“The Financial Jigsaw Part 2” offers a survival manual for the populations of the ‘Global North’ in its quiet battles against ‘The Global South’ using silent disinformation weapons

SIMONS TOWN is a local community in the Western Cape, South Africa – 34 deg S (at the M66 mark). It is home to the South African Navy; next door is the False Bay Yacht Club

NOTICE TO READERS

Every two weeks, on Saturdays, I will publish my usual ‘Letter from Great Britain’, and on Tuesdays my re-post of BOOM’s weekly editorial, with no Paywalls.

- On alternating Saturdays I will publish ‘The Financial Jigsaw Part 2’ (Paywall) which will include vital wartime news in ‘Despatches from the Frontlines’.

- The Introduction to Part 2 (16 pages) was published during August 2020, on the opening of hostilities, linking PART 1, the final ‘Chapter 13 – The New Emergent Economy’ and is available free to read HERE.

- SPECIAL issues are published occasionally on Thursdays, like this one, free to all subscribers, on specific subjects of vital consequence for everyone.

PREFACE – SETTING THE GLOBAL SCENE 2023

“In the time of the end the King of the South will engage with him in a pushing, and against him the King of the North will storm with chariots and horsemen and many ships; and he will enter into the lands and sweep through like a flood” [Daniel 11: 40]

“There is wisdom in always exploring the counterpoint – sometimes a silver cloud has a dark lining too.” – Gyan Nagpal

WORLD WAR 3 (WW3) is a 5th Generation ‘Quiet’ War using multiple ‘Silent’ Weapons. Hostilities became public upon launching the Covid Scamdemic in March 2020. CMN News tracks progress of the Covid PsyOp – Sign up for free: https://cmnnews.substack.com/p/cmn-news-update-your-covid-medical-754?utm_source=substack&utm_campaign=post_embed&utm_medium=web

It was planned for more than 50 years following the publication of, “The Club of Rome” book, “Limits to Growth” in 1972, which closely followed the 1971 collapse of ‘Bretton Woods I’ (1944) global financial system, evolving into an informal Bretton Woods III 50 years later.

In 2022 the Russian SMO initiated a ‘Multipolar World’. However, we don’t know which options China will choose in this new ‘Global Financial Jigsaw’ – aka, the ‘New Multipolar World Order’. This short talk, in a pithy 11 minutes, offers one explanation of our dynamically changing global monetary system of things:

The Club of Rome and the Globalist Plan

‘The Massachusetts Institute of Technology’ (MIT) analysed the implications of continued worldwide growth. They examined five basic factors that determine, and ultimately limit, economic global growth.

- Population control

- Agricultural production

- Non-renewable resource depletion

- Industrial output limitations

- Pollution control

The MIT team fed data into a global computer model and then tested the behaviour of the model under several sets of assumptions to determine alternative patterns for mankind’s future. Download a PDF HERE for this non-technical report of the ‘boffins’ findings.

I read this book long ago, and re-read it recently. This is the Banksters’ Bible’, a blueprint for the beating heart of all the madness we see today, following the silent Repo crisis in September 2019 when BlackRock advised the Banksters to “Go Direct”. In only two minutes you can view the future planned for you – ‘The Final Solution’:

During 2022, ‘The Club of Rome’ published an update to ‘Limits to Growth’ titled, ‘Earth For All’ – A Survival Guide for Humanity [including ‘DavosMan’ but excluding everyone else!]. Earth For All declares, “…is both an antidote to despair and a road map to a better future. It uses powerful state-of-the-art computer modelling to explore policies likely to deliver the most good for the majority of people. A leading group of ‘scientists’ and ‘economists’, from around the world, present five extraordinary turnarounds to achieve prosperity for all, within planetary limits, in a single generation.” It comprises [four] keys areas some of which I guess the reader will recognise:

- Results of new global modelling that indicates falling well-being and rising social tensions heighten risk of regional societal collapses

- Two alternative scenarios – Too-Little-Too-Late vs The Giant Leap – and what they mean for our collective future

- Five system-shifting steps that can upend poverty and inequality, lift up marginalized people, and transform our food and energy systems by 2050

- A clear pathway to reboot our global economic system so it works for all people and the planet.

‘The Economist’, the globalist megaphone, claims “by 2050, 6 billion people could be living in cities. How should the challenges caused by rapid urbanization be handled in the world ahead?”

New ‘Digital Programmable Money’ (CBDC) is on the way

One of the most important issues that some people fear are ‘Central Banks Digital Currencies’ (CBDCs) because the globalist financial cartel is proposing this as a ‘Final Solution’ to the failing western Global Financial System which I describe in my book, The Financial Jigsaw – Part 1. However, it is only part of their wider UN Agenda 2030 being driven by Environmental, Social, and Governance (ESG).

