For all those claiming that stocks had priced in 3 (or more) 50bps (or more) rate hikes, we have some bad news.

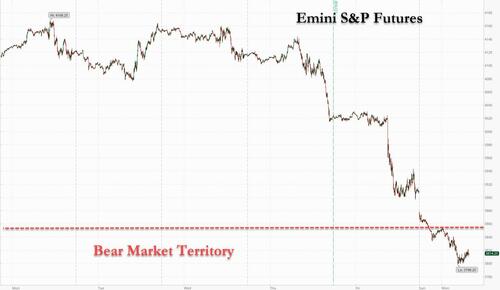

All hell is breaking loose on Monday, with futures tumbling (again) into bear market territory, sliding below the 20% technical cutoff from January’s all time high of 3,856 and tumbling as low as 3,798.25 – taking out the May 10 intraday low of 3,810 – before reversing some modest gains. S&P 500 futures sank 2.5% and Nasdaq 100 contracts slid 3.1%, in a session that has seen virtually everything crash. Dow futures were down 567 points at of 730am ET.

The global selloff – which has dragged Asian and European markets to multi-month lows and which was sparked by a hotter than expected US CPI print which heaped pressure on the Federal Reserve to step up monetary tightening – accelerated on Monday as panicking traders now bet the Fed will raise rates by 175 bps by its September decision, implying two 50-bp moves and one hike of 75 bps, with Barclays and now Jefferies predicting such a move may even come this week. If that comes to pass it would be the first time since 1994 the Fed resorted to such a draconian measure.

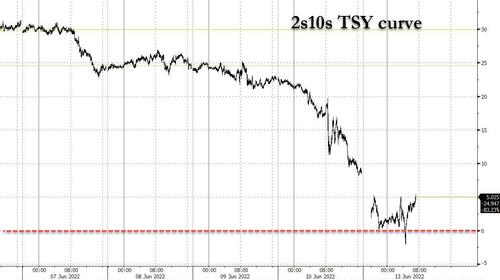

The selling in stocks was matched only by the puke in Treasuries, as yields on 10-year US Treasuries reached 3.24%, the highest since October 2018, yet where 2Y yields sold off more, sending the 2s10s curve to invert again…

… for the second time ahead of the coming recession, an unprecedented event.

Meanwhile, the selloff in European government bonds also gathered pace, with the yield on German’s two-year government debt rising above 1% for the first time in more than a decade and Italian yields exploding and nearing 4%, ensuring that another European sovereign debt crisis is just a matter of time (recall that all Italian net bond issuance in the past decade has been monetized by the ECB… well that is ending as the ECB pivots away from QE and NIRP).

The exodus from stocks and bonds is gaining momentum on fears that central banks’ battle against inflation will end up killing economic growth. Inversions along the Treasury yield curve point to fears that the Fed won’t be able to stave off a hard landing.

“The Fed will not be able to pause tightening let alone start easing,” said James Athey, investment director at abrdn. “If all global central banks deliver what’s priced there are going to be some significant negative shocks to economies.”

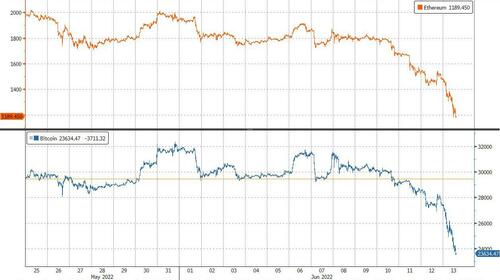

Going back to the US market, big tech stocks slumped in US premarket trading as bets that the Federal Reserve hikes rates more aggressively sent bond yields higher, and Nasdaq futures dropped. Cryptocurrency-exposed stocks cratered as Bitcoin continued its recent decline to hit an 18- month low, precipitated by news that crypto lender Celsius had halted withdrawals…

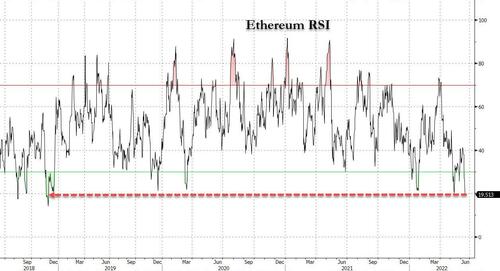

… which sent Ethereum to the most oversold level in 4 years.

Here are some of the biggest U.S. movers today:

- Apple shares (AAPL US) -3.1%, Amazon (AMZN US) -3.4%, Microsoft (MSFT US) -2.8%, Alphabet (GOOGL US) -3.7%, Netflix -3.8% (NFLX US), Nvidia (NVDA US) -4.5%

- Tesla (TSLA US) shares dropped as much as 3.1% in US premarket trading amid losses across big tech stocks, while the electric-vehicle maker also filed to split shares 3-for-1 late Friday.

- MicroStrategy (MSTR US) -18.4%, Riot Blockchain (RIOT US) -15%, Marathon Digital (MARA US) -14%, Coinbase (COIN US) -12.5%, Bit Digital (BTBT US) -10%, Silvergate Capital (SI US) -11%, Ebang (EBON US) -4%

- Bluebird Bio (BLUE US) shares surge as much as 86% in US premarket trading and are set to trim year-to- date losses after the biotech firm’s two gene therapies won backing from an FDA advisory panel.

- Chinese education stocks New Oriental Education (EDU US) and Gaotu Techedu (GOTU US) jump 8.3% and 3.4% respectively in US premarket trading after peer Koolearn’s endeavors into livestreaming e-commerce went viral and sent its shares up 95% in two sessions.

- Astra Space (ASTR US) shares slump as much as 25% in US premarket trading, after the spacetech firm’s TROPICS-1 mission saw a disappointing launch at the weekend.

- Invesco (IVZ US) and T. Rowe (TROW US) shares may be in focus today as BMO downgrades its rating on the two companies in a note saying it favors alternative asset managers over traditional players as a way to hedge beta risk against the current macro backdrop.

In Europe, the Stoxx 600 also extended declines to a three-month low, plunging mover than 2%, with over 90% of members declining, as meeting-dated OIS rates price in 125bps of tightening, one 25bps move and two 50bps hikes by October. Tech leads the declines as bond yields rise, with cyclical sectors such as autos and consumer products also lagging as recession risks rise. The Stoxx 600 Tech Index falls as much as 4.3% to its lowest since November 2020. Chip stocks bear the brunt of the selloff: ASML -3%, Infineon -4.2%, STMicro -3.6%, ASM International -2.9%, BE Semi -2.8%, AMS -5.3% as of 9:36am CET. As if inflation fears weren’t enough, French banks tumbled after a first round of legislative elections showed that President Emmanuel Macron could lose his outright majority in parliament. Here is a look at the biggest movers:

- Atos shares decline as much as 12%; Oddo says the company’s reported decision to retain and restructure its legacy IT services business in a separate legal entity is bad news for the company.

- Getinge falls as much as 7.6% after Kepler Cheuvreux cut its recommendation to hold from buy, cautioning that headwinds and supply chain challenges may intensify as Covid-related tailwinds abate.

- Elior plunges as much as 15% amid renewed worries over inflation and rising interest rates impacting a caterer that’s still looking for a new CEO following the unexpected departure of the previous one.

- Valneva falls as much as 27% in Paris after saying its effort to salvage an agreement to sell Covid-19 shots to the European Union looks likely to fail.

- Subsea 7 drops as much as 13% after the offshore technology company lowered its 2022 guidance, with analysts noting execution challenges on some of its offshore wind projects.

- French banks decline after a first round of legislative elections showed that President Emmanuel Macron could lose his outright majority in parliament.

