For all those claiming that stocks had priced in 3 (or more) 50bps (or more) rate hikes, we have some bad news.

All hell is breaking loose on Monday, with futures tumbling (again) into bear market territory, sliding below the 20% technical cutoff from January’s all time high of 3,856 and tumbling as low as 3,798.25 – taking out the May 10 intraday low of 3,810 – before reversing some modest gains. S&P 500 futures sank 2.5% and Nasdaq 100 contracts slid 3.1%, in a session that has seen virtually everything crash. Dow futures were down 567 points at of 730am ET.

The global selloff – which has dragged Asian and European markets to multi-month lows and which was sparked by a hotter than expected US CPI print which heaped pressure on the Federal Reserve to step up monetary tightening – accelerated on Monday as panicking traders now bet the Fed will raise rates by 175 bps by its September decision, implying two 50-bp moves and one hike of 75 bps, with Barclays and now Jefferies predicting such a move may even come this week. If that comes to pass it would be the first time since 1994 the Fed resorted to such a draconian measure.

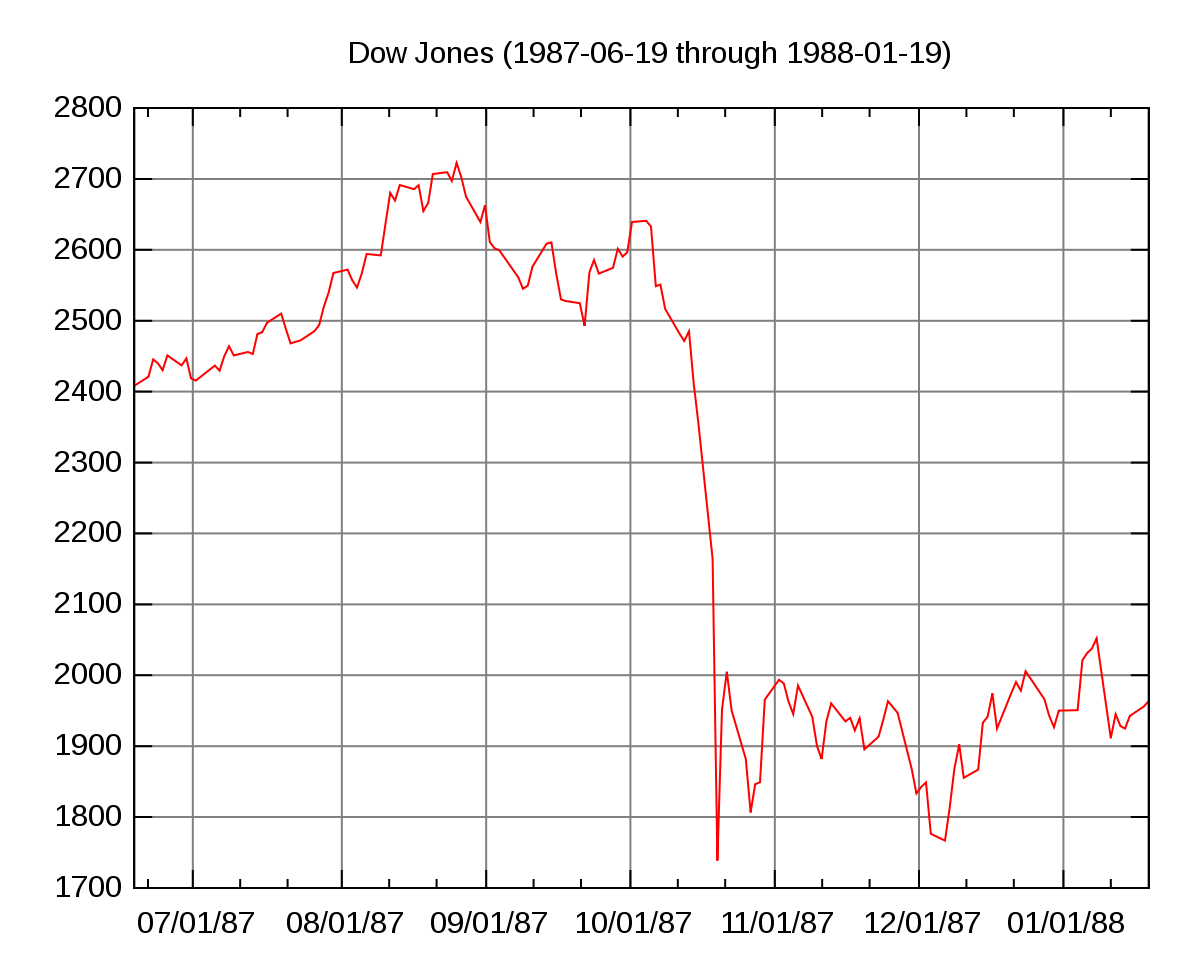

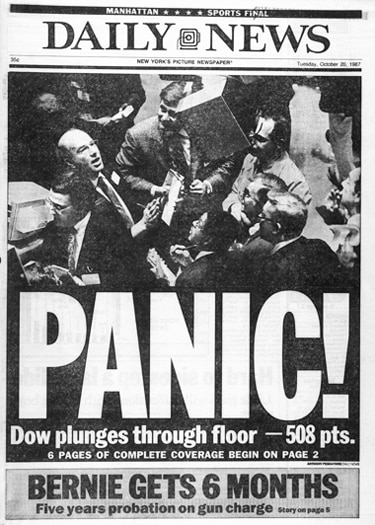

The largest-ever one-day percentage decline in the Dow Jones Industrial Average comes not in 1929 but on October 19, 1987. As a number of unrelated events conspired to tank global markets, the Dow dropped 508 points—22.6 percent—in a panic that foreshadowed larger systemic issues.

Continue reading “THIS DAY IN HISTORY – Stock markets crash on “Black Monday” – 1987″

Via FederalReserveHistory.org,

Authored by Donald Bernhardt and Marshall Eckblad, Federal Reserve Bank of Chicago

The first contemporary global financial crisis unfolded in the autumn of 1987 on a day known infamously as “Black Monday.”

A chain reaction of market distress sent global stock exchanges plummeting in a matter of hours. In the United States, the Dow Jones Industrial Average (DJIA) dropped 22.6 percent in a single trading session, a loss that remains the largest one-day stock market decline in history. At the time, it also marked the sharpest market downturn in the United States since the Great Depression.

The Black Monday events served to underscore the concept of “globalization,” which was still quite new at the time, by demonstrating the unprecedented extent to which financial markets worldwide had become intertwined and technologically interconnected.

Continue reading “31 Years Ago Today, “It Felt Really Scary” – The Fed Remembers ‘Black Monday’”

Thirty years ago today was the biggest single day stock market crash in history. An equal size crash today would be over 5,000 Dow points.