According to the World Economic Forum (WEF) this will be achieved, hypothetically at least, by multiple silent attacks upon the people, economic infrastructure, like 15-minute Cities, and eventually by removing the use of cash in favour of programmable CBDC money. Digital money will be time-limited, forcing disposal through spending on eco-friendly products by a target date, thus avoiding hoarding by saving. This is an introduction of how CBDCs will work in practice using a ‘social credit system’, not unlike the current FICO credit-rating system:

It is likely that the introduction of this money will be accompanied by ‘Universal Basic Income’ (UBI) already being quietly trialled in Britain over the next two years. Participants will be monitored to see ‘what effect it has on mental and physical health’; (if you believe that, I have a bridge to sell you!). It is of course a pilot to test how far people will be enticed to accept the bribe of ‘free money’ and to set parameters prior to launch. Critical thinkers already know that there never has been a free lunch.

In Russia, any CBDC created by Russia’s central bank serves only the Russian state. Further, they’ve expressly stated that the digital ruble will not replace cash although admittedly, none of us take governments at their word when it comes to such things, so I don’t blame anyone for balking.

The Russian government since 1991 has listened to its people’s demands quite a bit better than those in the West. For instance, the government initially joined the bandwagon of ‘The Vaxx’ and attendant restrictions during the scamdemic. However, after outcries by The People, most of the PsyOp was abandoned in short order. That’s how healthy governance should work, unlike the corrupted criminal mafia in UK, AUKUS, 5-Eyes, and the unelected EU.

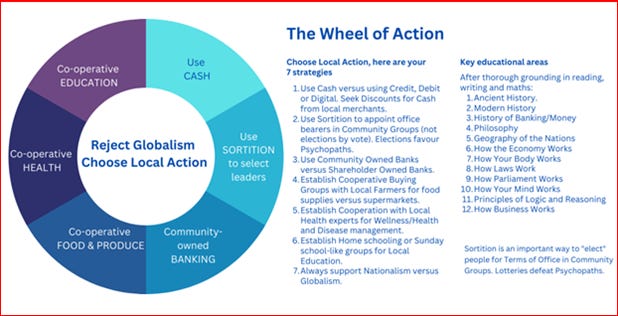

An honest alternative to the CBDC solution going forward

BOOM reported this fact on Tuesday: “In the West, there is a decline in the population of willing borrowers due to their declining working age populations. To ensure a return to economic growth and controlled CPI inflation, Western governments will have to quickly issue increased volumes of non-interest bearing, physical cash into their economies and encourage people to use it as much as possible. In other words, western governments will have to take back the control of their money supply which they have effectively surrendered to the private bankers over the last 400 years and especially over the last 50 years.”

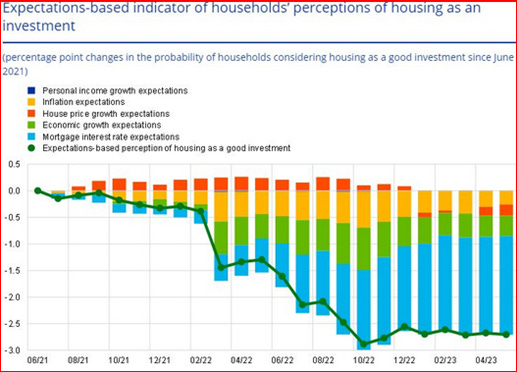

This week the ECB reported on the state of the housing market in the Europe, which also applies to UK and USA. BOOM went on to explain that under the current debt-based western system: “if the borrowers become either reluctant or shrink in number from disease, demographics or warfare and the Government does not increase physical cash in circulation, then the economy becomes starved of fresh newly originated money. The result is economic stagnation.”

BOOM offered a workable solution two years ago but the Banksters have no interest in a solution that fails to give them TOTAL control over the world which they believe is their exclusive domain.

Mortgage debt is a significant driver of new money in the West

If mortgage demand falls economies will stagnate or even decline and this is beginning to happen now. Under the current system mortgages create new money. I guess we all know now that banks don’t lend out deposit money, instead they create new money when they make loans, Professor Richard Werner explains in 10 minutes:

Therefore, whenever a bank makes a mortgage loan it creates new money from fresh air and injects it into the financial system. Thus, the more demand for mortgages the more money is in the system. This worked well in the growing economies of the West for over 200 years; but now growth has slowed – western economies are contracting.

Recently the ECB asked a worrying question: “Why has housing lost its lure?” This is the latest ECB #EconomicBulletin, with Evangelos Charalambakis, Johannes Gareis and Desislava Rusinova. There are three main findings based on responses to the ECB’s ‘Consumer Expectations Survey’:

- People’s perceptions of housing as a good investment are a good leading indicator of macroeconomic dynamics, as they began to deteriorate before the recent decline in housing investment in the euro area.

- People perceive housing as an investment differently depending on their demographic and economic characteristics. On average, older consumers, males and financially stronger households show a greater willingness to invest in housing than younger consumers and females.