- Societe Generale shares fall as much as 4.5%, BNP Paribas -4.2%

- Euromoney rises as much as 4.4% after UBS raises the stock to buy from neutral, saying the financial publishing and events firm’s “ambitious” growth targets for 2025 are broadly achievable.

Earlier in the session, Asian stocks also declined across the board following the hot US CPI data and amid fresh COVID concerns in China. Nikkei 225 fell below the 27k level with sentiment not helped by a deterioration in BSI All Industry data. Hang Seng and Shanghai Comp. conformed to the downbeat mood with heavy losses among tech stocks owing to the higher yield environment and with mainland bourses constrained after the latest COVID outbreak and containment measures.

The Emerging-market stocks index dropped about 3%, falling for a third day in the steepest intraday drop since March, as a fresh high in US inflation sparked concerns that the Fed may need to be more aggressive with rate hikes.

In FX, the Bloomberg dollar rose a fourth day as the dollar outperformed all its Group of 10 peers apart from the yen, which earlier weakened to a 24-year low with NOK and AUD the worst G-10 performers. In EMs, currencies were led lower by the South Korean won and the South African rand as the index fell for a fifth day, the longest streak since April. The onshore yuan dropped to a two-week low as a jump in US inflation boosted the dollar and China moved to re-impose Covid restrictions in key cities. India’s rupee dropped to a new record low amid a selloff in equities spurred by continuous exodus of foreign investors. The euro fell for a third day, touching an almost one-month low of 1.0456. Sterling fell after weaker-than-expected UK GDP highlighted the risks to the economy, with a global risk-off mood adding pressure on the currency, UK GDP fell 0.3% from March. The yen erased earlier losses after earlier falling to a 24-year low while Japanese bonds tumbled, prompting a warning from the Bank of Japan as its easy monetary policy increasingly feels the strain of rising interest rates globally. Bank of Japan Governor Haruhiko Kuroda said a recent abrupt weakening of the yen is bad for the economy and pledged to closely work with the government hours after the yen hit the lowest level since 1998.

Bitcoin is hampered amid broad-based losses in the crypto space with the likes of Celsius pausing withdrawals/transfers due to the “extreme market conditions”. Currently, Bitcoin is at the bottom-end of a USD 23.7-27.9 range for the session.

In rates, the US two-year yield exceeded the 10-year for the first time since early April, an unprecedented re-inversion. The 2-year Treasury yield touched the highest level since 2007 and the 10-year yield the highest since 2018.

Treasuries continued to sell off in Asia and early European sessions, leaving 2-year yields cheaper by 15bp on the day into the US day as investors continue to digest Friday’s inflation data. Into the weakness a flurry of block trades in futures added to soaring yields. Three-month dollar Libor jumps 8.4bps. US yields remain close to cheapest levels of the day into early US session, higher by 13bp to 6bp across the curve: 2s10s, 5s30s spreads flatter by 5bp and 5.5bp on the day — 5s30s dropped as low as -16.6bp (flattest since 2000) while 2s10s bottomed at -2bp. US 10-year yields around 3.235%, remain cheaper by 8bp on the day and lagging bunds, gilts by 2.5bp and 5bp in the sector. Fed-dated OIS now pricing in one 75bp move over the next three policy meetings with 175bp combined hikes priced by September, while 55bp — or 20% chance of a 75bp move is priced into Wednesday’s meeting. A selloff of European government bonds gathered pace as traders priced in a more aggressive pace of tightening from the ECB, with traders now wagering on two half-point hikes by October.

The Bank of Japan announced it would conduct an additional bond-buying operation, offering to purchase 500b yen in 5- to 10-year government bonds Tuesday after 10-year yields rose above the upper limit of its policy band.