#1 – Could a crash of this magnitude happen again?

#2 – The stock market valuation today is far higher than 1987 and on par with 1929 and 2000. Will we experience at least a 20% bear market decline within the next year?

#3 – Has the Federal Reserve and Wall Street figured out how to keep the stock market at a permanently high plateau?

Submitted by Tyler Durden on 12/11/2015 17:45 -0500

Four months ago, China decided to devalue the Yuan sending a shudder up and down collateral chains globally and forcing carry trade unwinds and derisking everywhere. Friday August 21st saw notable weakness as that weakness washed ashore in US equities.. and then Black Monday struck. The ensuing debacle stalled The Fed and shocked markets.

The last week, we have seen China devalue the Yuan very significantly, EM capital markets turmoiling, and today, that was ashore in US equities… what happens next?

Deja vu?

Deja vu?

As a reminder, JPMorgan’s “seer” Marko Kolanovic warned this week that…

John Hussman has the right to gloat on this Black Monday morning as global stock markets meltdown under the weight of central bank created debt, insane debt financed corporate buybacks, and stock valuations rivaling 1929 and 2000 levels. He has been scorned, ridiculed and laughed at by the Ivy League educated sociopathic Wall Street titans of greed and avarice. Only in a warped, manipulated, corrupt, rigged financial world would those who speak the truth, use facts, and honestly assess the markets based on historical relationships would a man like John Hussman be abused by the elitist Wall Street lemmings. He has too much integrity and class to lower himself to the level of Wall Street hucksters. His letter this week is heavy on substance, facts, and sound reasoning. Therefore, it is of no use to CNBC cheerleaders or Wall Street shysters. His lessons are timeless.

Rather, the key lesson to draw from recent market cycles, and those across a century of history, is this:

Valuations are the main driver of long-term returns, but the main driver of market returns over shorter horizons is the attitude of investors toward risk, and the most reliable way to measure this is through the uniformity or divergence of market internals. When market internals are uniformly favorable, overvaluation has little effect, and monetary easing can encourage further risk-seeking speculation. Conversely, when deterioration in market internals signals a shift toward risk-aversion among investors, monetary easing has little effect, and overvaluation can suddenly matter with a vengeance.

