In the small print detailing the end of the debt ceiling melodrama which, as we explained, is a farce as it boosts inflation-adjusted spending contrary to Republican promises, there was some actual news: the great student loan boondoggle is about to come to a screeching halt, after a three year “emergency pause” which redirected tens of billions in dollars away from mandatory student loan repayment to other forms of discretionary spending.

According to Goldman, the agreement announced on Saturday between uniparty leaders Joe Biden and Kevin McCarthy titled hilariously the “Fiscal Responsibility Act”, prohibits the Biden Administration from extending the pause on student loan repayments in place since March 2020, even if it does not block the Administration’s student loan forgiveness plan, which would wipe out up to $20,000 in federal loans per borrower and is currently being weighed by the Supreme Court (the plan was announced last year but has not yet implemented).

Here are the details: late last year, Biden extended the repayment pause, which postpones roughly $5bn per month in student loan repayments, until 60 days after the Supreme Court ruled on the separate $400bn loan forgiveness plan the – the Supreme Court is likely to rule on loan forgiveness in June, so this likely would mean a restart of payments after August 2023.

And now, the debt limit agreement prohibits further extension of the payment pause, but remains silent on the student loan forgiveness plan which however will be nixed by SCOTUS much to the chagrin of screaming libs and lifelong members of the “free $hit” army. Prior to the announced debt limit deal Goldman had already assumed the repayment pause would end on schedule, though there was clearly a chance the White House might have extended it once again. The debt limit agreement eliminates that possibility (“except as expressly authorized by an act of Congress”) and should result in a restart of student loan payments in September 2023.

What happens then?

Well, according to Jefferies, the return of monthly loan payments presents risks similar to the effects of the 2013 fiscal cliff, when tax increases led to reduced consumer spending. And in a note released Monday (available to pro subscribers), JPMorgan’s chief US economist Michael Feroli said that the end of the payment moratorium will reduce annual disposable personal income by $38 billion, which will reduce consumer spending.

Separately, a March analysis by FreightWaves found that federal government programs boosted personal income by an estimated $2.3 trillion from March 2020 to December 2022. According to The Motley Fool, consumers received an average of $3,450 in stimulus during the COVID economy. This included direct payments into bank accounts, an expanded Child Tax Credit and an expanded Earned Income Tax Credit. But one of the biggest COVID-related stimulus programs was not factored into the s numbers: student loan forbearance.

As noted above, Education Secretary Miguel Cardona said the student loan deferment program will end no later than June 30, 2023, and payments are expected to resume by Sept. 1, 2023: “The amount of money we are talking about, in excess of a trillion dollars, is staggering. Student loans represent 7% of U.S. GDP” according to FrightWaves.

Putting these numbers in context, 64% of the $1.7 trillion in student loan debt have been in forbearance for the past three years, amounting to $1.1 trillion. Many of the 25 million Americans who have deferred payments for student debt are aged 18-44 years old, one of the most important demographic groups that drive consumer spending.

Some more math: according to a New York Fed study, the average student loan payment is $393 per month.

For consumers taking advantage of the program, they have deferred 39 months worth of payments, resulting in more than $15,327 in additional discretionary income during the period, much larger than the amount most consumers received from other COVID stimulus programs.

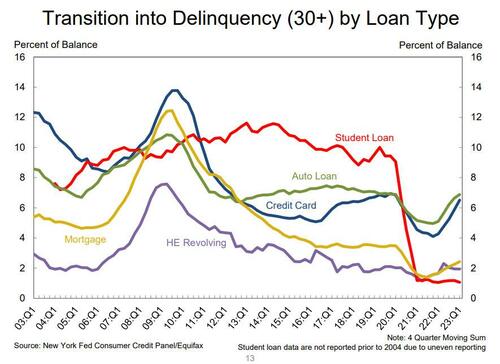

The forbearance program, when originally conceived, was intended to be a short-term program to protect consumers from the COVID black swan event. But many consumers made financial decisions based on this short-term cash flow boost, treating the cash as permanent. In fact, as the latest NY Fed household debt study showed, delinquency on student loans – until 2020 the highest among all types of credit – collapsed to near zero courtesy of the repayment moratorium. Expect the red line to soar higher in coming quarters.

