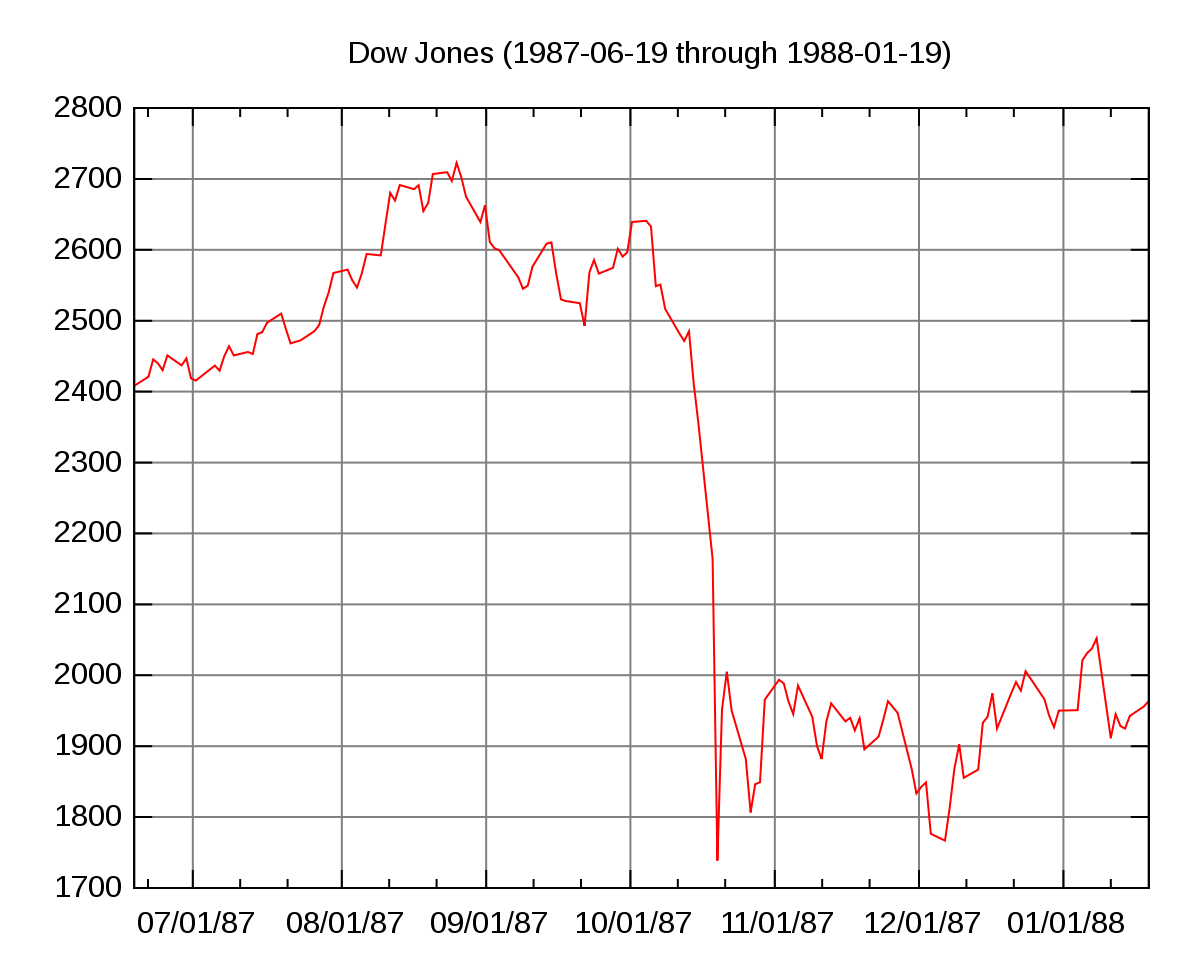

The largest-ever one-day percentage decline in the Dow Jones Industrial Average comes not in 1929 but on October 19, 1987. As a number of unrelated events conspired to tank global markets, the Dow dropped 508 points—22.6 percent—in a panic that foreshadowed larger systemic issues.

Confidence on Wall Street had grown throughout the 1980s as the economy pulled out of a slump and President Ronald Reagan implemented business-friendly policies. In October 1987, however, indicators began to suggest that the bull market of the last five years was coming to an end. The government reported a surprisingly large trade deficit, precipitating a decline in the U.S. Dollar. Congress revealed it was considering closing tax loopholes for corporate mergers, worrying investors who were used to loose regulation.

As these concerns grew, Iran attacked two oil tankers off of Kuwait and a freak storm paralyzed England, closing British markets early on the Friday before the crash. The following Monday, U.S. investors awoke to news of turmoil in Asian and European markets, and the Dow began to tumble.

Further compounding the crash was the practice of program trading, the programming of computers to automatically execute trades under certain conditions. Once the rush to sell began, matters were quite literally out of traders’ hands and machines escalated the damage to the market.

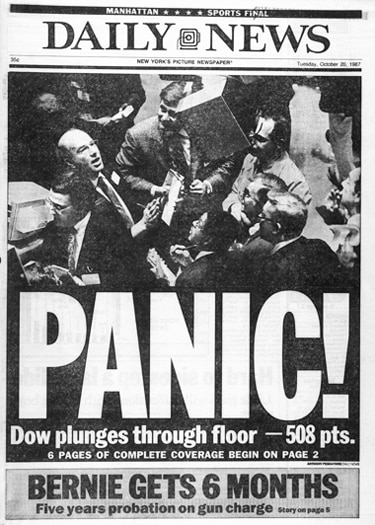

Despite looking like the beginning of another Great Depression—the L.A. Times’ headline read “Bedlam on Wall St.” while the New York Daily News’ simply read “PANIC!,” Black Monday has been largely forgotten by Americans not versed in financial history. As it would again in 2008, the federal government took a number of measures to “correct” the market, resulting in immediate gains over the next few weeks. By 1989, the market appeared to have made a full recovery.

Some now interpret the events surrounding Black Monday as proof that boom-and-bust cycles are natural and healthy aspects of modern economics, while others believe it was a missed opportunity to examine and regulate the kind of risky behaviors that led to the crash of 2008.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Bernie Goetz ~ I’m surprised there hasn’t been more incidents like that over the years

My then-boss made a small fortune that day with his father-in-law on the S&P 100 (OEX), because it was pre-Internets and the broker’s phone was impenetrably busy, so he couldn’t get out fast enough, so nailed a five-figure bundle that day by accident, when that was a lot of money for a working stiff. He would have screwed himself out of it had he been able to get out sooner.

Joe Dirt Person just doesn’t know how to ‘play’ da market .

cattle (ie voters, citizens, deplorables) futures

Skipped all my classes in college to watch on cnbc. Owned fidelity Magellan.

Did not sell that day. That fund paid for half of my college. Sold soon after Peter lynch retired.

Always stay in the market.

Your fear makes me more rich.

perhaps you are immortal, then.

accrual giveth – until it giveth to somebody else.

good – new – one to me. Too Much Stuff, too: