Via Greg Hunter’s USAWatchdog.com,

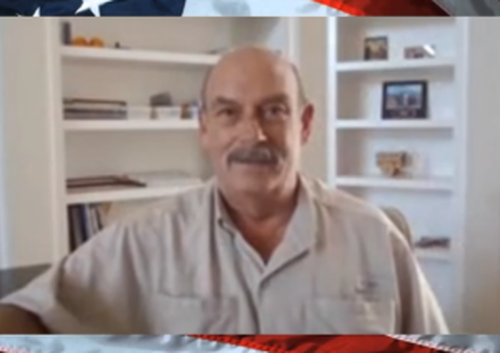

Precious metals expert and financial writer Bill Holter says there is a long list of financial trouble coming to America sooner than later.

There is the commercial real estate implosion, rising interest rates, an exploding federal budget, banana republic political problems, but the at the top of the list is the monster unpayable debt problem and the soon-to-be failing U.S. dollar. Holter says, “You can’t have a third of the federal taxes paid out in interest, and that number is only going to grow over time…”

“If the markets would not collapse ahead of time, which they certainly will, but if they did not, we would get to the point where the interest would eat up all the tax receipts. That is a mathematical impossibility. We’re broke…

On the other side of it, we have two rules of law. We have one rule of law if you are a liar from the left and another rule of law if you are a conservative and you don’t support the bull crap rules they are putting out there…

This is an illustration that this country has already become a banana republic. The problem with that is the dollar issued by this country is the world’s reserve currency. It’s a huge problem.”

Holter says the dollar is going to take a big hit in the next financial crisis that has already started. When it hits, Holter predicts,

“The actual bottom line is dollars are just pieces of paper backed by our government.

The dollar is backed by the full faith and credit of a bankrupt insolvent government, and people will figure that out very quickly.

When it comes to survival, people are not going to give up something real for nothing…

We are in the weeds right now because of interest rates . . . look at mortgage rates, they are well over 7% for a 30-year mortgage. So, that’s going to hurt housing. Commercial real estate has already been destroyed…

I think we are in the weeds because interest rates are at a point that nothing can be refinanced and rolled over.”

In closing, Holter says, “This is not my opinion, it’s a mathematical equation…”

” The debt cannot be paid back. It’s not possible. We will default one way or another. We will print the crap out of the dollar and devalue it, or outright nonpayment.”

Holter predicted years ago we would end up in a “Mad Max” scenario when credit dries up and store shelves empty. Holter contends that credit is drying up with the money supply shrinking for eight straight months. The “Mad Max” world Holter is still predicting is now looking like it’s going to come true sooner than later.

There is much more in the 42-minute interview.

Join Greg Hunter as he goes One-on-One with financial writer and precious metals expert Bill Holter for 8.12.23.

To Donate to USAWatchdog.com Click Here

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

That’s MY take on it exactly! Listen to this guy. He sees clearly.

“We are in the weeds right now because of interest rates . . . look at mortgage rates, they are well over 7% for a 30-year mortgage. So, that’s going to hurt housing. Commercial real estate has already been destroyed…”

1. Mortgage rates are predicted to go back down to 5% or less next year.

2. This commercial real estate “implosion” is going to affect us when, exactly?

3. The national debt is going to affect us when, exactly?

When the rest of the world takes their ball and goes the fuck home.

The problem with forcing people to do business with you is that it instills hatred and they will bail on your obnoxious ass at the very first opportunity…preferably leaving you with your pants down and a big dick up your ass.

WHEN? I’ve been hearing this forever. Even the great financial crisis wasn’t the end of the world.

I find it BEYOND fucking hilarious that you’ll take a banker’s word of what’s going to happen TOMORROW, much less next year!

It just grinds things down until they no longer work. Then you will see what has been happening, maybe.

Back in the 80’s interest rates were 21% or close to that, if memory serves me right. People were still buying homes and the usual stupid spending along with it, no cares in the world, just complaints.

Then the trouble started. Real estate signs started popping up everywhere and it wasn’t unusual to see two or more houses for sale in a block. People stated walking away from them and real estate agencies because property managers for the banks because nobody was buying and rentals were needed. Perfect scam, imo, rape the stupids signing onto a contract with high interest rates and when they can’t pay, take back the asset and rent it back to them.

Whats changed? Neth’n. Interest rates will go up and people will still keep buying and spending money like theres no tomorrow. They’ll bitch’n moan some but thats about all, if they can still get the hot dogs and watch the circus stars of their fav team then all will continue, until it doesn’t. I think most here know its all going to crash, but we just don’t know when or the trigger to get the party started. In the mean time, we prep and keep the eyes alert.

true, moose.

It’s the when that is tough to peg.

not the what

clues of signs and trends

cycles = rolluh coasters

–> strap in for the ride kids

pray the carny assembly team tightened all the nuts and bolts. short riders like faux-chi excluded.

opt out if cotton candy, elephant ears, warm pretzels, or carmel corn the preferred bread of choice.

barnum & bailey making a killing. figuratively and literally. a new variant cometh.

and to think the great white north was once considered a getaway to escape uncle sam the rapist.

nowhere to run, nowhere to hide.

who is john galt?

I worked with developers in the ’80s in LA when the prime rate was about 18% or so … and, yes, mortgage rates were above 20%.

But, don’t forget, that was before those developers bought down the mortgages by upwards of 5-8% … for ca$h … so that they could move their merchandise.

In the 80’s wage inflation was built into the system. People in the trades were making big money in relation to what things cost. Construction jobs paid more than $20hr, in an environment where a new pickup truck was $6000, and the median cost of a home was under $50K.

The standard of living in the US has been dropping steadily for over 70 years. Back in the late 1950’s my father was working as a master machinist, making $5.75 hr. His take home pay was enough in one year to buy a new house, or a new car every 3 mos.

At the end of Forth Turnings, the wealthy collapse the economies, and steal the peoples wealth. The last time they stole the farms and the gold. This time around they will steal all assets that have debt attached to them. Economic depressions are in fact a debt trap.

After years of inflation and debt promotion to purchase assets, the elite collapse the economy, forcing debtors into default and allowing them to steal all the equity people have in assets. Today, that represents most of the wealth of the people. Most people will lose their homes, and any money they have in equities will disappear as stock prices fall to levels no one today can imagine.

And just as they did last time, they will use this engineered crisis to change the monetary system. In the great depression, they changed the system by decoupling it from gold, this time they will use it to roll out the CBDC’s using Universal Basic Income (UBI) as the bait in the trap.

People who are unemployed or impoverished by the economic depression after being laid off from their jobs, stripped of their home equity, and the loss of value of any stocks they held will be eligible to apply for UBI from the Federal and State Governments. This UBI will be conditional upon having a Crypto wallet, and being paid in Central Bank Digital Currency.

This UBI will only be available under conditions dictated by the Federal and State Governments. Once agreeing to accept this system, you will not have the option to ever go back, and you will be locked in. If you find employment latter on, you will have agreed to accept pay for your work in digital currency, which will be deposited in your government managed account.

Your account will dictate what you can buy, and in what quantities. If you do not maintain the Governments accepted level of Social Score, your contributions and your options for purchases will be adjusted. Any thoughts or actions deemed dangerous by the government will result in penalties assessed to your account, and possible suspension of your account all together.