He wrote this letter over the weekend before the plunge in Chinese shares and the opening decline of 1,110 points on the Dow. There has been no specific event or tragedy which triggered the start of this global equity collapse. Hussman describes the explosion perfectly. The Fed and other central bankers around the world have loaded the wheelbarrow with dynamite (debt) and rolled into the den of rookie Wall Street fire jugglers. The Chinese dropped the torch (currency devaluation) and the world is blowing up like a Chinese sodium cyanide plant.

Continue reading “ROLLING A WHEELBARROW OF DYNAMITE INTO A CROWD OF FIRE JUGGLERS”

If you were wondering what happens when margin debt is at the highest level in history and the market abruptly drops because a corrupt Chinese central banker devalued their currency, welcome to Black Monday 2015. I hope you aren’t leveraged. Enjoy the show. The calls from Wall Street bankers and CNBC talk show morons for a bailout to follow shortly.

Germany is coming to their senses. They have run their country the right way, while the PIIGS have lived far above their means for decades. The entire European Union rests on the back of Germany. They’ve bailed out Ireland. They’ve bailed out Greece. It looks like they are going to tell Italy to fuck off. Most people don’t realize how big Italy is. They have the 8th highest GDP in the world. Their GDP is $2 trillion. Germany’s is $3.3 trillion. Germany will bankrupt itself trying to save the Italians. Plus, Germany knows that Spain is in worse shape than Italy. They have the 12th largest economy in the world.

If Germany is balking, then European stocks will crater on Monday. Asian stocks will crater in anticipation that Europe and the US markets will collapse on Monday. The earliest indication we have is Saudi Arabia, whose market is down 5.5%.

You can bet that the phone lines are buzzing between Timmy Geithner, Bennie Bernanke and their friendly puppet master CEOs – Lloyd Blankfein, Jamie Dimon, Vikrim Pandit, Ken Lewis, John Mack. These are the people trying to retain their wealth and power. They DO NOT care about you, the country, or the long term best interests of our nation. They care about their billions. This is a game to them. They are agreeing on a plan of attack to manipulate the markets on Monday.

It is highly likely that the markets will plunge at the opening as a knee jerk reaction to the S&P downgrade. The criminal Wall Street banks will then instruct their computers to buy stocks and an unbelievable rally will commence. This is supposed to pump confidence back into the investing public. CNBC will do their part and tell you to buy the fucking dip. This is all a show.

The S&P downgrade should have happened two years ago. The US is a bad long term credit. We will default by printing money and paying interest to gullible foreigners in worthless pieces of paper. The US economy is in recession. Stocks fall 40% during recessions. The wheels are coming off this bus. It doesn’t matter whether stocks finish up or down on Monday. They will be at least 30% lower in the next year. You can Buy the Fucking Dip or you can focus on the facts and the truth.

Submitted by Tyler Durden on 08/06/2011 12:20 -0400

Remember when we said (yesterday) that Germany will soon balk over the fact that it is pledging its entire economy to bail out an insolvent Europe? Well, that moment has come.

Dow Jones just hitting the tape referencing Spiegel

As a reminder, yesterday’s stopgap announcement by the ECB to expand its SMP purchases of secondary market Italian and Spanish bonds was merely as a precursor to full EFSF monetization until its comes fully online in September (or sooner) in a vastly expanded format (between €1.5 and €3.5 trillion).

If Germany is now against this, which appears to be the case, it pretty much means, well, game over.

Add the uncerainty over the unwind of the Europe rescue “gamechanger” as one of the more naive CNBC anchors said yesterday, and Monday is now guaranteed to be a bloodbath.

As for those saying China will gladly step in and fund a $5 trillion EFSF shortfall, they may want to read the following article from Reuters:

Italian Economy Minister Giulio Tremonti said on Thursday that Asian investors are reluctant to buy Italian bonds because it sees they are not being bought by the European Central Bank.

Speaking at a news conference, Tremonti also said it would be desirable for the central bank to follow the lead of the Japanese and Swiss central banks in taking expansionary steps to tackly the euro zone’s crisis.

“I note that the Bank of Japan today launched quantitative easing and the Swiss cen bank cut rates to zero, we are waiting for decisions if possible, but desirable (from the ECB),” Tremonti said.

When you talk to Asia they say: “We don’t understand what Europe is,” he continued. “The second point is that they say ‘if your central bank doesn’t buy your bonds, why should we buy them”?

P.S. Time to unwind that Bund short we suggested yesterday. In fact, if true, it is time for a big rush to safety.