- Expectations of higher inflation, lower economic growth and, in particular, higher mortgage rates have weighed heavily on people’s perceptions of housing as a good investment since mid-2021

CONCLUSION

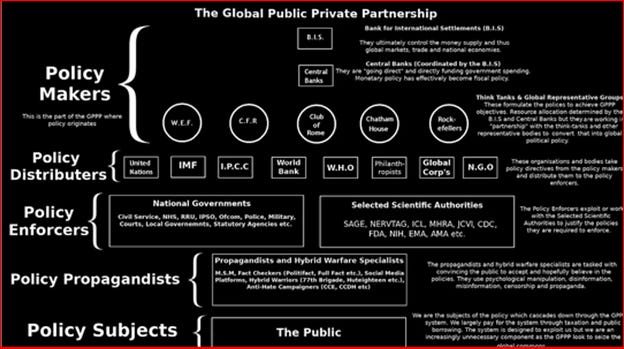

In order to preserve their extreme wealth and privileges the Banksters and their elite lackeys must implement a new global financial system that does not rely on a willing borrower. Driven and coordinated by the ‘Bank for International Settlements’ (BIS), and executed by the UN/WEF/IMF and World Bank, they have determined that CBDCs even a global one, like WorldCoin + World ID, is in fact The Beast System, which is their preferred solution. OffG says, “…most people in the world are not even aware of proof-of-personhood protocols, and if you tell them to hold up a QR code and scan their eyes for $30 they will do that.” – Vitaliy Buterin

This is the rationale behind WW3. Hyun Song Shin, Economic Adviser and Head of Research of the BIS, lays out the BIS vision for their future monetary system: https://www.bis.org/publ/arpdf/ar2022

If you do nothing else, spend 15 minutes as Prof. Richard Werner explains exactly how the Banksters create money out of thin air!

If the Banksters win this war against ‘The People’ (comprising 99% of the western populace) will find themselves in a digital prison with all aspects of their lives totally controlled by the ruling elite. Iain Davis writes extensively about the ‘Policy Power Structure’ describing who actually rules the world.

REFERENCES

- The Club Of Rome: How Climate Hysteria Is Being Used To Create Global Governance https://alt-market.us/the-club-of-rome-how-climate-hysteria-is-being-used-to-create-global-governance/

- Author of ‘The Limits to Growth’ promotes the genocide of 86% of the world’s population https://expose-news.com/2023/05/02/club-of-rome-genocide-of-the-worlds-population/

- WW III Has Begun: You Are The Enemy https://vidrebel.wordpress.com/2022/07/05/ww-iii-has-begun-you-are-the-enemy/

- WORLDCOIN: AI Requires Proof That You Are Human “…most people in the world are not even aware of proof-of-personhood protocols https://off-guardian.org/2023/08/05/worldcoin-ai-requires-proof-that-you-are-human/

- https://simplicius76.substack.com/p/russias-cbdc-exploring-the-truth?utm_source=substack&utm_campaign=post_embed&utm_medium=web

Deagel’s 2025 Depopulation Figures are a target, not an estimation, because you’re no longer needed due to the birth of Artificial Intelligence. The next stage of the Elite’s plan is to use Global “Boiling” Propaganda to convince you that you are the ‘Carbon Footprint’ that should be eliminated https://expose-news.com/2023/08/12/deagel-2025-depopulation-artificial-intelligence/

Nearly Babylon Bee-level headline: Global elite need to cover up their actual conspiracy, by banning little boys on the Internet from pointing out the Emperor’s naked ambition.

Another one that needs to be eliminated.

We all know the type.

They need to all be rounded up, and made to drink Round Up.

Too many to even list.

I was puzzled that the WEF,” We Are Now Gods” threat was only carried on four sites. Only two were high traffic sites, TBP and Steve Quayle. ZH didn’t post it either unless I missed it.

That is just very odd.

Yes, I too was puzzled BL – but lets be fair most of them are controlled anyway and maybe even ZH is Limited Hangout. I get the feeling that now their Polycrisis PsyOp is failing, their plan is to tell some truth in-between the lies and hope to regain some credibility – which is currently totally lost.

Mike “The Big Short” Burry’s betting 90% of his chips against Wall Street:

EXCERPT:

“Burry is making his bearish bets against the S&P 500 and Nasdaq 100, according to Security Exchange Commission filings released Monday. Burry’s fund, Scion Asset Management, bought $866 million in put options (that’s the right to sell an asset at a particular price) against a fund that tracks the S&P 500 and $739 million in put options against a fund that tracks the Nasdaq 100.

“Burry is using more than 90% of his portfolio to bet on a market downturn, according to the filings.”

Yes, I follow Mike – a very clever guy IMHO. I read the whole story at the time in 2007.

You are crazy to move to South Africa unless you are black. On second thought, if you are black, you are crazy to move to South Africa.

You have no idea – you can’t evaluate a country unless you have lived in it.

Peter- Any thoughts on the 26BN FX outflow from China? Batten down the hatches, China is barely hanging on.

The world is is turning into a giant flaming turd, DEW induced, or not. The best laid plan is to avoid any area with a dense black population. You must know something I don’t about SA.

I know a lot about SA that not one in a million knows BL. Fear not – I am looking forward to some good seafood at reasonable prices!

https://www.seaforthrestaurant.co.za/