A sudden increase of $393 per month in “new” – but really old – loan repayments will force prime-age consumers (those aged 18-44 years) old to cut back on discretionary spending. Since portions of this demographic have a tendency to prioritize experiences over goods consumption, we can expect this will have a much bigger impact on services demand and spending, which as discussed previously, has been the only pillar supporting the US economy now that goods spending has fallen off a cliff.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

You mean all those poor starving college grads buried under those predatory loans were not saving their money during forbearance but instead just buying more product & “experiences”?

This whole mammon circle-jerk really needs to burn.

Release the flaming cock rings!!!

Well, we’ve got that to look forward to! I don’t think I have ever seen so much lame and blatant gaslighting. McCarthy has a couple of limp wristed minions telling fabulous tales.

Where was something about paying for their millions of new illegal pets? Where was leverage to gain border control? 2,000 maybe cut from the 87,000 new IRS agents? F’ all these worthless shitheads.

They have photos and videos of McCarthy and his “DC roommate” Fat Frank Luntz blowing each other and doing anal in their apartment.

Tip for student debtors: 8 oz. instant coffee: $3.39 at Aldi.

Buy my Luzianne coffee & chickory online (4 pack) from the W.H.Reily Co. in Nola. $25 or so. Percolator, mix in chopped pecans. One pack lasts a month, 4 cups every morning.

They were/are tight with the CIA & had a famous employee 60+ years ago. Lee Harvey.

We are sooooo screwed.

The government will make up for the consumer spending shortfall.

Si.

They did the same thing with the $787 Billion Stimuless spending of Bathhouse Barry. Baseline budgetary spending ALWAYS goes up with every “one-time” special spending.

I’ll be surprised if Democrats vote for this bill. Student loan repayments, SNAP work requirements, and a new pipeline are things they absolutely detest. I don’t know if there’s a spoon big enough for all the sugar that’s going to be needed to gulp that down.

I guess you missed the Democrat who said they got everything they wanted from this deal and would vote in lockstep for it.

And they only need 5 Republican votes to pass it. I doubt there will be a roll-call vote as well.

The Democrats have been eerily quiet since getting the bill to read it. I didn’t hear anything about Hakeem Jeffries or Chuck Schumer being apart of the negotiations. This is strictly a deal created by McCarthy and the White House.

They don’t even put any effort into the theater anymore. Soon they will just tell us how things are going to be.

They just passed it.

Well dern, confessions of a Texan that grew up rather rowdy and rebellious.

I offered college to my children and in fact I encouraged it. Growing up ( oh no here we go, Dr. Phil) my parents became Republicans with Goldwater. Step dad was Catholic so probably ok with JFK before he was killed in Dallas , Texas. Anyway, emphasis was college degree.

Now while I offered my children college there were real conditions to consider. First of all , dad, “Let’s do it first at the local level, community college. I’ll help you with an apartment for two years then evaluate. Meanwhile you work a part time job so you can eat”. How I was going to pay for the college and all, I knew I would figure it out, somehow. Starting out at Texas A&M right off the bat was simply not in the equation. For whatever reason my children were not that keen on college out the shoot anyway. I can’t blame them, me, after HS all I cared about was living in my own place (apartment) and working for a living. It was a true freedom IMO.

I believe SEVENTY PERCENT (70% … !!!) of America’s GDP is based on consumer spending.

Huh, imagine that. An entire huge fucking economy based on buying shit! Wow. How is that even possible? I wonder what Jeebus thinks about our State Of Materialism..

Anyway, 70,000+ people showed up at the NJ Meadowlands TWICE (Sat and Sun) last week to listen to that average twerp Taylor

HamSwift, and the cheap seats in the ozone layer started at $900 a pop. I see teenagers all over the place with their thousand dollar phones and $300 sneakers … and more than a few driving expensive cars. So, I’ll believe the decline-in-household-spending Chicken Little crowd when I see it.Well look at that. Not one word of the impending collapse of the automobile industry. Get your affairs in order people, there’s a contraction coming that’s going to make the Reagan Recession look like a picnic.

By the time this administration is done every ass in America is going to look like the Holland Tunnel! That’s the objective.