In commodities, oil and iron ore paced declines among growth-sensitive commodities; crude futures traded off worst levels. WTI remains ~1% lower near 119.30. Spot gold gives back half of Friday’s gains to trade near $1,855/oz. Base metals are in the red with LME tin lagging

While it’s a busy week ahead, with the FOMC meeting on deck where the Fed is set to hike 50bps, or maybe 75bps and even 100bps, there is nothing on Monday’s calendar. Fed Vice Chair Lael Brainard will discuss the Community Reinvestment Act in a pre-recorded video and an audience Q&A; she is not expected to discuss monetary policy given the FOMC blackout period.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

What price is the Put?

Today could be the day. Dow futures are down another 600 points. Either way it’s coming soon, I for one can feel it in my bones.

dunno. the preppers have been saying that for 14 years now.

Even a blind squirrel finds a nut every once in while.

The bots were busy today. The only thing that went up is oil. Long on Popcorn for tomorrows show.

” Never Under Estimate Joes Ability to F@ck Things Up”

-Barak Obama

Where are the fat cats and institutional investors putting the money that they’re pulling out of the markets? Everything is down, including gold.

Interest rates – even with a 175 basis point increase – are still way lower than the inflation rate, so how long will the big boys keep their money in cash positions in this type of environment?

Anyone have any suggestions?

rubles and yuan.. Just kidding, that’s the bazillion dollar question your asking. I’m waiting for the shit house economist (and were all shit house economist) to esplain it to us.

It’s probably going into gold and silver with cover from the banks naked shorts scam.

I’m deeply invested in heavy metals.

It will be invaluable.

Lead and brass.

Don’t worry about gold, silver, or your positions in them. When the highly leveraged markets take a hit gold and silver always get hit with them–but not for long. The big boys sell gold to meet margin calls for their underwater accounts. They know what real money is and they use it to give buoyancy to their overleveraged asses. Buying opportunity soon if you are nimble. This pattern has repeatedly and reliably played out for decades. It’s called market justice where the zombie, and idea-only companies go to die.

I’m not worried. I’m just wondering where the money that’s being pulled out of the stock market via the selloff is going. I don’t think the fat cats will hold cash positions very long when inflation is so high and interest rates still so low – even with a 175 bp increase looming.

I think we’re in another dump-and-pump; they’re going to sell off and create a panic, shake the scared money out of the tree, then come scoop up equities at a deep discount.

There’s nowhere else for them to put their money.

Farmland? Fertilizer futures? Sex slaves?

Long on AI Sex Bots. They are becoming sentient you know. Hookers union forming in 3-2-1. The latest model is 3 feet tall with a flat head, so you can set beer your on top.

You may joke, but the Japanese have just managed to graft human (type) skin on a robot skeletal system.

Dolores may not be too far off.

https://www.abc.net.au/news/science/2022-06-10/robotic-finger-wrapped-with-living-human-skin-by-scientists/101129954

It’s no joke, well the flat head is, but in a very sick world where humans have reduced themselves to meat poles, one’s imagination is no match for the realities that befall us. West World any body?

Moar like Crap World (C)

I suspect they are sitting on a larger cash position waiting to buy back in at much much lower cost

I did what Bill Gates did. Bought farmland. I did it through an ETF sold half during the peak last month. Still above where I bought it. Sold when it was up 75%. Follow the oligarchs.

Paleocon – which farmland ETF? Just curious.

You beat me, Pal, to it so excuse the redundancy.

Canada’s central bank warns mortgage payments could rise 30 percent in next few years

Amid massive inflation and interest rate hikes, the Bank of Canada is warning homeowners that their mortgage payments may increase by 30 percent or more over the next few years.

The Bank of Canada, the nation’s central bank, warned those who bought homes during the COVID-19 so-called pandemic on Thursday that even the slight increase in mortgage rates that occurs when the central bank raises rates will likely result in monthly payments increasing by hundreds of dollars a month.

https://www.lifesitenews.com/news/canadas-central-bank-warns-mortgage-payments-could-rise-30-percent-in-next-few-years/

Massively inflated stock price bubble equals “economic growth”.

