last but not least, the interest rate paid for said loans. Here are a few places to start:

- Are We Headed For An “Auto Loan Crisis” As Delinquencies Begin To Rise? – July 7

- A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market – July 25

- American Drivers Go Deeper Into Debt As Inflation Pushes Car Loans To Record Highs – Aug 29

- Credit Card Rates Just Hit A Record As The Average Car Loan Rises To Fresh All Time High – Oct 9

- New-Car Loan-Rates Set To Hit 14-Year High As Affordability Crisis Worsens – Nov 3

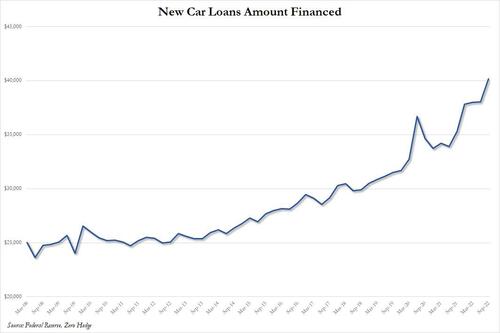

So while the big picture is clear – Americans are using ever more debt to fund record new car prices – fast-forwarding to today, we have observed two ominous new developments: the latest consumer credit report from the Fed revealed a dramatic spike in the amount of new car loans, which increased by more than $2,000 in one quarter, from just over $38,000 (a record), to $40,155 (a new record).