Riiight.

With fixed rates below 3 for the past couple of years, why would anyone still have an ARM?

In 1980 you could get a six month bank CD paying as much as 12.9% or a one-year CD for 1.5% less. Given the trend and volatility of stocks and the unknown interest rate of bonds, is it difficult to see why money left stocks and bonds? That same time provided sufficient exit from stocks, bonds, and banks to start the growth in money market mutual funds. As a young accountant in the 1970’s my money mostly went to living expenses and payments on my 8.5% mortgage. However, I did manage to squeeze out the minimum $1,000 for a one year 10% CD.

Experienced finance people of the 70’s remembered that it was 1954 before the stock market returned to its level before the 1929 crash. 25 years to recover.

Advisors were euphoric when the DJIA hit 1000 in late 1972, and they proclaimed it was just the beginning. It was–the beginning of a bear market. By December 1974, the index had fallen to 577. Yes, it dropped 43% in two years.

Now it’s 2022 and we have inflation again, and again caused by excessive government spending. The Fed–just as dumb as the socialist Democrats–says “What we did in the 70’s didn’t work, but maybe it will this time.” Incompetent, greedy, and lazy people in government…that is what is common between the 70’s and now.

“What we did in the 70’s didn’t work, but maybe it will this time.”

it worked then, and it’s working now. for them.

Pffffffft.

Stocks go up.

Stocks go down.

Everything will be back to normal by Friday.

Also, NOW is the best time to invest in real estate.

.

.

That’s some genius level advice you just got. Act accordingly.

Let the market manipulation begin!

You just can’t get enough trolling now day’s can you?

Haha, just checked and Bitcoin is down to 23k, down 14% in last 24 hrs. The HODL’ers must be crapping their pants!

Auntie hopes this decline is followed by a summer of “discontent*” with a precipitous decline in the stock markets and everything else, especially real estate, in the early autumn. Chou Bi Din will be proud to report “I did that!”.

Let the burn-it-to-the-ground party begin.

*Urban yutes acting out as they know best to do, yo.

“Auntie hopes this decline is followed by a summer of ‘discontent*’”

not by the usual suspects – the ebt cards can be pumped up with new dollars, as many as needed, with a flick of a switch.

Oldie but goodie.

Wow.

An Auntie fave!

As hot as it is getting this week, the tempers of the Urban yoots may be ready to erupt for missing Fathers Day.

Looks like some ones finally figured out that within four years there will be 100 million fewer consumers in the USA borrowing fake money at 29% interest to buy useless imported shit. Safe and effective…

Why is it called black Monday when it’s

Gushing red all over?

We need a combat tourniquet asap!

Black is bad, except in accounting where it is good.

Or in commercials on TV where all featured are black except for the coal burner girlfriend/wife.

Like all countries in economic collapse, you will have to barter for what you need. The stuff in your physical possession is the only thing of value.

“you will have to barter for what you need”

barter is grossly inefficient. they’ll shoot for what they need.

That’s how you know it’s working.

that’s what my doctor says about my medical treatment ….

Finally sum betta neux.

Everyone is predicting a 75 basis increase by the fed this week and when they come with a 50 basis jump, everyone will jump back into stocks and we will see a massive upside.

It is all part of the Kabuki Theater.

Nope, .75 is baked in, and will probably be followed soon with another. The Fed does not dictate rates, it follows the bond market, and the bond market is turning vigilante. With mortgage rates spiking to over 6% and even higher rates to come the RE market is getting ready to shit the bed along with stocks.

The morons who believed the hype and leveraged up on overpriced assets with borrowed money are going to lose everything just like Klaus said. Only they will not be happy. It is hard to be happy when you are hungry and poor.

The only way they are going to be happy is to lace the next round of vaccines with fentynal. I would not put it past them.

Neither the Fed nor bond markets dictate rates. The Cabal dictates them, always has. They created the bond market.

BTFD……suckers.